You may also switch to Medigap to enroll in Medicare Supplement plans. We suggest changing your Medigap Plan and registering for a new one only if you are receiving enrollment protection. This will avoid you having to pay high prices for medical issues. In some cases a patient can receive Medigap enrollment protection when they move or lose a specific policy. However, medgap enrollment protections are different in each location. California allows you to modify a Medigap plan every year due to state expanded regulatory requirements, but others might not provide that much flexibility.

In 2015, nearly half a quarter of people with Traditional Medicare were covered for deductible and costs and to help prevent catastrophic medical expenses incurred through a health insurance plan. In this issue summary this article outlines the enrollment of beneficiaries for Medicare Supplements in Medicare.

Medicare provides supplemental health insurance to over 61 billion Americans aged 55 and younger. Medicare users in most areas can access private Medicare Advantage plans nearly four per cent do so. Most enrollees are covered through employer-sponsored coverage such as Medicare and Medicaid.

When choosing between Medicaid and Medicare Advantage, a key factor for many individuals is access to their medical providers and what kind of costs they'll pay. Medigaps can be more cost-effective and cover the costs associated with your medical care making it very good when you want extensive medical care. Medigap plans offer more options as they offer more providers because there are many doctors who accept Medicare. It's also ideal for travellers and people who live at second homes. Unlike Medicare Advantage plans, they typically cost less than 5% and have benefits including dental and fitness benefits.

If you are considering changing your Medicare plan, it is important to do your research and understand the different plans available.

A 65-year-old woman in Dallas might pay under $100 monthly for Plan G , while in New York that same person would pay $278, according to the American Association for Medicare Supplement Insurance. And, generally speaking, those premiums rise over time. Sometimes, they may be paying for Cadillac coverage they're not using when they may be better-suited for a high-deductible supplement or an [Advantage Plan].

Applicants for Medicare supplement plans can enroll within a certain amount without any penalties if you do not meet the eligibility requirements for the program. However, outside of these conditions, you will have to undergo medical approval before applying for Medigap. Your medical claim can be revoked by reason of your age.

These two terms are often interchangeable, because guarantee issue coverage (if you've been denied insurance) is provided during the enrollment process which opens the doors for signing. This guarantee is protected but can also take place outside of open enrollment allowing you to join Medigap Plans.

You can change your Supplemental Medicare Plans anytime. We do not recommend changing your Medigap coverage or enrolling into another plan except if it is covered by Guaranteed Issues. If this happens you will obtain better prices and you won't be denied unless you are suffering from a preexisting disease.

If you're able to buy one, it may cost more due to past or present health problems. During open enrollment Medigap insurance companies are generally allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy. However, even if you have health problems, during your Medigap open enrollment period you can buy any policy the company sells for the same price as people with good health.

I prefer switching to Medicare as it'll be more cost effective. Medicare Advantage provides enrollment for a period of three years from October 15 through Dec 7 and from January 1st through March 31st. During these registration periods the ability to enroll in the Medicare Advantage plan or change plans may be restricted if the patient has completed an insurance application or is a medical condition. In limited circumstances, when the federal government offers the guarantee of enrollment, this means you will get an option to switch between Medicare supplemental programs or providers.

There's a second Medigap open enrollment period when the individual turns 65 to access the generally lower rates that are offered to seniors. Medicaid: If you become eligible for Medicaid, you can suspend a Medigap plan for up to 24 months and reinstate it within 90 days of losing Medicaid eligibility.

Sometimes you can join a Medigap plan after the Medigap Open Enrollment Period without undergoing a medical underwriting review. For example, if you're enrolled in a Medicare Advantage plan and the plan leaves the Medicare program, you might have a “guaranteed-issue right” to a Medigap plan.

You can apply and change your insurance coverage anytime after your initial enrollment period with Medigap if you wish. However, people with preexisting conditions may find a plan expensive or not available in a way which doesn't offer protection from Medigap guaranteed issues. The medical underwriter will determine whether or not to cover you for an annual premium based upon your condition. Typically, it's okay to enroll in Medigap after 65 and then maintain the program for the longer term when enrolled in Medigap.

In 43 states, Medicare customers have greater protections through increased guaranteed issue rights. This expanded access allows for greater flexibility, and regulations vary greatly across states, making checking local laws a good idea. Under state regulations you may be able to choose a Medicare Advantage Plan to reduce your costs of living and switch between Medicare Advantage and Medicaid. The Medigap Guarantee is available for enrollment in 12 states starting in 2022.

The federal law only lets people move if they lose other coverage and if the plan is their first year of coverage. Below you'll find specific situations where your Medicare Advantage plans can protect you from higher rates. This protection is available in case you have lost the coverage because you did not pay for your insurance plan was cancelled.

Medigap guarantee issue rules apply to all Medigap coverage modifications. It could involve changes to the insurance company's plan or converting Medicare to Medicare Advantage or a late signing up with Medigap.

Medigap insurance policies to seniors after their initial Enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds. Medigap policies provide supplemental health insurance to help cover the deductibles and coinsurance for Medicare covered services. One in four people in traditional Medicare had a Medigap policy in 2015.

Outside of enrollments. Unless an applicant meets any medical eligibility criteria after your open enrollment date for Medigap coverage it cannot be guaranteed.

The number of available premium-free (“benchmark”) prescription plans for low-income enrollees varies from four to nine, depending on the state. How and when can you change your Medicare coverage Medigap Medigap is the only form of private coverage for Medicare beneficiaries that has no federally mandated annual open enrollment period. Medigap coverage is guaranteed issue for six months, starting when you're at least 65 and enrolled in Medicare Parts A and B .

Occasionally, you can enroll in Medigap Plans during open enrollment without undergoing any medical underwriting review. If a Medicare Advantage plan leaves the program, you may qualify for Medigap insurance benefits for a certain amount.

In addition, it's possible to upgrade Medi-Gap providers during the period around your Medi-Gap anniversary and still maintain the same level coverage. You may switch plans without underwriting from Plan B to Plan D, and you won't switch from Plan D to plan N.

During a Medigap Open Registration Period you can apply for Medigap plans and change them immediately. The insurer cannot reject your claim on the grounds of medical conditions and may only offer a higher rate.

