Medicare Supplements Plan N, F, E and H could be the solution to the gap in health care coverage. When your senior citizens reach the age of 66, you might need help understanding Medicare and Medigap. Tell me the important plan for you? This plan offers a greater benefit than Plan G. Plan G generally offers higher premiums than Plan N since its coverages include higher premiums. You're going to have to pay more in plan N because the costs are usually much lower for Plan G. Medicare Supplement Plans - G, and N can reduce gaps between Medicare and other insurance programs.

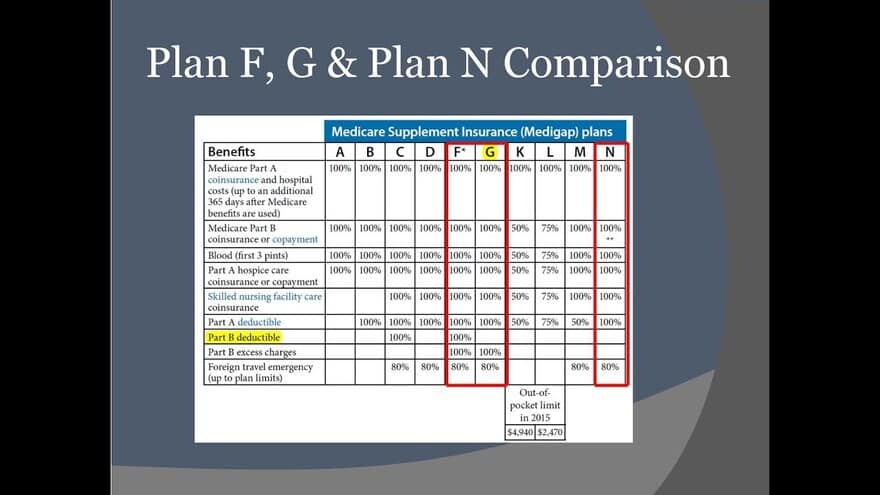

Compare Medicare Supplement Plan F to Plan G vs plan N to find the best Medicare Supplement plans available in the United States. Most people need insurance to pay for their health care and medical costs. That is exactly the goal of Medicare Supplement plans. How to Find Medicare Plan? We have many options. The standardized Medicare Supplement Plan Letters can vary greatly among different plan letters. Below is a comparison of all Medicare Supplement plans across the nation: Medicare Supplement plans F and N.

You've come to: Home / Medicare Supplement Plans / Health Supplement Plans X and N. Plan X has most features, but Plan N provides excellent value at a low monthly rate.

Medicare Supplement Plans are designed together with Original Medicare in order to pay for expenses normally owed by the patient. The insurance level varies depending on what Medicare supplement you are taking. Across the United States, the most popular Medicare Supplements plans include the Plan A, Plan E and Plan N. This scheme is most famous because it has the highest coverage levels. Lets go to the podcast episodes! Comparisons of Medicare Plans A and G versus N will give you a similar coverage ratio. Despite the differences in premium between states and carriers, all benefits remain constant.

Medigas policies in the USA can be standardized across all of the US except for Michigan. Each plan is accompanied by one letter. This plan has been sold through private insurers. Not all companies sell plans. The Medigap program is different from the Medicare benefit. Since Medicare supplement coverage is standard, all policy types with similar letters must provide the same benefits regardless of the condition, age or position of a beneficiary. The comparison is easy. Similarly Cigna's Plan Letters have similar coverages to those of Aetna or Mutual Omaha.

What does a surplus fee do for a company? Medications providers who have not voluntarily accepted the “Medicare Assignment” will be charged an additional 150% of Medicare’s approved amount. These fees are considered part B excesses. Medicare assignments are basically agreements between medical providers with the Medicare network. Accepting assignment by your doctors means your physician accepts Medicare reimbursements. If your physician hasn’t accepted Medicare assignments, then Medicare can reimburse you up to 15% more than your Medicare allowance.

If one compares Medicare Supplement Plans G vs N, it will be clear the plan G has higher coverage. Nonetheless, Medicare Supplement Plans N will be less costly. In exchange for less monthly premiums you agree to subsidize your visit at a medical clinic. In addition, the Plan G plan is able to provide a lower amount of coinsurance when you visit a hospital. Medicare supplement plan N benefits can help with your cost-savings and reduce your premiums over time. You have the choice to enroll within this enrollment window.

Medicare Supplement Quote You might wonder about the difference in cost between Medicare Plan N and Medicare Plan G. This is an important factor in selecting the most suitable Medicare plan for you. Because Medicare Part n is not the same as Plan G, you'll probably pay less for your Medicare plan. Nevertheless there are small costs differences. In most situations Medicare Plan n costs are around $30 or $15 per month lower than Plan GS. Click on this video here for more information about how to use quoting technology.

Medicare Supplement Plan F offers the best coverage because it has the cheapest premiums and has no hidden costs. If you believe that the monthly premiums are lower, it's best to use the Supplemental Plan for Health Benefits. It also depends upon what your needs are. A further important factor in determining the difference between a Supplement plan and a Plan g plan is the eligibility to use both. Those new to Medicare do not have access to the F plan so countless people enroll in Medicare Supplement Plan G.

How can I enroll in Medicare if my insurance isn’t available at my current location? Has anyone ever contacted the various packages available on the market? The decision to choose a plan may be hard. It's no big problem there's no one. Plan N and plan G have a huge following among people (also known as Medigap plans). The plans are easily compareable as most of them offer similar benefits. Several similarities and differences exist within this debate. By the end you will be a smart, smarter Medigap buyer.

Another benefit that Plan N cannot provide covers part B excess fees. The cost of this service may be as much as 15% if Medicare approves the provider's service. Physicians accepting Medicare payments in full are known as Participating Providers. They have the option to collect additional fees. No billable balances with Plan N will come unless you see an insurance agency accepting a payment assignment. If a doctor accepts Medicare assignments, you may check Medicare's physician-finding site for details.

Medicare supplement plans G and N cover Medicare Parts A and B deductibles and coinsurance. Skilled Nursing facilities, rehabilitation, medical assistance, and emergency travel. Both programs do not cover Medicare Part A deductibles. This annual deductibility must be paid annually. This deduction resets in January and is subject to changes each year. Once the plan meets the annual deductible the plan pays for 100% of all medical expenses for all taxable periods of the year.

Tell me about the benefits that Medicare covers in its gpd plan? Plan F remained the most affordable supplemental insurance until its elimination in the early 2020s. Now, the highest level Medicare Supplement insurance offered is provided in Part G. What is the coverage for the Medicare plan? Can you list some Medicare coverage? How do you decide if Medicare is effective? See the table comparing Medicare supplement plans below.

Do Supplement Plans Cover B Deductibles? Unfortunately that isn't terribly straightforward either way. Plan n & Plan g don't include a small annual deductible of $226.25. If, for example, the first time you visit the doctor at the beginning of a new calendar year, your premium for the medical expenses will exceed your $226 deductible. It's here when a major difference occurs between plans G and N. Until your Part B deductible is reached, Plan A pays for the entire cost for the full year. Medicare Plan N covers certain other expenses which we're going over next.

There's also another important coverage variation in a plan which could be much more costly than expected. Plan N also doesn't cover excess fees whereas plan G does. If you choose Plan N, your health care provider will pay you a balance bill if the provider refuses to accept a Medicare-based payment program. They can also charge your Medicare premium as much as 15 percent. The cost of doing so is very steep.

If it becomes necessary to switch Medigap plans, you should notify your insurer about the change. The insurer must then buy another policy of their choice. Always check the cost before buying the plan. If you have Medicare plans for the last two years you may switch your Medigap plans. You can also change companies or buy them separately. A change of plans may lead to underwriting before you accept your next plan.

The answer is complex, and there are several factors involved. Plan G is the most suitable plan if you want complete coverage at low costs. Plan G provides more benefit but has costs. The most expensive plan is the one with the greatest benefits. Which plan should I use? The right plan will be determined according to your coverage goals or budget.

How can Medicare Supplemental Plans Compare to G? Please follow us as we discuss Plan G vs. Plan N to help you make a better decision in selecting a Medicare plan. Let us start with the basic details regarding Medicare Supplement plans.

These plans are sold by private insurance companies . Not every company sells every plan letter and Medigap plans are different than Medicare Advantage plans . Since Medicare Supplement insurance plans are standardized policies, any policy type with the same letter has to provide the same benefits no matter the health, age or location of the beneficiary.

It is the third most popular plan. What's the Difference Between Medicare Plan F vs Plan G vs Plan N? Medicare Plan F used to be the most popular plan. However, it is no longer available to new Medicare beneficiaries who want Medigap. Now that Plan F is no longer available for new beneficiaries, the highest level of Medigap coverage that is currently available is offered by Plan G (followed by Plan N). If you like Plan F, then Plan G is the next best thing.

The only time he sees a doctor is when he goes for his annual physical. In his case, it would be more cost effective for Tom to choose Plan N over Plan G. Why? Because even though he will have had to pay a copay and perhaps more if his doctor doesn't accept Medicare assignment, it will amount to less than if he paid that higher premium for Plan G. Example 2: Linda is 69-year old woman, who lives a sedentary life. She's a smoker, slightly overweight, and has high blood pressure.

Medigap plan N and Medigap plan G have co-pays compared to Plan N and Plan G. Using Medigap Plans N would likely have been cheaper.

Medigap plan N has a number of advantages and can suit a budget-conscious buyer looking for good coverage. Plan B costs a lot less than plan E. It has some extra medical costs.

You can upgrade your health insurance coverage in the month that follows your birthday. For example you can convert Plan G to Plan G without underwriting.

Plan G and Plan N cover, according to Part A coinsurance and hospital stays up to an additional 365 days after Medicare benefits are used up. Part A deductible. Part A hospice care coinsurance or copayment. Skilled nursing facility care coinsurance. Blood transfusion (first three pints). Medically necessary emergency health care service for the first 60 days when traveling outside the U.S. Deductible and limitations apply.

Plans differ according to carriers, so the prices are generally higher for G as it is more expensive for the coverage it provides. Despite Plan G generally having a lower premium, this plan can help you in the long term and lower your risk.