Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs. Shop and apply for an AARP Medicare Supplement Insurance Plan Shop Now How do Medicare Supplement insurance plans work with Original Medicare? Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own.

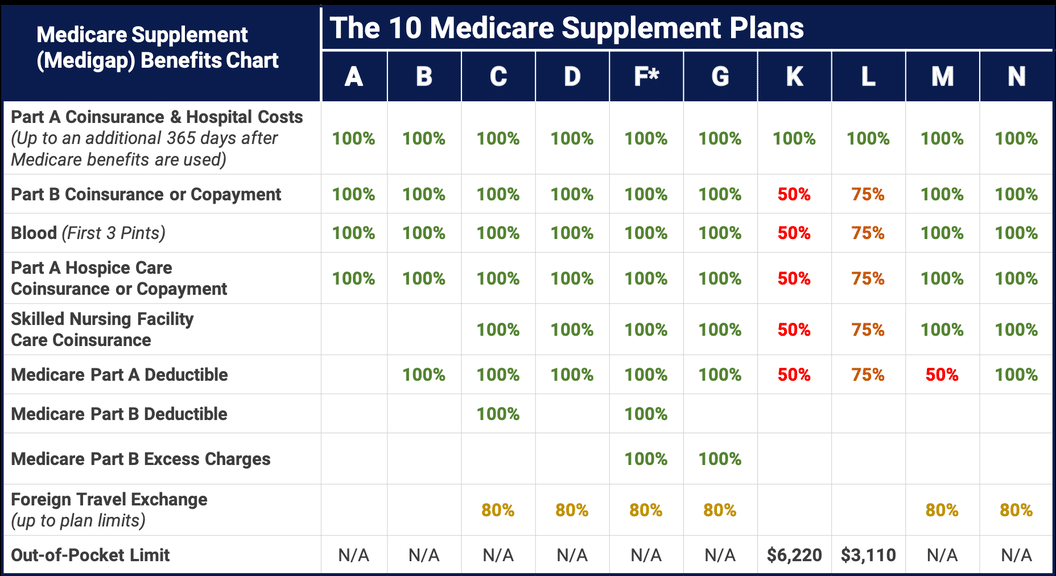

Anthem Offers Medicare Supplement Plans A, F, G, and N Medicare Supplement Plan A Plan A is the most basic of Medigap plans, with the lowest premiums. It is the only Medicare Supplement insurance plan that doesn't cover the Part A deductible. Medicare Supplement Plan F Plan F helps cover Medicare deductibles and some copayments and coinsurance. Per government regulation, Plan F is only available if you first became eligible for Medicare before.

UnitedHealthcare offers AARP Medicare Supplement Plans to help cover out-of-pocket costs associated with Original Medicare. These plans can be used to supplement the coverage that Original Medicare provides, helping to pay for copayments, coinsurance, and deductibles.

Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Coverage may be limited to Medicare-eligible expenses. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected. Depending on the insurance plan chosen, you may be responsible for deductibles and coinsurance before benefits are payable.

Forbes Health evaluated every insurance company offering a plan in the country to find the best Medicare Supplement Provider in 2020. The ZIP code and demographic information needed to make specific recommendations about the best possible policy is critical to providing accurate recommendations. For this purpose, we suggest using Medicare.govs PlanFinder tools.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. You go 63 days or more in a row before your new Medicare drug coverage begins For more information Find a Medigap policy.

While Medicare Part A or Part B covers some of these health costs, it does not cover all. Here are the AARP Supplement Insurance Programs to be helpful for UnitedHealthcare. Medicare supplements are sometimes known as Medicare supplements and offered by private insurers. This is designed to provide a seamless connection between Medicare and Original Medicare coverage.

Medigap plans hold a 4-star rating from the Centers for Medicare and Medicaid Services (CMS) for their quality of preventative services and chronic condition management, as well as customer satisfaction indicators. How We Picked the Best Medicare Supplement Providers To determine the best Medicare Supplement providers for 2023.

Medicare Supplements are private coverage that pays for things not covered by Original Medicare. This includes Part A, Part B. They only apply with original medical insurance unless they are part of Medicare's Medicare Advantage program. Medigap plans usually do not cover prescription medications, and it may make a difference to enroll in Medicare Part D. Medigap is a different type of plan compared to Medicare Part C or Medicare Advantage.

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments Coinsurance Deductibles Note Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare.

You can enroll in Original Medicare A or Part B, but not in Medicare Advantage. If you do not have insurance or are currently on Medicare, you will lose coverage. If Medicare Part B coverage is denied you may still have access to a free enrollment period in a private insurance plan that offers free enrollment for Medicare Part B. You'll have to wait until the end of the year if you have group coverage. Medigap plans can never be revoked unless you pay your premiums.

Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

Medicare Supplement plans do not provide prescription drug coverage. Alternatively, a Medicare Part D plan is available with an additional fee, which helps with the insurance costs. Medicare Supplement plans also do not cover dental and eye insurance but a dental or vision insurance policy may cover you if you reside in California, Connecticut or Georgia. The newest Medicare Supplements in California include vision and hearing support.

A Medicare Advantage plan is essentially a replacement plan for Medicare. This coverage includes additional coverage such as prescription drug coverage (Part D). In some cases, a Medicare Supplement plan – or Medigamation plan – can also be bought by a private insurer for people who qualify under Original Medicare.

These are standard insurance plans nationwide that provide benefits like deductibles, coinsurance, and copayments. Since coverage plans are standardized, the average monthly cost of the product varies between providers. The Medigap policy does not provide coverage for prescription drugs.

The Medicare Supplement and Medicare Advantage (Part C) plans do not offer either option. There are many different choices in your selection. Medicare Advantage Plans Medicare Prescription Drug Plans Medicaid Employer or union plans, including the Federal Employees Health Benefits Program (FEHBP) Tricare Veterans' benefits Long-term care insurance policies Indian Health Service, Tribal, and Urban Indian Health plans Dropping your entire. Prescription drug plans for seniors are available through Medicare Part D. These plans provide coverage for prescription medications that are not covered by Original Medicare, such as certain brand-name and generic drugs.

How long does Medicare Supplement open enrollment last? The initial open enrollment period for Medicare Supplement coverage lasts six months, beginning the month you're both at least 65 years old and enrolled in Medicare Part B coverage.

You can try to enroll in a Medigap plan outside this open enrollment period as well, but you may be denied coverage or subject to medical underwriting. Enrollment in Medicare is available to most people who are age 65 or older, and certain younger people with disabilities.

The Medicare Flex Card is a prepaid debit card that is used to pay for medical expenses. It is issued by the Centers for Medicare & Medicaid Services (CMS) and can be used to pay for Medicare-covered services, such as doctor visits and hospital stays.

Plan F provides Medicare coverage for deductibles, copayments and deductible amounts. Per regulations, plan F will only be accessible if you have already become eligible to receive Medicare after 1 January 2019. Select or Innovative F is also offered for certain states of operation.

Medicare Supplement programs have the primary benefit of minimizing the cost of healthcare that is not covered by Medicare. If a Medicare claimant has an interest in potentially high out-of-pocket expenses they may need assistance in determining whether they qualify. Many Medicare enrollees who travel regularly enjoy supplemental protection.

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

It's best to join Medicare Supplement plans during your first Medigap Open Enrollment period. These six months begin the day you are 65 and older enrolled for part of the program. During the enrollment period, there's an annual fee to be paid for the program. Attempts to enroll in Medicare Supplement plans during other enrollment periods may result in penalties or denial of coverage.

You can see any doctor who accepts Medicare patients. There are no network restrictions. A variety of plans to choose There are many different Medicare Supplement Insurance plans, so it's important to understand what each plan covers and how federal law affects your eligibility.

The first open enrollment period for Medicare Part B coverage runs six months. If your insurance coverage is denied you can also try the Medigap Plan outside of the open enrollment period. The risk of medical underwriting may increase.

Medicare Supplement Plan G Plan G helps cover all out-of-pocket costs not covered by Original Medicare ‡ for Medicare approved services, except for the Medicare Part B deductible. Select and Innovative G are available in some states. Medicare Supplement Plan N Plan N helps pay for Medicare Part A and Part B coinsurance costs.

If you would like to change your Medicare plan, you must first contact the insurance company that provides your current plan. They will be able to provide you with information about what other plans they offer and how to switch.

Medicare Supplement Plan F was widely accepted for the benefit of the medical community. Those with an eligible plan for Medicare after January 31 2020 are eligible; the person if he or she has not yet been covered by the plan is eligible for the Medicare Advantage Plan F. All Medicare-enrolled patients will be required to sign up for another Medigap Plan.

How Medicare works with other insurance Learn how benefits are coordinated when you have Medicare and other health insurance. Retiree insurance Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first.

How much money is needed to purchase Medicare Advantage plans and how much is needed for Medicare to meet their medical requirements? Medicare Advantage is an alternative to Original Medicare and includes coverage with additional benefits as prescription drug coverage.

Medigap plans were marketed by private health insurers to individuals on Original Medicare to cover gaps. Medigap provides standardized coverage and helps to cover deductibles, copays and co-insurance costs. However, Medigap policies do not cover prescriptions.

Supplemental Medicare insurance is private health insurance that helps cover costs not covered by Original Medicare, such as deductibles, copayments, and coinsurance. It can also provide coverage for services not covered by Original Medicare, such as vision or dental care. Some policies may also include additional benefits.

Medicare Supplement plan costs are expected to average $139 a month by 2023. The rates vary widely, between $50 and $400 monthly.

Medigap policies are different from Medicare Advantage programs. The plan provides the best means to receive Medicare benefits while a Medicare plan only extends your original insurance coverage. Payments for coverage for medical insurance or prescription medications to Medicare.