Medicare is a fee-for-service medical insurance policy for a person who is older. It includes alphabet soups that offer many coverage or benefit categories. Medicare is a complicated business. There are holes that can just not be filled out completely. If your gap is widening, enroll in a supplemental Medicare plan. For your consideration, we have collected unbiased expert insights into coverage cost, convenience, and options.

We review products in the most independent manner and advertisers have no effect on their selections. We may be compensated for visiting partners we recommend. Find out what we have disclosed to advertisers on a separate page. Anyone who wants to join Medicare should take several choices. How can I supplement my original Medicare with Medigap if I am not a registered Medicare beneficiary?

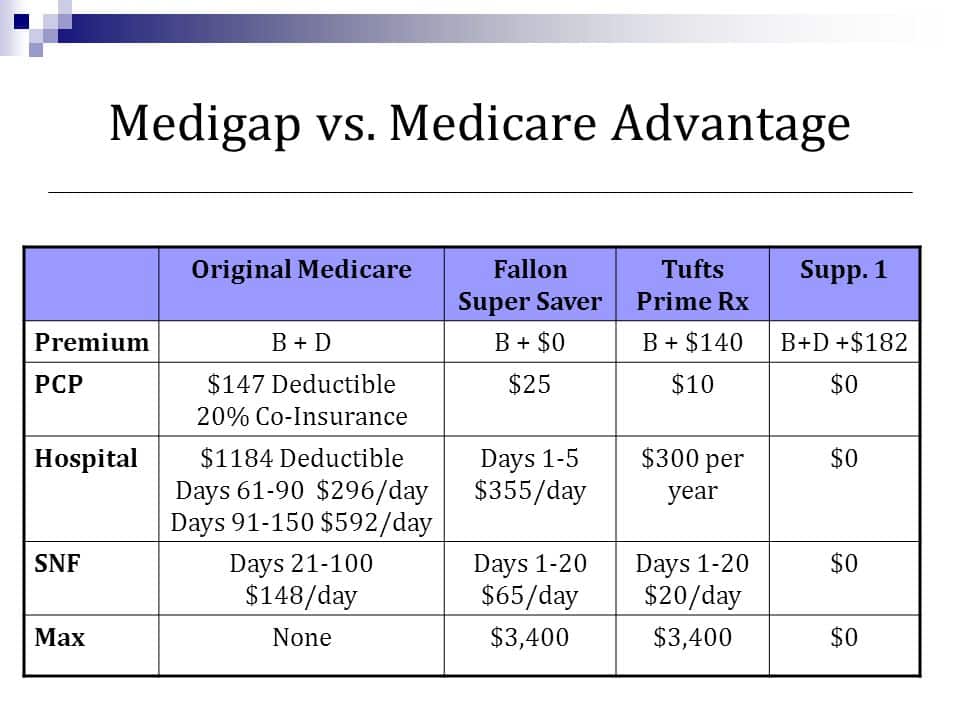

How Medicare Advantage is different from Medigap Medicare Advantage, also known as Medicare Part C, is an all-in-one alternative to original Medicare. Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services.

Medicare Part C, also known as Medicare Advantage, is a comprehensive health insurance plan offered by private insurers. This plan includes all benefits of Parts A and B, along with additional benefits such as prescription drug coverage, dental, vision, hearing, and wellness programs.

Contrary to common belief Medicare and Medigap are two very different coverages and neither one is suitable. Tell me the right policy? Find the right plan immediately! Having not taken health insurance since you were 65 is a relief unless you are in a coma. Part A and Part B (medical insurance) cover most medical expenses but they don't cover anything else.

When you choose the most affordable private insurance options you can get the most money and the most competitive rates available.

If it isn't available, you can buy another Medigap policy. The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D) . If you joined a Medicare Advantage Plan when you were first eligible for Medicare, you can choose from any Medigap policy.

Medicare Advantage policies (PARTC) can be purchased by private insurance companies under the Aetna Humana or Kaiser Foundation names for consumers. There could also be no premium on the policy, but lower premiums when compared to the premium rates on Medigap insurance. Medicare Advantage plans cover doctors, hospitals and often provide prescription medications. Other coverages do not cover Medicare. By 2020, 42% of Medicare beneficiaries would have chosen this plan.