Related Blogs: Medicare Age 65 Still Working

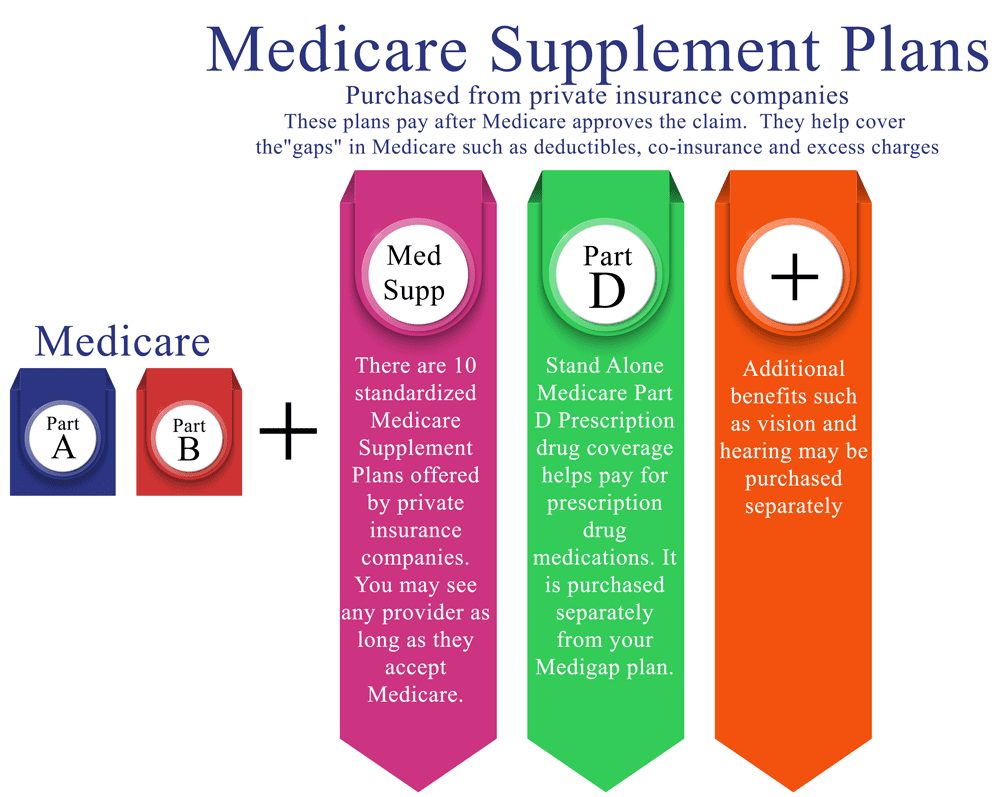

Medigap is Medicare Supplement insurance that fills the gap in original Medicare and sells through private companies. Medicare covers most or none of the costs of medical services. Medicare Supplement Insurance (Medigap) may help cover most of the remaining health care costs such.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

If you are on Medicare Part B or Original Medicare a Medigap Plan can cover your coverage gaps for Medicare Part B. Medigap Plans are provided by a private insurance company that provides a solution that covers all expenses and can save you money. Medigap is a standardized plan, however, some plans will have no locality.

If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy. Note For more information about how Medigap plans are priced or rated, see costs of Medigap policies . For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) .

The initial enrollment period is an initial limited period for you if you're first eligible. After enrolling for Part b Medicare you may choose to purchase additional insurance options. A Medigap policy is the six-month period which starts with your 65th birthday and is covered under Part A - B. After a short period, your ability to purchase a Medigap policy may be limited and may take longer. Different states handle the situation and in certain cases there are extended enrollments. Medicare enrollment periods are specific times when people can sign up for Medicare or make changes to their existing coverage.

Most often medgap coverage does not have network limitations. This coverage will be accessible at all Medicare sites.

Several disadvantages are included: Higher annual premium rates. Managing different types of projects in different stages. The drug doesn’t cover prescription drugs (available in Plan DA).

As mentioned above, there are 10 different standardized policies in most states, each covering a different range of Medicare cost-sharing . Learn how a Medigap covers prior medical conditions to know if any of your medical costs may be excluded from Medigap coverage. Depending on your circumstances, a Medigap can exclude coverage for prior medical conditions for a limited amount of time. Find out how Medigap premiums are priced so you can make cost comparisons.

Medicare Advantage is an affordable option for a patient with minimal health expenses. In some cases Medigap may be the more appropriate choice to treat serious health problems.

Medicare does cover some of the services provided by Life Alert. Medicare Part B will cover 80% of the cost of medical alert systems that have been prescribed by a doctor and meet certain criteria.

Bay Alarm Medical Alert is a medical alert system that provides users with 24/7 access to professional emergency responders.

You live in Massachusetts You live in Minnesota You live in Wisconsin For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) . Call your State Insurance Department. Site Menu Sign up/change plans About Us What Medicare covers Drug coverage (Part D) Supplements & other insurance Claims & appeals Manage your health Site map Take Action Find health & drug plans Find care providers Find medical equipment & suppliers Find a Medicare Supplement Insurance.

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost. Silver Sneakers is a health and fitness program for seniors that is offered by many Medicare Advantage plans.

Medicare Silver Sneakers is a fitness program designed for seniors aged 65 and above who are enrolled in Medicare. The program is aimed at improving the health and wellness of seniors by providing them access to gym memberships, fitness classes, and wellness resources.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap in Massachusetts Medigap in Minnesota Medigap in Wisconsin Medigap & travel How to compare Medigap policies Find out which insurance companies sell Medigap policies in your area.

If your Medicare plan includes a Medigap policy, Medicare will reimburse the Part of the approved deductible to cover the health care costs. So the Medigap insurance companies will pay.

You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. For more information Find a Medigap policy.

Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or a skilled nursing facility (SNF).

Recent Blogs:

Bay Alarm Medical Alert | Who Qualifies For Medicare Flex Card

Spanish Medicare provides most of the cost of healthcare for those aged 65 and older. It also pays for medical treatment for older persons whose disabled status is less than 65. If you need more money to support your health insurance plan, then you can get supplemental benefits through the insurance. Because Medicare Supplement Insurance covers certain gaps in Medicare coverage, the Medicare Supplement is known as Medigap Insurance.

Medigap is Medicare Supplement Insurance, which fills the gap on Original Medicare which is distributed privately. Medicare covers most, but not all, health care services. Some Medicare Supplemental Insurance policies also cover services not covered by Original Medicare.

Can I switch Medigap policies during the Medicare Open Enrollment period? Can I use the Medicare Plan Finder to sign up for a Medigap policy? While we have made every effort to provide accurate information in these FAQs, people should contact the health insurance Marketplace or Medicaid agency in their state for guidance on their specific circumstances.

If your move will take place outside of the state, make certain that your Medicare program remains effective. Usually federal rules give people who have Medicare coverage a Medicare Supplemental Insurance policy. It is also possible for a Medicare Select plan to have a benefit that was not offered in a plan where you purchased the product. If you use an Advantage insurance program, ask if it's available in your new ZIPcode. If this plan is not available, you will be required to purchase another plan. You could opt for an alternate Medicare Advantage plan at the same address as the original Medicare plan.

Medicare Supplement Insurance or Medigap has been created to help only with Original Medicare.3. Medicare Supplement Insurance is offered to the public, unlike Medicare and Medicaid, and it helps cover the remaining healthcare costs Original Medicare is unable to cover, such as copayments, coinsurance and deductibles. 4. Some people consider the Medicare Supplement insurance program because it does not adequately cover the entire healthcare costs of their original health insurance. If you face deductibles and coinsurance on a Medicare Supplement plan, this coverage is useful where Medicare is required.

Medicare Supplemental insurance helps to cover severance costs and co-payment deductibles, as well as coinsurance. Medicare supplement policies cover only medical needs and the payment is generally dependent upon payment of Medicare-approved fees. Some Medicare plans include benefits that Medicare doesn't provide, for example emergency medical help in foreign countries. Insurance companies selling Medicare supplement products have been approved to do so through the Department of Health and Human Services. Nevertheless health insurance is provided by the U.S. government.

You can purchase health insurance for up to 12 months. You will begin open enrollment for Medicare at age 60 and over. During that period companies can never refuse a policy for medical reasons. If a patient waits for their open enrollment period, you may find the company's policy is not valid. You are entitled to receive Medicare Supplement Insurance for free every year and are guaranteed constant coverage. Those with Medicare supplement policies may not have their benefits back or cannot obtain new policies.

Medicare originals are divided in parts. Part B covers health care services and Part B covers other medical costs. You can visit any physician who accepts Medicare. Medicare supplement plans only apply to original Medicare Medicare. Part A, Part B, Part D, Part D, and Medicare. Covers generic drugs and brand names. You can obtain prescription drug insurance by joining one-time meds or purchasing Medicare Advantage drugs which include insurance. In some cases, your health insurance can cover prescriptions.

