Medicare Advantage and Medicare Supplement provide coverage for coverage that was previously not included in Original Medicare. Advantage and Supplement plans vary according to cost coverage, provider networks (HMO, PPO and PFFS). So, you need to compare these policies to choose optimum Medicare coverage. Medicare Advantage plans generally cost less but include some extra services, such as dental and prescription benefits. In addition you pay for some medical care. People with more medical need will have a bigger bill.

Medicare is an age-based health insurance plan offering free services. There are several components offering different coverages and benefits. But Medicare faces challenges, including many shortcomings, that are not covered in any way. You should consider enrolling in Medicare Supplements and Medicare Advantage plans. Our goal is to provide information to make an informed choice and weigh both benefits and disadvantages.

Our reviews are unbiased and advertisers don't influence our selection. You could be compensated for visits to our recommended companies. Find out about advertising disclosures here. All people enrolled in Medicare have many things to do. What are the best ways for Medicare Advantage patients to supplement their existing Medicare Plan?

Medicare Advantage health plan is similar to private health coverage. Some services, like doctor appointments, laboratory visits, surgeries and other services, are usually covered by fewer charges. Plan offers may include an HMO and PPO network. Every plan provides yearly limits to total expenditure. All plans come with different benefit requirements. Some of these are covered by prescriptions. Some require reassurance from their doctor and some don't. Some will provide medical treatment from other hospitals and may only cover doctors within their network or PPO network. Other kinds of Medicare Advantage plans exist. Selecting a plan with minimal annual premiums is very important.

Medicare Advantage is the Medicare replacement for Medicare Part A and Part B. This is a comprehensive policy with all the benefits of Part A (hospitalization) Part B, and occasionally, Part D (prescription drugs). A benefit plan provides additional advantages that are not available under Original Medicare including eye, hearing & dental care. Medicare benefits may not be purchased unless you have already registered for Medicare Part A or Part B. Once you have signed up for a plan, you can then start evaluating the different Medicare Advantage plans offered by private health insurers.

It is reasonable to take advantage of the savings from a Medicare Advantage plan - a plan that can pay off when your health improves, then switch to regular Medicare a few years later if your conditions require medical treatment. Currently, the ability for a user to switch from one Medicare plan to another is available during the open enrollment period. Each year the election season takes place between October 15 to 7 a year. Let us take a closer look. If the Medicare program is canceled or you are unable to use Medigap coverage, you could lose coverage.

Medicare Supplements help reduce the cost of living by making the cost less costly. Many people prefer the cost-based model because of the absence of worry when you're in the hospital for medical treatment and the hospital stays, added Jacobson. “You could literally see every doctor anywhere you wanted to go”. If you live in Arizona, you can fly to Minnesota to visit Mayo Clinics. Unfortunately, Jacobson says the benefits are often even better at the time people feel ill - even though there are no symptoms.

Recent research from the Common Wealth Fund examined Medigap plans that offer nontraditional services, such as vision and hearing services that are not covered by Original Medicare. The study found only 7% of plans offered these benefits, Jacobson noted. Many Americans are not aware of these plans that offer the same benefits as Medicare. The Federal Government may be tempted to encourage or inhibit such benefit from a policy or by imposing a tariff.

Besides these costs the Medigap plan has some advantages. It is advisable to learn various plan types. Coverage will not exist under Plan D unless a physician requires this.