Most Medicare Advantage plans are operated in the manner of health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Aetna Medicare Advantage plans are health insurance plans offered by Aetna that provide coverage for Medicare Part A and Part B benefits. Medicare Part B is a supplemental health insurance policy that helps cover medical expenses not covered by Medicare Part A.

Medicare Advantage plans resemble private insurance. Most services are provided in exchange for a small amount of money. Plan offerings may also have HMOs or PPO networks. Almost all plans impose annual limits for expenses. All plans have their own benefits. Most of them offer medical insurance. Some need a referral from a physician and others don't. Depending on the situation, certain doctors and hospitals will be covered unless they have access to HMOs or PPOs in the network. Some Medicare Advantage plans exist. Choosing an alternative plan may be of great interest. The eligibility age for Medicare is 65.

Medicare Advantage plans are a replacement for Medicare Originals. Sold by private insurers this program covers all the covered services under the original Medicare and offers additional benefits for things Medicare does not. In addition to medical services and prescriptions there are prescription drug benefits such as eye health, hearing and dental. Upon acquiring Part B health insurance and Medicare Part A hospital insurance, you may receive Medicare Advantage plans. When you apply, Medicare Advantage replaces Part A, Part B, or other types of coverage.

Medicare Part D Medicare Supplement (Medigap) Plan Type FAQ Medicare by State Managing Your Medicare Blog About eHealth Open About eHealth menu Back About eHealth Licensing Privacy Policy Terms of Use Careers Find Medicare Plans Find Medicare Advantage Plans Find Medicare Supplement Plans Find Medicare Part D Plans Learn About Medicare New To Medicare Enrollment Open Enrollment.

The average annual payment for a Medicare supplement plan is estimated at between $100 and $200, based on how often the insurance company has. Just like Medicare Advantage, it's good to shop around—65-year-olds will save an average of $740 a year with Medicare Supplement Plans G and $648 a year with plans N. Depending on what is offered at your location, your doctor may recommend a combination of Medicare “We are focusing largely on the benefits of private health coverage and Medicare as a way of improving the quality of life,” he said. Home health aides are professional caregivers who provide assistance to individuals and families in need of help at home. They are typically employed by home health care agencies, but may also be self-employed.

Medigap or Medicare Advantage programs offer a variety of advantages that depend on the individual health needs that apply. Medigap plans also offer additional coverage to Medicare users. The Advantage Medicare program provides the same coverage as Original Medicare plus extra benefits including prescription drug, vision, dentistry, hearing and other wellness benefits.

Medicare Supplemental Insurance or MGAP works together with your current Medicare plan. It helps cover the costs of services covered by Part A. Part B does not reimburse for example the expenses for traveling abroad and excessive costs for medical visits. It may even cover Part A deductibles that are worth $1,555 in 2022 as well as 20% of the coinsurance charges that you are required to cover Part B insurance. I think the Medigap plan should be part of a larger plan, as they would help reduce copayment costs,” she said today. A medical alert system is a device that allows individuals to call for help in the event of an emergency.

The Medicare Advantage plan is a Medicare supplement. They are available by private insurance companies. Under an MD Plan your benefits may continue to include A and B, but you will usually also be given Part D along with other benefits like regular hearing and eye care. Medicare Advantage Plans are administered under the same rules as Original Medicare. But it could require staying connected or seeking a referral before a plan pays for it, says Donovan. Original Medicare allows you to see all of the doctors that accept it.

Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or skilled nursing facility (SNF) if you're medically necessary.

As we reach age 65, it is crucial to find out how long it takes to enroll in school. Start with a check of eligibility. Most Medicare Part A patients must enroll with their doctor or health care provider within the seven-month window that starts at a year-end three months prior to their 65th birthday. This window is for a three-month period after you reach 65. In case of Social Security. If you haven't yet enrolled, you can enroll online. If you don't register, you will need a paper application form.

The CPT code for a home visit depends on the type of service provided. Generally, the most common codes used are 99211 (established patient office or other outpatient visit), 99347 (home visit for an established patient) and 99348 (home visit for a new patient).

If your condition requires undergoing medical attention out-of-town, it is possible to take advantage of Medicare Advantage benefits, then return to normal Medicare if necessary in a non-urban setting. During this open enrollment period switching between both Medicare Advantage plans may be available to any person. Each year, the elections take place from October 15 – Dec 7. Let me explain it. During a switch to Medicare, you can no longer enroll with Medigap.

