Choosing a provider that provides Original Medicare is an expensive mistake that can cost hundreds of thousands of dollars to repair. Original Medicare will not cover all healthcare expenses resulting from unplanned or expensive medical bills. Basic Medicare covers only a portion of your Medicare deductible. You have the remainder of the 20 per cent that's incredibly important! It only takes a single major hospital trip if you want thousands in money back. Can Medicare Supplement coverage work? We will explain the benefits of a Medigap program. Tell me the reason for supplemental insurance for Medicare? Is a health plan worth pursuing?

Does Medicare provide additional coverage? You can ask yourself: Are these costs really wasteful? Supplemental XMedicare Medicare insurance is a Medicare supplement which a Medicare ad-hoc beneficiary purchases to cover any gaps in their Part A & Part B Medicare coverage. Magap (aka Medigap) cost us all. There's nothing to waste! This provides several benefits for the business. We're going to discuss why Medicare supplements have many advantages.

You might wonder about the benefits and risks of the health benefits if you have insurance. Consider Medicare only covers the rest and pays for your medical bills. Adding deductibles along with co-pays makes Medigap premiums seem reasonable. Find the most affordable supplemental Medicare plan in a simple step. You'll know if you can take a look at Medigap or other additional protection. Yes, Medicare Part B covers emergency room visits. Medicare will cover 80% of the cost for approved services and you are responsible for the remaining 20%. Medicare does not cover non-emergency medical transportation. Medicare Part B (Medical Insurance) may pay for ambulance services to the nearest hospital that can provide the necessary care if you have a medical emergency and an ambulance is medically necessary.

Medicare Advantage incorporates these in Part C. Medicare Advantage is available either as a POS or HMO. You must access a doctor and hospital network under this scheme. Those who are not connected have higher deductibles. When you have Medicare Advantage plans, there is no Medicare Advantage program and you don't have to purchase a Medicare Advantage policy. Almost all people enjoy low premiums on Medicare Advantage plans. However, low premiums mean less benefit. Lets face it, you won't be getting something for nothing. You may have little money right away, but a Medicare Advantage program can save you much more.

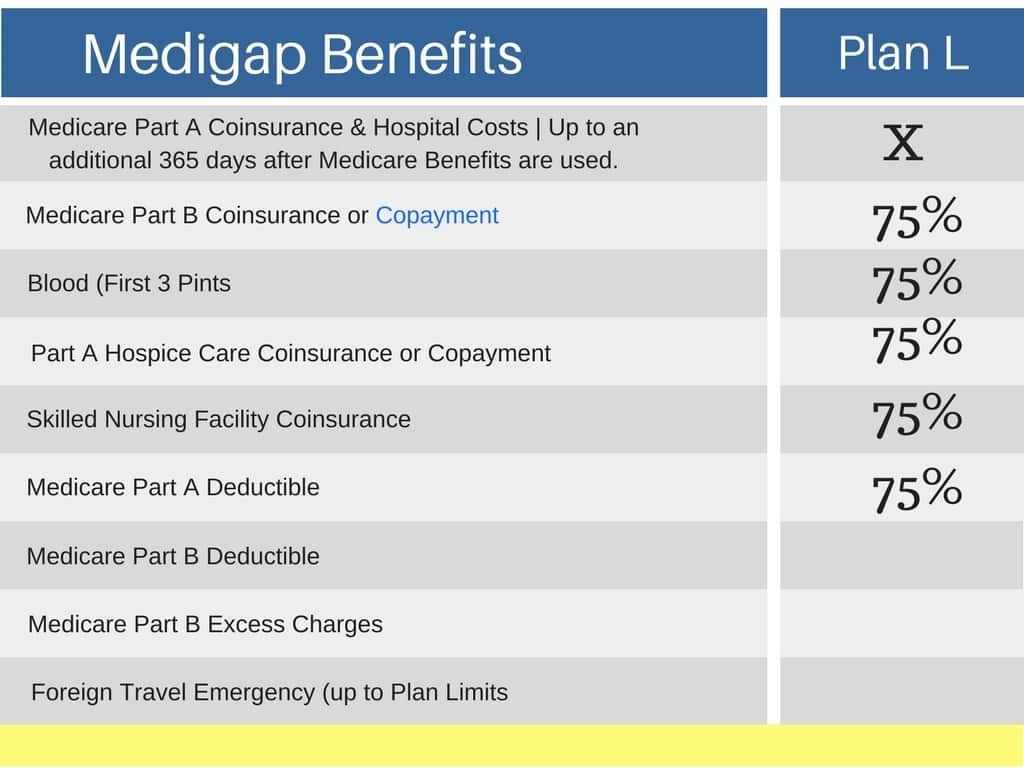

How do high-deductible Medigap plans work? There are 10 types of standardized Medigap plans with letter names in most states. The benefits for each plan type are regulated by the government. Only two types have high-deductible versions: Plan F and Plan G . If you have a Medicare Advantage plan, you can't also buy a Medigap plan. Nerdy Tip Medigap Plan F isn't available to Medicare beneficiaries who became eligible for Medicare on or after Jan.

