Comparison of costs of each standard type Medicare Supplement Plan. Compare plans available across the country. The average monthly premium for beneficiaries under Medicare Supplemental Insurance is 125.913. Compared to other Medicare-based plans in the U.S., the average cost varies significantly. It should be noted that the various Medigap plans have different combinations of the same standard benefit. Plans containing lower premiums could lower their premiums. Depending upon where and how many people smoke and how old they are, the rates of Medigap plans may also vary.

Medigap is a program of Medicare Supplement insurance for people who are eligible for Medicare Supplement payments. The average monthly premiums for Medicare supplement plans G are $144.34 per month for the average 63-year-old, while premiums for Medicare supplement plans F are $144.44 per month. The Medicare Supplemental Supplements Comparison website offers a simple and quick comparison. The Medicare Supplements Comparison Tool is a simple way to look at different health insurance plans in the area of your location.

How do I determine how many premiums a Medicare Supplement will have? Unfortunately, the answer isn't easy. How can I find a suitable health insurance plan? In addition, the cost of Medigap is varying from person to person as these variables influence the plan.

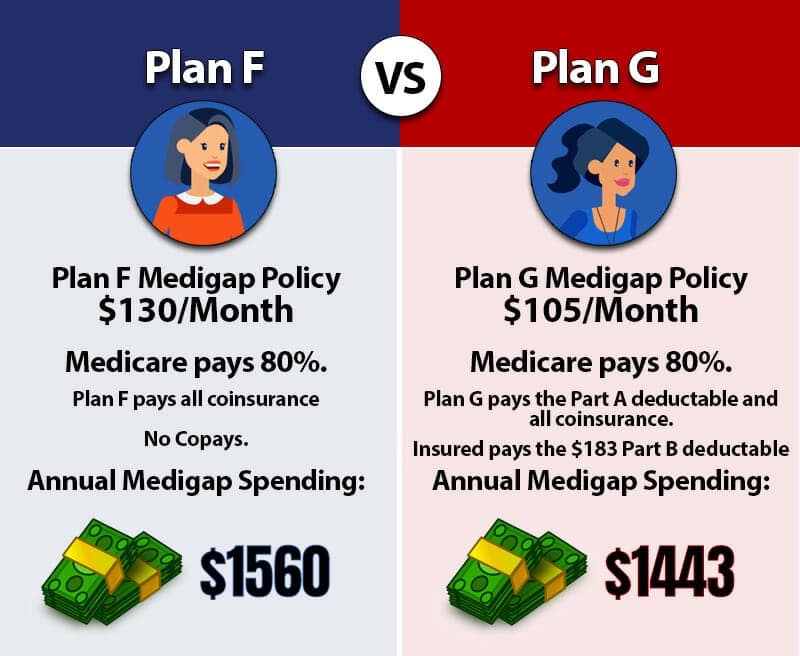

Medicare Supplements insurance plan F provides more flexibility than all other Medicare-related insurance plans. A comparison of Medigap's average costs shows a difference.

This difference in enrollment affects the average monthly premium that is actually paid by Medigap beneficiaries. That's why the weighted average Medigap plan premium paid by a beneficiary in 2018 was $125.93 per month. (Data excludes Plan K and Plan L, which have a combined enrollment of fewer than 1.5% of all Medigap beneficiaries).

Based on the cost of Medicare Supplements in your area, the benefits might cost more. If you decide whether a plan is suitable for your needs, then consider the potential cost incurred if you don't have a Medigap plan available for you. While Part A co-insurance will not be encountered because it can lead to a long hospital stay, it is likely that one single payment of Part A coinsurance will be less expensive than a typical Medicare Supplement insurance policy's monthly premium for a single day. Typically the Medicare Part A plan includes Medicare Part B coinsurance as well as health expenses.

Typically, Medicare supplemental insurance plans cost about $150 per month. The Supplemental Insurance Program provides coverage for Medicare Part B and Part A coverage. Medigap provides you with choices for the payment of your deductible and copay. Medigap supplemental insurance coverage: Medicare subsequently provides reimbursement of premiums for the cost of the Medigap plan. Hence, policy pricing is extremely varied. Two insurance companies may offer very different insurance rates for identical policies. If coverage is extensive, the higher the price.

Medicaid Supplement plans have uniform benefits, ensuring that similar plans have similar benefits for all carriers. However, premiums are dependent on the individual beneficiaries of Medicare. Three factors that impact the Medicare Supplement rate include: location, age, and gender. For more information on the cost and benefits a Medicare plan offers for different age groups and gender groups, we provide examples and comparisons. This list contains examples of non-tobacco users. If you smoke, your premium could increase 10%.