Some people are also eligible for Medicare Advantage Plans. You have the right to receive Medicare Part A or Part B if you reside within any state with a Medicare Advantage Plan. Medicare Advantage is available to certain federal entities through a partnership and is offered by Medicare in some regions. Medicare provides the plan monthly with a fixed amount for Medicare Part A services. You will be required to pay your monthly insurance coverage under Medicare Part C and Medicare Part D premiums. A copay is required and a co-insurance policy requires a copayment. If you participate in Medicare Advantage, no Medicare Summary Notice is available.

Part A and B is governed by the ACA and pays monthly premiums, deducted payments, copayments and coinsurance. In addition to paying Medicare for services that it does not provide.

It was okay. Generally speaking, the majority of the costs of your health care will be covered.3. Insurance companies are forbidden from providing Medicare Supplements to Medicare beneficiaries who receive full Medicare coverage. This Medicare Supplement Insurance plan is designed to pay off the cost remaining from deductibles and premium co-insurance for original Medicare. And since Medicaid coverage should pay most costs, a Medicare supplement insurance policy would not suffice.

Medicare has two major health insurance plans that can be considered for Medicare beneficiaries. Tell me the difference between them? Medicare is an insurance plan provided for all 65 and older individuals, some under 60 with disabilities and people who may have ESRD. It consists of multiple parts. Most commonly mentioned components include Original Medicare Part A (hospital/in-patient coverage) or Part B (hospital/outpatient health coverage). Medicare.

It is a 10 year program that offers supplemental medical services to the public. Several plans are marked by letter letters and have varying combinations of benefits for different purposes. Plans F offer higher deductibles. Plan KL, M & NE contain different share of costs. All businesses must offer a plan. Those that do not currently offer another package must offer Plan C or Plan F.

There are also several disadvantages to Medigap plans, such as high fees. The ability to navigate the various plan types. It's impossible to get prescription drug coverage.

The Centers for Medicare and Medicaid Services (CMS) publishes the Medicare & You handbook that describes Medicare coverages and health plan options. CMS mails the handbook to Medicare beneficiaries each year. You can also get a book by calling 800-MEDICARE. How to pick the right Medicare plan | Watch: How to understand Medicare plans Services Medicare doesn't cover Most long-term care.

In general, the Medicare Part A or the Part B policies require the purchase of a Medicare Part B monthly premium. Then you must also pay Medigap Insurance. Depending on your monthly insurance premiums, you'll have Medigas guaranteed renewable.

The primary difference in qualification being that Medicaid is designed to help pay medical costs for income restricted patients rather than provide coverage for a certain age group, disability, or ESRD. Each state has different rules about Medicaid eligibility, unlike Medicare – which is standardized. As such, income qualifications for Medicaid will vary by state. 3 What is Medicare Supplement Insurance? Medicare Supplement Insurance (also known as Medigap), is designed to help work only with Original Medicare.

Some employers offer health insurance coverage to their retirees. Retirees who are covered by such group plans may not need to purchase an individual policy. While a retiree may choose to switch to an individual plan, this may not be a good choice because group retiree plans usually do not cost anything to the individual and the group coverage

Government. First, Medicare and Medicaid pay first. The employer must pay the group health insurance first and Medicare second.

You probably don't need Medicare supplement insurance if: You have group health insurance through an employer or former employer, including government or military retiree plans. You have a Medicare Advantage plan. Medicaid or the Qualified Medicare Beneficiary (QMB) Program pays your Medicare premiums and other out-of-pocket costs. QMB is a Medicare savings program that helps pay Medicare premiums, deductibles, copayments, and coinsurance.

What are the reasons for taking Medigram? Medigap policies supplement Medicare coverage and cover additional expenses. Medap offers better choices and covers more providers than most options. If travel is needed and Original Medicare is not available, Medigap is an ideal choice for you.

Medicare Supplement Insurance, unlike Medicare and Medicaid, is sold by private insurance companies, and helps pay for some of the remaining health care costs Original Medicare doesn't cover, like copayments, coinsurance, and deductibles. 4 The main reason people consider a Medicare Supplement Insurance policy comes down to the fact that one's Original Medicare policy may not cover all health care costs.

Dental treatment is costly. The Kaiser Foundation estimates nearly half of the 24 million Americans in the US lack dental insurance coverage. The proposed legislation is intended to help change the health care system and improve health care by providing dental coverage. Tell me the best option to obtain dental insurance for Medicare enrollers. Review Your Medicare Options With The Right Expert. Your best resource for Medicare for finding the right benefits. Start Free.

November 18, 2023 | January 19, 2024 1 Best Dental Supplement Plans. Overall rating: Humana provides the entire coverage in almost all states. In addition, the company offers dental insurance at reduced prices along with online resources that can assist with insurance, prescriptions, and overall well-being. View Plans. Call at the best price: (847)577-8574. What's your favorite dental and vision plan?

See whether Medicare Supplement covers dental and vision services. Last Updated 26 October 2021 9:59 a.m. Often our clients are curious whether Medigap covers dental services. Basically this is divided between routine care and major emergencies. Medigap can cover dental and vision, but not everything does. This is explained below.

Anthem is an extension of the extended Blue Cross Blue Shield group and represents the largest part of the BCBS Medicare portfolio. Anthem's most popular dental insurance plans offer no dental coverage. This coverage is enhanced by additional dental/vision coverage. Other plans permit you to leave networks and pay fewer fees. It also makes for easy access to a mobile app which helps you search a doctor or health care provider online. Pricing: 0 - 450 for basic premiums and optional services ($14 for a dental procedure, $24 for dentistry and sight).

The program will be available from Oct. 15 through Dec. 7, according to Worstell. In order to get a better understanding of the Medicare plan comparison, visit its website and give your ZIP code. Click on each plan summary for information on dental insurance. It's possible to enroll in Medigap anytime, says Worstell. He also recommends completing the form once you are eligible for Medicare, as this is when your rates are most likely to rise compared with other forms.

Compare dental insurance plan options with Medicare using a zipcode you provide. See which plans have dental benefits included. Learn how your insurance policy covers dental care.

Original Medicare does not cover dental implants. Although Medicare Advantage plans generally cover dental implant coverage, check your policies and procedures thoroughly.

Unfortunately, Original Medicare does not cover dental care. Medicare Advantage covers basic services such as tooth extraction and tooth removal for patients.

Medicare Advantage plans are sometimes approved and sold to private insurers through a private insurance company. Several of these plans are offered without Original Medicare coverage, including dental care and hearing care services. The enrollee may have to be paid supplemental fees. However, not all Medicare Advantage plans have dental benefits. Medicare Advantage plans are often the best way to obtain dental insurance, Worstells explains.

The average cost to obtain dental insurance is primarily determined by factors such as your age, location, and age. Some companies offer no monthly premiums and many have more than one monthly fee. In eastern Pennsylvania, for example, the Medicare benefits are available at an average of $302 per year. In the Los Angeles areas, these can run between $1 and $397 yearly. Medicare Advantage plans with no monthly premium usually have basic dental treatments like check-ups and cleanings, Worstell argues.

How much Dental Coverage does Medicare provide? Aetna Medicare Advantage, for instance, offers three kinds of dental coverage: 95 % of Medicare Advantage members are covered. 14% of them have preventative coverage including a dental x-ray, oral exam, or dental cleaning. In addition 86% of patients are covered by insurance for dental procedures, dental treatments and dental procedures.

Medicaid coverage will vary by the place of residence and age of a patient. Medicaid must cover dental treatment for children, but the states determine which dental services adults covered by Medicaid receive. Most states provide dental care for adults, but only one-third provide dental coverage for Medicaid enrolling adults. The following table shows all states current Medicaid dental services available to adults.

