Publiée par Lauren Hayden | Copywriter Lauren Hayden is the copywriting director at Ritter Insurance Marketing. She graduated Magna cumlaude from Misericordia University, where she obtained a Bachelors in English with a minor in communication. Among Lauren's interests are theater, beaches, and her beautiful kitten, Mango! She enjoys watching the Broadway shows and concerts in her spare time. The center's cost estimate for Medicare for 2022 is available on the Medicare Web site. Please see the recent articles, Part A and Part B premium rates and deductions, 2022.

The new law requires you to increase the Medicare prescription drug premium by 10%.

Deductible $1,556 for each inpatient hospital benefit period Benefit period The way that Original Medicare measures your use of hospital and skilled nursing facility (SNF) services. A benefit period begins the day you're admitted as an inpatient in a hospital or SNF.

Most people pay Medicare taxes for a period of 10 to 10 years. If you have Medicare before 65, no Part A coverage will apply to you. Some of these are known as “premium-free Part. A”. If you're in a state of non-competitive income you can get a part A. Part AA will cost $274 or $479 per month based on the length of time your spouse worked for Medicare taxes. Remember: $1,556 for every inpatient hospital benefit period Original Medicare There is no limitation on how many years a patient has been eligible. This means they can be paid twice per year.

Prime: $179.95 each month. It can vary annually. It costs you monthly a premium for services provided under Part B. You can pay penalties each month for not registering with Medicare Part B once your 65th year is over. You will pay penalties based on the time you've got Part A. During the long time you wait you can expect more penalties. How do you avoid Part B penalties? $333. Until Medicare starts paying for itself. You pay it every month. Medicare Accreditation. Medicare approval. Medicare Advisability. Medicare Approval.

This document announces the monthly actuarial rates for Medicare beneficiaries 65+ who have not received Medicare or disability coverage beginning on January 1, 2020. This notice also announced monthly premiums for disabled and elderly beneficiaries, the deductibles for 2021 and income adjustments based on adjusted gross income. The deductibles will not exceed. The monthly actuarial rate for 2021 is $299.90 for aged enrollees and $349.90 for disabled enrollees. The Medicare Flex Card is a prepaid debit card that allows people with Medicare to pay for their health care services.

Variable according to plans. The sum can be changed annually. Part B must still be paid for your Part B premium for the remainder of your life. Find out how much the plan costs. See the Medicare Advantage Plan.

These documents do not require the data to be collected—e.g. reporting, keeping of records and the disclosure to third parties. Therefore, under the Paperwork Reducer Act of 1995 (44 USC 3050 & 3500 a).

Under Section 1839 of this Act, you have the right to annually adjust Part B monthly actuarial costs for the age or disability of the beneficiary. We have also introduced part B annual tax deductions for the purposes of the calculation directly relating to the age-based rates.

How can you get assistance with your drug costs? Those who qualify will pay no part-time late Enrollment penalties or fees. Get information for assistance with cost planning. Get information on Part D.

Part A provides assistance with medical treatment when necessary. Part B also provides preventative services such as laboratory tests and testing shots to diagnose and treat medical problems and provides information about the prevention of medical problems. Costs: In Part B your payments are covered by the Part B premium.

Part A Hospital Insurance: Helps cover the costs of hospital inpatient care. Part A (Medical Insurance) helps cover services performed by physicians and medical staff.

Part B is a medical insurance premium. 170.10. Average monthly earnings vary by income. It can be changed yearly. Despite not having Part B coverage the premium will remain yours.

Medicare Part A and Part B programs, and the 2022 Medicare Part D income-related monthly adjustment amounts. Medicare Part B Premium and Deductible Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A. Each year the Medicare Part B premium, deductible.

Medicare enrollee monthly payments will be about $170 to $170 by 2022 – up $11.65 by 2021.

The annual deductible for Part B coverage, which covers doctor visits and outpatient care, also will go up by 7% to $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The announcement comes a nearly a month after the Social Security Administration set a modest 1.6% cost-of-living adjustment to benefits in 2020 , which works out to approximately $24 a month for the average retired worker.

Definition: Prime is billed to the insurance companies as a periodic sum to cover the insurers risk. Description: A policy contract transfers risks from an insured person to an insurer. When taking on these risks, a premium is due.

The cost of medical insurance. In addition to the premium, you have to pay deductible copayments.

The premium insurance includes health, homeowner's insurance, and rent insurance. Insurance premiums are commonly found in auto coverage.

Premiums. A premium is a fee paid to an insurance company to purchase the coverage you have selected. The payment is typically monthly but is also billed in various forms. The coverage is in no way affecting the user.

Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement. Medicare Part B Income-Related Monthly Adjustment Amounts Since 2007, a beneficiary's Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B.

Part B Monthly Payment. Part B premiums will increase to $144.42 or higher depending on your annual income. Typically Social Security benefits are paid at least $135 per month (about 130 per month).

2022 PART B PREMIUMS Beneficiaries who file an individual tax return with income: Beneficiaries who file a joint tax return with income: Income-related monthly adjustment amount Total monthly Part B premium amount Less than or equal to $91,000 Less than or equal to $182,000 $0.00 $170.10 Greater than.

In 2019, the standard monthly Part-B premium is expected to be $170 a month, doubling from $159.50 in 2022 to $168.70 in 2021.

Your Email Get Updates Ritter Promotion Related Posts Trending 2022 Medicare Part A and Part B Premiums and Deductibles Nov 15, 2021 The Centers for Medicare & Medicaid Services have announced the 2022 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

In November 2020 CMS released that Part B standard monthly premium would go up $148.50 to $170.20 in 2022. The increase was partly driven by an imposed requirement for planning for potential costs, like expenditures caused by COVID19, and the uncertain price and usage of AduhelmTM.

These higher costs have a ripple effect and result in higher Part B premiums and deductible," the Centers for Medicare and Medicaid Services said in a statement . Pharmacy drugs are covered by another part of Medicare, the Part D prescription program. Prescription drug plans for seniors are designed to help seniors pay for the cost of their prescription medications.

The MMA made no change to the actuarial rate calculation, and the standard premium, which will continue to be paid by beneficiaries whose modified adjusted gross income is below the applicable thresholds, still represents 25 percent of the estimated total cost to the program of Part B coverage for an aged enrollee.

Premium and Deductible Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Medicare Part B is not free until a person is on a low income or is enrolled in a Medicare Savings Plan. Depending on the state, a program may help with eligibility by providing higher incomes or eliminating a certain asset requirement.

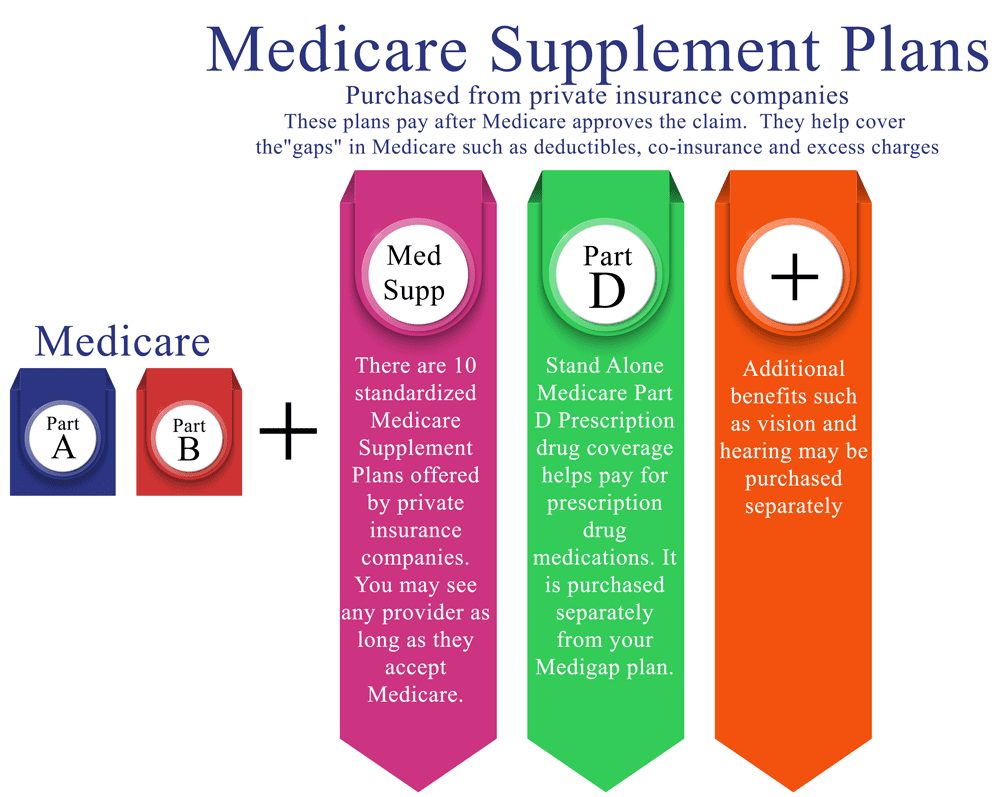

If you have Original Medicare, you should get Medicare Supplements. Medigap insurance policies cover certain deductibles or copayments that Medicare pays when it covers a portion or all of the services. It has standardized medigap plans but the plans are sold to private insurers who set the premium. What we charge can be determined based upon the geographic location, age, gender, smoking and other factors like the health history of the individual. This is the information needed for Medicare Supplement coverage.

The government standardizes Medigap plans, but they're sold by private insurance companies, which set the premiums. So what you'll pay can depend on such factors as geographic location, age, sex, tobacco use, health and medical history, insurance company, and plan. Here's what you need to know about the cost of Medicare Supplement Insurance.

How much does Medicare Supplement cover? Unfortunately the answer does not seem easy since the Medicare Supplement plan costs vary. Identify the most effective Medicare Supplement (Medicaid) plan in three simple steps. In other words it can be hard to know what your premium will be on Medigap.

Apple or continue with email By signing up, I agree to NerdWallet's Terms of Service and Privacy Policy . Insurance Medicare Medicare How Much Does a Medicare Supplement Insurance Plan Cost? Advertiser disclosure You're our first priority. Every time. We believe everyone should be able to make financial decisions with confidence. And while our site doesn't feature every company or financial product available on the market.

The Medicare Supplement Insurance program has several pricing options: Community-rated. The premium is not determined by age – all of the people pay the same monthly premium. The price is sometimes termed no age ratings. Aged. Premium rates are calculated based on the age of purchase. The younger person usually has a higher premium than the more advanced. These pricing methods are sometimes described as entry rates based on age. Attained age. Premium payments depend upon your current age and can also mean cost increases for older people. Some states require a specific cost for Medicare supplement insurance, therefore there is no universal price system.

The prices of each type of Medigap plan can be obtained from an elderly non-smoker from North Carolina which has the most expensive rates among US States. Medigap Plans – Type Monthly Premium Prices Medicalgap Plans A — The basic benefits of Medigap plans include no extra charges. $175 – $116. Plan B: Basic Medicare benefits plus deductible Medicare. $114-30. Medigap plans are inexpensive and offer most Medigap benefits. 105-638. Plan G — the most comprehensive insurance option for the newly enrolled Medicare. Available as standard or high-deductible option at many places. 98 – 33. High Deductibility Medicaid Plan G. $25-67.

Unlike traditional insurance plans, the Medicare Supplement Plans are standardized to ensure each letter of plan provides the corresponding benefit for the same company. Medicare Supplemental Plans G of UnitedHealthCare are the same for all plans offered through Aetna. The rates vary between the companies as a result of each provider determining different rates for their Medicare supplement programs. It is crucial to consider these factors as part of the provider's financial strengths and their rates history. Some companies can have low costs, but they may be able to raise them faster if they become elderly or ill.

We recommend Medigap Plan G from UnitedHealth and AARP for the elderly which costs roughly $31 for ages 55 and older. This program gives you health insurance coverage from an established company. All supplemental plans also provide uniform health protections for out-of-pocket medical expenses incurred by Original Medicare Part A.

Plan A are the most common Medigap Plans. Approximately 46% of Medicare beneficiaries have chosen this plan based off of the extensive benefits offered to them. Plan G holds 27% of market share and is therefore the most popular option among new Medicare users.

Medicare supplements cost $139 monthly in 2023. The cost of a plan is, however, very broad because of the varied plan options and price factors such as age and location. The Supplement plan may charge people under $40 and some over $400 per month.

Medicare Supplement Plan A has the most extensive coverage in Medigap. It is therefore the most widely available plan for people who are eligible. Below the average premium for Medicare supplement plan F is slightly lower – the premium ranges from $251 to $504 for our example. It's obvious that Medicare Supplement costs vary by place, including premiums. The average life expectancy of a slacker is a little less in the US. But the patterns are different between states. You may see New York a state without this rule. Because the state's guaranteed issue plan has many community ratings, the majority have.

Medigap is about 150 per month, industry sources say. Providing coverage for Medicare Part A, B or A can provide coverage that is not currently offered. Medigap can provide you with insurance to offset your medical bills, coinsurance, etc. Medicare's Medicare Supplement Plan is offered by companies with the largest network. Medicare reimburses Medicare for a portion or all. The price of a policy is therefore variable. Two companies will charge different rates for a specific product. The more coverage, the more health insurance may cost.

Medicare Supplement plan costs are estimated to cost about $299.50 annually by 2019. The rates are typically between $100 and $400 per month. To choose Medicare Supplement Plans, check if they provide you with a coverage gap that will help you pay for the most health care you need. If a patient requires specialized care then the cost will also be covered under the Medigap Plans G and K. However, Medigap Plan K covers only half its coinsurance, while Medigap Plan A doesn't cover nursing coinsurance.

In 2022, the average premium on Medigap was about $150 each month. Many factors have an influence on Medigap costs. Rachel Christian Rachel Christian Financial Writings and Educator in Financial Planning Rachel Christian writes for the Retirement Guide. She also specializes in life insurance annuities, Medicare, and retirement. Rachel is an Associate in Financial Planning Education and Counselling. Learn More Matt Mauney Matthew Mauney Finance Manager.

RetirementGuide aims to give seniors resources to make financial decisions that affect their future. We are looking forward to helping readers learn the necessary tools and knowledge for achieving a comfortable and prosperous retirement life. Our goal is to provide you with the highest level Medicare information available to help you make a healthy choice for yourself and your family. Please visit our website to view Medicare information. RetireGuide LLC has partners at GoHealth, Tranza and Cover Right. Interested parties may contact us using our contact details or forms found on our web sites.

RetireGuide maintains full control over the contents published. Our operations are independent and our partners are able to give you impartial advice. Visitor confidence in us for editorial autonomy is important. Our relationship with RetireGuide has no influence on the editorial content.