Medigap provides supplemental coverage for health care. Medigap is a program that provides more coverage of routine care that Medicare covers but can also cover part of those expenses that Medicare doesn't cover, like medical treatment or dental treatment. A Medigap plan aims to reimburse you in advance for the cost you paid out of your direct pocket. These plans are provided by private insurers, so compare prices and make a selection for the right one. Please remember that lettering plans of all companies have a common benefit as determined in government regulations.

As with car insurance, healthcare is an economic tool. We all purchase insurance in different ways, but the most common one is financial protection. How much the expense will actually be dependent upon how much your financial situation will affect your decision making. In most regions, supplemental insurance costs are less than people think. Most of our users have looked into Medigap Plans but are disappointed by the premium. Medicare supplement plan G may be more expensive. Probably one of the best known. You might have thought Medicare Supplement Plan F.

Medicare is not a universal insurance program, as discussed below. That's the reason. Medicare Part A or B—and Medicare prescription drug coverage, Part D pay a lot for your medical expenses. The cost for sustaining severe illness may not be as high. In some cases routine services are covered by a copay or deductible. Medigap Insurance comes on. Professional caregiving help at home can include a variety of services such as providing personal care, companionship, and assistance with activities of daily living.

“There are different types of Medicare Advantage Plans that may limit your ability to see a certain provider,” Nance says. “The vast majority of doctors accept Original Medicare and the Medigap supplemental insurance.” What is Medigap? Medigap, also known as Medicare Supplement Insurance, adds to original Medicare by filling in gaps where you aren't covered. Medigap plans usually don't cover vision, hearing, long-term care or at-home care. If you want to change your Medicare plan, you will need to contact your current plan provider or visit.

The deductible is set by law, and it's the same for everyone: $2,490 in 2022. The Part B deductible and the cost-sharing you pay out of pocket apply toward the high deductible amount. Premiums aren't the same for everyone.

Enrolling in a plan will help give you peace of mind and financial security. Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Our team of experts is ready to answer your questions are share the best Medicare Supplement plans in your area.

Medigap vs. Medicare Advantage plans An alternative to Medigap is enrolling in a Medicare Advantage plan , also known as Medicare Part C . When evaluating your options, consider that you can't have a Medigap policy and a Medicare Advantage plan. Medicare Advantage plans combine your Part A and Part B benefits. They also typically include prescription drug coverage and may cover other services Original Medicare doesn't, like hearing aids or glasses.

Medicare Supplement plans would help cover the 20% you're responsible for paying. Medicare Supplement plans, or Medigap policies, are insurance plans sold by private insurance companies. You pay the insurance company a monthly premium for your Medigap plan, in addition to the Part B premium you pay to Medicare. Some Medigap plans cover additional services that Original Medicare doesn't, such as coverage when you are traveling outside of the United States.

Parts A and B of Medicare offer basic coverage, while Part D is optional drugs you can buy in private health plans or apply for Medicare on your own. Medicare Advantage Part C replaces basic public health coverage with private insurance. But a Medigap plan is more important if you are going for Part D plus the Medicare Original Medicare. All letters indicate standardized coverage levels. For the Medigap Plan, the most commonly offered plans are F and A.

These plans could be replaced by plan F in popularity as they offer practically the same coverage except reimbursement of Part B deductible—a bonus not available on any Medicare newbie plan until 2020. A Plan G would generally cost less than Plan F. Costs of applying, however, are largely dependent on zipcode, gender and tobacco use and increase as the applicant grows older. Medigap's G plan has nearly exactly as much coverage and has a maximum deductible of $2000 as compared to plans A & C. This plan has no deductibles.

It's the most comprehensive plan, and has been the most preferred option for years. In January 2020, plans for new Medicare patients will not be available for plan F until January 1, 2020. Plan F plans may still allow the public to get a Medicare plan if they want.

Medigap option may cost you more for medical care if they do not cover your health benefits. Medigap is also an affordable treatment option for chronic illness or those needing expensive surgery.

Medigap is specialized medical insurance which you can purchase from private companies to pay medical bills for traveling outside the United States. The insurance is not covered in Medigap policies for people who have traveled overseas.

Plans E and G are the two most common Medigap Plans. Plan F has been offered to Medicare recipients only since 2020, but the comprehensive benefits are so good that nearly a quarter opted in for the program based on the benefits provided.

Medigap covers the outstanding deducted, co-insurance or copayments. Medigap can even help pay for the medical care costs of those people who receive no Medicare coverage, including travel abroad. Remember, Medigap ONLY works with the Medicare Originals. Those on Medici Advantage plans cannot buy Medigap.