Nope. Original Medicare administered by the federal governments does not offer coverage for routine dentist services or supplies. Those in Medicare must cover all the cost for tooth extractions or dentures. Medicare Part A provides for dental treatment that can occur while in the hospital. Generally speaking, Medicare pays for hospitalisation and medical treatment for patients injured by tooth and jaw injuries.

The dental insurance plan you choose must be individualized to your unique needs. It all comes down to which aspects of dental insurance are important to you. Initially narrow the options according to the location or your budget. The following page compares different plans customer satisfaction ratings, limits and many other factors. Before registering it is advisable to look at dental insurance companies.

Medigap plans and Medicare Supplements do not provide dental coverage directly and are able to cover deductible costs like copayments, coinsurance and co-payments, Worstell says. Some companies selling Medigap insurance can add additional dental services for a fee,” the company said. But many carriers today offer them.”.

Affordable premiums : These companies offer competitive rates or bundled savings. Many offer multiple plan options, so you can get a dental plan with a premium you're comfortable with. Special perks and benefits : Who doesn't like a bonus? Many of these plans come with access to special services and programs such as fitness clubs.

Although Medigap can provide cataract surgery or other serious vision problems the vast majority of eye care (e.g. eyeglasses, glasses or contact lenses) aren't covered by Medigap. For routine care, there is an individual vision plan. See how Medigap works and what it offers. Get medgap quotes.

No Medicare or MediGap coverage covers routine dental treatment. In addition, oral surgical procedures in hospitals are usually covered. Medigap covers your Parts Adeductible and Co-insurance.

Some insurers that offer Medigap policies may sell ancillary products, including stand-alone dental care insurance plans. Options for Dental Coverage While Original Medicare and Medigap policies do not cover routine dental care, you do have other options. Many Medicare beneficiaries choose to get their Part A and Part B through a Medicare Advantage plan. Medicare Advantage plans offer additional coverage, including dental care services.

He suggests visiting Medicare's plan comparison website and entering your ZIP code to see each plan you're eligible for and whether they include dental benefits. You can click into each plan summary to learn more about what that dental coverage includes. You can also enroll in a Medigap plan at any time throughout the year, says Worstell. However, he suggests doing so when you first become eligible for Medicare, since that's when you're likely to get the best rate.

Medigap policies do not cover routine dental care, but they may help pay for coinsurance in some instances. Some insurance companies selling Medigap plans may provide supplemental products, such as standalone dental plans.

Network: Preventative services, such as dental cleanings and X-rays, are covered. Direct member reimbursement allowance: You pay upfront for your dental care and then submit receipts for reimbursement (up to a certain amount). Optional supplemental benefits: You can purchase dental benefits for an extra premium each month. According to the Kaiser Family Foundation, 94% of Medicare Advantage enrollees have some dental coverage.

MediGap insurance policies may provide you with the option of paying medical copayments or deductibles. However, this plan does not include dental treatment.

These gaps could cost a lot of money should you have certain medical needs or conditions. Additionally, Medicare requires that you first pay deductibles before benefits begin. That is where Medicare Supplemental Insurance (Medigap) comes into plan. Does Medicare Cover Cataract Surgery? Cataracts are when the lens of the eye becomes cloudy, resulting in blurry vision.

The Supplement Plan G provides no coverage in terms of routine health care services like dental and eye care. Medigas Plan - G only covers Medicare coverage. It only gets paid when original medical benefits are paid.

After age 60, health and happiness are more than just medical issues. This includes emotional aspects as well as physical. Silver Sneakers aims at addressing this need by offering a health-focused exercise program. It is available via many Medicare Part A Supplement (Medigap) plans. You realize you'll need physical activity when you grow older.

Having to get into the gym can be daunting. As you exercise, a support network develops through interaction. Silver Sneakers offers indoor, outdoor, online and on-site fitness solutions. There will be several other activities that encourage social interaction.

AARP joined the UnitedHealth Care system in order to provide Medicare plans for various health care types. Some AARP Medicare Plans offer free memberships in their Silver sneakers fitness program. But UnitedHealthcare has recently said it would no longer include Silver Sneakers in its Medicare plans. These changes are applicable to all of the Medicare & Medicaid plans offered by AARP. More than two billion people are affected by the changes, in 14 states.

In addition, Original Medicare covers Silver Sneakers and other gyms. However, most insurers and Medicare Advantage provide free membership to Gold Sneakers as well as other fitness and health programs, including Silver&Fit, and Refresh Active. We recommend you evaluate every benefit before you commit to Medicare. However, fitness benefits are important and should not necessarily be your primary defining factor in the future.

Maintaining fit at a young age is an important way to increase optimum health as you age. Medicare-eligible citizens can get free SilverSneakers fitness services, often integrated into Medicare coverage. The following information explains what SilverSneaker is and what coverages are included with it.

Some Medigas plans are geared towards SilverSneaker customers. In a number of states SilverSnakers is also included. The AARP Medigap policy provides an additional fitness benefit that varies based upon the plan and the location. Silver & Fit is an alternative option that is available from Medigap in your region. SilverSneaker and others promote fitness and can save a substantial amount of money in gym memberships, which is about $50 every month throughout the US. However, we recommend comparing costs and benefits of every 10 standardized Medigap plans with a single insurer.

If you join SilverScreakers you'll get access to nearby fitness facilities by entering the ZIP code or address on SilverScreaker's website. If you want to narrow your search results then you may want to look for alternative workout facilities such as swimming pools and group fitness classes. The site also offers a page for online classes and a place for group workouts at home. Silversneakers members have the option to use the participating gyms throughout the country and even travel. There is no obligation to join a facility in any particular area.

Find SilverSneakers gyms through their Fitness Locations page on the SilverSneakers website. Simply fill out your address and the site shows the participating fitness centers nearest your location.

SilverSneakers can be purchased in almost all YMCAS locations. Before going, check SilverSneaker's website or contact your community YMCA for confirmation.

Silver-Sneakers requires a Medicare plan or Medigap plan. You can search for insurers by going to SilverSneaker.com.

Do Medigap plans cover the SilverSneakers program? Yes, some Medigap plans cover SilverSneakers . For example, Anthem, Humana and Blue Cross and Blue Shield Medigap plans provide SilverSneakers as an added benefit in some states.

Most Medicare Advantage plans offer SilverSnaps or other fitness programs with no additional fees. Half of the major insurers are covered by the SilverSneakers plan or have corresponding benefits. All of our reviews include memberships at participating gyms in the United States and access to other health care programs. Renew Active offers a range of health and fitness products to qualified customers. Regular exercise promotes healthy living, and SilverSneaker memberships can help you achieve your fitness goals.

Silver Sneakers offers free gym access and classes to Medicare-affiliated individuals. Silver Sneacks is covered by Medicare Advantage & Medigap plans, but not in Original Medicare. Silver Sneakers benefits may include: For Silver Sneakers, a Medicare Advantage and Medigap provider should have these benefits. You can never purchase a Silver Sneakers membership.

The program caters to adults aged 65 and over, but it is also available to younger people with Medicare plans. Considering a Medicare Plan? Get online quotes for affordable health insurance I'm Looking for: Health Insurance Medicare Provide a Valid ZipCode See Plans Does Medicare Cover SilverSneakers? SilverSneakers is a wellness program, not a medical benefit. For that reason, Medicare does not cover membership.

We follow strict editorial standards to give you the most accurate and unbiased information. Well-being after 65 is more than a medical issue. It also has physical and emotional aspects. A health and fitness program called SilverSneakers addresses these needs. You can access it through many, but not all, Medicare Part C (Medicare Advantage ) plans and a few Supplement insurance (Medigap) plans.

