The most important aspect of Medicare supplement plan comparison is matching the coverage to the health care you expect. For example, if you anticipate having to pay for medical treatment or expensive surgery it may be cheaper to purchase a plan that has greater protections in order to reduce or eliminate the medical expenses.

For the majority of people enrolling for the Medicare Supplement plan we suggest Medigap plan G because it offers the greatest coverage for everyone. This program is usually very expensive and starts from around $120 yearly.

Medicaid Supplement Insurance (Medicaid) is a type of insurance that provides coverage for medical expenses. Medicare supplemental insurance acts as supplementary not primary insurance protection. You need Part A or Part B to get Medigap insurance please. Each plan is varying by the coverage it covers, and by the amount a user's own pocket can afford or premium. This policy has been sold by Private Health Insurance Companies. The plans have been standardised to ensure Medigap Plan G is offered by a company in New York.

There are no optimal Medigap options available. Medigap plans work if they have coverage that fits your needs and have premiums that are affordable. Medigap Plans have become popular Medicare Supplemental Plans. The plan is available to Medicare beneficiaries for up to 50 percent of their health benefits.

Plan F offers Medicare cost savings that are greater than the rest of the plans. Plan F also includes the nine standard Medigap Benefits that a company may have. In 2022, a typical plan F premium will be $77.20 a month. Its second-most popular Medigap Plan has a growing popularity. Plan G enrollment has risen 38 percent since 2000.

Medigram plans are standardized in terms of benefits. For the Plan letter, you get the same insurance regardless if you work at ETSNA Humania or any other company. Despite this higher letter on the plans the benefits are no guarantee. We calculated the health costs for a given plan by comparing coverage costs and popular coverage for each plan. As you can see, Medigap plan coverage has become more widely used. Medicare's plan E and plan G are extremely effective, and cover 73% of all Medicaid enrollees. Medigaps have higher coverage and are generally much more expensive. The eligibility age for Medicare is 65.

Medigap plans also have disadvantages: high monthly payments. The ability to choose between various plans. The plan does not offer prescription coverage.

Plan G usually has higher premium rates than plan n as it provides higher protection. This plan may help reduce the outgoing cost of your health insurance and reduce deductibles if your coverage is lower than Plan G. Medigapa insurance cost varies according to state and carrier.

Medicare plans F are the more extensive Medicare supplemental plans that have. The plan covers deductibles and co-insurance and requires no monthly payments from your employer.

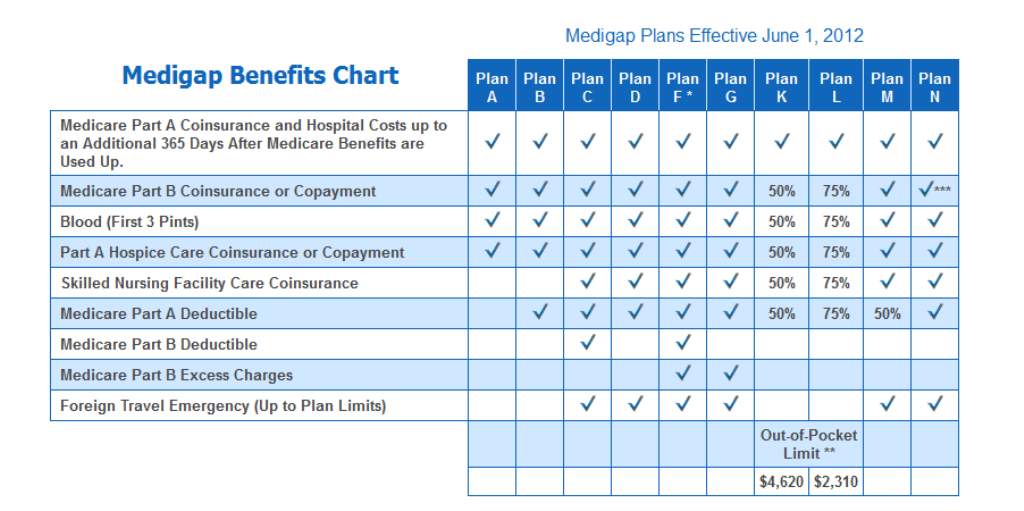

These plans are labeled Plan A, B, C, D, F, G, K, L, M and N . When shopping for the best Medigap plan for your needs, it can help to compare Medigap quotes . How to Compare Medicare Supplement Plans You can use the 2022 Medigap plan chart below to compare the benefits that are offered by each type of plan. However, some long-term care insurance policies may cover the costs of Life Alert services. It is important to check with your individual insurance provider to determine if they do cover the costs of Life Alert services.

We and the licensed agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program. This website is not connected with the federal government or the federal Medicare program.

In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer.

Medicare Part B deductible Before Medicare Part B covers any of your costs for things like doctor's appointments or medical devices, you must meet your Part B deductible. In 2022, the Part B deductible is $233 per year.

only after you've paid the deductible The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible). A stair lift is a device that is used to help individuals with mobility issues safely and easily navigate stairs. The best Medicare plan for you will depend on your individual needs and preferences. Some of the most popular plans include Original Medicare (Part A and Part B), Medicare Advantage Plans (also known as Part C), and Medicare Supplement Plans.

This table breaks down the 10 standard Medigap plan types into categories so you can learn more about which plans might be the best fit for you: Get details on Medicare Supplement Insurance options Coverage Medigap Plan Basic benefits Medigap Plan A. Basics plus some extras Medigap Plan B. Medigap Plan M. Highest coverage Medigap Plan D. However, some long-term care insurance policies may cover the costs of Life Alert services. Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or a skilled nursing facility (SNF) if you’re medically necessary to use this type of service. Medicare Part B covers insulin for people with diabetes. This includes regular and rapid-acting insulin, but not inhalable insulin.

Click here to view enlarged chart Scroll to the right to continue reading the chart Scroll for more Medicare Supplement Benefits Part A coinsurance and hospital coverage Part B coinsurance or copayment Part A hospice care coinsurance or copayment First 3 pints of blood Skilled nursing facility coinsurance Part A deductible Part B deductible Part B excess charges Foreign travel. Medicare does not cover transportation services. However, it may cover certain ambulance services in certain circumstances. In some cases, Medicare may also cover non-emergency medical transportation if the beneficiary has no other means of getting to and from their medical appointments.

Accessed May 13, 2022. View all sources : Medigap benefit Medigap plans that cover it Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. A, B, C, D, F*, G*, K, L, M, N. Part B coinsurance or copayment. A, B, C, D, F*, G*, M, N**. K covers 50%. L covers 75%. Blood (first 3 pints).

These policies are sold by private health insurance companies, and the plans are standardized, so Medigap Plan G from one company in New York will offer the same coverage as Medigap Plan G from a different company in Ohio [1] Centers for Medicare & Medicaid Services . Choosing a Medigap Policy .

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and a copayment of up to $50 for emergency room visits that don't lead to inpatient admission.

If you are diagnosed with cancer you must realize there is no single battle. Most cancer diagnoses are found in people 60 and older, making it an important health issue among senior citizens. 1. Medicare Parts A and Part B cover certain cancer treatment programs. Unfortunately, despite being covered by the Medigap program, patients are left with high-priced medical treatment. This is crucial in understanding your medical coverage and Medi-Gap option. Our experts analyzed all available Medigap options available in the United States. - Seniors who suffer from cancer.

The best Medicare plans for cancer patients include MEDGAAP PLAN G of Mutual Omaha and MEDICA PLAN H of MEDI. Alternatively, if your cancer diagnosis means that your health care provider can't pay for your medical expenses, our doctors suggest contacting Medicare.gov to discuss your case. Another excellent option to pay less for treatments for cancer can be to take part in Medicare and Medicaid.