Medicare Advantage plans are based upon original Medicare and provide coverage for certain services that were not covered by Original Medicare including sight screening, dental treatments, hearing and health care programs. Some plans even provide transportation for doctor visits and adult daycares. The plan also provides benefit plans for chronically ill individuals.” Among other services, Cigna is offering Medicare Advantage users COVID-19 free vaccinations.

If you are healthy but have minimal medical bills, Medicare can be the best option. In general, Medigap can provide relief to a patient who needs urgent treatment or is experiencing high health problems. Talk to an insurance company for advice and guidance on the health of an individual. Because Medicare Advantage and Medigap cannot be used together, you should select a plan carefully so that you can have the best coverage.

Medigap was created to fill in a gap between original Medicare and Medicare's copays. Medicare provides only 80% of the cost of Medicare coverage, including the services of your physician. A Medigap plan could help cover 80% of your out-of-pocket costs. Medigap cannot be used for the costs incurred in Medicare Part A or Part B. If your Medigap coverage doesn't cover hearing, vision or dental services, Medicare cannot cover.

Medicare Supplements help reduce costs and improve the budget. According to Jacobson, Cost Share has become a popular way for many people to avoid paying owed medical bills or getting rushed to a hospital. It's easy for people to see doctors in the USA. If one is from Arizona, one can fly to Minnesota for Mayo Clinic visits. In fact, Jacobson says it is much harder to use the benefits if someone gets sick.

A recent analysis by The Commonwealth Fund looks at Medigap plans offering nontraditional health care services which cannot even be offered under original Medicare[3]. We found that only 7 percent of plan members offered those benefits. Many people are still unaware that these insurance plans have the same coverage as Medicare's Advantage. There is a compromise between policy that encourages and discourages the offer of these advantages to consumers at federal level.

It's often difficult to calculate how much you'll pay for medical expenses during your retirement years. While traditional Medicare provides adequate basic coverage and provides good coverage, they are not paying nearly as much for hospitals, doctors or other procedures. Another 20 percent is individual responsibility, as is the Affordable Care Act. Tell me if a cardiac surgery is required.

The Medicare Supplement plan is a type of private insurance plan sold for the purpose of covering the coverage gaps in Medicare. In 2018, 33% of Medicare beneficiaries were covered by Medicare Supplements roughly 11 million people. The Medigap plan offers standardized coverage for things like deductibles, coinsurance, or copayments.

Medigap covers out-of-pocket expenses for Medicare patients who choose original coverage. Medigap offers a number of advantages, including choosing doctors. You get to choose between many medical offices because they accept most medical services. Whether your doctors work with Medicare Advantage plans or have other health plans you may consider Mediga. You can visit anyone accepting Medicare. In some cases, while Medigp's premium rates can exceed those of Medicare Advantage, Medigap charges you more out-of-pocket charges.

People on Medicare are either on Medicare Original Medicare or in the Medicare Feed-for-Service Medicare program. Generally, your Medicare insurance coverage costs are covered in your own pocket.

In fact, Medicare covers a large portion of covered medical care services. In most situations a medical insurance policy will cover the remaining cost of the healthcare, such as copayment.

A Medicare Advantage plan may be a more appropriate option for those whose monthly payments exceed the maximum amount. Medicare Medicgap insurance programs usually give you more choice where you can get treatment.

You may choose to join a separate Medicare Prescription Drug Plan (Part D). because most Medigap drug coverage isn't creditable prescription drug coverage , and you may pay more if you join a drug plan later. If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

A Medicare supplement is a Medigap plan offered to consumers through private companies that helps to pay for health care costs that are not covered by original Medicare, such as copays, insurance or premiums.

Get the information you need today! How do I change my Medicare coverage? Thousands of Medicare beneficiaries change their coverage each year during several enrollment windows. Find out how and when you can switch plans. How are Medicare benefits changing for 2023? Medicare changes for 2023 include premium and deductible increases for Part A, lower rates for Part B, and better Part D coverage due to the Inflation Reduction Act.

A Medicare supplement is a Medigap plan offered to consumers through private companies that helps to pay for health care costs that are not covered by original Medicare, such as copays, insurance or premiums.

Plans F and G also offer high-deductible versions in some states. 15 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer's prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.

Related Blogs: Does AARP Medicare Cover Life Alert?