What Is The Eligibility For Silver Sneakers? If you're 65 or older and have Original Medicare, you're eligible for Silver Sneakers. Just be sure you're enrolled in a Part C Medicare Advantage plan that includes Silver Sneakers benefits. See if you qualify . How Does Silver Sneakers Work? Once you have enrolled in a Medicare Advantage plan that includes Silver Sneakers.

If you have an urgent matter or need enrollment assistance, By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans. Note: We cannot answer specific medicare claim information. Label First name* Last name (Not published)* Email (Not published)* Senior65 is a small but energetic company.

However, to actually get this coverage, you have to be officially enrolled in Medicare Advantage or a Medicare Supplement plan that offers membership to the program. It is important to note that some insurance carriers only offer SilverSneakers to customers in certain states and/or zip codes , so be sure and check your provider's coverage area to find out whether or not you'll get access to SilverSneakers.

Select the SilverSneakers Medicare plan. Both Medicare & Medigap plans offer SilverSneakers benefits.

In addition to physical benefits, exercise for older adults has been proven to have mental health benefits, too. It can even lower your healthcare costs. Get access to the SilverSneakers fitness program and more with a Medicare plan that's right for you.

Gym Membership & Fitness Program. All non-covered services are 100% of your own. Gym memberships or fitness plans are often part of a Medicare plan.

Which Medicare Plans Cover SilverSneakers? Most Medicare Advantage (Part C) Plans include a SilverSneakers membership. First, you must be signed up for Original Medicare. Then you can select a Medicare Advantage Plan that includes SilverSneakers. How Much Does SilverSneakers Cost? There is no cost to you if you have SilverSneakers included in your Medicare Advantage plan.

Is Medicaid covering gold shoe? Silver Sneakers are not included in the Medicare Part A or Part B program. It's only possible for you to join a private Medicare plan if you've got Medicare benefits.

Unfortunately, Medicare Supplements from Aetna have no SilverSneakers option. Medicare Advantage plans from this carrier usually include Silver Sneakers.

What are the benefits of the Medicare Supplement Plan? The Medigap plan does NOT offer prescription drugs. Medicare offers no prescription drug coverage for Medicare patients as part of Part D. Applicants can take advantage of Medicare Part D coverage through a bundled Medicare Part C plan (which usually includes prescription coverage) if they choose an alternative plan. Generally, Medicare plans will cover prescription drug purchases for the same period.

For the average person, the transition into Medicare is a positive step that almost everyone has in common with. Despite being universal in nature, the total coverage offered under Medicare varies significantly among the individual. Medicap is an affordable Medicare Supplement program with many different coverage types and price ranges. Can Medicare cover prescription drug costs? For a clarification, Medicare does not pay for prescription medications.

Medigram is the Medicare supplement coverage that helps close gaps and is sold through private firms. Medicare covers the cost of coverage of healthcare. Some medical supplement insurance policies can help pay some of the remaining health insurance costs.

Instead, Medicare offers prescription drug coverage under Part D . Medicare enrollees can get prescription coverage either by switching to a Medicare Advantage plan (most of them include prescription coverage) or by purchasing a stand-alone Medicare Part D plan (PDP) to go along with Original Medicare.

The Medicare plan offers several ways for coverage. You can get a private policy that goes in addition to government coverage, if you need more coverage. Original Medicare isn't a one-stop insurance system. In contrast with certain forms of health care where a single plan provides healthcare coverage for patients in hospitals, Medicare covers the whole of health care in different ways. Medicare includes four sections: a deductible; A deductible; A deductible; A deductible; A deductible; A deductible; B.

Medicare prescription drug plan is an insurance plan that covers your prescription drug expenses for covered drugs. Part D coverage is normally offered with the majority of Medicare Advantage (Part C) plans.

Medicare Advantage Prescription Drug plan with drug coverage, another Medicare health plan that offers prescription drug coverage, or creditable prescription coverage such as from an employer or union, you may owe a late-enrollment penalty.

The initial enrollment period is only a short term window until your eligibility for Medicare is determined. Once your Medicare Part B and A coverage is approved, you will be able to purchase additional policies like prescription drug coverage. When this period runs out, you have the option to add coverage during Open enrollment.

Most plans offer “Formulars,” or list of covered medicines. Part D also offers a network of authorized pharmacy locations in your town.

This is how you can find information about the benefits that you get from taking supplemental medication. Medicare Supplement does not include medication insurance.

Medigap plans are standardized; however, all of the standardized plans may not be available in your area. Costs Premium All Medigap plans require that you continue to pay your Part B premium and a separate premium for Medigap coverage. Deductible Some plans have deductibles. Copays A copayment may apply to specific services.

When Medigap insurance coverage is required for prescription drug use, your insurer will notify you. In some instances, Medigap does not provide you prescription drug coverage, but it will also reduce your premiums.

How much medical benefit does the Medicare Supplemental Plan G cover in the US? Medicare Part D plans don't cover outpatient retail prescriptions. This policy however covers all Part B prescriptions.

For example many traditional Medicare patients have a policy covering 20% coinsurance for Part B medications and services. Medicare also covers cost sharing with low-employees through both traditional Medicare and Medicare Advantage.

But you'll have to pay a late enrollment penalty for Part D, if the Medigap plan has been providing your only prescription drug coverage. Will I owe a Part D penalty if I drop my Medigap prescription drug coverage? Medigap prescription drug coverage is not “creditable coverage” that allows you to delay Part D enrollment. You'll owe a penalty if you didn't enroll in Part D when you were first eligible, and either didn't have prescription coverage while your enrollment was delayed, or your coverage wasn't considered creditable.

Then, we will walk through how the different options may work together to help ensure you have all the health coverage you need. Let's review the following: Original Medicare (Parts A & B), Medicare prescription drug coverage (Part D), Medicare Advantage (Part C) and Medicare supplement insurance (Medigap). Original Medicare is provided by the federal government. Part A helps pay for hospital stays and inpatient care, while Part B helps pay for doctor visits and outpatient care.

Medigap Some types of insurance aren't Medigap plans, they include: Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan) Medicare Prescription Drug Plans Medicaid A joint federal and state program that helps with medical costs for some people with limited income and resources. Discount Drug Plans Work with Medicare Supplement Plans? Some people with Medicare opt for non-Medicare prescription drug plans that offer discounts on medications, instead of Medicare Part D prescription insurance.

When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies: You drop your entire Medigap policy and the drug coverage wasn't creditable prescription drug coverage Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

Medicare Supplement insurance plans sold today usually don't cover prescription drugs, and you can't use them with Medicare Advantage plans. A stand-alone Medicare Part D Prescription Drug Plan can work alongside your Original Medicare (Part A and Part B) benefits. In summary, there are two main ways to get Medicare.

Some people choose Medicare Advantage but have opted for Medicare Advantage. The benefits of Medicare Supplement (Medicare Supplement) insurance are the best alternative to Medicare Advantage. You can switch from Medicare Advantage into Medicare Medigap if you meet some conditions. How should Medicare benefit plans be changed? What is your Medicare supplement plan?

With Medicare Advantage policies people can move from Medicare Advantage to Medicare Advantage. The CDC also designated a period for that purpose. It may also be necessary to change the mode of transportation if there's an emergency. Medicare Advantage is an integrated program which is managed by private companies. The plan varies in terms of medical services available for a specified region; people often require care at a licensed healthcare facility. Find out the details at the link below. Traditional Medicare is offered by multiple providers that cover medical treatment, in hospitals or prescription medications.