Recent research has revealed cancer patients who have not received Medicare treatment spend nearly a quarter of their typical household income on medical bills a year. Although Medigap plans wont totally eliminate treatment costs they can ease burdens as they cover expenses outside of the Medicare.org coverage period. In order for patients to be able to get cancer treatment in a timely manner, they have to confirm that their physician accepts Medicare. You'll also get Medicare Supplement coverage if you'd like it to apply. Unfortunately, medical costs can cause the largest personal bankruptcy cases.

Medigap or the Medicare Supplement can help pay the out-of-pocket expenses a cancer patient incurs. New enrollees may choose 8 standardized Medigap Plans: AB, D, G - K, L - M.

If someone has had cancer, you can never have to worry about any insurance issues. Medicare is an excellent way for you to get better coverage and save money. Medicare pays for nearly half of the annual $74 billion in cancer treatments. To ensure maximum coverage we advise that you buy Medigap in addition to your existing Medicare plan. Continue the read to get the best coverage possible at Medigap.

Concerns about Medicare Advantage Plans and Cancer Coverage The HHS Office of the Inspector General (OIG) recently found that Medicare Advantage plans deny care—inappropriately—at relatively high rates. It may be that prior authorization rules are a reason that sicker Medicare Advantage patients are more likely to dis-enroll in their plans than healthier people.

State Health Insurance Assistance Programs : Offers assistance for Medicare-eligible individuals, their families, and caregivers through objective outreach, counseling and training to make informed health insurance decisions that optimize access to care and benefits.

These conditions are listed below under "How do I apply for Medicare Savings Programs?" If you meet certain income and resource limits, you may qualify for Extra Help from Medicare to pay the costs of Medicare prescription drug coverage. Medicare Help : Compare various insurance options to see which one suits your needs best.

This means that Medicare prescription drug coverage is an essential part of your cancer protection strategy. Part B covers 80% of the cost of intravenous cancer treatment and anti-nausea drugs.

Because there are so many plans, you have the ability to shop around and find the best plan at the best price. This is one of the benefits of Medigap insurance- you have the power to find the appropriate plan for you at your desired price point. HOW CAN MEDIGAP PLANS HELP? The main reason to purchase Medigap coverage is to supplement Original Medicare.

In both cases, you can't be denied enrollment because of a preexisting condition. Is Medicare good for cancer patients? A patient's cost for cancer treatment is about the same with either Medicare or an employer-sponsored health insurance plan, according to a study from Johns Hopkins. However, choosing the right Medicare coverage can help you save thousands of dollars on cancer treatment.

These plans are offered by private insurance companies and cover Parts A and B; most of the time, they also cover Part D. Enrollees must stay enrolled in Parts A and B while enrolled in a Medicare Advantage plan.

They offer a range of products and services to those over the age of 65, and while they are not an insurance company, they have partnered with UnitedHealthcare to provide a range of Medigap plans backed by AARP's trusted name in senior care.

For example, generic drugs are usually cheaper than new, experimental or specialty drugs. Additionally, each insurance company sets its own formulary about the drugs it covers.

We were pleased with the transparency of prescription pricing. With their prescription cost estimator, pricing common cancer drugs was straightforward. Visit our UnitedHealthcare Medigap review to learn more about this provider. Quick Tip: Not an AARP member? Visit our guide to AARP membership for all the details on benefits and signing up.

Medicare Part A generally covers prescription medications you take while you are an inpatient in the hospital. Medicare Supplement Plans typically do not, however, pay for other prescription medications you take at home to treat your cancer symptoms or treatment side effects.

As a cancer patient, your annual drug costs may be high, so it is imperative that you look at all of the available plans to find the one that best meets your needs. 4 Quick Tip: For a closer look at our top picks for prescription drug plans, visit our list of the best Medicare Part D plans . Our three best Medigap plans for seniors with cancer all offer the option to add a Medicare Part D prescription drug plan.

Does Medicare Cover Cancer Screenings? Medicare covers 100% of specific cancer screenings as a preventive health service as long as your doctor accepts Medicare assignment .

Parts A and B pay for the same care, no matter how old you are. Does Medicare Cover Cancer Screenings? Medicare covers 100% of specific cancer screenings as a preventive health service as long as your doctor accepts Medicare assignment .

If you have multiple hospital stays, you may end up paying the deductible more than once. Part A also pays the full cost of the first 20 days in a skilled nursing facility after cancer surgery, and it covers hospice care at a certified hospice facility.

Whether you have a bundled Medicare Advantage plan or a combination of Medigap and Medicare Part D, most cancer care is considered medically necessary and is covered.

The purpose of this site is the solicitation of insurance. Contact may be made by an insurance agent/producer or insurance company. eHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

Best for Medigap Plan G Best for Medigap Plan G Best for Medicare Part D Best for Medicare Part D Cost of cancer treatment and chemotherapy with Medicare If you have Medicare, the annual cost for cancer treatment and the plan ranges from $3,714 to $10,698, depending on the coverage you choose.

It's the amount you must pay each year for your own prescription drugs, with some discounts. Once your total drug costs (what you and the plan pay for your prescriptions) reach a pre-set dollar amount for that year, you're in the donut hole, where you pay more for drugs.

To get started finding your ideal plan at the lowest possible price point, use Ensurem's Medigap Multi-Quote Tool . With this tool, you can instantly compare rates from top insurance providers in your area.

We recommend the best product reviews and advertisers don't influence this decision. We might be compensated for your travel visits to our partner, as we suggest. Find out more about our advertisers disclosure here. Medicare Supplement plan - sometimes known as Medicare Supplement plan - is a private company plan separate from Medicare.

Medicare Supplement plans cover coverage that is not covered by Medicare. They can include medical appointments or prescription drugs. The best insurance providers for Medicare Supplements offer attractive prices along with modern website interfaces.

When looking at Medicare Supplement policies, it can help if you learn about the best 10 health insurance plans. Providing all the information for a good plan can make a big difference. Find the right Medicare Plan in 3 simple steps, We can help you find the right Medicare plan. In determining the top companies' choices consumers are reporting, AM Best ratings, Standard and Poor ratings and the number of year of operation.

Finding a suitable coverage plan is an important step in the process. Each program will provide specific benefits, according to your state, your desire for benefits, and cost. Step -1: Decide how many people qualify to take benefits. If a person has passed 65 years of age or is not able to take Medicare yet it is possible to take Medicare as well.

When buying a Medicare Supplement policy, you must have an active Medicare enrollment period. It is just once every six months federal legislation allows people in the USA to buy any Medicare supplement they desire and sell it in your state.

Plans F have the broadest coverage available in the industry. In case of Plan F, the benefits you receive from Medicare are virtually unpaid. Plan F reimburses deductibles from Parts A and B and covers excess fees.

In 2020 the average premiums on supplemental Medicare / Medicare & Medicaid were around $200 or more each month compared with $1600 yearly. Medigap charges can vary depending upon the age, and the place you reside.

How Do You Select a Medicare Supplement Insurance Company That Works for You? After researching and comparing companies, you will select a supplemental insurance company that works best for you.

What Is the Difference Between a Medicare Supplement Plan and Medicare Advantage? Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan.

Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Top 11 Highest Ranked Medicare Supplement Insurance Plans in 2022 Did you know that roughly 20 percent of Medicare beneficiaries also have a Medigap plan? 1 Medigap plans, also known as Medicare supplemental insurance, are optional plans provided by private insurance companies to help lower health care costs, including deductibles, coinsurance, and copays. As its name suggests, Medigap helps fill the gaps in Original Medicare's coverage .

Medicare Supplement Eligibility To be eligible for a Medigap plan , you must be enrolled in Original Medicare Part A and Part B, but not a Medicare Advantage plan. You can receive extra funds for dental (at no cost) through the Extra Essentials Flex Account.