Plan G also has an extremely high-deductible variant. It provides the same benefits as Medicare Supplement Plan G, however at a lower cost. Medicare Supplement Plans are expensive because their deductibles have higher costs and lower monthly premium costs. This plan resembles the high-deductible plan that preceded the HSRP. Below is shown the cost of Medicare Supplement G premium for the same person in New York is lower than on the standard plan.

Medicare Supplement plans offer the same coverage across different insurers. Nonetheless, Medicare Supplement costs like the premium are largely dependent on the recipient. Your age or gender will affect your Medicare Supplement rate. We also include a number of Medicare Supplement example quote examples for individuals whose income and age are varying in the United States. All these examples were provided to people with no smoking habits.

The best Medicare Supplement Plan should have the balance between the cost and the benefits. Policies that provide more comprehensive coverage for healthcare typically carry higher monthly payments. See more plans. The rate can vary depending on the location, age, gender etc. Plang is ideal for people who have no medical expenses or can be paid $15 a month. This is a way to keep your mind calm, and to prevent unnecessary hospitalizations.

Medicare Supplement Plan f is available in all major states. However it does offer a higher deductible for the benefit. Although the maximum amount may be a long time until you reach the maximum deductible, the average deductible is lower. The following are examples showing reducing costs for the Medicare Advantage plan compared with the standard Medicare Advantage Plan F.

The average cost of Medicated Supplemental Plans N premiums tends to be higher than the two of the best three health care plans. Medicare supplement plan N will require additional expenses like the copayment but will cover anything that Supplement Plan G does not cover. It doesn't appear to be any problem to live in the state which allows excess charging.

How a company decides on your Medigap coverage will affect your premium. Depending upon insurer, your age does not affect how much your insurance policy will cover. Other companies charge you a fee every year for extending coverage. Bob Glaze, an insured agent, demonstrates how the age of the insured impacts Medigap cost.

The amount of insurance varies according to the age of the insured when purchasing the plan initially. Monthly premiums have a lower rate for youth. However, prices will never increase with age. Similarly, Amy purchases a policy based on age and pays $110 every month. His insurance starts at age 72 and costs $171 a month on a similar policy. Amy's premium will not increase as she ages, but the rate will not be as high. Prices are usually fixed at the age at which policy is purchased, although the cost can increase gradually in the event of inflation.

Medicare is a fee-for-service medical insurance policy for a person who is older. It includes alphabet soups that offer many coverage or benefit categories. Medicare is a complicated business. There are holes that can just not be filled out completely. If your gap is widening, enroll in a supplemental Medicare plan. For your consideration, we have collected unbiased expert insights into coverage cost, convenience, and options.

We review products in the most independent manner and advertisers have no effect on their selections. We may be compensated for visiting partners we recommend. Find out what we have disclosed to advertisers on a separate page. Anyone who wants to join Medicare should take several choices. How can I supplement my original Medicare with Medigap if I am not a registered Medicare beneficiary?

How Medicare Advantage is different from Medigap Medicare Advantage, also known as Medicare Part C, is an all-in-one alternative to original Medicare. Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services.

Medicare Part C, also known as Medicare Advantage, is a comprehensive health insurance plan offered by private insurers. This plan includes all benefits of Parts A and B, along with additional benefits such as prescription drug coverage, dental, vision, hearing, and wellness programs.

Contrary to common belief Medicare and Medigap are two very different coverages and neither one is suitable. Tell me the right policy? Find the right plan immediately! Having not taken health insurance since you were 65 is a relief unless you are in a coma. Part A and Part B (medical insurance) cover most medical expenses but they don't cover anything else.

When you choose the most affordable private insurance options you can get the most money and the most competitive rates available.

If it isn't available, you can buy another Medigap policy. The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D) . If you joined a Medicare Advantage Plan when you were first eligible for Medicare, you can choose from any Medigap policy.

Medicare Advantage policies (PARTC) can be purchased by private insurance companies under the Aetna Humana or Kaiser Foundation names for consumers. There could also be no premium on the policy, but lower premiums when compared to the premium rates on Medigap insurance. Medicare Advantage plans cover doctors, hospitals and often provide prescription medications. Other coverages do not cover Medicare. By 2020, 42% of Medicare beneficiaries would have chosen this plan.

Most Medicare Advantage plans are operated in the manner of health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Aetna Medicare Advantage plans are health insurance plans offered by Aetna that provide coverage for Medicare Part A and Part B benefits. Medicare Part B is a supplemental health insurance policy that helps cover medical expenses not covered by Medicare Part A.

Medicare Advantage plans resemble private insurance. Most services are provided in exchange for a small amount of money. Plan offerings may also have HMOs or PPO networks. Almost all plans impose annual limits for expenses. All plans have their own benefits. Most of them offer medical insurance. Some need a referral from a physician and others don't. Depending on the situation, certain doctors and hospitals will be covered unless they have access to HMOs or PPOs in the network. Some Medicare Advantage plans exist. Choosing an alternative plan may be of great interest. The eligibility age for Medicare is 65.

Medicare Advantage plans are a replacement for Medicare Originals. Sold by private insurers this program covers all the covered services under the original Medicare and offers additional benefits for things Medicare does not. In addition to medical services and prescriptions there are prescription drug benefits such as eye health, hearing and dental. Upon acquiring Part B health insurance and Medicare Part A hospital insurance, you may receive Medicare Advantage plans. When you apply, Medicare Advantage replaces Part A, Part B, or other types of coverage.

Medicare Part D Medicare Supplement (Medigap) Plan Type FAQ Medicare by State Managing Your Medicare Blog About eHealth Open About eHealth menu Back About eHealth Licensing Privacy Policy Terms of Use Careers Find Medicare Plans Find Medicare Advantage Plans Find Medicare Supplement Plans Find Medicare Part D Plans Learn About Medicare New To Medicare Enrollment Open Enrollment.

The average annual payment for a Medicare supplement plan is estimated at between $100 and $200, based on how often the insurance company has. Just like Medicare Advantage, it's good to shop around—65-year-olds will save an average of $740 a year with Medicare Supplement Plans G and $648 a year with plans N. Depending on what is offered at your location, your doctor may recommend a combination of Medicare “We are focusing largely on the benefits of private health coverage and Medicare as a way of improving the quality of life,” he said. Home health aides are professional caregivers who provide assistance to individuals and families in need of help at home. They are typically employed by home health care agencies, but may also be self-employed.

Medigap or Medicare Advantage programs offer a variety of advantages that depend on the individual health needs that apply. Medigap plans also offer additional coverage to Medicare users. The Advantage Medicare program provides the same coverage as Original Medicare plus extra benefits including prescription drug, vision, dentistry, hearing and other wellness benefits.

Medicare Supplemental Insurance or MGAP works together with your current Medicare plan. It helps cover the costs of services covered by Part A. Part B does not reimburse for example the expenses for traveling abroad and excessive costs for medical visits. It may even cover Part A deductibles that are worth $1,555 in 2022 as well as 20% of the coinsurance charges that you are required to cover Part B insurance. I think the Medigap plan should be part of a larger plan, as they would help reduce copayment costs,” she said today. A medical alert system is a device that allows individuals to call for help in the event of an emergency.

The Medicare Advantage plan is a Medicare supplement. They are available by private insurance companies. Under an MD Plan your benefits may continue to include A and B, but you will usually also be given Part D along with other benefits like regular hearing and eye care. Medicare Advantage Plans are administered under the same rules as Original Medicare. But it could require staying connected or seeking a referral before a plan pays for it, says Donovan. Original Medicare allows you to see all of the doctors that accept it.

Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or skilled nursing facility (SNF) if you're medically necessary.

As we reach age 65, it is crucial to find out how long it takes to enroll in school. Start with a check of eligibility. Most Medicare Part A patients must enroll with their doctor or health care provider within the seven-month window that starts at a year-end three months prior to their 65th birthday. This window is for a three-month period after you reach 65. In case of Social Security. If you haven't yet enrolled, you can enroll online. If you don't register, you will need a paper application form.

The CPT code for a home visit depends on the type of service provided. Generally, the most common codes used are 99211 (established patient office or other outpatient visit), 99347 (home visit for an established patient) and 99348 (home visit for a new patient).

If your condition requires undergoing medical attention out-of-town, it is possible to take advantage of Medicare Advantage benefits, then return to normal Medicare if necessary in a non-urban setting. During this open enrollment period switching between both Medicare Advantage plans may be available to any person. Each year, the elections take place from October 15 – Dec 7. Let me explain it. During a switch to Medicare, you can no longer enroll with Medigap.

Medicare Advantage plans are based upon original Medicare and provide coverage for certain services that were not covered by Original Medicare including sight screening, dental treatments, hearing and health care programs. Some plans even provide transportation for doctor visits and adult daycares. The plan also provides benefit plans for chronically ill individuals.” Among other services, Cigna is offering Medicare Advantage users COVID-19 free vaccinations.

If you are healthy but have minimal medical bills, Medicare can be the best option. In general, Medigap can provide relief to a patient who needs urgent treatment or is experiencing high health problems. Talk to an insurance company for advice and guidance on the health of an individual. Because Medicare Advantage and Medigap cannot be used together, you should select a plan carefully so that you can have the best coverage.

Medigap was created to fill in a gap between original Medicare and Medicare's copays. Medicare provides only 80% of the cost of Medicare coverage, including the services of your physician. A Medigap plan could help cover 80% of your out-of-pocket costs. Medigap cannot be used for the costs incurred in Medicare Part A or Part B. If your Medigap coverage doesn't cover hearing, vision or dental services, Medicare cannot cover.

Medicare Supplements help reduce costs and improve the budget. According to Jacobson, Cost Share has become a popular way for many people to avoid paying owed medical bills or getting rushed to a hospital. It's easy for people to see doctors in the USA. If one is from Arizona, one can fly to Minnesota for Mayo Clinic visits. In fact, Jacobson says it is much harder to use the benefits if someone gets sick.

A recent analysis by The Commonwealth Fund looks at Medigap plans offering nontraditional health care services which cannot even be offered under original Medicare[3]. We found that only 7 percent of plan members offered those benefits. Many people are still unaware that these insurance plans have the same coverage as Medicare's Advantage. There is a compromise between policy that encourages and discourages the offer of these advantages to consumers at federal level.

It's often difficult to calculate how much you'll pay for medical expenses during your retirement years. While traditional Medicare provides adequate basic coverage and provides good coverage, they are not paying nearly as much for hospitals, doctors or other procedures. Another 20 percent is individual responsibility, as is the Affordable Care Act. Tell me if a cardiac surgery is required.

The Medicare Supplement plan is a type of private insurance plan sold for the purpose of covering the coverage gaps in Medicare. In 2018, 33% of Medicare beneficiaries were covered by Medicare Supplements roughly 11 million people. The Medigap plan offers standardized coverage for things like deductibles, coinsurance, or copayments.

Medigap covers out-of-pocket expenses for Medicare patients who choose original coverage. Medigap offers a number of advantages, including choosing doctors. You get to choose between many medical offices because they accept most medical services. Whether your doctors work with Medicare Advantage plans or have other health plans you may consider Mediga. You can visit anyone accepting Medicare. In some cases, while Medigp's premium rates can exceed those of Medicare Advantage, Medigap charges you more out-of-pocket charges.

People on Medicare are either on Medicare Original Medicare or in the Medicare Feed-for-Service Medicare program. Generally, your Medicare insurance coverage costs are covered in your own pocket.

In fact, Medicare covers a large portion of covered medical care services. In most situations a medical insurance policy will cover the remaining cost of the healthcare, such as copayment.

A Medicare Advantage plan may be a more appropriate option for those whose monthly payments exceed the maximum amount. Medicare Medicgap insurance programs usually give you more choice where you can get treatment.

You may choose to join a separate Medicare Prescription Drug Plan (Part D). because most Medigap drug coverage isn't creditable prescription drug coverage , and you may pay more if you join a drug plan later. If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

A Medicare supplement is a Medigap plan offered to consumers through private companies that helps to pay for health care costs that are not covered by original Medicare, such as copays, insurance or premiums.

Get the information you need today! How do I change my Medicare coverage? Thousands of Medicare beneficiaries change their coverage each year during several enrollment windows. Find out how and when you can switch plans. How are Medicare benefits changing for 2023? Medicare changes for 2023 include premium and deductible increases for Part A, lower rates for Part B, and better Part D coverage due to the Inflation Reduction Act.

A Medicare supplement is a Medigap plan offered to consumers through private companies that helps to pay for health care costs that are not covered by original Medicare, such as copays, insurance or premiums.

Plans F and G also offer high-deductible versions in some states. 15 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer's prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.

Related Blogs: Does AARP Medicare Cover Life Alert?

Medicare Physician Fee Schedule (MPFS) uses an RBRVS-based relative value system which assigns relative value to current CPT code which is developed and copied by the US Medical Association with input from representatives from various medical organizations in the United States. The relative weight factor (relative value unit, or RVU) is developed on a resource basis. Each component of the RBRVS procedure is outlined in detail.

Calendar year 2020 Proposed rule CMS published its Calendar year 2020 Physician Fee schedule proposal rule which announced and solicited public input regarding proposed policy changes for Medicare payment under the PFS as part of a Medicare Part C program. Check out this summary of the provisions. Our proposal includes: This period ends September 5, 2020.

Medicare Part B pays physicians for medical care according to the Medicare Physician Fee Schedule. The services of physicians are provided by a variety of medical and diagnostic services including surgery and anesthesia. For more information please follow the links above or visit their website. Find the State or Area.

Skilled nursing facilities are the most common applicable setting where facility rates for audiology services would apply because hospital outpatient departments are not paid under the MPFS. Therapy services, such as speech-language pathology services, are allowed at non-facility rates in all settings (including facilities) because of a section in the Medicare statute permitting these services to receive non-facility rates regardless of the setting.

In order to calculate the final payment, a Medicare Part B service provider must consider many factors. Medicare CPT Codes for audiologists or speech therapists. Part B treatment is billed as 20% of the total patient's total costs. MPFS cannot collect copayments for any reason. Therefore, the actual reimbursement for Medicare is 20% lower than the schedule for fees. Your employer must take reasonable steps to recover 20% of the payment. Medicare offers two different categories. Providers that accept assignments. Non-participating providers that refuse assignments.

Visit CMS' Physician Fee Schedules LookUp and click on Start a Search. The License Agreements for CMS must be submitted first. Providers can use a CMS physician fee schedule search site if they need information on payment policy indicators, relative value units, and geographically specific practice costs. How do you search Medicare physician fee schedules online? Medicare is reducing its reimbursement of second therapy procedures, surgical, and radiologic imaging procedures provided for a single patient.

