The most important aspect of Medicare supplement plan comparison is matching the coverage to the health care you expect. For example, if you anticipate having to pay for medical treatment or expensive surgery it may be cheaper to purchase a plan that has greater protections in order to reduce or eliminate the medical expenses.

For the majority of people enrolling for the Medicare Supplement plan we suggest Medigap plan G because it offers the greatest coverage for everyone. This program is usually very expensive and starts from around $120 yearly.

Medicaid Supplement Insurance (Medicaid) is a type of insurance that provides coverage for medical expenses. Medicare supplemental insurance acts as supplementary not primary insurance protection. You need Part A or Part B to get Medigap insurance please. Each plan is varying by the coverage it covers, and by the amount a user's own pocket can afford or premium. This policy has been sold by Private Health Insurance Companies. The plans have been standardised to ensure Medigap Plan G is offered by a company in New York.

There are no optimal Medigap options available. Medigap plans work if they have coverage that fits your needs and have premiums that are affordable. Medigap Plans have become popular Medicare Supplemental Plans. The plan is available to Medicare beneficiaries for up to 50 percent of their health benefits.

Plan F offers Medicare cost savings that are greater than the rest of the plans. Plan F also includes the nine standard Medigap Benefits that a company may have. In 2022, a typical plan F premium will be $77.20 a month. Its second-most popular Medigap Plan has a growing popularity. Plan G enrollment has risen 38 percent since 2000.

Medigram plans are standardized in terms of benefits. For the Plan letter, you get the same insurance regardless if you work at ETSNA Humania or any other company. Despite this higher letter on the plans the benefits are no guarantee. We calculated the health costs for a given plan by comparing coverage costs and popular coverage for each plan. As you can see, Medigap plan coverage has become more widely used. Medicare's plan E and plan G are extremely effective, and cover 73% of all Medicaid enrollees. Medigaps have higher coverage and are generally much more expensive. The eligibility age for Medicare is 65.

Medigap plans also have disadvantages: high monthly payments. The ability to choose between various plans. The plan does not offer prescription coverage.

Plan G usually has higher premium rates than plan n as it provides higher protection. This plan may help reduce the outgoing cost of your health insurance and reduce deductibles if your coverage is lower than Plan G. Medigapa insurance cost varies according to state and carrier.

Medicare plans F are the more extensive Medicare supplemental plans that have. The plan covers deductibles and co-insurance and requires no monthly payments from your employer.

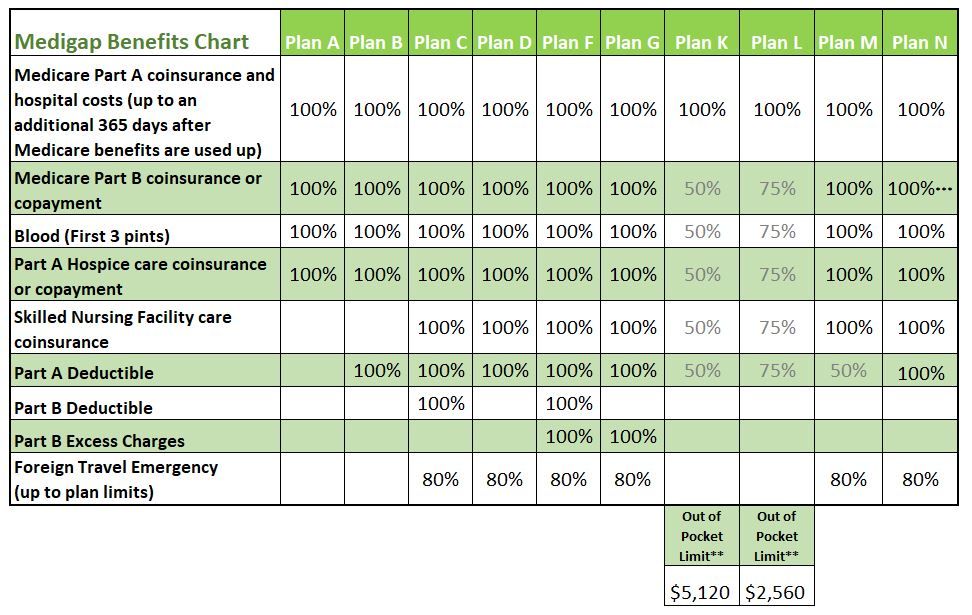

These plans are labeled Plan A, B, C, D, F, G, K, L, M and N . When shopping for the best Medigap plan for your needs, it can help to compare Medigap quotes . How to Compare Medicare Supplement Plans You can use the 2022 Medigap plan chart below to compare the benefits that are offered by each type of plan. However, some long-term care insurance policies may cover the costs of Life Alert services. It is important to check with your individual insurance provider to determine if they do cover the costs of Life Alert services.

We and the licensed agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program. This website is not connected with the federal government or the federal Medicare program.

In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer.

Medicare Part B deductible Before Medicare Part B covers any of your costs for things like doctor's appointments or medical devices, you must meet your Part B deductible. In 2022, the Part B deductible is $233 per year.

only after you've paid the deductible The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible). A stair lift is a device that is used to help individuals with mobility issues safely and easily navigate stairs. The best Medicare plan for you will depend on your individual needs and preferences. Some of the most popular plans include Original Medicare (Part A and Part B), Medicare Advantage Plans (also known as Part C), and Medicare Supplement Plans.

This table breaks down the 10 standard Medigap plan types into categories so you can learn more about which plans might be the best fit for you: Get details on Medicare Supplement Insurance options Coverage Medigap Plan Basic benefits Medigap Plan A. Basics plus some extras Medigap Plan B. Medigap Plan M. Highest coverage Medigap Plan D. However, some long-term care insurance policies may cover the costs of Life Alert services. Medicare Part B (Medical Insurance) covers ambulance services to or from a hospital, critical access hospital (CAH), or a skilled nursing facility (SNF) if you’re medically necessary to use this type of service. Medicare Part B covers insulin for people with diabetes. This includes regular and rapid-acting insulin, but not inhalable insulin.

Click here to view enlarged chart Scroll to the right to continue reading the chart Scroll for more Medicare Supplement Benefits Part A coinsurance and hospital coverage Part B coinsurance or copayment Part A hospice care coinsurance or copayment First 3 pints of blood Skilled nursing facility coinsurance Part A deductible Part B deductible Part B excess charges Foreign travel. Medicare does not cover transportation services. However, it may cover certain ambulance services in certain circumstances. In some cases, Medicare may also cover non-emergency medical transportation if the beneficiary has no other means of getting to and from their medical appointments.

Accessed May 13, 2022. View all sources : Medigap benefit Medigap plans that cover it Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. A, B, C, D, F*, G*, K, L, M, N. Part B coinsurance or copayment. A, B, C, D, F*, G*, M, N**. K covers 50%. L covers 75%. Blood (first 3 pints).

These policies are sold by private health insurance companies, and the plans are standardized, so Medigap Plan G from one company in New York will offer the same coverage as Medigap Plan G from a different company in Ohio [1] Centers for Medicare & Medicaid Services . Choosing a Medigap Policy .

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and a copayment of up to $50 for emergency room visits that don't lead to inpatient admission.