You can add the enhanced dental to your existing Medicare Advantage plan up to 90 days after your plan starts. Many Medicare Advantage plans come with dental, vision, hearing, and prescription coverage.

Can the insurance company cancel my Medigap plan? In most cases, an insurer can't cancel your Medigap coverage except for one of three reasons: you stop paying your premium, you lied on your application, or the company goes bankrupt or becomes insolvent.

Blue Cross Blue Shield: Best Medicare Insurance Company Mobile App Blue Cross Blue Shield has been a prominent insurance company since 1929. Receiving an A rating from AM Best and a B rating from S&P, BCBS is one of the most highly recognized Medicare insurance companies.

Mutual of Omaha also offers a 7% to 12% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. Plan availability differs by location, but you should have around three to five options.

Best rankings in terms of financial health (which impacts how reliable an insurer is when it comes to paying claims) J.D. Power rankings in terms of consumer feedback We focused exclusively on providing general summaries of the companies and their reputations.

Mutual of Omaha pays 98% of Medicare claims within 12 hours, according to the company. Cigna Call Now Get A Quote On CoverRight's Website 4.2 All ratings are determined solely by our editorial team.

It also offers one of the biggest household discounts we've seen, shaving between 7-12 percent off your monthly premium for eligible policyholders. Mutual of Omaha makes it easy to get the coverage you need, whether you're looking for a plan that covers all (or nearly all) eventualities with few out-of-pocket expenses or a backup plan for unexpected health problems.

In 2020 the average premiums on supplemental Medicare / Medicare & Medicaid were around $200 or more each month compared with $1600 yearly. Medigap charges can vary depending upon the age, and the place you reside.

Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Cigna Pros: Cigna Cons: Additional perks for policyholders include a 24/7 telehealth line and Healthy Rewards discount programs for living a healthy lifestyle. Most areas only offer four Medicare Supplement Plan options (Medicare Supplement Plan A, Plan F, Plan G, and Plan N). Cigna offers wide plan availability with policies available in every state.

It's also important to note that Medigap policies don't cover prescription drugs. A person enrolled in Original Medicare who wants prescription drug coverage needs to purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan.

What is the most popular Medicare Supplement plan? Plan F, Plan G and Plan N are the most popular types of Medicare Supplement plans. What's the most popular Medicare Supplement plan? Plan F and Plan G are the two most popular Medigap plans.

Our editorial content is based on thorough research and guidance from the Forbes Health Advisory Board . Medicare doesn't cover all of your health care expenses when you turn 65. Medicare Part A covers 80% of inpatient care in hospitals and skilled nursing facilities, and Medicare Part B covers 80% of outpatient care and medically necessary supplies.

Some Medicare Supplement plans also provide coverage for services that Original Medicare doesn't cover, such as medical care needed during travel outside the U.S. Medicare enrollees who enjoy frequent travel often enjoy the additional layer of protection.

Medicare Supplement Plan F is the most comprehensive Medigap option available, providing beneficiaries with 100% coverage of Medicare-covered medical expenses after Original Medicare pays its portion. Medicare Supplement Plan G leaves beneficiaries responsible only for their annual Medicare Part B deductible, after which the plan provides 100% coverage on all Medicare-covered medical expenses.

The monthly premium for Plan F averages $231, which makes this plan even more expensive than Plan G. Unfortunately, Plan F is not available to new Medicare enrollees who become eligible after Jan. 1, 2020. Anyone who currently has Plan F will be able to keep their coverage.

You don't want to sign up for a plan and find out the procedure you need isn't covered. Explore the exclusions upfront. Deductibles: Know how much the deductible is so you can compare it to deductibles offered by other insurance companies. Do You Need Medicare Supplement Insurance? If you're experiencing a gap in Medicare coverage, you may need to choose supplemental coverage.

Finally, Medicare Supplement Plan N is considered a pay-as-you-go type of plan that tends to be the most affordable for beneficiaries who don't require medical care regularly but are interested in emergency coverage. Is Plan F the best Medicare Supplement plan? Medicare Supplement Plan F is considered one of the best Medigap plan types due to its comprehensive nature.

Find An Affordable Medicare Supplement Insurance Plan Today Call Now Get A Quote On Mutual of Omaha's Website Find An Affordable Medicare Supplement Insurance Plan Today Chat with a licensed insurance agent today Compare free quotes from each type of plan in your area Call Now Get A Quote On Mutual of Omaha's Website Best Medicare Supplement Providers of 2022 Humana Call Now Get A Quote On CoverRight's Website 5.0 All ratings are determined solely by our editorial team.

How do Medicare AARP Benefits and Benefit Plans work? People who have a keen interest in this policy may find it interesting to learn a bit about the organizations behind them. AARP is a nonprofit advocacy group founded by Ethel Percy Andrus in 1958 under the leadership of JoAnn Jenkins. More than 38 million seniors are members of AARP, which enjoy the educational resources and benefits offered through its program.

United Healthcare was created from 1975 to 1975 in Minnetonka, Minnesota. It is now one of the largest health insurers.

If you have UnitedHealth Care Medicare Supplement Insurance, you get the same policy. AARP supports and promotes certain UnitedHealth Care plans through this business agreement. In turn, they receive the expected 4.95% fees per plan purchased.

The Medigap policy also includes additional benefits compared with Medicare Part B. An additional plan will cover your medical bills by providing coverage for deductibles and other costs. Depending on what plan you choose, coverage may be available. Medicare Part B can pay $100 of the cost.

A variable plans structure may make comparing costs difficult because of the most accurate comparison of quotes from different insurers, depending upon location and circumstance. The various formulae for prices that increase as you age affect your overall life-time cost.

A woman 65 could pay higher rates for a Medicare supplement if she opted for another plan by Humana or BlueCross BlueShield. However, a AARP plan has a slower price rise. By age 85 Medigap has an average cost of 62 percent.

Plan G usually has higher premium costs, as plan n offers broader coverage. The plan's premiums can be higher than plan G if the health needs differ. In some instances Medigap's costs may be influenced by states or carriers.

Medicare Supplement Insurance (as well as Medigap) is a common choice among most Americans. This rating does not compare with others. AARP's endorsement of your plan will provide you with peace of mind.

These Medicare Supplements are among the best available and most widely used programs with 31% of Medicare Supplement users using AARP/United Healthcare. In order to be eligible for insurance coverage, the insured has the right to be registered in an AARP account.

These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographical availability and may be discontinued at any time. None of these services should be used for emergency or urgent care needs.

Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, co-payments and deductibles. AARP Medicare Supplement Plan Comparison View PDF 10 Things to Know About Medicare Supplement View PDF What is Medicare Supplement Insurance?

Providers & Benefits Medicare Cost Basics Introduction to Medicare Back Learn About Medicare Introduction to Medicare Introduction Eligibility Coverage Options Prescriptions, Providers & Benefits Medicare Cost Basics Types of Plans Overview of Plans Medicare Advantage Plans Medicare Supplement Insurance Medicare Prescription Drug Plans.

To understand how aging will affect your costs, you can request multiple price quotes to discover the best deal now and for decades to come. How do AARP Medicare Supplement plans work? When you buy an AARP Medicare Supplement Insurance plan, you're actually getting a policy from UnitedHealthcare .

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Not all plans are available in all locations. View Important Disclosures Below UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers.

What it covers : All Medigap plans cover some portion of out-of-pocket costs (deductibles and coinsurance) for Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). What it doesn't cover : A supplemental plan will not cover prescription drugs.

Available discounts can vary according to factors such as your location, household status and how you apply for a policy. Back to top UnitedHealthcare's spending on care 71.7% for member benefits Medicare Supplement Insurance providers are required to report data on the premiums they collect and how much they spend to provide benefits for members.

