Medicare offers Medicare benefits to older adults. It is presented by an alphabet of different components offering different coverage types. But Medicare is plagued with difficulties and some are completely unreachable. You can enroll in either a Medicare Advantage or Medicare Supplement Plans. We have gathered unbiased research and expert opinions to help guide you to the best coverages, price, conveniences and options.

The best product reviews are independently reviewed by our competitors, No advertising influences our selection. You might also get reimbursements from visiting our partner recommended websites on the internet. Please see our advertisement disclosure for further details. Any person wishing to enroll in Medicare has many choices. Is Medigap the most efficient alternative to Medicare for Supplemental Supplemental Coverage?

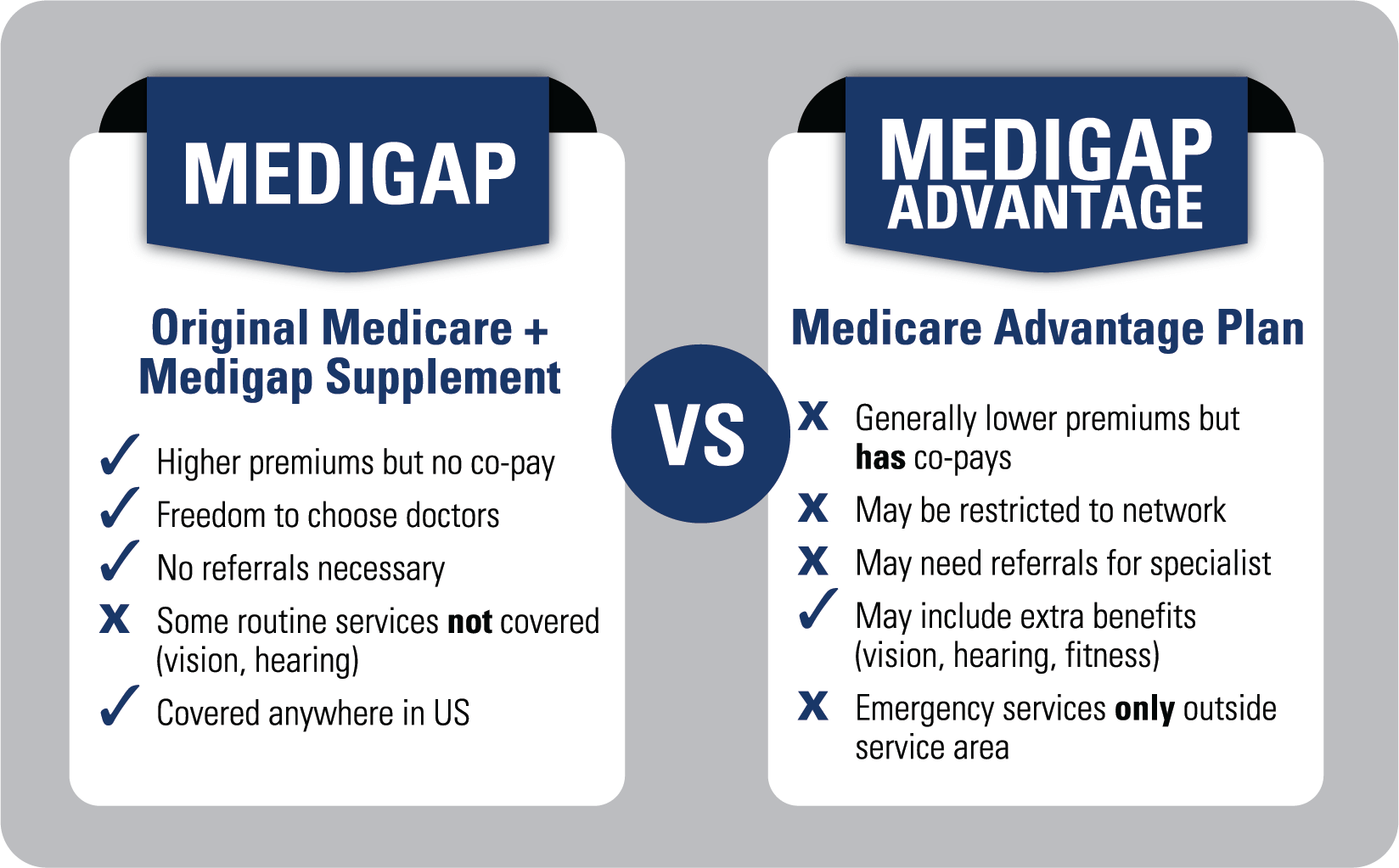

You can enroll in either type of insurance, therefore, you will need to understand their operations first. The largest difference between MediGap and Medicare Advantage is the fact that you have the right to see every doctor that accepts Medicare. Medicare Advantage requires you to visit any doctor or hospital that accepts Medicare. Tell me a little more information.

Medigap is a private Medicare Supplement Insurance program designed to fill in gaps in a person's life. Original Medicare reimburses most but not all the costs associated with covered health care. Some medical insurance policies may pay some health care fees for those who are not Medicare eligible or if their original Medicare is not available for them.

Medicare Advantage plans look a little like public health coverage. Generally, the office visit, testing procedures, surgeries etc are covered under the terms of a copayment. Some plans have an insurance network for HMOs and PPOs while others include limits on annual costs. Several plans have differing benefits and requirements. The majority of these companies offer insurance for prescription drugs. Many doctors ask that patients be referred to a specialist, but other doctors haven't. Some will offer a portion of the medical care outside the system, whereas other will cover medical services only in the PPO network. There is another type of Medicare Advantage. Selecting plans that have no annual premiums can help you make an informed choice about your options.

When you enroll in Medicare, the first important decision you have to make is whether to purchase Part D drug coverage. If someone doesn"t get Part D coverage after starting Medicare and has no insurance at that point, a late enrollment will result in a permanent penalty.10. If you have creditable prescription drug coverage, which is coverage for prescription medication provided by a company or union, you can avoid it, but the penalties may apply to other individuals. If you have the drug protection you have in your Medicare plan, you should generally have it.