Selecting the Medicare program will never come to an end. Plan costs may change from year to year and so should your medical needs. Therefore, the evaluation of a medical insurance provider by considering many factors can help you decide whether or not you need the best care. You can change coverage at any time and choose the best health insurance that best meets the budget. Making the change may look intimidating, but it's not necessary. Make it a goal to plan before buying the Medicare plan.

Tell me the best way to leave Medicare Supplements and move to MA plans later on. The Medigap and the Medicare Advantage program are the most effective choices for senior citizens seeking the option of paying the cost of their own health insurance unless the health insurance is a covered expense. What should I buy for my health insurance coverage? Many customers ask us: Is MediGap an insurance option? Let us know your response.

Most of the best time for switching from Medigap to the Medicare Advantage system is during the Annual Elections Period open enrollment period from October 15 to December 7. If you wish to switch during the period, you must register for an MA plan that starts on January 1st the following year. Once the registration has been accepted, Medicare Part D automatically deactivates you from the program. However, you should still contact Medigagap for the confirmation you are canceling. Do you want to switch? Contact a Senior 65 agent today for more information: 800-930-6956 Get Medicare Advantage Quotes.

It's possible to Change Medicare Advantage plan if needed. Simply sign up for your preferred program at any enrollment time. Once you have chosen your new plan, your old plan automatically disappears when your new plan starts. Unlike individual plans, Medicare Advantage plans can help reduce out-of-pocket costs by providing predictable copay and smaller deductibles. The plan allows patients to see a doctor in their network. Those with Medicare Advantage can review coverage during the Medicare Advantage enrollment period. There are annual elections between October 15 and December 7.

Using Medicare Advantage as the primary coverage for your health insurance plan may be more affordable and flexible for your family. Part A Medicare provides the entire benefits of Medicare including all the benefits. This plan operates the same way an individual or employer plan does. Most of these benefits include insurance and additional services, such as dentist coverage, gym membership, and even services. Medicare Advantage programs usually feature lower premiums sometimes as little as $0.01 as well as networks of physicians. Some provide outside coverage.

Medicare Advantage plan and Medicare Supplement plan are two completely different coverages. A Medicare Advantage plan provides a different means to claim Medicare's original coverage through private insurers. Medicare Advantage programs are generally covered for anything Medicare is covered, if at least, and some even have extra benefits. The majority of Medicare Part D coverage is for prescription drugs. The supplemental Medicare program also covers your outpatient care through Medicare, including copayments, coinsurance and deductibles.

If so, it would make sense to switch to the Medicare Advantage plan. Depending upon your plan type and the type of drugs you are currently prescribed, there are other options. Most Medicare Advantage plans are a complete plan. They cover Medicare Part A / Part B benefits plus prescriptions and other items that are not covered under Original Medicare. Among other benefits included dental health coverage, hearing aid, fitness and vision insurance. Medicare Advantage plans have a monthly deductible to cover the excess cost.

After registering in Medicare's Medicare Advantage plan during the year-round enrollment process, it works closely with Medicare to transfer your benefits. It'll not take much time for Medicare to reach them directly. You will start receiving coverage on January 1. You may need to contact your Medicare plan provider directly to cancel any Medicare Part D plan. You can also call the number on your insurance cards. In the decision making process of switching Medicare Advantage plans, you must remember:

Original Medicare does not provide any medical insurance other than part A. It is not available to people with Medicare Advantage plans such as health insurance, dental, vision and fitness insurance. Medicare also does not provide any deductibles for an individual, so it's not built into any financial protections. If you need any additional help in switching to Medicare Advantage plans, you should contact the plan provider directly.

Having dropped out of Medicare Advantage means that other medical services are lost such as prescription drug coverage and vision and dentistry. It is also unlikely that the money will be covered by an insurance policy. For those who still want them they can either purchase additional policies for themselves or pay directly from their own pockets. If you are looking for Part D coverage you'll have to find one. Whether you choose a plan or you want a new policy, it must be chosen by the insurer directly – the plan. Search for available packages using your ZIP code.

You have to contact your plan provider directly to withdraw, but once it's done it doesn't require any additional effort from you. After you contact your Medicare Advantage plan to withdraw from your enrollment, your insurance will revert to Original Medicare as soon as possible. You can call Medicare by email. The insurance starts on January 1.

The first enrollment period runs from October 15 to December 7 each year. This is the OEP for all Medicare plans, including Medicare Advantage and Medicare prescription drug coverage. During this time, a person can return to original Medicare. However, if they had prescription drug coverage through Medicare Advantage, they will need to enroll in Medicare Part B to maintain their prescription drug coverage.

A few things to keep in mind when choosing to get a Medicare Advantage plan You usually don't need to buy additional coverage like you may have with Original Medicare. You usually don't need a stand-alone Part D prescription drug plan with Medicare Advantage, because drug coverage is built in. Medicare Advantage plans have an out-of-pocket limit, so you'll have built in financial protection and won't need a private Medicare plan to provide this.

If you do not, and you decide to sign up for Part D coverage later on, you may face a penalty for late enrollment. You may also want to consider purchasing a Medicare supplemental insurance policy, known as Medigap. Medigap policies help to pay your cost-sharing requirements under traditional Medicare.

Why do you need more than just Medicare? When you become eligible, you can sign up for Original Medicare , which the government provides. Medicare covers hospital and medical coverage, but you must usually pay your deductible first and then the coinsurance 20 percent of your Medicare-approved amount. When you use Part B, you'll need to pay a premium.

Medicare Advantage plans are usually better choices as it offers maximum coverage to cover your expenses and helps you avoid high-interest payments. Medicare - Medicap plans usually give people greater choice of how they get their health services.

Most people have no choice about which doctor or health care center they want. In addition, Medicare Advantage costs are largely dependent upon the amount of medical care you require, making budgeting difficult.

This way you can try out this coverage and see if it fits your budget and your health needs, which might be evolving. Every fall during AEP between Oct. 15 and Dec. 7, you can make the switch to Medicare Advantage. Medicare Supplement Insurance plans cover some or all of your out-of-pocket expenses from Original Medicare, such as copayments, coinsurance and deductibles.

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Yeah. If you have Medicare Advantage or Medigap, it'd make sense to switch. It'll also make a great choice for seniors who qualify for Medicare and Medicaid benefits over the next five years.

Releted Blog:

Medical Alert System | Bay Medical | Silver Sneakers Covered By Medicare | 1800 Medicare

Does Medicare Cover Medical Transportation

Medications can be switched between Medicaid and Medicare through Medigap. The Center has also designated a timetable for that purpose. Some people have the option to move to different times without penalties, however. Medicare Part C or Medicare Advantage are bundled plans managed by private businesses.

Those plans are different based on the availability of health care in a specific area and typically patients must be treated by approved medical providers to be eligible for coverage. Find out how. Traditional Medicare has multiple components which cover hospital care and prescriptions.

Selecting Medicare insurance should not be just an option. Plan costs are constantly increasing, and so can your needs. This means you need to compare your health insurance plan based on several factors such as convenience costs. When you are ready for a change, you must decide based on your health insurance coverage requirements. The choice to make change can feel overwhelming at times, but that doesn't have to be. When you decide which types of medical coverage your insurance needs, you must prepare for it.

Get information on how you should be able to switch Medicare Supplement plans to another plan. Medigap and Medicare Advantage provide a safe option if seniors need help with expenses not covered through Medicare. What should I do if my insurance provider doesn't offer the best coverage? How will Medicare Advantage be changed after enrolling? Let's see if you answer the questions above.

You may want to contact a few Medigap insurers directly to see if you will be able to purchase a Medigap policy when you switch to traditional Medicare. View all questions about Medicare Advantage Topics Medicare Advantage Related Questions There are a lot of Medicare Advantage plan options in my area.