Enrollment in these plans depends on the plan's contract renewal with Medicare. You do not need to be an AARP member to enroll in a Medicare Advantage plan or Medicare Prescription Drug plan. This information is not a complete description of benefits.

Plan B On average, AARP/UnitedHealthcare's quoted prices for Medigap Plan B were about 16% higher than the least-expensive Plan B policy in the area. Get details on AARP/UHC's rates for Medigap Plan B In each of the locations used for this review, AARP/UnitedHealthcare only offered Plan B with wellness extras included.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP Medicare Supplement Insurance Plans AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

AARP Medicare Plans from UnitedHealthcare United Healthcare UnitedHealthcare Insurance Company or an affiliate or an affiliate AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company, or UnitedHealthcare Insurance Company of America, or United Healthcare Insurance Company of New York.

Medicare Advantage plans and Medicare Prescription Drug plans Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor.

Know More : Medicare Supplement vs Medicare Advantage Pros and Cons

Medicare Supplement Insurance Plan or Medigap — is an alternative plan that can be purchased for most Americans and is not available elsewhere. Terry Turner. Terry Turner is Senior Financial Writer and Financial Wellness Facilitator. Terry Turner is a veteran journalist and covers government spending on Social Security programs, Medicare and other federal programs. As a financial wellness coach, he holds certification from the National Health Educator Association and from the Foundation for Financial Wellness. Read More Matthew Mauney Matthew Mauney Financial Editors.

Can I still be covered by a Medicare Supplement Plan? Medicare Parts A & B, or Original Medicare may not cover all your health care expenses. Find ways in Wisconsin that a Medicare supplement plan provides coverage for your coverage.

Wisconsin's health-saving Medicare Supplement plans are quite different from typical letter plan available throughout America. This state offers the basic plan and the option to use riders. A state law mandates that Medigap insurers provide supplemental benefits as an additional protection. The Wisconsin Medigap Guide is available here. How does cheapest insurance plan exist in Wisconsin?

In general, you'll get a great deal on Medicare Supplement insurance if you purchase a plan once you qualify and have Parts A and B. Medigap Open enrollment starts on the day after your 65th year. A company cannot ask a physician to approve a patient's payment for the same period. To apply to MEDICAP plans, contact a medical insurance company to check if your account is open for new enrollment. Fill out your application for a plan and decide when it should begin.

Most common types of Medigap plan options exist in Wisconsin, though the most common is Plan A. There is no enrollment for Plan M. Only about half of people choose Plan H.

The Wisconsin Medicare Supplement is very different from typical letter plans in many states. The program in these states includes basic plans which have the option to ride. State law requires Medigap insurers to provide special benefit to the premium coverage.

There are several disadvantages to using Medigap plans. Have difficulty navigating a variety of plans. No prescription insurance.

Plan A generally carries higher premium rates than plan A because the insurance is more comprehensive. However, you may save money by using plan n for a higher cost than plan g, depending on your specific medical requirements. Medigap policies cost differently depending on the state.

If you're not eligible for an MSP, you might still qualify for Extra Help with your prescription drug costs. Beneficiaries eligible for an MSP are always entitled to Extra Help . Wisconsin's State Health Insurance Program (SHIP) is through the Wisconsin Department of Health Services .

Read More Updated: August 12, 2022 4 min read time This page features 5 Cited Research Articles Fact Checked Fact Checked A licensed insurance professional reviewed this page for accuracy and compliance with the CMS Medicare Communications and Marketing Guidelines (MCMGs) and Medicare Advantage (MA/MAPD) and/or Medicare Prescription Drug Plans (PDP) carriers' guidelines.

Other options include: Medicare Advantage: Medicare Advantage plans provide Medicare benefits through a private health insurance plan. Medicare Advantage, or Medicare Part C, usually includes benefits like vision and prescription drug coverage .

Subscribe Now Call Now Get My Free Open Enrollment Guide Close Home > Medicare > Supplement Insurance > Compare Plans > Wisconsin Medigap in Wisconsin Medicare supplemental insurance — or Medigap — plans in Wisconsin are different from the standardized choices of Medigap plans available in most other states.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

One of the most important decisions you have to make is what type of Medicare coverage to enroll in. There are multiple factors to consider. It can be easy to make the wrong choice, a choice you may not be able to undo.

Shop Plans Need help finding the right plan? Talk to a licensed agent through ChooseHealthy ®4 EyeMed vision care program 4 Hearing Care Solutions hearing program 4 Base plans offer unlimited preventive coverage 5 Optional foreign travel emergency coverage up to $100,000 6 Optional dental coverage (requires a premium) Services available to every customer To make our Medicare supplement insurance plans even better for you, we offer additional services 7 you can use at no extra cost.

Are in your initial open enrollment period and are guaranteed the opportunity to join a plan regardless of your health condition. Can afford the monthly premiums Don't want a Medicare Advantage Plan No, if you: Want a Medicare Advantage Plan with zero or low monthly premiums Don't mind following the rules and restrictions of a Medicare Advantage Plan to get your healthcare services and drugs.

Part A: skilled nursing facility coinsurance 175 days per lifetime in addition to Medicare's benefit of inpatient mental health coverage 40 home health care Health care services and supplies a doctor decides you may get in your home under a plan of care established by your doctor.

If you and your spouse both want Medicare supplement coverage, you will have to buy separate policies. However, WPS offers a 7% household discount when two or more individuals who reside together in the same dwelling have WPS Medicare supplement coverage. A dwelling is defined as a single home, condominium unit, or apartment unit within an apartment complex.

Ads Medical alert systems are advanced safety equipment that provide help in emergencies via a single click. The Life Alert System offers senior citizens independence, peace and safety for their families and caregivers.

Medical alarm systems provide many useful functions such as automatic fall detection, GPS tracking, medication reminders and 24 hour professional monitoring. But choosing a system that fits your needs can be overwhelming. We reviewed the best life alert devices available.

We evaluated the most popular medical alert providers based on product offerings and website reviews and evaluated features, costs, and reliability. Our criteria have been divided into five major categories ("core metrics") and 31 separate subcategories ("sub metrics"). These criteria were then classified according to their scores.

A list of the most effective healthcare alert providers in Australia has been compiled by our research team and includes the most reliable healthcare alert companies. Our guides then were checked to be correct by medicare coverage our geriatric nurses practitioner, Christopher Norman.

“This means if you're not in a guaranteed issue period, private insurance companies can charge you higher premiums based on your health status or preexisting condition(s) and whether you smoke.” Medical underwriters attempt to determine a private insurance company's level of risk.

Today, you can purchase your medical alert device in the form of a high-tech smartwatch; attractive jeweled pendant; small, lightweight push button; or even a smartphone.

How We Ranked the Top Life Alert Systems The eight medical alert system companies on our list represent only a fraction of the numerous systems available on the market today.

These systems do not qualify as necessary medical equipment, so most insurance companies refuse to pay for them. You'll probably need to pay for your in-home or mobile medical alert system out of pocket. However, you can take a few steps to save money on your alert system.

Should I Get an In-Home System or Mobile Device? If you're planning to purchase a medical alert device, you should consider whether an in-home system or mobile device would suit your needs best. In-home medical alert devices are best for people who spend most of their time at home. These systems provide coverage within your home only and connect to either a landline or a cellular network.

Check out our requirements for making the cut below: No long-term contracts : Some medical alert companies still require customers to sign long-term contracts for up to three years, which we're not big fans of.

Discuss your concerns and why you think a personal emergency response system might be a good idea. Ask them what features are most important to them. You and your loved one might even pick out the device and complete accompanying paperwork together, designating yourself as an emergency contact.