CMS released the updated Medicare Physician Fee Schedule (PFS) final rule in January 2022. Listed in the list above are key provisions in effect at and after the 1st January 2022.

The Non-Participating, and Limiting Charge amounts listed are based on the lower of the fee schedule amount and the OPPS payment caps. Note : Payments for the technical component of a code are capped at the OPPS amounts. The Non-Participating and Limiting Charge amounts listed are based on the lower of the fee schedule amount and the OPPS payment caps.

The Health Management webpage offers a list of all new services that are included within the Physician Fee schedule.

Fee schedules are a list of maximum allowable units for HCPCS codes, if applicable. Pricing on durable medical supplies, prostheses and orthotics (DMEP) has been calculated from cms fee schedule lookup and payment methods.

The Medicare Physician Fee Schedule (PFS) is published annually in the Federal Register by the CMS. It contains Medicare's payment rates for each of the Current Procedural Terminology (CPT) codes used in pathology practice. The CMS publishes a Proposed Rule on or about July 1 each year, which is open to public comment for 60 days.

CMS has published the Medicare Physician Physician Fee Schedule (PFS) Final Rule for 2022 CY. The final rule updates payment guidelines, payment rates, and other terms of service. See summary of key provisions effective from 1 January 2022.

Final 2020 Medicare Physician Fee Schedule and Hospital Outpatient Rules Nov 01, 2019 ACC News Story Share via: Print Font Size A A A The Centers for Medicare and Medicaid Services (CMS) has released the 2020 Medicare Physician Fee Schedule final rule addressing Medicare payment and quality provisions for physicians in 2020.

This fee schedule has been updated annually by the US government by changing the fees on the January 1 of a particular year. CMS requires that the rate be published in the Federal Registers before November in each fiscal year.

The website shows rates vary depending on the healthcare provider. Clinical nurse specialists receive 85 percent of their costs while a clinical social worker gets 75 percent.

Physician Fee Schedule Medicare Physician Fee Schedule The Centers for Medicare and Medicaid Services (CMS) uses the Medicare Physician Fee Schedule (MPFS) to reimburse physician services. The MPFS is funded by Part B and is composed of resource costs associated with physician work, practice expense and professional liability insurance. Under the MPFS, each of these three elements is assigned a Relative Value Unit (RVU) for each Current Procedural Terminology (CPT ) code.

Medicare's final rule on physician fees is expected to be published by December 30 and focuses on payments of Medicare premiums for medical professionals and quality provisions in 2019.

CMS is a federal government program that uses a Medical Physician Fee Schedule if deemed necessary. The MPFS is funded through Part B and is primarily reimbursement of medical expenditures, practice expenses and professional liability coverage.

Typically Medicare charges physicians and other providers for their medical services. Using these detailed fee caps, a physician or another medical provider can be paid for the services of their provider for the services they have provided.

Medicare Fee Schedules are compiled in detail by Medicare that provide for the treatment fees of the physician or provider/supplier. Generally this list includes maximum fees used as reimbursement for doctors in return for their services.

Find a Medicare reimbursement rates for services, treatments and devices on this Medicare site. Use the HCPCS code and Medicare fee schedule lookup.

If you have no premium paid Part A the monthly rate can be as much as $499. Usually after age 60, when people turn 65 they pay a penalty. The average Part B monthly premium cost will be 170.1 in 2021.

The new 2019 Physician Payment Schedule Rule (PPS) was announced in December 2019 as part of the Medicare Payment Schedules.

Until part B is paid for, you pay a monthly rate from $549 to $449 in the United States. If you do not buy Part A when you qualify for Medicare (usually after 65), you may pay a penalty. Typically, the average Part B premium is $190.40 per month in 2020.

If you enroll in Medicare in 2022, you're credited with your regular monthly premium of $170.10, but you only require a copy of your Medicare card. Medicare reimbursement rates.

According to the majority, Medicare Advantage and Medicare Medigap are two completely separate types of insurance. Find the most suitable insurance that suits your requirements. Get your plans for the region immediately! If your health insurance is not covered at the time, you will most definitely feel relieved as you get older. Although Part A (hospital and hospital insurance) covers most health care expenses, it does not cover all costs.

Medicare is billed to older people for their medical needs free. There is an alphabetical array of parts that offer different kinds of protection or benefit options. Medicare has some difficulties. Some holes in Medicare are completely ignored. For these gaps, consider transferring your Medicare Advantage and Medicaid plans. We found the most comprehensive coverage available for the most affordable price, and the benefits are discussed.

Our recommendations are based on our own reviews and advertising does not impact on our choice. We may receive compensation for visiting a partner we recommend. See the advertisement disclosure page to learn about the advertising services offered. All Medicare enrollees have several choices on hand. What is a better alternative option if Medicare is the best option?

When you decide to buy supplemental coverage over Original Medicare, then it's time to figure out what private policy will meet your budget.

How will the Inflation Reduction Act affect Medicare enrollees? Under the new law, Medicare beneficiaries will see a series of prescription drug-pricing provisions phased in – mostly over the next several years Nearly three-quarters of readers feel overwhelmed by Part D options We asked how confident our readers were with comparison shopping for a Medicare Part D plan during the 2022 Medicare Annual.

Medicare's supplemental health coverage is the same as a private plan. Most service visits, labwork, surgery, etc. can be paid for with only one small copayment. Some plans provide HMO or PPO networks and each plan has a limit for total billed expenses each year. The plan varies in terms of advantages and conditions. Most insurance companies offer prescription drugs. Some require the consultation with a medical doctor and some don't. Several may offer out-of-network medical services while others can cover only medical providers that belong to HMO or PPO networks or hospitals. Some of them also offer an alternative Medicare plan. It is important that you find an affordable monthly plan if the premiums are not as high as expected.

Medicare Advantage plan provides a substitute for original Medicare. These private insurance programs cover the entirety covered by Original Medicare but offer additional advantages over things Medicare does not cover. Additional benefits include medical insurance and prescription drugs as well as dental and vision care. If you are eligible to enroll in Medicare Part B hospital coverage and Medicare Part C medical coverage, the Medicare Advantage plans are available. When a person enrolls in Medicare, their Medicare Advantage plan replace Part A and Part B coverage.

Choosing a Medicare Advantage Plan Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules.

After enrolling in Medicare, you must decide whether to get Part D prescription drugs or not. If Part D insurance is not available when the patient gets Medicare or tries to purchase drugs, you may face penalties for late enrollment or late enrollment. But you can avoid the penalties if the prescription drug coverage that you have is creditable. The coverage is essentially prescription drug coverage that is paid in a manner comparable to the Medicare standard prescription drug coverage. If a person is receiving Medicare drug protection, they usually get it back.

Medicare Advantage is a replacement plan for original Medicare Medicare. The products have been made available through insurance companies. A MA Plan gives you the parts A, B, and C, but you can usually get Part D as an additional benefit. The Medicare Benefits plan covers all kinds of healthcare — including hospital visits, doctor appointments and laboratory testing, for instance. But you may have to be within the network or seek referrals to make sure the program covers the cost. Original health care will be available from any physician that accepts the plan.

The Medicare Advantage program is available from private, approved insurance companies to consumers. They could not pay any premiums or be lower when compared with high premiums on Medicare and Medicaid. Typically Medicare Advantage coverage covers hospitals or physicians, and may provide prescription drug coverage as well as a variety of other services that aren’t covered by Medicare. During this period, 82 million people will have been enrolled in this program. Most Medicare Advantage programs offer health-related insurance in HMO or PPO form.

