Hundreds of Medicare Supplement Plans exist. Tell us what's your favourite one? Market Watch identified some of our product and service offerings because it believes that its readers are going to find it helpful. It is not affiliated with Marketwatch and may earn commissions by linking to this article. Buying health insurance supplements can prove tricky for most seniors. This article presents three commonly used Medicare Supplements and their detailed details. Important information.

Medicare Supplement Insurance is popular. Nearly one in five Medicare patients has access to Medicare Supplement Plans, also known as “Medgap”. Tell me your favorite health insurance plan? The latest data released by AHIP indicates the latest Medicare Supplement Insurance Plan F. Despite recently passed legislation regarding Medigap Plans plan G quickly became the most popular Medicare Supplement for Medicare.

You may buy a Medicare Supplement from a Medicare insurer to cover any out-of-pocket deductible costs that come after the use of original Medicare. Often called Medigap plans. Medicare Supplements are optional health insurance policies that can be purchased to help reduce your monthly medical expenses which are not covered by Medicare alone. Ensure that the Medicare Supplement plan is reviewed by a Medicare Supplement Specialist and that the plan is suitable for your situation. You may want to try this every single year, because certain Medicare rules and other benefits may change. You must pay an annual fee on Medicare supplementation.

Enrolling in Medigap plans is easy. Medicare supplements can be purchased directly from the carrier, explains Corujo. Because the annual registration period does not exist, you can enroll at any time. If you wish to purchase the MediGap coverage, it will take a minimum of ten months before you begin enrolling. The program starts on January 1st when Medicare Part B is in effect. You can purchase Medigap policies that are available to you in the states where you live, even if you are ill. How do I get Medigap insurance?

In addition to Medicare Supplement insurance, Medicare Supplement is also available as an alternative insurance program for people with disabilities requiring medical services. This secondary plan applies to Original Medicare no other private coverage or standalone Medicare plans. Medigap plans do not typically include prescription drugs, therefore you may be interested in joining Medicare's Medicare Advantage plans which cover prescription drugs. Medicare Advantage plans differ from Medicare Part B.