Meanwhile, the more you spend, the more features and functionality you get, such as automatic fall detection, live location tracking, caregiver app access and more. Choosing a Medical Alert System The right medical alert system depends on you or your loved one's activity levels and preferences.

Smartwatches Several companies, such as Bay Alarm Medical, offer mobile alert devices in the form of smartwatches. Medical alert watches covered by medicare. These watches have similar features to what you could find in a traditional smartwatch, such as an Apple Watch.

How do non-monitored medical alert systems work? Typically, an unmonitored medical alert system requires a landline connection as opposed to cellular service. When the wearer presses the emergency button, the system either dials 911 directly or a preset personal contact via that landline connection.

However, some systems have better equipment ranges than others. If you're planning to purchase an in-home medical alert system, you'll want to make sure it has a large enough range of service to cover your entire home. When we chose the emergency response systems to add to our list, we only included options with impressive equipment ranges.

Seniors with Active Lifestyles Seniors who live active lifestyles can also benefit from medical alert devices. The top medical alert systems allow you to take them anywhere within the U.S. and use cellular service to connect you to a monitoring center.

The Medigap or Medicare Advantage plan you're on leaves Medicare or stops offering coverage in your area, or you leave the plan because they didn't follow Medicare's rules. You enrolled in a Medicare Advantage plan.

This in-home base station comes with Bluetooth technology, a rotating photo gallery, apps, and games that promote cognitive function. MobileHelp also offers two mobile medical alert devices with GPS tracking: its standard device, the Solo, as well as a smaller and lighter version called the Micro. The latter is a good fit for seniors who prefer a discreet medical alert system when they're out in public.

What is Automatic Fall Detection? Medical alert providers typically offer automatic fall detection pendants in certain packages or as an add-on feature. With fall detection, the user won't even have to press a button after a fall.

The second device, the Sidekick Smart, has a higher monthly fee than other smartwatches with medical alert capabilities on the market, but it includes a variety of premium features. And you're not required to pay an upfront equipment fee as you would with other providers.

If you buy through affiliate links, we may earn commissions, which help support our testing. Home Best Products Health & Fitness Medical Alert Systems The Best Medical Alert Systems for 2022 A personal emergency response system can give you peace of mind knowing help is only a button-press away.

As a result, medical alert systems need to include mobile devices that are waterproof and that users can wear in the shower or bath. All of the companies on our list offer waterproof or water-resistant mobile devices, ensuring that these devices will continue working wherever you need them.

You may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program.

What Customers Are Saying About Aloe Care Aloe Care is a relatively new medical alert company, so there's only a handful of user reviews for its products. Overall, Aloe Care is an advanced medical alert company with unique, helpful features that place it a step above other companies in the industry.

Does Medicare cover medical alert systems? Typically, traditional Medicare (Medicare Part B) doesn't cover the purchasing or monthly subscription costs of medical alert systems because they are not deemed “medically necessary” durable medical equipment (DME).

This feature can allow you to save money by not needing to purchase a completely new system for each family member. Cellular Medical Alert Systems Vs. Landline The in-home medical alert systems on our list connect to a monitoring center either through a cellular network or a landline.

The company pairs its unique devices with helpful caregiver monitoring tools and a reliable five-diamond monitoring center, delivering top-notch medical alert services all around. Company Overview Aloe Care Health first launched in 2018 with the goal of intuitively enriching the human experience.

During our process, we: Engaged in ongoing independent research Consulted with licensed adult caregivers and doctors who specialize in caring for older adults Mystery shopped 13 medical alert system brands Surveyed medical alert system users Tested various medical alert systems Read hundreds of verified customer reviews from trusted third parties, such as Better Business Bureau (BBB) and Trustpilot Read more about our medical alert system review methodology .

Even better, if your recovery period is less than 30 days, you may even be able to return your device with a money-back guarantee when you no longer need it. Frequently Asked Questions How Much Do Medical Alert Systems Cost? Emergency response systems can come in a range of prices.

Mobile systems work all throughout the 50 states, however, they only work outside of the country when you are in an area that has cellular network coverage. How much does a medical alert system cost per month? Medical alert systems cost $19.95 to $49.95 per month on average. Prices will vary by provider and the type of system that you choose.

Medicare provides medical dermatology treatments for skin ailments. Medicare Advantage (MA) plans do not generally require the referral to a dermatologist, though certain MA plans do require the referral. It is always advisable to consult your provider first and find out if Medicare will provide the procedure and get the referral from the doctor before you go on any surgery. You can find dermatologists accepting Medicare in your area by going to Medicare.gov or speaking to your insurer.

Referrals can be referred by your medical doctor or if your medical condition has changed. If your insurance isn't covered by your plan, or your policy doesn't cover the referral fee, your plan can't afford them. Referrals may be a way to reduce out-of-pocket costs as well as improve continuity in treatment and communication with health professionals. Referrals from a specialist are generally not necessary in Original Medicare and other types of Medicare Advantage plans, but it is advisable to ask about your dermatological needs.

Doing so will ensure coverage of services and confirm costs. Cosmetic services such as Botox treatments to remove wrinkles are not part of the dermatology services Medicare covers. Per Medicare's guidelines, Botox can receive coverage when treating severe migraines and may require prior authorization for treatment of other conditions.

Using Medicare's physician compare tool , enter your city and state plus the keyword dermatology. Finding the right Medicare plan to cover dermatology services does not need to be complicated. Our team can help you find the right plan for your healthcare needs. Call us at the number above or fill out our online rate form to get your free quote today.

To use the tool, simply type in your city and state and the keyword “dermatology.” Doctors and medical groups within 15 miles of your location should appear in the search results. You may also ask your primary care physician to give you a recommendation for a dermatologist. Medicare information is everywhere. Medicare information is everywhere. What is hard is knowing which information to trust.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Medicare covers dermatology treatments. The coverage will differ according to your insurance plan. In addition to dermatological care, Medicare pays no medical fees. Find the best medical plans in three steps. Medicare Part B covers dermatology services that assess, treat and diagnose certain conditions. This article describes basic dermatologic services as well as the coverage provided by Original Medicare.

You'll receive coverage from your original Medicare plan if your dermatology procedure is needed. In most cases, routine medical treatments and cosmetic treatments are not covered by the original Medicare plans.

How can we get referral letters from private Dermatologists to the NHS? You can bring it back to a dermatology office when you schedule a consultation. You can choose which doctors you see so you can get the care you need immediately.

Medicare covers dermatology care and dermatology services in the event of medical necessity. Because skin-related medical procedures are often cosmetics you are covered by Original Medicare. Medicare Advantage Plans also have additional options. Christian Simmons. Christian Simmons. Financial Write-in.

Medicaid beneficiaries have access to various healthcare sources. Coverage covers dental and vision health, laboratory and x-ray services, along with renal dilution and transplant services.

Consult your doctor about any symptoms or discomforts. Extreme eczema if used in combination with a prescription drug. Worsening skin infections – even those that have yellow spots and pus.

He is featured in many publications as well as writes regularly for other expert columns regarding Medicare. Stacy Crayder Corporate Trainer and Licensed Medicare Agent Stacy Crayder is the corporate trainer and licensed Medicare agent at MedicareFAQ.

You can avoid this situation by asking for a referral to a dermatologist that accepts assignment. The term assignment, in this context, means that the doctor waives whatever fee they typically charge and accept the Medicare pricing for Medicare patients. Medicare coverage can extend to dermatology, but it depends on the situation. If your doctor deems it medically necessary for you to see a dermatologist, Medicare will usually provide coverage.

Treatment can include lotions, ointments, oral medication and more. Was this article helpful ? Yes (82) No How To Find Dermatologists Near Me That Accept Medicare Finding a dermatologist that accepts Medicare within your service area is easy.

“ 2020 Medicare Parts A & B Premiums and Deductibles .”(accessed December 2019). Some Medicare Supplement plans, also called Medigap, can help cover out-of-pocket costs for dermatology.

With Original Medicare, you do not typically need a referral if you see a specialist who is enrolled in Medicare. Your primary care doctor may recommend a dermatologist to you as well. If you access Medicare-covered dermatology services through a Medicare Advantage plan, you should contact your plan or ask your primary care provider which dermatologists they would recommend who are in-network. If you don't need a referral, you can use so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Before receiving the treatment patients need to contact a dermatologist who accepts Medicare. So a company can ensure service coverage and verify its cost. Cosmetic treatment for wrinkles is not included in Medicare coverage. In order for patients to have migraine treatment, Botox must also have prior authorization from Medicare. Medicare covers dermatology services for prevention purposes. Here is the list of health plans that Medicare offers. Patients must discuss all possible treatments with their dermatologist.

In the case of a skin condition under Medicare, dermatologist services are restricted. Treatment of skin cancer is generally covered by the Original Medicare Program. However, regular checks and skin examinations are not deductible when there are no clinical benefits. Alternatively, the screening may be provided for suspected cancer cases. You'll also have limited coverage for medicines related to dermatological treatments.

You also may wish to make a dermatology appointment for a variety of cosmetic disorders related to the skin, including hair loss or skin changes associated with aging such as wrinkles.

However, finding the answer... Updated on March 10, 2022 Can You Be Denied a Medicare Supplement Plan? Medicare Supplement plans are a great option for Medicare beneficiaries who want to keep the freedoms of Original Medicare but... Updated on September 22, 2021 Deductible vs. Copay vs. Coinsurance vs. Premium If you're new to Medicare, understanding the different terminology can be overwhelming.

Part B of Medicare covers hospital visits in emergency rooms and regular physician visits. There are urgent medical offices in most nations with Medicare. The urgent care provider will charge Medicare for your services, and the rest will only be paid for deductibles or other payments. The vast majority are covered by Medicare. Unless they have Medicare, they accept a medical insurance program. Sometimes recipients get into urgent services that are unavailable for the Advantage plan. During treatment you must call the clinic. Find your Medicare coverage with a simple guide.

Nearly every urgent care center accepts Medicare. These visits are arranged primarily for sudden illness that is unheard of. Medicare covers 80% of visits. You need to pay a 20% Medicare fee for any services you need and a 20% fee if any of these services have already taken place. Christian Simmons. Christian Simmons is Financial Editor. Christian Simmons has authored for RetireGuide and is a member of AAFCPE®. He also discusses the Medicare issue and related pension matters.

However, just because an urgent care center accepts Medicare doesn't mean they will accept all Medicare Advantage plans. Much like more traditional health insurance plans, many Medicare Advantage plans feature networks of doctors, hospitals, pharmacies, medical equipment providers and other types of health care providers including urgent care locations.

Urgent medical services provide immediate medical assistance in cases that occur unexpectedly. Medicare covers this visit in Part B, as well as any treatment you undergo during your trip. Common ailments that warrant immediate hospital visits. Urgent care facilities can offer additional Medicare coverage unless you are injured. In the medical community, you can get physical examinations and radiographic tests each year along with vaccination vaccination shots.

Typical urgent care visits average $200 to $150, according to Debt.org, which offers monetary advisory services to the public. Whether the doctor can help you with an acute condition can affect your actual costs.

eHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. We offer plans from a number of insurance companies.

Elite Insurance Partners LLC d/b/a MedicareFAQ. This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area.

Before visiting an urgent care location, check to see that the facility is included in your Medicare Advantage plan network. If they are not a network participant, the visit is not likely to be covered and you may be left responsible paying out of pocket for your care.

Check with your plan's benefits, or ask your agent how urgent care is covered if you do have a Medicare Advantage plan. Urgent Care Options in Decatur, IL In Decatur, there are really only two urgent care options for seniors, and both are through DMH.

Contents Urgent care centers vary Opt-out physicians Accepting physicians Medicare Advantage plans have their own networks You can get the urgent care you need If you require urgent medical care, you might wonder if urgent care centers accept your insurance.

n most parts of the country, if you're not feeling well, you have several choices for care. If your doctor is closed or can't squeeze you in right away, an urgent care clinic might be open. If you're really ill, an emergency room is there to take care of you. But if you're on Medicare, you may wonder whether to go to urgent care vs ER, and what your choice means for your Medicare costs.

While Medicare Part B covers urgent care and emergency room care, urgent care is typically cheaper and has a shorter waiting time. Learn more about the qualifications for Medicare urgent care coverage and how to get help covering some of the additional costs. Medicare Urgent Care Coverage Urgent care typically falls under the Medicare coverage category of emergency department services .

Some Medicare Advantage plans may also offer extra benefits Original Medicare doesn't cover. Does Medicare Advantage cover urgent care? By law, every Medicare Advantage plan must cover the same benefits that are offered by Original Medicare, which means Medicare Advantage plans will cover urgent care.

The use of durable medical supplies is covered under original Medicare – Part A, as well as Part B. Examples of durable medical products include medical facilities and hospitalization services as defined by Medicare Part A. So, medical devices for patients in hospital will have Medicare Part B protection.

Medicare Part B provides medical equipment that allows you to provide medical care in your own home. Durable medical equipment must contain a doctor's recommendation for protection. Medicare will not cover all medical items but there are several items. Find the most suitable health insurance in the US.

Medicare defines the term "durable medical equipment" as a medical device deemed medically necessary. The doctors determine the equipment needed for Medicare according to the rules outlined above. The doctor will assess your health conditions, what equipment should you use at home and what equipment you are using. Part B of Medicare provides coverage for medically necessary medical equipment. Durable medical equipment must include the following items for a Medicare Part B plan:

Medicare does not cover any durable medical equipment. Benefits are available to patients with medical conditions. If you have medical supplies that aren't insured under Medicare, your medical expenses could be incurred. Find Medicare Plans in 3 Simple Steps. Original Medicare covers the following medical supplies: The above list is not a complete listing. Therefore, speaking with a physician is very important when buying a product.

Descriptions. Durable medical instruments are defined according to the following conditions. Usually used primarily for health-related purposes. This isn't helpful to someone who has no injuries.

Durable medical equipment comprises equipment for the use in a patient's home or for prosthetics. A completely different type of DME might consist of a single-use medical device, bands or incontinence pads. The DME definition must also be understood, this may impact insurance coverage. Some health insurance companies reimburse the cost associated with purchasing medical durables. A durable medical item is defined as if it was a medical device that could have survived in a hospital unless it was:

Orthodontics and braces can be categorized as Durable Medical Equipment. Braces are used for supporting your knees and neck. Combining orthotics with other medical procedures could reduce surgery time.

Durable medical equipment (DMEM) is tools and materials for everyday use. This collection contains many products including wheelchairs and oxygen tanks. Medicare normally covers DME when it has withstand repeated use.

To qualify for Medicare coverage, the equipment or supplies must be: Medically necessary for you — not just convenient Prescribed by a doctor, a nurse practitioner or another primary care professional Not easily used by anyone who isn't ill or injured Reusable and likely to last for three years or more Appropriate for use within.

Coverage for DME may include: oxygen equipment, wheelchairs, crutches or blood testing strips for diabetics.

Get Answers Search Back to glossary Durable medical equipment (DME) Equipment and supplies ordered by a health care provider for everyday or extended use. Coverage for DME may include: oxygen equipment, wheelchairs, crutches or blood testing strips for diabetics. Preview plans and prices based on your income .