Medicare Advantage plans offer most of what Original Medicare provides, but also cover items and services which aren't covered by Original Medicare. These include certain vision, dentistry, audio and wellness services such as gym memberships. Some plans also offer transportation to doctors and adult day-care providers. The company said its benefit packages could be tailored to the needs and conditions of chronic illnesses and their families. Cigna has offered its Medicare Advantage subscribers free vaccinated vehicles.

Managing health care expenses at retirement is tough because most people don't know how much money they will spend each year. While traditional Medicare provides largely basic coverage, it only pays around 80-80% of the fees approved for hospital, physician or medical procedures. The remaining 20% is the individual's responsibility and unlike coverage under the ACA, it does not contain any limits to how much a person can pay in a year. Tell me a case where a heart bypass operation is needed.

About 62% of older adults who qualify for Medicare choose Part 1 and Part 2 of Medicare, which covers doctors and hospitals. 5. The 81 percent who participate in Medicare Supplemental coverage pay for the same coverage and the 48 million pay for supplemental Medicare Part D prescription drugs. Medicare Supplement insurance and Medicare Supplement insurance policies are not affiliated with or endorsed by any government agency. Despite being cheaper than the others, they do have advantages.

Medigap is designed to cover some gaps that are not covered by Medicare. Coinsurance, copay and deductible are examples. Medicare covers covered medical and other medical expenses in the form of doctor's services and medical equipment. A Medigap program may help you cover 20% of the money gap you are currently paying. Medigap does not reimburse the cost of Medicare Part A or Part B coverage. This means you wont be covered under Medigap for medical care.

If you're well-being with no medical expenses, Medicare Advantage could be a useful money saving option. Medigap is generally safer for people with serious medical conditions. Consult an experienced insurance agent who knows your medical situation and will guide you through the options available. Because it's impossible to combine Medicare Advantage vs Medigap in one place, you must decide carefully to ensure you're receiving the appropriate coverage.

The Medicare Supplement program provides a cost-effective solution to your monthly expenses. Jacobson says many customers like it because it does not require that they worry a lot when they are rushed home. “You could visit any doctor you wanted in any place”. In Arizona, you could travel to Minneapolis to visit the Mayo Clinic for example. Unfortunately, Jacobson said this is more useful in sick situations than when sick.

A recent report by the CommonWealth Fund examines Medigap plans that offer nontraditional benefits such as vision, dental and hearing services that are not available under traditional Medicare(2]. The survey revealed that only 7 percent of these programs offer these benefits. Most Americans are unaware that they have Medicare-like benefits. There is some trade-off between federal policy encouraging or disabling this benefit being offered.

Some Medicare Advantage plans provide no premiums and are therefore worth exploring. The plan that charges premiums will be paid by the person who enrolls. Medicare Part B coinsurance and the deductible are $226, according to Medicare.gov. If these conditions are satisfied, your copayment under Medicare Advantage will generally be 20 % the Medicare-approved value for the most services and products.

Medicare supplement insurance, also known as Medicare Advantage, is available to you. This fund provides assistance for services Part B and Part E are unable to cover. It also helps cover your Part A deductible – $1556 for 2020 – along with 20% coinsurance for your Part B coverage, if necessary. I would recommend a Medigap program that can help with these costs,” she explains.

A Medicare Supplement plan can have up to $200 annual premiums, which can vary depending on the state you live in and the insurance company you choose. Just like Medicare Advantage plans you can look at if you are 65 and you are saving up for Medicare Advantage. We've been studying private plans to improve efficiency in our communities, Jacobson explains.

Medigap and Medicare Advantage offer a number of benefits that vary in their specific health needs. Medigp offers supplemental coverage to Medicare patients, but does not contain prescription drugs. Medicare Advantage Plans also include supplemental benefits including prescription medications, vision, dental, hearing and other services for the health and safety of the patient.

Medicare Supplements are sold by private insurance companies for the purpose of filling gaps in Medicare. In 2018, 34% of people who enrolled in Original Medicare were enrolled in Medicare Supplement coverage — that's almost 11 million people. Medigap offers standardized coverage that covers everything from deductibles to coinsurance and copays.

In this context Medicare includes Part AB (hospital and hospital coverage) and Part B (medical coverage). This coverage is available as part of Medicare Part d or supplemental Medicare Part d insurance. While Medicare will give you Part B coverage, you must buy a supplement.

Medicap plans are privately available plans, offered either through an insurance company or broker. Plans A, B, C, D, F, and G each have standardized coverages that differ. Plans GF and G also offer deductible plans for certain states. Several insurances provide medical assistance in the event of a medical emergency in the country. Because Medigap's cover is standard, they don't have ratings for it yet. Consumers may easily compare insurer pricing and simply pick the best offer. From January 1, 2020, new Medicare plans will be prohibited from paying Part B deductibles.

A Medicare Advantage program could be an excellent plan to get out of a larger bill. The regular Medicare and Medigap plans generally give you better options on where to get treatment.

Costs Monthly premium, deductible, coinsurance, and copayment Monthly premium Income-related premiums Yes Yes Prescription drug coverage Often included Not included Medigap and Medicare Advantage together It is not possible for a person to have both Medicare Advantage and Medigap. The two plans do not work together. An individual may use Medigap to help pay original Medicare's copayment, deductible, and coinsurance costs, but they may not use it to pay Medicare Advantage's out-of-pocket expenses.

The biggest disadvantages of Medicare Advantage are closed providers network that limit your choice of the medical provider. Medicare's health insurance costs largely depend upon the amount of care needed and make it difficult for a person to pay.

Medigap offers some downsides including: increased monthly fees. There are various kinds of plans. No prescription insurance (available through Plan D).

If you have a Medicare Advantage plan, you aren't allowed to enroll in a Medigap insurance plan unless you're also switching your Medicare Advantage plan back to Original Medicare. If you want to enroll in Original Medicare and buy a Medigap policy, you'll need to contact your Medicare Advantage plan and ask if you can disenroll from it. You may be able to do so only during certain times of the year, known as “enrollment periods.”

Medicare Supplements. Medicare Part C Advantage plans are designed as bundled options with lower annual premiums. Medicare Supplement plans provide supplemental coverage to Original Medicare at no cost to individuals.

Get the information you need today! Read More Do Medicare supplement plans include prescription drug coverage? Modern Medigap plans do not include prescription drug benefits. Instead, Medicare offers prescription drug coverage under Part D. Medicare enrollees can get prescription coverage either by switching to a Medicare Advantage plan or by purchasing a stand-alone Medicare Part D plan (PDP) to go along with Original Medicare.

The Medicare Supplement or Medigap Plan is an insurance program offered by private companies. Some Medigap policies offer coverage for services which Original Medicare does not cover, such as healthcare, if you travel abroad. If you buy Mediga Preferred Medicare coverage and have Medicare coverage, Medicare can pay the portion of Medicare-approved amounts for covered benefits. Then you pay for the benefit of meds.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

Medigap consists of Medicare Supplemental Insurance that fills gaps in Original Medicare. In addition Medicare covers a lot of health care expenses but doesn't cover all of those costs. Several Medicare Supplement insurance plans cover services that Original Medicap cannot provide.

Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap in Massachusetts Medigap in Minnesota Medigap in Wisconsin Medigap & travel How to compare Medigap policies Find out which insurance companies sell Medigap policies in your area.