Many health insurers offer no premiums and you should investigate your options. Baethke said if a plan charges premiums, you must be paying the premium monthly, along with your Medicare Part B premiums, which are approximately $65 or more. Medicare Part B's coinsurance and the deductible is $226, according to Medicare.gov, and once these are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, including durable medical equipment (DME) like glucose.

Yes, Medicare Part B covers emergency room visits. Medicare Part B covers 80% of the cost of medically necessary emergency room services after you meet your yearly deductible. Medicare eligibility is based on age, not employment status. Individuals who are 65 years old or older are eligible to enroll in Medicare, regardless of whether they are still working or not.

Medicare Advantage plans provide essentially the same benefits as Original Medicare as well as coverage of services not included in Original Medicare. Several plans even give transportation from the doctor's office. The company said it will also be extending supplementary benefits for employees in North Carolina. Plan sponsors may be positioned for special benefits based on health conditions, such as chronic illness”. In fact, the company has offered vaccine travel for Medicare Advantage patients with COVID-19.

The ability to budget for health expenses is difficult as it is usually impossible to determine if your monthly expenses are small or huge. Although standard Medicare (Part A and Part B) provides good basic protection, it pays about 88% to 90% of its expenses approved for medical care. The rest 20% of the bill is personal responsibility, in contrast to the ACA, the amount of insurance the person must pay is not set by statute in one year. Tell me if your heart bypass surgery is needed.

The Medicare Advantage plan has been approved by private insurance companies. These may not have much more premiums or are lower than the high premiums for Medicare & Medicaid. Medicare benefits are designed to help doctors or hospitals cover medical care as well as prescription drug coverage. By 2020, 42% of Medicare patients would have chosen the plan. Most Medicare Advantage plans offer health maintenance organizations (HMOs) and preferred provider (POOs) coverage.

About 58% of older Americans (65 and older) and people requiring disability care choose Original Medicare Part A and B that covers hospitals, doctors and medical procedures4. Around 80 million of these people pay the full cost for Medicare Part D prescription drug plans. Medicare Supplements or med-gap plans have no association or affiliation with the United States Government or Medicare program. While these are cheaper options they have certain advantages.