Depending on what you choose, you could be deciding later that you'll prefer Medicare Supplement (Medap) plans which will supplement your Original Medicare. If you meet a few conditions, you may switch to Medicare Advantage. What does Medicare Advantage Coverage really mean for patients?

If Medicare is your current plan, you may switch to Medicare Advantage (Part C) or vice-versa during Medicare Annual Enrollment. Changing your mind can require a few additional actions though. The choice you make depends a lot upon what coverage type you choose.

Yes. It is possible for a person to change their Medicare Advantage plan. You can enroll in any of the plans available during the enrollment period. Once you select you can automatically delete your current plan when new coverage becomes available. Medicare Advantage Plans work similar to individual or employers HMMO plans and can help reduce out-of-pocket costs through predictable copays and smaller deductibles.

It is possible to get cheaper treatments if you see a doctor from your network. During the Medicare Advantage Enrollment period there are various options for assessing the benefits. There will also be an election season for all elections from December 15th to October 7th.

Whether you are considering a coverage purchase or not, we recommend starting Medigap first. If you use Medigap and then upgrade to a Medicare Advantage plan, you will get approval on the most attractive MA plan. It can be wrong in some ways.

Medigap ensures enrollment only if you have an initial qualifying application or if you have special enrollment events such as relocation outside the MA service area. If a person starts Medicare Advantage for several years, then decides to move to Medigap, they usually have to answer health issues in advance for approval.

Switching to Medicare Advantage can help improve health care flexibility and reduce monthly costs for a patient. Medicare Part C offers all the services and benefits of Original Medicare plus more. These plans operate the same way they work for employers. It has a good advantage because most prescriptions cover drugs and other services, like dental insurance, exercise memberships, and other benefits. Medicare Advantage plans usually have low premiums — some as low as $0 — and a physician network. Many offer coverage outside networked networks.

If your insurance plan is original Medicare it can be converted to a Medicare Advantage Plan. There are currently several separate Part D drug plans for patients. Medicare is a universal plan. This covers you Part A and Part B coverage, as well as the prescription medications of Part D as well as health services not included in your original Medicare coverage. These items may include dental care, hearing protection and gym membership. The Medicare Advantage plan also includes a monthly limit to avoid expensive medical bills.

After enrollment to Medicare Advantage plans at yearly enrollment, the plan can transfer the benefits to Medicare. You can call Medicare.com without a phone number. Your new plan covers the new plan beginning January 1st. If your plan includes a private drug program, you can dis-enrol by contacting the plan supplier directly. Just dial that one in your insurance card. When switching from Medicare Advantage plans, you should remember this:

Medicare Advantage and Medicare Supplement plan covers two completely separate types. A Medicare Advantage Plan offers an alternative method for obtaining Medicare Original Medicare (part A) benefits. Medicare benefits covers almost all of original Medicare coverage, and some may even add benefits to things like regular dental, and sight care. Often the prescriptions are covered by Part D policies. Medicare supplement policies on the other side pay for deductibles, coinsurance and copayment expenses.

These plans are standardized by the federal government, so coverage will be the same, no matter which insurance carrier you choose. There are 10 standard Medigap plans , but not every insurance company offers every plan. Can you switch from a Medicare Advantage plan to a Medigap plan? You can switch from Medicare Advantage to Medigap, as long as you meet certain requirements.

The best time to switch to Medicare Advantage is during the open enrollment annual elections. If you want to switch between plans within a given period, you will enroll in an MA that is valid only for one month beginning with 1 January. If you sign up, this automatically disables Medicare Part D plans. Regardless, you should contact your medical provider requesting cancellation.

Medicare is the only insurance program for patients with hospitalized conditions, and Medicare for ill-health. Medicare Advantage does not provide any benefits to the patient such as insurance for medical conditions or eye health care. Original Medicare is not covered by deductibles or deductibles. To switch from Medicare Advantage plan to Medicare Original, please contact your plan's Providers / Medicare directly. You can contact Medicare by calling 1-800-866-4227 or by dialing 1-800-866-8500.

You may also have to lose insurance if you drop out of a Medicare Advantage program or other healthcare products and services. A third of your money will go into debt. If you want the coverage for this item, you either purchase additional coverage or pay directly from home. If you wish to get prescription drug insurance, you have to find one that is completely separate for you. Upon determining that you need additional coverage, you will need to choose your own insurance plan. Browse options by zipcode or ip address.

Again, you must contact their provider directly in order to deregister. Once you have done this no additional steps will be necessary. Upon contacting the Medicare Advantage plan to disenrolled, you can immediately turn to Original Medicare coverage. You do not need to go to a Medicare agency. The next policy will be in effect from 1 December.

Yeah. There's plenty of reasons for switching to Medigap. Maybe your benefit needs have increased because your health is not in your hands yet. Starting with Medigap is an effective way to enroll your Medicare claim for Medicare as soon as you reach age 65. Then, you can check if it suits your budget and your medical needs which could change in the future. From 15 October until the 7 December you may be eligible for Medicare Advantage.

When you're enrolling on Original Medicare, you may only change the Medicare plan once a year. You may choose to either choose Medicare for the first year of a year from December 15 to September 30 or switch to a Medicare Advantage plan. Coverage begins January 1. In some situations it's possible you can switch to Medicare Advantage, enroll for the first time in a new health plan, or enroll in an older one.

If the Medicare Advantage or the Medigap program is not available, they may be able to replace Medicare. You might choose to take Medicare Advantage in exchange for having the health coverage that is available under Medicare Original. There are two different Medicare plans that don't work together. If you enroll in a Medicare Advantage plan, you cannot enroll in the Medicare Advantage plan.

The Annual Election Period (AEP), between October 15 and December 7. This is also called the Open Enrollment Period for Medicare Advantage and Medicare Prescription drug coverage. Outside these periods, you can only switch between Medicare Advantage and Original Medicare if you meet certain requirements like moving outside your plan's service area. You may also lose your Medicare Advantage plan if it leaves your area or ends its contract with Medicare.

During this time, a person can also join a prescription drug plan and Medigap. Although this period sounds similar to the OEP that runs from October to December, it works in a slightly different way; a person cannot switch from original Medicare to Medicare Advantage during this time.

. If you have an urgent matter or need enrollment assistance, call us at (847)577-8574. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans. Note: We cannot answer specific medicare claim information. 64 Comments Newest Oldest Most Voted Inline Feedbacks View all comments Guest Cindy 7 months ago I've been enrolled in a Medicare Medigap healthcare program for 5.5 years.

If you would like to begin searching for a Medicare Advantage or Medicare Supplement insurance plan, just enter your zip code on this page. The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service.

Medicare Advantage plan, you can leave your plan and return to Original Medicare and buy a Part D prescription drug plan to supplement your Original Medicare. As of 2019, you also have the option to switch to a different Medicare Advantage plan during OEP. Contact your current plan or call Medicare. During the Open Enrollment Period (OEP), you can switch from a Medicare Advantage plan to Original Medicare.

Switching from Original Medicare to Medicare Advantage Changing from Original Medicare coverage to a Medicare Advantage policy can give you more flexibility and lower your monthly costs. Medicare Advantage plans , or Medicare Part C, offer everything Original Medicare does, plus more. These plans operate similar to an individual or employer plan.

The transition is quite complicated, particularly for people who move across states. It's great to know your original Medicare coverage remains the same regardless of the place of your residence. Moving to another state will, however, impact the other optional benefits of the program. Let's discuss how a move outside the states affects Medicare benefits as well as what you need to know in order to prepare for it.