What's Medicare Supplement Insurance (Medigap)? Medigap & Medicare Advantage Plans Search Search Print this page. Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Medigap costs Medigap & Medicare Advantage Plans Medigap & Medicare drug coverage (Part D) Illegal Medigap practices Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap & travel Medigap.

There's a disadvantage to Medigap plans: More monthly premiums. It takes navigating the various plans. The plan does not provide any coverage for prescription medication.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

Medigap policies differ from Medicare Advantage Plans. These programs offer a means of gaining Medicare benefits while a Medicare supplemental plan provides supplemental insurance to all your Medicare benefits. The private insurance companies are charged monthly premiums for their Medigap policies.

Viewing this Medicare overview does not require you to enroll in any Blue Cross Blue Shield plans. Plans are insured and offered through separate Blue Cross and Blue Shield companies. Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract. Enrollment in these plans depends on the plan's contract renewal with Medicare. To find out about premiums and terms for these and other insurance options, how to apply for coverage, and for much more information.

Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) . Call your State Insurance Department. Site Menu Sign up/change plans About Us What Medicare covers Drug coverage (Part D) Supplements & other insurance Claims & appeals Manage your health Site map Take Action Find health & drug plans Find care providers Find medical equipment & suppliers Find a Medicare Supplement Insurance.

It is not possible to get both Medicare Advantage and Medicare Medigap benefits simultaneously. You can change these plans as your medical bills change.

If you have a Medicare Advantage (MA) plan, you can apply for a Medigap policy, but make sure you leave the MA plan before your Medigap plan starts. You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

A Medicare Advantage plan may provide a more flexible option to pay your insurance premiums. Medicare, plus Medigap coverage, gives you more choice of how and what you receive care.

Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

Medicare offers a variety of health benefits to Americans 65 and older. Similarly, certain people older than 60 may also be eligible under Medicare, such as people with disabilities or permanent renal failure. The program provides assistance with health expenses but does not cover any medical or long-term health insurance expenses. There are various ways to obtain Medicare insurance. You may buy Medicare Supplement Insurance policies (Medicare Supplement Insurance) for your Medicare premiums by private insurance companies or through an independent insurance broker.

Medicare Supplement insurance helps reduce unexpected medical expenses. You aren't sure if your health will improve if you are 67. Your illness might cause your family medical expenses that will destroy countless hours of preparation. Combine it with fixed income for dozens of seniors to see how important health coverage is for seniors. This is an excellent option. A Medicare Supplemental may be helpful. According to the plan, it covers 85% of all costs. In fact about one in three people with Medicare opted for it. Home health aides provide professional caregiving help at home, allowing elderly and disabled individuals to remain in their own homes.

Medicare provides a federal health insurance system for people 65 years old and older. The new plan provides funding for health care for disabled children and older people. You might need to purchase Medicare Supplemental Insurance to get the money you need to pay Medicare. It does no good to pay. As part of Medicare supplement insurance it can be categorized under Medicare Supplement Insurance or Medigap.

Original Medicare is divided between Part A and Part B. Medicare Supplement insurance plans are health plans offered from private insurers which provide insurance for the cost of medical care from a patient – these include coinsurance, copays and deductibles. Find upcoming events right now for the city of your choice.

If your Medicare eligibility is approaching, it may have been a little surprising how private coverage is offered as an alternative to Medicare. Is this plan useful? Can a patient who does not want private insurance still benefit from Medicare? That depends.

When choosing a new health plan after 66, you must select Original Medicare Part C. Original Medicare covers most of the medical bills. There are no prescriptions for this drug, but there are private plans. All costs are left for you to choose from, there is no maximum cost. Original Medicare gives your doctor the ability to visit any American doctor whose Medicare program is accepted. It offers excellent flexibility – it doesn t require networking. Medicare Part C (or Medicare Advantage) provides medical insurance to patients in addition to hospital care. This covers the majority of those costs; however, your deductible, copays and insurance coverage will vary.

Original Medicare includes a few components. Part A covers hospitals while Part B covers other medical expenses. You can visit any hospital accepting Medicare. Medicare supplements are not compatible with Medicare Original Medicare. Medicare Part B medical coverage covers Medicare Part B prescription drug coverage covers generic drug coverages and brand names. You are entitled to prescription drugs by signing a standalone prescription drug plan or purchasing an eligible Medicare & Medicaid plan that offers prescription drug coverage. If the patient is insured by group insurance the prescription will likely cover that coverage.

Prescription drug plans for seniors can vary depending on the type of coverage and the insurance provider. Generally, these plans cover medications prescribed by a doctor or other healthcare provider.

You could choose to enroll in Medicare Advantage Plans or Medicare Part C. For the benefit, a patient has to qualify for Medicare Part C or Part A or B and live within a locality that provides such a plan. The government has agreed with health insurers and specialized medical plans to allow patients to access Medicare Advantage in certain parts of the country. Medicare provides members with Medicare Part B coverage for a certain amount a month. You pay your annual Medicare premium. Then there will be deductibles and coinsurance. In the case of Medicare Advantage, the summary of Medicare's benefits does not appear on e-mailed forms.

The Medicare Flex Card is a debit card that allows Medicare beneficiaries to pay for health care services and products. The card can be used to pay for doctor visits, prescriptions, medical supplies, and other health care needs.

Assignments are agreements between the physicians of the hospital, their providers, and Medicare. Doctors accepting assignments are charged the amount Medicare is willing to pay to perform their services on Medicare terms. All of your deductibles, coinsurance payments are due. Medics who do not accept assignments may be charged more than Medicare-approved amounts. You pay higher costs. You might also need to pay for your services at your medical center, then wait for a Medicare reimbursement. Make a copy of your Medicare Summary Notice. Each quarter Medicare sends out an overview notification.

Part B Medicare pays a premium each month as well as the deductible copay. You may also pay a fee for services Medicare cannot reimburse.

The Original Medicare plan doesn't cover all of the expenses. Medigap is Medicare's alternative to Medicare's coverage that isn't covered. Private insurance companies offer them as a way to help pay for expenses from an undetermined source. It is no more insurance than this policy provides. Instead, it provides for the benefits that Medicare Parts B and A cannot cover — including copayments, coinsurance, and deductibles. U.K. Medicare website. Can you list some good benefits of Medicare Supplements Insurance? Medicare,gov. The benefits of Medicare Supplement plans are outlined here.

You can always check that Medicare coverage will stay on after you leave. Generally, the federal government is allowed in the event that Medicare supplements have expired. It is possible to get exemptions in certain circumstances from the Medicare-Select Plan if your insurance plan is not enrolled and includes additional benefits. Ask Medicare Advantage if they are able to offer the plan at your new ZIPcode. If the plan cannot go forward, you will need another plan. You have the choice of moving to another Medicare Advantage plan at your new location or the original Medicare plan.

To purchase health insurance, you will need to join Parts A and B of Medicare. Medicare is responsible for managing the payments between Original Medicare Supplement plans. You seldom have a claim. Initially, your provider pays Medicare before you pay your insurance plan. In the event the plan deductible has not been met, your payment is billed to the insurance company. You can renew your MedigAP policy if you pay premiums. It can not be used to modify a plan or increase a policy. In some cases the different states have a specific guarantee or limitation for them.

Medigap policies include a list of cost-free services for Medicare. Medicare.gov (accessible December 20, 2020). Part B excess fees can be confusing but crucial knowledge must be acquired. Physicians accepting Medicare assignments must pay Medicare rates for covered services. Those not covered will be charged an additional 15% of the Medicare payment. In addition to your Medigap plans, you are also liable if there are excess charges. Are there alternatives? Usually only involve participating medical professionals but this can be hard in emergency situations.

Federal government plans are being used for Medicare Supplements. The same coverage is available for all customers, regardless of the insurance provider. Premiums vary by insurer. However, prices quoted as well as reputations may differ. There are 10 separate plans, numbered A through N. 2 plan C and E were discontinued by the new beneficiaries. This table lists the specific advantages a particular plan has. Once you decide how much cover is required, you may look up quotes from insurance brokers or online.

Medicare - Medigap plans do not provide additional coverage for Medicare. Moreover, these policies don't cover dental and eye care, hearing aids, or home health care. Medigap doesn't cover prescription drugs. Medicare Part D is available only in private health insurers. The majority of Medicare Advantage plans include medication. Medigamp does not provide long-term or private nursing care. Such coverage should come through an independent insurance plan.

This seems like a quick answer. To enroll in Medigap, you'll first be required to have Medicare Part A and Part B. Your Open enrollment period in Medicare Part B begins on the 1st Monday of each month. During the open enrollment period, you'll need to first complete an application for Medicare Part B. Outside of Medigap's Open Enrollment Period, you can receive less coverage for your medical conditions.

These programs allow people to use their savings to cover other expenses or to buy more coverage. The Medicare savings programs are: The Qualified Medicare Beneficiary (QMB) program. The Specified Low-Income Medicare Beneficiary (SLMB) program. The Qualified Individuals (QI) program. The Qualified Disabled Working Individuals (QDWI) program.

Medicare coverage can last for a whole year. As people become older their medical visits will increase. It’s difficult for you to predict what you need in your healthcare. Medigap plans are partnered with Original Medicare to minimize the risk to you for unexpected expenses. Then choose the amount of premiums you'll pay. A medical alert system is a device or service that helps people who may be incapacitated due to illness, injury, or disability to get help quickly in an emergency.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

The Medigap plan offers some limitations such as high premiums. Managing various plan types. There's no prescription insurance plan available on Plan D.

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

How much do Medigaps cost? Medigap offers optional insurance coverage. If you decide that you want this coverage, you must pay the premiums of the private insurer each month for the policy. These costs add up to your Medicare Part B monthly payments.

It's possible not everyone is eligible for health insurance after turning 60. If you worked after age 60 and enrolled into a spouse's employer plan, you may delay enrolling in Medicare.

Most Medicare users are not convinced: 19% of original Medicare beneficiaries aren't covered through supplemental Medicaid programs or Medicare plans. You can use the Medicare Advantage program for most of your expenses without paying a premium for the remainder of your monthly salary.

Some people with limited resources and income may also be able to get Extra Help to pay for Part D drug costs . What Happens After I Apply? The Centers for Medicare & Medicaid Services (CMS) manages Medicare. After you are enrolled, they will send you a Welcome to Medicare packet in the mail with your Medicare card. You will also receive the Medicare & You handbook, with important information about your Medicare coverage choices.

Medigap is Medicare Supplement insurance that fills the gap in original Medicare and sells through private companies. Medicare covers most or none of the costs of medical services. Medicare Supplement Insurance (Medigap) may help cover most of the remaining health care costs such.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

If you are on Medicare Part B or Original Medicare a Medigap Plan can cover your coverage gaps for Medicare Part B. Medigap Plans are provided by a private insurance company that provides a solution that covers all expenses and can save you money. Medigap is a standardized plan, however, some plans will have no locality.

If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy. Note For more information about how Medigap plans are priced or rated, see costs of Medigap policies . For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) .

The initial enrollment period is an initial limited period for you if you're first eligible. After enrolling for Part b Medicare you may choose to purchase additional insurance options. A Medigap policy is the six-month period which starts with your 65th birthday and is covered under Part A - B. After a short period, your ability to purchase a Medigap policy may be limited and may take longer. Different states handle the situation and in certain cases there are extended enrollments. Medicare enrollment periods are specific times when people can sign up for Medicare or make changes to their existing coverage.

Most often medgap coverage does not have network limitations. This coverage will be accessible at all Medicare sites.

Several disadvantages are included: Higher annual premium rates. Managing different types of projects in different stages. The drug doesn’t cover prescription drugs (available in Plan DA).

As mentioned above, there are 10 different standardized policies in most states, each covering a different range of Medicare cost-sharing . Learn how a Medigap covers prior medical conditions to know if any of your medical costs may be excluded from Medigap coverage. Depending on your circumstances, a Medigap can exclude coverage for prior medical conditions for a limited amount of time. Find out how Medigap premiums are priced so you can make cost comparisons.

Medicare Advantage is an affordable option for a patient with minimal health expenses. In some cases Medigap may be the more appropriate choice to treat serious health problems.

Medicare does cover some of the services provided by Life Alert. Medicare Part B will cover 80% of the cost of medical alert systems that have been prescribed by a doctor and meet certain criteria.

Bay Alarm Medical Alert is a medical alert system that provides users with 24/7 access to professional emergency responders.

You live in Massachusetts You live in Minnesota You live in Wisconsin For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) . Call your State Insurance Department. Site Menu Sign up/change plans About Us What Medicare covers Drug coverage (Part D) Supplements & other insurance Claims & appeals Manage your health Site map Take Action Find health & drug plans Find care providers Find medical equipment & suppliers Find a Medicare Supplement Insurance.

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost. Silver Sneakers is a health and fitness program for seniors that is offered by many Medicare Advantage plans.

Medicare Silver Sneakers is a fitness program designed for seniors aged 65 and above who are enrolled in Medicare. The program is aimed at improving the health and wellness of seniors by providing them access to gym memberships, fitness classes, and wellness resources.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap in Massachusetts Medigap in Minnesota Medigap in Wisconsin Medigap & travel How to compare Medigap policies Find out which insurance companies sell Medigap policies in your area.

If your Medicare plan includes a Medigap policy, Medicare will reimburse the Part of the approved deductible to cover the health care costs. So the Medigap insurance companies will pay.

You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. For more information Find a Medigap policy.

Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or a skilled nursing facility (SNF).

Recent Blogs:

Bay Alarm Medical Alert | Who Qualifies For Medicare Flex Card

Medications can be switched between Medicaid and Medicare through Medigap. The Center has also designated a timetable for that purpose. Some people have the option to move to different times without penalties, however. Medicare Part C or Medicare Advantage are bundled plans managed by private businesses.

Those plans are different based on the availability of health care in a specific area and typically patients must be treated by approved medical providers to be eligible for coverage. Find out how. Traditional Medicare has multiple components which cover hospital care and prescriptions.

Selecting Medicare insurance should not be just an option. Plan costs are constantly increasing, and so can your needs. This means you need to compare your health insurance plan based on several factors such as convenience costs. When you are ready for a change, you must decide based on your health insurance coverage requirements. The choice to make change can feel overwhelming at times, but that doesn't have to be. When you decide which types of medical coverage your insurance needs, you must prepare for it.

Get information on how you should be able to switch Medicare Supplement plans to another plan. Medigap and Medicare Advantage provide a safe option if seniors need help with expenses not covered through Medicare. What should I do if my insurance provider doesn't offer the best coverage? How will Medicare Advantage be changed after enrolling? Let's see if you answer the questions above.