Medicare Supplement Plans K and L are unique within the Medicare Supplement (Medigap) world. These two plans are reasonably cheap in monthly terms since they are covered with a 50% coinsurance payment on your plan X (50 per K & 25 per K) - maximum monthly cost. If your plan k is approved and you receive outpatient services at 100 without a Medicare supplement plan, you'll have to pay $20 out-of-pocket. The plan will be billed for the same month but it will charge the full $20 per month.

Medicare Supplement Plan K is classified into 10 Medigap plans with an annual cost of about $2000. Medigap plans cover the cost of some medical expenses not covered by Medicare Part A and Part B. Medigap policies covers people who reside in Massachusetts, Minnesota and Wisconsin. For Medicare, the first two years of Medicare are required. Tell me the benefits that the Medicare Supplement Plank provides for people with chronic illnesses. I can tell you which is better.

Medigram plan K offers Medicare supplement plans to meet the expenses incurred in obtaining Medicare Part A or Part B health insurance plans. Plan KB differs from all other Medigap plan options because it provides a small amount of coverage that helps lower premiums for services that it covers.

Medicare plan k is one of a more affordable Medicare supplement plans aimed at filling in the coverage gap in traditional Medicare. Typically Plan K covers some of the costs relating to Medicare Part B. Medicare's average monthly costs for a K plan are $77.

This plan is regulated by the federal government but sold by private health insurance companies, which set prices according to factors including age, location and tobacco use.

Medicare plan K is Medicare supplement plans to fill gaps in Medicare coverage. The supplementary plan helps the beneficiary to manage medical costs at an accelerated rate. Medicare plans K only covers 50% of the cost of many services until beneficiaries meet a maximum deductible of $6940 in 2023. Once the beneficiaries have reached the maximum level, they will pay 100% of medical expenses for the remaining calendar year. There are some important differences between the Medicare deductible of averaging $255 and the excess charge.

It is possible to get Medigap coverage from any state or region, with the exception of Massachusetts, Minnesota, and Wisconsin. These plans have differing coverage of service, out-of-pocket limits and premium costs. Like many Medigap Plans Plan K does not cover 100% the service covered. This covers 50% of the costs of almost all the coverage, so your payment will remain at 50% of your bill. Plan K has one of the few plans to pay more than 80% of covered services for the remainder of the year with a total cost of $6 620.

Plan K is available as soon as possible but is no longer limited by a year of enrollment. While you can purchase Medicare supplements at any time, such changes are ideal during a statutory warranty period, which gives you the guaranteed best rates. Plans K can be obtained via private insurance firms like UnitedHealthcare. Plans k policies are sold in different states and regions in the United States. It is essential to compare rates among different providers to obtain the best Medicare rate possible.

Plan K may cover the SilverSneaker programs, which help older persons engage in physical activities promoting healthier living habits. The insurance company pays the basic membership for every gym that is part of the SilverSneakers network. The SilverSneakers program is covered depending on which insurer offers SilverSneakers on their plans K. This may vary according to your purchase and your place of living. You can find out how to qualify for the SilverSneakers policy online.

Similar to other Medicare coverages, medical expenses are considered medical expenses and are therefore tax deductible on federal tax returns. Items in a medical report can make a huge difference when the cost is less.

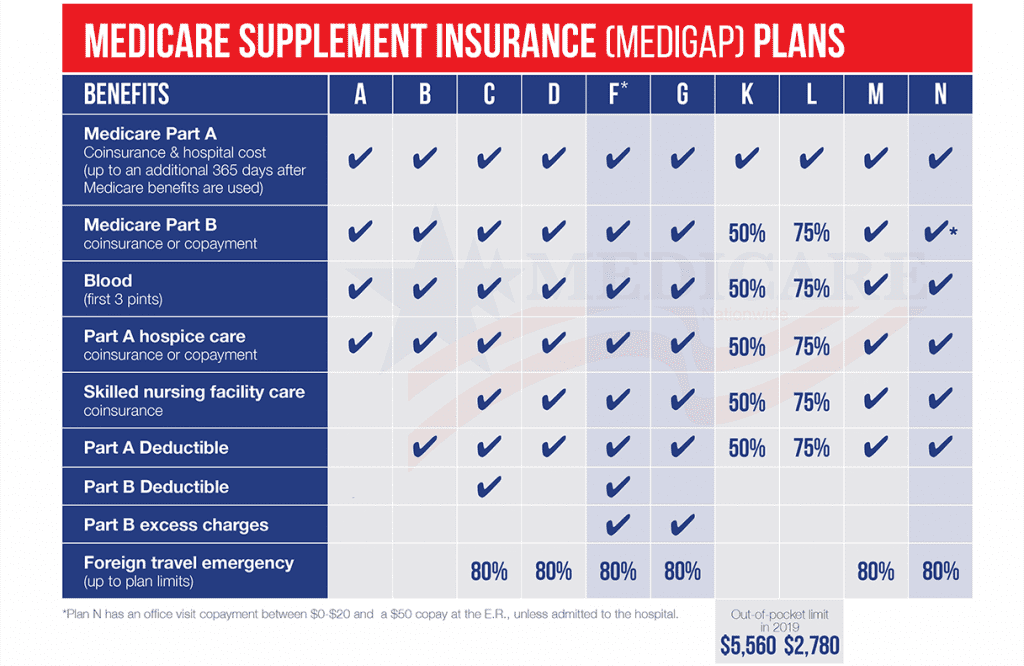

It pays 100% of the Part A coinsurance, hospital costs, and hospice care coinsurance/copayment; Part B coinsurance or copayment; blood (first three pints); and skilled nursing facility care coinsurance.

The Medicare Supplement Program augments or does not substitute Medicare as the only supplemental insurance. Medicare covers disability patients and older adults. The program has two sections: Part A covers inpatient and hospitalization, while part B covers hospitalized treatment. They cover about 90% of medical expenditures and fill gaps in coverage provided in Supplemental Medigap coverage. Can I know if my Medicare Plank coverage is available?

Plan K covers Medicare deductibles of $26 a year as of December 31, 2018 or Part B excesses. A further disadvantage is that it is limited to emergency trips outside the country. Medicare Plan K does not offer eye exams, vision services or dental treatment.

In Medicare Original, the physician will be required to cover the expenses for the visit. Medicare Supplements are designed to help lower medical expenses that Original Medicare does not cover. The Medicare Supplement Plans offered to you varies by the state you live in. What Medicare Supplement is best to use will vary according to your specific needs. Please use the information above to guide your decision regarding Medicare Supplements.

Medigap Plan K covers Part a coinsurance and hospital costs as long as Medicare benefits expire within one year. Parts B. Deductibles (50%). Part A hospice care co-insurance (55%). Part B co-insurance/copayments (50%). Assisted Living Facility Insurance (Aff.) 50%. Blood transfusions (third pint) (50%. A maximum annual expenditure for 2022 is 6620.

Medicare Plan K has a similarity to Medicare Plan L. They have several common features. The two companies pay some service charges and both have monthly costs. Plans L is not suited for travel, emergency or medical expenses. The biggest difference between plan K and plan L is the cost and the coverage of each. Health insurance plan. K. Plan.

Only people first qualified for Medicare by 2020 can buy Plan B and Plan F. A checkmark indicates 100% payment of benefits. Part A Coinsurance and hospital care (as long as the benefits are prepaid). Part B coinsurance / copayment. 78%. 1 Blood (1st pint, per annum) 77%. Part A Hospice insurance or copayment. 75%. 65%.

United Healthcare is a free service offering information about health care plans and services.

Medicare Supplement Plan L This plan is similar to Plan K, except it covers a higher percentage of your costs, offers a lower annual out-of-pocket amount and out-of-pocket limit, but has a slightly higher monthly premium.

What is the benefit for Medigap Plan K that isn’t covered by another plan? The plan also covers a portion of Part B of Medicare for new Medicare customers. Assisted living (a type of care that offers non-skilled care). Private nursing.