Prescription drug plans for seniors are available through Medicare Part D. These plans provide coverage for prescription medications that are not covered by Original Medicare, such as certain brand-name and generic drugs. The coverage varies depending on the plan and may include deductibles, coinsurance, and copayments.

The Medicare Advantage program replaces the original Medicare program. The private insurer selling the insurance covers most aspects of original Medicare and may also provide extra benefits to things Medicare does not. In addition, prescription medication may cover hearing care as well as vision care. Those who have Medicare Part A health insurance can get one. During enrollment, your Medicare Advantage plan will replace or increase Medicare Parts A and B.

As a person reaches the age of 65 the deadline for enrollment should be considered. Check if you are eligible. The average American would need to sign up for Medicare Part A (hospital) and Part B (doctors) within seven months from the date you turn age 62. If a social security claim exists in the future, you will receive a Social Security account automatically; if you don't, you can apply either via the internet or through the Social Security office.

Medicare Supplement Plans (sometimes called Medigrap Plans) are offered in private insurance to cover Medicare's gaps as well as other Medicare plans. The Kaiser Family Foundation said in 2018 that 34% of individuals with original Medicare insurance had coverage through Medicare supplemental plans. Medigap is a group program of 10 plans each having letter numbers A to N offering coverage and reducing deductibles and other coinsurance expenses.

Medicare Supplement plans help reduce your costs in advance. Jacobson says many people prefer Cost Sharing because there is less stress on paying the bills every time they get to the doctors or hospitals. The doctor is literally anywhere you want in the United States. Suppose you live in Arizona, you might be flying into Minnesota for Mayo Clinic. Jacobson explains that the benefit is often even more important for patients who are sick.

When it comes to health, you can consider switching to regular Medicare to avoid costly complications and then getting treatment in a hospital. Changing between the two forms of Medicare can be viewed by all people during open enrollment periods. The election period runs from 15 to 7 of any given year. What do we know about this? During your switch to Medicare (Part AA or Part B), you may be eligible to purchase Medigap coverage.

Medigap was created just so as to fill the gaps in the original Medicare system – such as coinsurance, deductibles. 80% Medicare coverage covers services that may not have previously been covered under Medicare. Medigap can help cover a 20 percent gap in your monthly expenses. Medigap can cover any of the benefits of Medicare Part A or Part B. This does not include medical services that were not covered under Original Medicare.

The average premium on Medicare Supplement plans is between $100 - $400 depending on state and insurance. With Medicare Advantage plans, you have a chance to shop for savings. The 69-year-old can save up to $900 a year with the Medicare Supplement Plan G. We're also trying to improve the health benefits of Medicare by providing more affordable health benefits to the citizens," says Jacobson.

Medicare Advantage is a viable option to save on medical care. Medigap is a good treatment option for serious health conditions. Speaking with your insurance company will help determine the best treatment option possible. Because you aren't allowed to have Medicare Advantage or Medigap, you need to carefully select your coverage to meet your needs.

If your employer is providing health insurance to you under the age of 65 but your employer doesn't provide health benefits under your policy, you are entitled to continue to pay your wages. When you're working in a workplace with more than 20 people, you must ask if there's an obligation to enroll in Medicare and get the decision in writing. 10.

Plans feature Medicare Advantage Unlimited providers and 0-premium plans. Pre authorization required for specialty care. Possibly if you have Medicare Advantage plans that permit you. Extra benefits including dental and vision care Cap on out-of-pocket costs. Plan K and plan L have a cost-benefit limit.

If you are considering changing your Medicare plan, it is important to do your research and understand the different plans available.

People in Medicare are either in Original Medicare or fee-for-service Medicare or are in Medicare Advantage Plans. She says her research focuses on a variety of health topics. The cost of any service that Medicare pays will generally exceed that amount in the event that the patient pays the premium.

Original Medicare carries the same basic Medicare insurances as the SSCI and the Medicare Advantage. You can add supplemental health plans to Medicare Part D or Medigap. If you sign up for Medicare, you'll be entitled to Part A B, but you'll be forced to purchase them all.

Releted Blog:

What is Medicare Part C | Medicare When Moving to Another State |