Medicare Supplement Plan F is the most comprehensive Medicare plan in the world, making this the popular plan among qualified patients. The charts below show the premiums in this scheme to a little less than the rest of these plans which range from $51 to $524 for some examples. The cost of Medicare supplemental services varies from one place to another. In almost all state-government programs, women are paid a lower premium and have longer lives than men. However, there are no states in all of the world following such patterns. The State of New York probably has none of these laws. Since New York is a guaranteed issue, most plans are community ratings.

Besides the Medicare Supplement Plans G, there's an option to get the highest-deductible version. Despite its high cost, Medicare Supplement Plan G offers many advantages. High Deductible Medicare Supplement Plan G - HDS carries higher costs due to its high deductible and low monthly premium rates. These plans are identical to Medicare Supplement Plans Fs highdeductible options that precede them. In the following section, the premiums are lower for the same person in NYC compared to their premiums on standard plan G.

By 2020, Medicare Supplements insurance cost was around $150 a month or $1800 each year. Some factors can affect the cost of Medigap, such as age or place of living. Rachel Christian Rachel Christian Financial Writer Certified Personal Financial Advisor Rachel Christian is an author at Retirementguide.com. Her coverage also includes annuities, life insurance and other important retirement issues. Rachel joined The Society for Financial Planning Education. Read More Matthew Mauney Matthew Mauney, Financial Editor.

RetireGuide retains complete editorial control of all information published. Consequently, the RetireGuide staff operates independently of all our partner companies. Visitors have confidence in us to ensure editorial freedom. Our relationship does not affect RetireGuides editorial content.

It’s possible to enroll in a Medigap plan anytime in the year. Occasionally however, your application may require medical assistance. The best time to purchase Medigap plans however is during the Medigap enrollment period or during other Medigap guaranteed issues. It helps prevent you from having higher costs for health insurance. Find further Medicare cost guides and find out the impact they have on your situation and your budget.

How Much Does a Medicare Supplement Insurance Plan Cost? Prices for Medicare Supplement Insurance, or Medigap, can vary based on age, geographic location, health, insurance company and plan type. Alex Rosenberg Sep 8, 2022 Share Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

In 2022 Medicare Supplements will pay a premium of $72.75 a year or $2073 a year.1. What are the estimated average cost of plan F? Medicare Supplement Insurance Plan F premium rates were lower at 64 and highest at 80. The premium was a yearly average of 62. Below are charts showing median costs in Medicare Supplement Insurance Plan F by age. There are several Medigap plans which include a different combination of standard benefits.

What companies set prices can affect what you will spend on Medigap coverage today and in the future. For many companies age does not affect your premium. Other insurers can increase your annual policy price or lock-in rates according to your age at the start of your policy purchase. Bob Glasze, an insurance agent, explains how age affects Medigap costs.

High Deductible Supplement Plan F has similar features to the standard plan but requires a higher deductible. Although the premium is a little lower in this program, the premium may be longer. Below are examples of the lower Medicare Supplement costs in Nevada compared to those for standard Medicare Supplement plans.

The most common Medicare plan for newly eligible recipients has Medicare Supplement Plan G because they cannot enroll under Medicare Supplement Plans F. The second-most extensive Medicare program, Medicare Supplement Plan G covers all the benefits of the Plan F except for Medicare Part B's $250 deductible.

Other reasons you might be eligible for guaranteed issue rights include if you move to an area that isn't served by your previous plan, if your insurance company stops offering your plan or if you otherwise lose coverage through no fault of your own. Pricing Structure Medicare Supplement Insurance companies typically price their plans in one of three ways according to age. They might charge everyone the same rate regardless of age. This is called a community rated plan.

Compare Medicare Supplement Plan Costs Near You The easiest way to collect Medicare Supplement Insurance plan costs is to contact a licensed insurance agent who can gather up price quotes for multiple carriers selling Medigap plans in your location. You can also compare plans for free online.

Compare plans Speak with a licensed insurance agent Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Several disadvantages are associated with the Medigap plan: higher monthly premiums. It requires understanding the different kinds of plan. It is not deductible to have prescriptions (which are offered under Plan D)

Including copayment, coinsurance etc. The average cost for Medicare Supplemental Plans G is $143.44 per month for older Americans while the premium for Medicare Plan F averages $184.99 per month. Compare Medicare Supplements prices online for free.

In 2019, Medicare supplement costs are expected to be in excess of $150 a month. Cost varies based only on two variables: the policy you decide on and the state's pricing structure for each policy.

Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Medicare Supplement (Medigap) plan costs can range from $50-$400+ in monthly premiums, depending on your plan. Additionally, these Medigap plan costs are different for each beneficiary because they are influenced by several factors.