Medigap is Medicare Supplement insurance that fills the gap in original Medicare and sells through private companies. Medicare covers most or none of the costs of medical services. Medicare Supplement Insurance (Medigap) may help cover most of the remaining health care costs such.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

If you are on Medicare Part B or Original Medicare a Medigap Plan can cover your coverage gaps for Medicare Part B. Medigap Plans are provided by a private insurance company that provides a solution that covers all expenses and can save you money. Medigap is a standardized plan, however, some plans will have no locality.

If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy. Note For more information about how Medigap plans are priced or rated, see costs of Medigap policies . For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) .

The initial enrollment period is an initial limited period for you if you're first eligible. After enrolling for Part b Medicare you may choose to purchase additional insurance options. A Medigap policy is the six-month period which starts with your 65th birthday and is covered under Part A - B. After a short period, your ability to purchase a Medigap policy may be limited and may take longer. Different states handle the situation and in certain cases there are extended enrollments. Medicare enrollment periods are specific times when people can sign up for Medicare or make changes to their existing coverage.

Most often medgap coverage does not have network limitations. This coverage will be accessible at all Medicare sites.

Several disadvantages are included: Higher annual premium rates. Managing different types of projects in different stages. The drug doesn’t cover prescription drugs (available in Plan DA).

As mentioned above, there are 10 different standardized policies in most states, each covering a different range of Medicare cost-sharing . Learn how a Medigap covers prior medical conditions to know if any of your medical costs may be excluded from Medigap coverage. Depending on your circumstances, a Medigap can exclude coverage for prior medical conditions for a limited amount of time. Find out how Medigap premiums are priced so you can make cost comparisons.

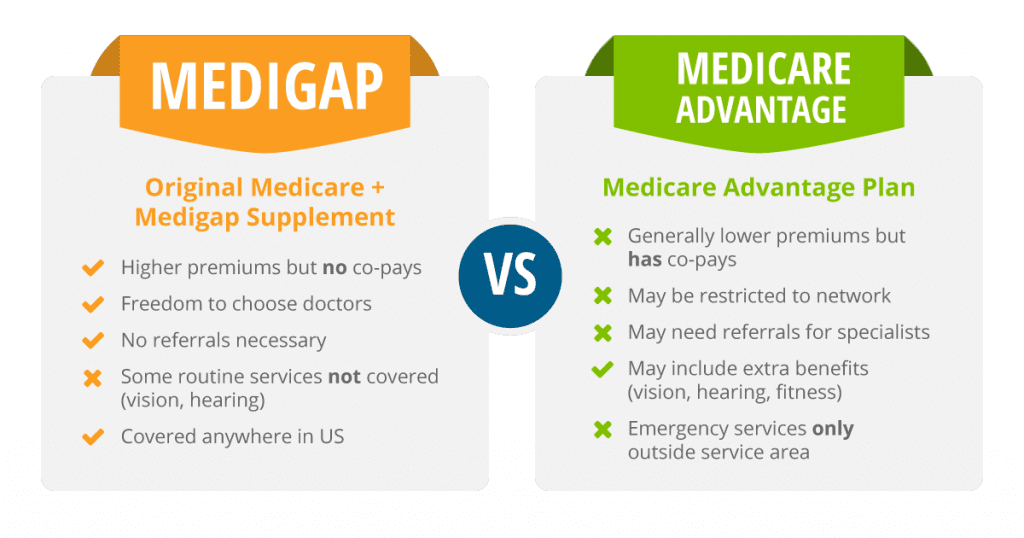

Medicare Advantage is an affordable option for a patient with minimal health expenses. In some cases Medigap may be the more appropriate choice to treat serious health problems.

Medicare does cover some of the services provided by Life Alert. Medicare Part B will cover 80% of the cost of medical alert systems that have been prescribed by a doctor and meet certain criteria.

Bay Alarm Medical Alert is a medical alert system that provides users with 24/7 access to professional emergency responders.

You live in Massachusetts You live in Minnesota You live in Wisconsin For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) . Call your State Insurance Department. Site Menu Sign up/change plans About Us What Medicare covers Drug coverage (Part D) Supplements & other insurance Claims & appeals Manage your health Site map Take Action Find health & drug plans Find care providers Find medical equipment & suppliers Find a Medicare Supplement Insurance.

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost. Silver Sneakers is a health and fitness program for seniors that is offered by many Medicare Advantage plans.

Medicare Silver Sneakers is a fitness program designed for seniors aged 65 and above who are enrolled in Medicare. The program is aimed at improving the health and wellness of seniors by providing them access to gym memberships, fitness classes, and wellness resources.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap in Massachusetts Medigap in Minnesota Medigap in Wisconsin Medigap & travel How to compare Medigap policies Find out which insurance companies sell Medigap policies in your area.

If your Medicare plan includes a Medigap policy, Medicare will reimburse the Part of the approved deductible to cover the health care costs. So the Medigap insurance companies will pay.

You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period. Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. For more information Find a Medigap policy.

Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or a skilled nursing facility (SNF).

Recent Blogs:

Bay Alarm Medical Alert | Who Qualifies For Medicare Flex Card