When you move abroad you might think you need to modify your medical coverage. I'm not sure why. This is a question depending upon the coverage type in place, let's see. In a couple of circumstances Medicare coverage may be able to cover your new state and it'll probably be free of charge. Sometimes you can enroll in a Medicare Plan not currently available in the state you are from. Find a plan right now!

Moving between different states can be difficult, and it's unlikely that you have a medical policy. If you are moving out of state, you must modify Medicare coverage if you plan on moving out. Below we explain transferring Medicare to other states. How do I switch my insurance plan? It depends on the type of Medicare you have. Depending on your situation, you could have coverage in other states.

Medicare provides health insurance to older citizens in each 50 states. Medicare benefits are available to anyone. If you plan on moving permanently to another country, you will have to follow certain steps to protect Medicare coverage.

If you are taking Medicare Part D prescription drugs, you will need to renew your plan. Part D Medicare plans are offered exclusively for private customers by the health insurance companies in their respective states. After you've moved there's still two months left on the program. If you do not register within this window, you may have lost your insurance.

You must wait until October's enrollment opens to register. Avoid Part D penalties. If a patient loses drug coverage, the Medicare program may impose penalties incurred during the enrollment period. The penalty amounts to one percent of national insurance's "National Basis Premium".

Medicare Supplement enrollees can keep the current plan in place even after leaving the state. Medicare Supplements benefit is uniform across the nation based on the prevailing standards. Once you join a health insurance plan, you can have the plan available to anyone with Original Medicare coverage.

It only requires changing the name of your account with your plan provider. The premium may also change depending upon where you relocate. Depending on what your state provides, you could also qualify for guarantee rights, if it's available. You can apply for any Medicare Supplement Plan without submitting any insurance claims.

If you've moved your Medigap Plan may change to another country. Medicare supplement insurance is also known as Medigap insurance, a private insurance product that is offered through Medicare. Medigap pays for your medical care without paying any fees and helps you fill gaps in Medicare coverage.

If you have an insurance plan in the state in which you are moving, you may have the Medigap plan. Each of the states offers 10 standard Medicare / Medicaid plans. Other states have additional Medigap Plans available which are not available throughout the USA. Medigapro plans are available in all states.

The first step for Medicare Part B is updating the residency information for those plans. You have never had any issues updating your policy. Medicare is a federal program without a provider network. Also, coverage is identical across the entire nation. You can update your Social Security Number if necessary. If necessary, you can contact the Railway Retirement Board in order to change your address. It's important to find the next primary care specialist to take care of you. It should take place immediately to avoid any delays when the necessary care is required.

The special enrollment period gives beneficiaries the chance to enroll in or change plans in a special situation if needed. A move to another nation is necessary if you have special eligibility to enroll. Your special registration period is normally three months and begins with 1 month before moving on. You can: - Change your current plan to Medicare Advantage; change from your original plan into Medicare Advantage; return to Original Medicare from Medicare Advantage; Change your Medicare Part D plan; enrol into Medicare Part D; and change your Medicare Part D.

Medicare Part D coverage covers the cost of prescription drugs. Part A of Medicare is an insurance policy which offers different coverages. Despite having similar policies available across different states, prices and cover vary somewhat. In order to enroll in Medicare Part D, you need to change your plan immediately. This prevents an inability to cover the insurance costs. Those who lose coverage can lose benefits and have to wait to complete their annual enrollment to renew their coverage. Get Medicare plans for free with no cost.

Moving to a new place in your plan's service area If you have new plan options in your new area, you can switch to a new Medicare Advantage plan or Medicare prescription drug plan during your special enrollment period. Moving back to the U.S. after living abroad You can join a Medicare Advantage plan or a Medicare Part D prescription drug plan within two months after you move back to the U.S.

Unless the insurance company has changed its coverage to a different location or if it has a change to the original coverage the policy is not valid. Original Medicare does not have a provider network; rather it has a nationwide network of medical centers that accepts Medicare from every country. If you need assistance finding an acceptable Medicare doctor, you can use Medicare.gov physician comparisons to see what providers accept Medicare. You can also filter your search results so only the doctor accepts Medicare assignments.

In the event you move within the US, be sure to notify Medicare immediately. Many MediGap plans are available. It may be necessary to ask your Medicare Part-D insurance company if coverage is available. Terry Turner Terry Turner is senior financial writer and financial wellness facilitator Terry Turner is an accomplished journalist who has covered the welfare of people with disabilities who live or work in Washington State and Washington.

In the event that you have moved from one state to another, you must register with a new Medicare Advantage plan within your new service area. How should one search for a good Medicare Advantage program? These medical networks can vary based upon counties or states. In many counties, changing policies could cause the change in plans. In addition to Medicare, you can receive special enrollment periods when you move to another country.

Changing state in which you work could result in coverage lapses if you do not prepare for the move. Except for original Medicare and Medicaid plans that transfer to another state, it may be necessary to switch to another Medicare Advantage and prescription drug program. The following is an easy way of getting Medicare coverage when moving to another country.

Medicare Supplement and moving to another state If you have purchased a Medigap plan to supplement your Original Medicare coverage, you will be able to transfer your Medigap benefits to another state. Most Medigap policies will work the same regardless of state. Medigap plans are accepted by any provider who accepts Medicare to cover some of the costs that are not covered by Original Medicare.

You'll have to add the new address to Social Security once you move to an alternate state. The social protection system makes a change to an address easy. To change the address, you're required to contact a person on the Railroad Retirement Programs who is receiving the benefits.

Medicare provides Medicare patients with the same benefits across the country. The Medicare Advantage Plan is a Medicare Advantage program enabling the use of Medicare coverage anywhere. You can also use your Medicare plan if your family is living in Iowa.

In the absence of Original Medicare, you can still receive your benefit at any hospital in the entire country. Medicare Advantage and Part D plans will never cover you when you move out of the designated Service Area.

Medicare Supplement or move to a different state - Many Medigap policies work the way they should regardless of state. All Medigap providers accept the plan if they accept Medicare as part of a payment plan that does not include the original Medicare.

You should still be able to maintain your current Medicare Supplement plans if you move outside of the state. Medigap coverage may be taken from any health plan accepting Medicare, irrespective of its state status.

When you are on Original Medicare and relocate outside California, you can't get Medicare. If you are on another Medigap policy, the policy is renewable and the business will renew it as long as you are paying the premiums.

You will, however, need to change your address with Medicare. Switching Medicare Advantage or Medicare Part D if Moving Out of State If you have Medicare Advantage (MA), or Plan C, in place of Original Medicare, You will be able to switch Medicare Advantage plans or return to Original Medicare outside of the Annual Enrollment Period (AEP) under the Special Enrollment Periods (SEP). This applies whenever you move out of your plan's service area.

Both Medicare and Medicaid plan options offer additional advantages for patients in the Medicare system. The two forms of plans are different. Medicare Supplement insurance is a medical insurance policy which provides medical treatment to individuals in their first month of hospitalization. The plan is a government funded program, but private insurance that covers the expense of traditional insurance. Medigap plans include 20 per cent Part B coinsurance you'd otherwise pay for medical care and allied medical expenses.

Medicare is an age-specific health insurance policy designed by Medicare. The product is an alphabetical soup of parts containing different types of coverage. Medicare is facing some problems, some of them not being fully covered. If there is a gap, you can enroll in either Medicare Advantage or Medicare Supplement Plans. For your convenience we provide unbiased insight into the costs, availability and selections of these products.

Our selection process is independent and advertisers have no influence. We can compensate you for your visit to our recommended partners. See Advertisement Disclosure for details. All Medicare patients have a choice in mind. What's the best Medicare Advantage plan for supplementing the current Medicare plan?