He is featured in many publications as well as writes regularly for other expert columns regarding Medicare. 26 thoughts on “ Durable Medical Equipment Covered by Medicare ” Cindy Hudnall says: August 11, 2019 at 10:38 am My mother in law who has Alzheimer's is currently in a long term care facility in Norfolk, VA, and is being charged $2700.00 per month for a wound vac.

Then, we will answer some common questions on whether Medicare helps cover durable medical equipment costs.

In either case, here are a few other ways that you can pay for durable medical equipment: Private insurance : Private insurers typically cover durable medical equipment.

Establishment of Medicare Fees for Newly Covered Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) For newly covered items of DMEPOS paid on a fee schedule basis where a Medicare fee does not exist, the Centers for Medicare & Medicaid Services (CMS) uses a process to establish fees called gap-filling.

Your costs with Original Medicare If your supplier accepts Medicare, you pay 20% of the Medicare-approved amount after you meet the Part B deductible. Medicare pays for different kinds of DME in different ways. Bay Medical is a healthcare provider in the United States.

How will Medicare cover durable medical equipment? Original Medicare's Part B covers durable medical equipment items when your Medicare-enrolled doctor or health care provider prescribes it for you to use at home.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area.

Common examples of durable medical equipment include: Wheelchair Crutches Walker Nebulizer Ventilators Heart rate monitor Medicare Part A covers skilled nursing facilities and inpatient care. So, inpatient devices are covered by Medicare Part A.

Discounts Receive updates about Medicare Interactive and special discounts for MI Pro courses, webinars, and more.

There are certain criteria that will warrant a replacement device to be covered by Medicare.

Furnish a replacement device as it may take Philips Respironics up to a year to repair or replace the device.

You may be able to choose whether to rent or buy the equipment. Medicare will only cover your DME if your doctors and DME suppliers are enrolled in Medicare. Doctors and suppliers have to meet strict standards to enroll and stay enrolled in Medicare.

Some examples of durable medical equipment covered by Medicare: Blood sugar monitors and test strips Canes CPAP devices [CPAP machines] Crutches Hospital beds Infusion pumps (some medicines need these) Nebulizers and nebulizer medications Oxygen equipment, supplies and accessories Power scooters.

Payment for the monthly supplies for the CGM may continue for as long as medical necessity and coverage of the CGM continues.

Sections 1834(a), (h), and (i) of the Social Security Act mandate that the fee schedule amounts for durable medical equipment (DME), prosthetic devices, prosthetics and orthotics, and surgical dressings, respectively, be calculated based on average reasonable charges paid for the item or device under Medicare from a past period (“the base year”).

A federal government website managed and paid for by the U.S. Centers for Medicare and Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244

Recent Blog :

Home Health Aides: Professional Caregiving Help at Home

Aetna typically offers Medicare plans A, B and N for Medicare participants, as well as plans F if eligible. Depending upon the state, they may also choose to make an exception. Aetna's premium on a number of common plans such as Plan N is among the lowest on the market. However Aetna offers a Medigap plan which does not have any premiums.

However, customers complain that it provides much better insurance than the typical. Here is the best information on Medicare Supplemental Insurance.

Aetna Medicare Supplement has the same basic standards as most Medicare Supplements. When you purchase the Aetna Supplement Plan F, you get the same exact benefits as any plan in the plan; Aetna Supplement Plan F coverage is integrated into your Medicare Part A and B coverage and provides the coverage for Part B and Part A deductibles.

Plan F gives you access to a doctor who participates in Medicare. You know you can get the Medicare Supplement right where the Medicare stops working. Plans are often referred to as First Dollars insurance. Coverage.

Our agency serves as an AES Supplements manufacturer in the United Kingdom. So we liked it. Aetnan has existed for 160 years and if you need stability then this insurer is for you. They made the first Medicare claims in 1967. Their current headquarters is in Brentwood, Tennessee. Depending upon your choice, Aetna Medicare Supplement can provide you with many options for your health plan.

The Medigap program offers exceptional coverage and low cost. Currently the company owns CVS Health, a large Medicare provider.

The Medicare Advantage plan offered by Aetna offers an extensive network of physicians and is one of the most affordable plans available. 4.3 out of 5 stars. Most people enroll in 4-star plans. Many plans have low cost of ownership and the costs of emergency care can be excessive if they are not accounted for.

When a person can no longer qualify for Medicare Supplement insurance, it might be useful to consider Medicare Advantage Plans, including Aetna Medicare Advantage Plans, in a nearby area. A Medicare benefit program from Aetna is offered to a trusted service provider for handling the claim for you.

Aetna Medicare Supplements often also asks people for information concerning Aetna Medicare Part D. While Part D plans can be purchased at a large number of places, there are no deductible plans available at the Aetna - IL office. Various pharmaceutical plans offer various monthly premiums and copays for different medications.

Be aware how often companies with the best Medicare supplement do not provide the most comprehensive Part DD plan available. Your Supplement and Part D plans differ by plan, so it's important you find the plan that provides you with the lowest prices for your medications.

For Aetna Medicare Advantage, your reported income could require you to pay additional premium to the government. Click here for details. Switch your plan, not your doctor.

As you can see below, for all age groups, Aetna Medicare Supplement Plan G is the cheapest available on the market. This is most significant for those close to the age of 75 years old, where Aetna's policy is $14 cheaper per month compared to the closest competitor Humana ).

Aetna is the brand name used for products and services provided by one or more of the Aetna group of subsidiary companies, including Aetna Life Insurance Company and its affiliates (Aetna). Aetna Resources For LivingSM is the brand name used for products and services offered through the Aetna group of subsidiary companies (Aetna).

Health Maintenance Organization (HMO) plans have stricter networks that don't extend coverage to non-network providers. Was this article helpful ? Yes (11) No How to Sign Up for an Aetna Medicare Plan The best part of Aetna Medigap plans is that you can change plans anytime, as long as you pass medical underwriting.

Pharmacy clinical programs such as precertification, step therapy, and quantity limits may apply to your prescription drug coverage. Providers are independent contractors and are not agents of Aetna. Aetna's Drug Guide is subject to change.

his website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

How well does Aetna Medicare Supplement pay bills? Medicare Supplement plans must pay after Medicare pays. They do not have a choice once Medicare approves and pays for the service.

Our Family of Companies Aetna Senior Supplemental insurance includes: Aetna Health and Life Insurance Company Aetna Health Insurance Company Aetna Life Insurance Company Accendo Insurance Company American Continental Insurance Company Continental Life Insurance Company of Brentwood, Tennessee Coventry Health and Life Insurance Company.

For coverage details on the Aetna Advantage plan without Medicare, please visit our plan brochure. Please see the Medicare Advantage plan benefits guide (PDF) for coverage details on the Aetna Medicare Advantage Plan.

The company scored a 1.57 for its Medicare Supplement product, meaning its complaint performance was significantly worse than the average of 1.00 across the industry.

It's the same great family of companies. Common Features of all Aetna Medicare Supplements Aetna Medicare Supplement plans have some features that apply to all policies.

Aetna makes no payment to the third parties — you are responsible for the full cost. Check any insurance plan benefits you have before using these discount offers, as those benefits may give you lower costs than these discounts.

Aetna plan options and costs Aetna offers a select number of Medicare Supplement plans. Although the company does not have the full suite of Medigap policies, its prices are extremely competitive when looking at the market as a whole.

Learn about the dispute process Medicare appeals for non-participating providers Appealing a Medicare hospital discharge Determining Medicare coverage The Centers for Medicare & Medicaid Services sometimes makes changes to coverage rules. See updated National Coverage Determinations (NCDs) that may affect patient coverage.

Pros Cons Competitive prices for popular plans: Aetna's rates are close to the lowest for Medigap Plan G and Plan N — the most popular plans for new Medicare members. Spending on member benefits: Aetna spends a greater portion of its income from premiums on benefits for members, compared to the average Medigap insurer.

On the other hand, the most expensive Plan G policies are offered through Cigna (for ages 65 and 85) and AARP (for age 75). Member benefits and extras Aetna has several overall member benefits that it offers to its policyholders.

Click on "Claims," "CPT/HCPCS Coding Tool," "Clinical Policy Code Search." The five character codes included in the Aetna Precertification Code Search Tool are obtained from Current Procedural Terminology (CPT ® ), copyright 2020 by the American Medical Association (AMA).

The Shingrix vaccine cannot cause a shingles outbreak. How Much Does the Shingles Vaccine Cost and Will I Have to Pay? Medicare Advantage HMO (Health Maintenance Organization) covers the shingles shot for the plans Intermountain Healthcare Nevada administers.

Adults over 50 must be treated with Shingrix twice a day separate from their daily meals. Adult populations whose immune system is weakened by disease or therapy should receive Shingrix 2 times daily.

Medicare Advantage plans cannot reimburse shingles vaccines or other shingles-related medications except when Part D is included on prescriptions.

Unlike most vaccines, shingles vaccine is often a mild side effect that lasts only for a short duration. Most commonly experienced side effects include headache and nausea. Redness, pain, swelling, itching, or warmth from injections.

Shingrix is the first vaccine against shingles and is the only currently in use in the USA. Instead of relying on virus-lived viruses, vaccines rely on protein in viruses that trigger a reaction against infection.

The medicine will be administered at two dose intervals between two weeks. It is known that shingles vaccination reduces the likelihood of occurrence in adults 59 and older by 92 percent in people aged 55 and younger and 94.

Shingrix is the first vaccine against shingles and is the only currently in use in the USA. Instead of relying on virus-lived viruses, vaccines rely on protein in viruses that trigger a reaction against infection.

The medicine will be administered at two dose intervals between two weeks. It is known that shingles vaccination reduces the likelihood of occurrence in adults 59 and older by 92 percent in people aged 55 and younger and 94.

Shingles or herpeszoster are conditions which should be avoided at all costs. Fortunately, shingles vaccines are able to reduce the chance of an shingles outbreak.

Tell me the cheapest way to purchase the Shingrix vaccine? Shingle smears are blisters that appear on nerve roots. The shingles virus can sometimes affect these nerves causing painful pain that can last months or years until the infection disappears.

This charge can sometimes be wrapped into your total vaccine cost. This may explain why the cost of the vaccine can sometimes be higher than the GlaxoSmithKline estimate. With Medicare Medicare Advantage plans with prescription drug coverage and Part D plans may cover the Shingrix vaccine, but that does not necessarily mean it will be free.

Therefore, getting the vaccine at your doctor's office could result in you paying the entire bill and having to submit a reimbursement request to your plan. How Much Does the Shingles Vaccine Cost? There are several vaccines covered by Medicare Part D, including shingles vaccines. Remember, your Medicare Part B does not cover the shingles vaccine. However, you can find Zostavax and Shingrix on your Part D plan formulary.

Most patients on Medicare Part B pay less than $5 per dose for Shingrex, according to pharmaceutical maker GlaxoSmithKline. Depending on your plan details and if you haven't met your deductible you might be able to buy additional drugs.

Some seniors may have free access to the shingles vaccine if the vaccine is covered by Medicare Advantage Part C or Medicare Part D plans. Some of the customers will have either paid part or full price when the deductible wasn't met.

All Medicare plan D covers shingles vaccination. However, coverage differs between companies and the real value depends on the information on the plan and whether you have already paid the deductible. With a Well-Care or Medicare Plan, you have a great chance of shingles vaccination. In each case the dose is under 50 dollars, whereas part-d coverage is affordable, ranging from $37 per month. Where can I find the cheapest insurance plans?

In order to get your shingles vaccine covered by Medicare, you will need to enroll in a Medicare Advantage plan with prescription drug benefits (an MA-PD plan) or a stand-alone Part D prescription drug plan. How much you pay will depend on the plan you choose, though it could be free in some instances. Deductibles and copays may apply.

Many insurance plans cover shingles vaccinations, including some Medicare plans. What Parts of Medicare Do Not Cover the Shingles Vaccine? Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) do not cover the shingles vaccine .

Other insurance plans, including private insurance and Medicaid, may cover the shingles vaccine with no out-of-pocket costs. Contact your insurance company for more information and coverage details.

Yes, Medicare does cover the shingles vaccine, but not under Original Medicare Parts A and B. Instead, your Medicare Part D plan is required to provide coverage for the shingles vaccines. It's a good thing that Part D covers shingles vaccines because there are an estimated 1 million new cases of shingles each year in the United States.

Does Medicare Cover Shingles Vaccines? Medicare requires that private insurers provide coverage for the shingles vaccines through Part D prescription drug plans. So you're covered if you're enrolled in a stand-alone Part D drug plan or a Medicare Advantage plan that has Part D drug coverage.

Doctors call this post-herpetic neuralgia, and it can sometimes last for months or even years. There are also risks for older adults who develop shingles.

Medicare offers health benefits to Americans 65 and above. Some older persons may also have eligibility to receive Medicare, i.e. those disabled and those who suffer kidney damage. The program is intended to help pay for healthcare expenses, however it doesn't include most medical expenses or long-term care expenses. There are different options for how one can obtain Medicare. If you want Medicare coverage, you may purchase Medicare Supplemental Insurance (Medicare Supplement) insurance from private insurance providers.

Medicare is health insurance for people 65 or older. You're first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig's disease).

Trying to sign up for Medicare? Follow these steps to learn about Medicare, how to sign up, and your coverage options. enrolling in medicare

United States government Here's how you know Here's how you know Cambiar a Español Official websites use .gov A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS A lock ( lock A locked padlock ) or https:// means you've safely connected to the .gov website.

Learn about Part A and Part B sign up periods and when coverage starts. Check when to sign up Answer a few questions to find out when you can sign up for Part A and Part B based on your situation. Check When to Sign Up Check how to sign up Answer a few questions to find out if you need to sign up or if you'll automatically get Part A and Part B.

Why do some people get Medicare automatically? Answer a few questions to find out These questions don't apply if you already have Part A and want to sign up for Part B .

Trying to sign up for Medicare? Follow these steps to learn about Medicare, how to sign up, and your coverage options.

If you do not have job-based insurance and you turn down Part B, you may incur a premium penalty if you need to sign up for Medicare coverage in the future.

The Centers for Medicare & Medicaid Services is providing equitable relief to people who could not submit premium-Part A or Part B enrollment or disenrollment requests timely due to challenges with contacting us by phone(847)577-8574.

You'll need to have a personal interview with Social Security before you can terminate your Medicare Part B coverage. To schedule your interview, call the SSA or your local Social Security office . Medicare Prescription Drug Coverage (Part D) Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

SilverSneakers is covered by Medicare through certain Medicare Advantage plans, also known as Medicare Part C. SilverSneakers is a fitness program designed for seniors, which offers access to gym facilities, fitness classes, and other wellness resources.

Share sensitive information only on official, secure websites. Menu Basics Basics Basics Caret Icon Health & Drug Plans Health & Drug Plans Health & Drug Plans Caret Icon Providers & Services Providers & Services Providers & Services Caret Icon Chat Log in Home Basics Get started with Medicare Search Search Print this page.

If you are receiving Social Security retirement benefits or Railroad Retirement benefits , you should be automatically enrolled in both Medicare Part A and Part B .

Note: Important Upcoming Change – Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month you're first eligible.

This relief applies to the 2022 General Enrollment Period, Initial Enrollment Period, and Special Enrollment Period. If you were unable to enroll or disenroll in Medicare because you could not reach us by phone after January 1, 2022, you will be granted additional time through December 30, 2022.