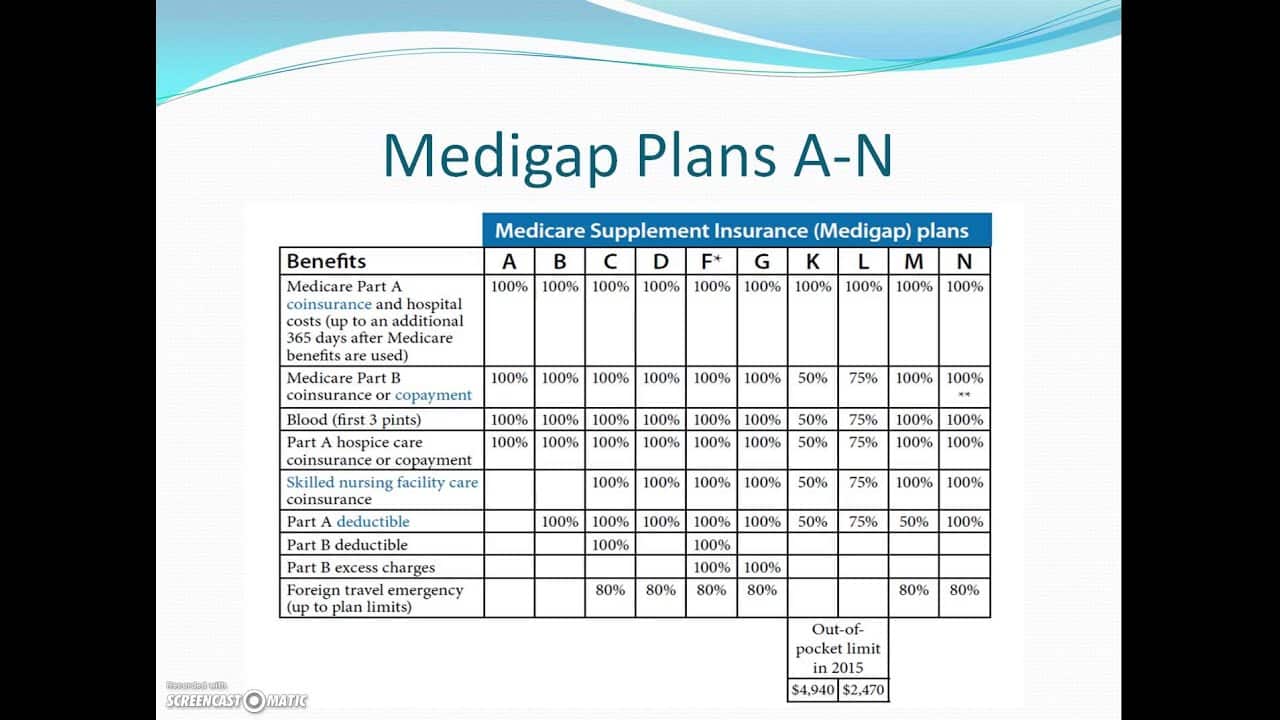

Policies C and F are more complex but often cost more. See the Medigap benefits chart for more details about the policies that cover each of these. The above information applies to plans purchased after June 1, 2010.

These may start out relatively inexpensive, but they often become the most expensive Medigap plans over time. Note: Premiums can always go up over time due to inflation or other factors, regardless of the company's pricing structure. Why Should I Compare Medicare Supplement Plans? Comparison shopping is important because two different insurance companies could charge you a different price for a plan with the same benefits.

We have a staff of licensed Medicare agents to walk you through finding the best coverage. You can easily compare Medicare Supplement plans and rates for 2022 by filling out our online rate form or calling us. Our licensed insurance agents can help you compare the best Medicare plans and carriers in your area.

Our licensed insurance agents are interested in pairing you with the best coverage for your needs rather than prioritizing a particular insurance company. What is the next best Medicare Supplement plan after Medigap Plan F is discontinued? For those newly Medicare-eligible, the next most comprehensive Medicare Supplement plan is Medigap Plan G.

The insurance company must continue to renew the discontinued Medigap policy each year you wish to keep it. See the Medigap Plan Benefits Chart for plans purchased between July 31, 1992, and May 31, 2010 for more information on your Medigap policy's coverage. Medicare Part B covers emergency room visits in certain situations.

However, the best choice for you is the policy with the most coverage and lowest premium in your area through a reputable carrier. How do I find the best Medicare Supplement insurance plans? Contact a licensed Medicare agent you can trust to provide an unbiased quote from each carrier in your area.

This is available to everyone 65 or over , people with disabilities , or those of any age with end-stage renal disease and Lou Gehrig's disease (ALS). 1 Centers for Medicare and Medicaid Services. “2020 Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare. ” (accessed June 2, 2020). Part A covers hospitalizations, home health, hospice, and skilled nursing care.

Plan B covers the above, as well as your Part A deductible. Plan C covers the above, as well as hospice care and skilled nursing facility coinsurance, your Part B deductible, and foreign travel. Plan F covers the above, as well as any Part B excess charges. Plan G covers the above, less your Part B deductible. Plan K covers only Part A coinsurance or copayments, 50 percent of Part B coinsurance or copayments.

By and large, Plan F is the most popular Medicare Supplement plan due to its coverage of more out-of-pocket Medicare costs than any other Medigap plan type. Plan F pays for Medicare deductibles, copays and other costs associated with Medicare-covered services, so beneficiaries don't have to worry about out-of-pocket expenses.

If you live in one of these states, please contact your, State Health Insurance Assistance Program (SHIP) or State Department of Insurance for more information on purchasing a Medigap policy. Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefit.

Overviews. The Medigap plans are the cheapest Medicare Supplement plans. The plan also known as Supplemental Medicare Plan F is a plan that covers deductibles and other copayments and coinsurance. This post was updated in 2024.

Medigap Plans N and G have the same benefits, compared with Plan N in some respects: Plan N has a copay for medical office and emergency department visits, while Plan G does not. Medigap Plan N is a cheaper plan than most plans.

Plan E provides the most coverage and doesn't provide enough protection to every person. Plans G is about a fifth of all plans based on Medicare and available to anyone. It costs more to implement F. If you'd like to apply for Medigap plan F, then you may be wondering why it would be an additional cost.