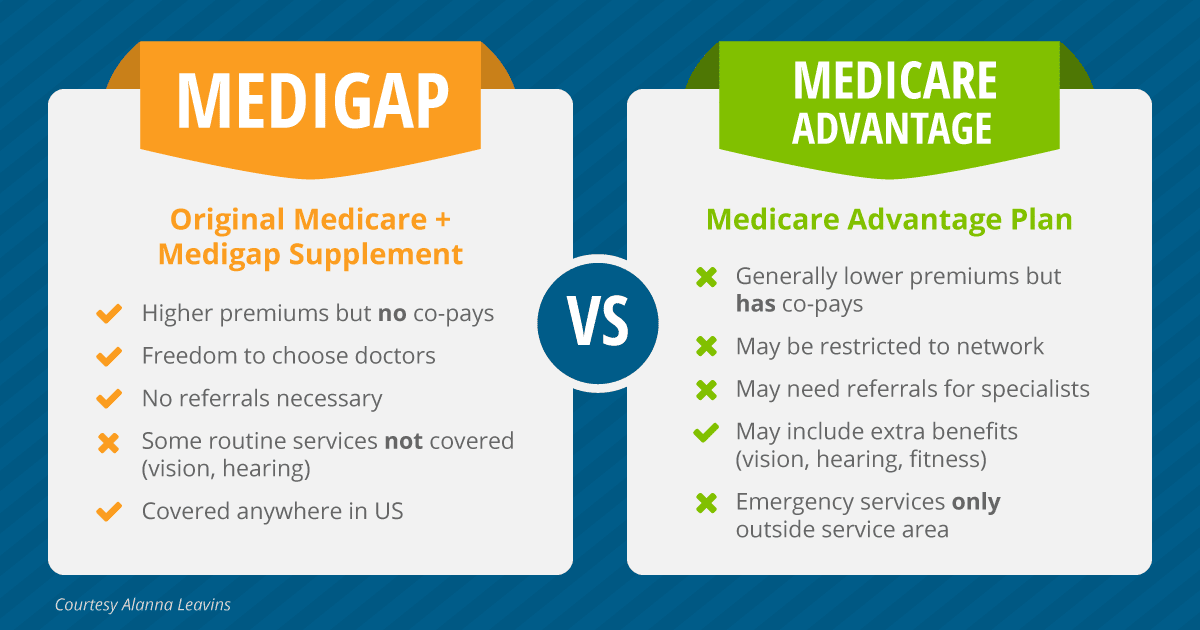

Having to make sure your preferred provider is in your plan No coverage while traveling A likelihood of higher out-of-pocket and emergency costs Some advantages of Medigap plans include: Fewer out-of-pocket expenses Access to all providers who accept Medicare Coverage while traveling overseas Some disadvantages of Medigap plans include: Higher monthly premiums.

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D) Part D adds prescription drug coverage to: Original Medicare Some Medicare Cost Plans Some Medicare Private-Fee-for-Service Plans Medicare Medical Savings Account Plans.

Medigap plans do not provide prescription drug coverage, and Medigap cannot be combined with Medicare Advantage. But Medigap plans are a way to tweak your Medicare to your specific situation while covering larger expenses.

1 Medigap is a private insurance option that is designed to work well with Medicare (Part A and Part B) plans. How do I choose between Medicare Advantage and Medigap? Consider your priorities, like budget, choice, travel, and health conditions.

Medicaid or employee or union coverage, or you enroll in a Medicare Advantage plan. Confused About Medicare Supplement Insurance Options? Find committed, licensed agents who work to understand your coverage needs and find you the best Medicare option.

Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Medigap policies can no longer be sold with drug coverage, but if you have an older Medigap policy that was sold with drug coverage (before January 1, 2006), you can keep it.

If you go to an out-of-network doctor, the visit might not be covered or you might have a higher copayment. Most Medicare Advantage plans include prescription drug coverage. Those without are designed for enrollees who have drug coverage from a previous or present employer or another source.

Should I choose Medicare Advantage or Medicare Supplement? The decision of whether to choose Medicare Advantage or Medicare Supplement depends on your budget, health care needs and how much effort you want to put into finding Medicare coverage. By selecting Medicare Advantage, you are choosing a simple policy that provides comprehensive coverage.

The two most common types of Medicare Advantage plans are health maintenance organizations (HMOs) and preferred provider organizations (PPOs). With HMOs, you usually don't have coverage for out-of-network providers except in emergencies.

There are four main types of Medicare Advantage Plans : Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS), and Special Needs Plans (SNPs). HMOs and PPOs are the most popular plan types and are widely available from most insurers.

Medicare Supplements are also referred to as Medicare Supplements. They are health plans that complement Medicare Original Medicare. Medicare Supplement provides financial support for Medicare Parts A and B in terms of coinsurance and deductible fees. Medigap Plan consists of three different letter combinations: A, B, C, D, F & G. Each plan has different services and covers different parts of Medicare. Despite these differences in monthly premiums, every policy should therefore provide a good balance in price and coverage for you. Medicare Part C, also known as Medicare Advantage, is a type of health insurance plan offered by private companies that contracts with Medicare to provide all Part A and Part B benefits.

Medigap Supplemental coverage plan covers Part B and Part A Medicare coverage gaps. Medicare Part A, sometimes called Medicare Part B plans, include more benefits than Medicare Part. Private health plans approved by Medicare provide coverage.

Many Medicare benefits require the usage of approved providers. Unlike most Medicare Supplement Plans, you can be treated at an employer whose services include Medicare.

Services Caret Icon Chat Log in Home Supplements & other insurance What's Medicare Supplement Insurance (Medigap)? Search Search Print this page. Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)?

Related Blogs: