Life Alert is renowned for its wildly successful commercial series that bring medical alert technology to mainstream markets. Unfortunately, though its popularity has increased in recent years our price comparison shows that the product lacks in terms of price transparency quality service and quality. The life alert system also features fewer functions and locks customers into a long-term three year contract when other competitors do not offer a 30 day refund guarantee. We also found very concerning the large amount of complaints from consumers to the Better Business Bureau.

Some Medicare plans offer medical alerts for patients who have been diagnosed with a serious condition. The premiums for the first six months will be between 0 and 260. This is much more affordable than Life Alert. It is $695 yearly with a $95 initial price and $50 monthly cost for a cheapest plan. Several health insurance companies have endorsed the Medicare Advantage program as the best coverage option in terms of the use of alerting devices. With this plan, enrollees can receive Philips LifeLine for free.

How does the price of Life Alert compare to other medical alert systems? When it comes to medical alert systems, Life Alert is definitely on the higher end of the spectrum. You can expect to pay $20–$30 a month for monitoring service with most other medical alert companies, with one-time activation fees between $0–$150.

You may have seen this website before and know that Life Alert has a fee structure that does not publicize their price or fees. What Are Your Costs for Lifetime Warnings? We reached out to a company to find out the information they needed regarding the equipment, policy and prices. Your seniority is important. Let us help! Subscribe daily for tips and review products to assist with the transition between age and independence.

Will private insurance pay for a medical alert system? Some private insurance plans may cover medical alert systems, but many of them don't. To determine whether your plan offers coverage of medical alert systems, visit the “covered benefits” portion of the company's website or call the company for more information.

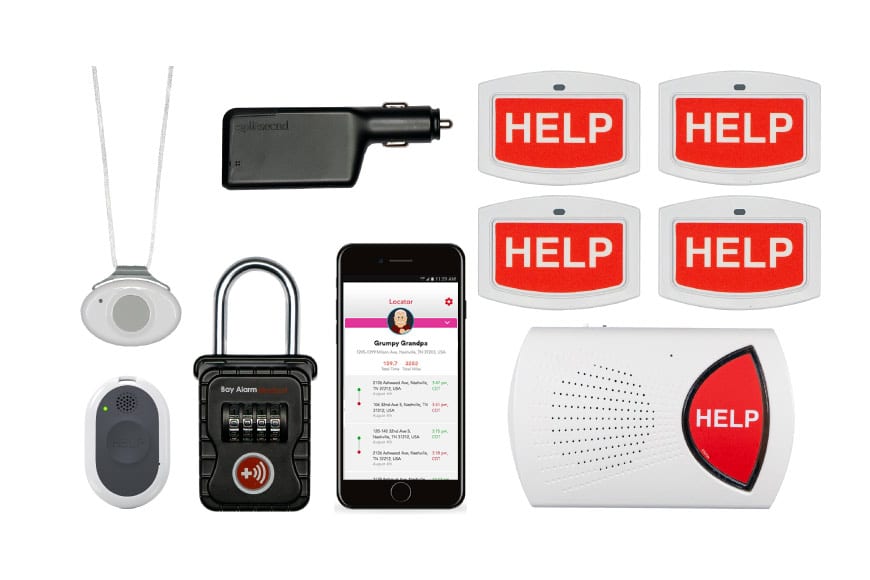

Nearly all Medical Alert companies offer added product options (like help buttons) and support (such as scheduling online medical care appointments with virtual doctors). These additional features generally require additional fees which can be one-time charges or monthly charges. For example the extra Wearable Aid button can be purchased one-time for between $35–$40. Other accessories are available for additional charges per month. Most of the brands we tested are automatic fall detection, a popular added feature and can cost between $5 and $10 a month. The Medicare Flex Card is a prepaid debit card that allows people with Medicare to access their benefits more easily.

Most companies have automated fall detection software in some systems. The majority of respondents surveyed said falling detection was a key feature they wanted in their healthcare alert system. Falls occur very regularly among older adults (a fifth of all older Americans fall annually), and fall warnings are a useful safety feature on your emergency response device. It's also a low cost option. If you want to understand the risk of falling use NCOA Falls Free Checkup Tool.

MobileHelp is one of three telehealth providers that we tested by our review team. MobileHelp is priced at $120 a year. Lively has packages ranging from $5–10 more monthly than the standard plans available. Telehealth services let you see a physician at a convenient location without a physical visit. This primarily happens online, allowing you to see a healthcare provider from anywhere on a PC / smart phone.

A few manufacturers have limited warranties that cover normal damages. Purchases provide coverage for the loss of valuable items, theft and damage of the equipment. The company with supplementary protection plans charges a monthly extra $1–7 for these plans, among the testing performed. ADT Health has another exception to the rule that it offers premium insurance plans without charges.

Almost all eligible Medicare beneficiaries will be able to get medical alert systems through Philips Lifeline. Free alerts from most insurance companies can be obtained for no additional fee. Nonetheless, coverages can also be different depending upon the insurance policy. Check the Medicare benefits schedule or input your member number on the Philips website to see if your claim qualifies. How can a person find the best Medicare plans near me? Humana and BPBS-funded plans provide alerts at as much as 0 but the cover is subject to limitations. The fee schedule for medical services is typically determined by the insurance company or health care provider.

This includes grab bars, fall detection systems or stair lifts. How does Medicare Advantage coverage work? Coverage for medical alert systems and fall detection devices is an add-on benefit available with some Medicare Advantage plans as a way for insurance companies to make their plans more attractive to shoppers.

Installation fee or activation fee are generally one-time costs of $25–100. Several medical alert systems reviewed by the Review team are available without installation fees, but some manufacturers include these fees as a part of the purchase package and may not appear on the website. Install or activate charges often will be visible only when the payment information is entered. Our review team advises customers to contact us for a free quote before purchasing a product.

Often medical alerts are included as part of a Medicare Advantage plan. Medicare Part A and B are managed by the federal government but are not intended for life-saving medical alert devices. In addition, Medicare Advantage is managed by private insurers which can provide insurance for wearable alerting devices based on Life Alert. Many of these plans also offer medical alerts. In some situations there may be discounts of as much as 40 percent.

Three-year contract Life Alert requires a minimum three-year contract, and you can only cancel it if the user dies or goes into a nursing home. No fall detection None of Life Alert's devices offer fall detection , and company representatives say that it's because the technology is not yet reliable enough to work properly.

Medical alarms can be used at-home or in travel mode. The brand tested with the review team has monthly fees between $20 and $30. In general, mobile systems cost more. On-the-go fees will be between $229 and $40 a month. Medical alert systems provide quick, reliable connections for users with company monitors. Center staff are trained to answer phone calls or provide other assistance. Read on for more about monitoring centres.

To complicate things, prices change depending on the type of system you purchase, and carrying out a medical alert systems cost comparison poses a challenge because no two systems are exactly alike. Plus, different companies use different pricing structures. For example, the average cost of medical alert systems used in the home differs from that of most on-the-go devices.

Even with your health insurance not covered by your plan, using Bay Alarm Medical can help reduce your life-saving costs by 65%. Life Alert costs $695 per year and is a high-cost alert system. Because of the cost, Medicare plans are unlikely to work. Instead, insurance companies typically offer insurance products to a provider that offers the midrange base price. When purchasing a new system, the price will be lower. Life Alert Cover is an insurance product offered by Life Alert that provides coverage for medical and non-medical emergency services.

An AARP Medicare Benefit plan could cover full costs for Philips Lifeline health alerts that are similar to Life Alerts. Those who are not eligible for Medicare can get free health care at a reduced cost. For Philips Lifeline and Lively devices, the discounts start at $300.

Life Alert prices begin at $50 a month with an additional $195 fee. It was nearly $1000 in the beginning. Life Alert is a highly specialized system, while other major medical alert brands range from $25 to $80 a year.

Calculating the cost of medical alerts is tricky because it involves several parts. Several businesses charge additional monthly fees for certain features, as well as activating fees for certain devices or services. Our medical Alerts Cost Comparison Guide provides you with a list of medical alarms costs and a summary.

Life Protect 24/7 has one of the most expensive monthly fees in our rating, charging $49.99 per month for monitoring services. However, monitoring fees are not the only associated cost, and some companies do charge an upfront device or device activation fee, rather than loaning the hardware for free.