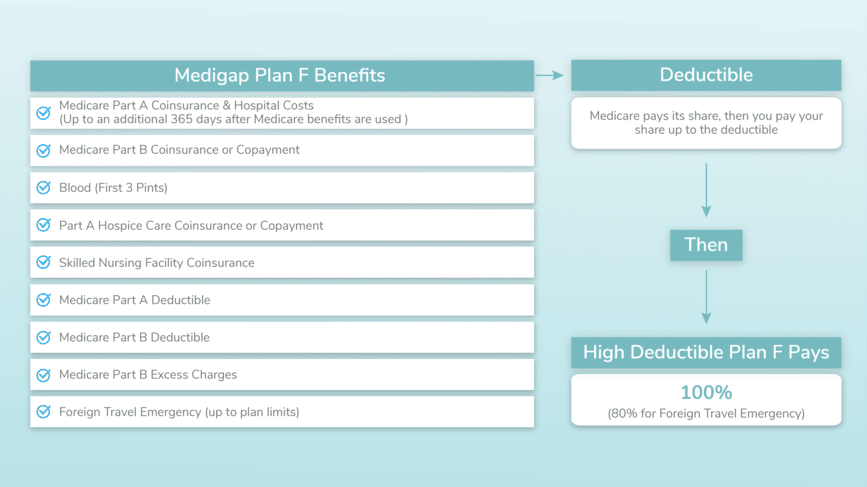

Medicare beneficiaries may change coverage during the Annual Registration Period to meet new economic conditions in the future. Participating Medicare customers are entitled to modify coverage on Medicare Supplement or Medigap any time of the year, for a variety of reasons. One of these changes that you can advise customers about will involve switching from a standard plan F to high-deductible plans F. The Medigap F program offers the best coverage of all current Medigap plans available. Medigap F offers an affordable procedure without any deductibles - the deductible is zero.

Medigap is Medicare supplement coverage which fills gaps in Medicare Original Medicare and is sold by private firms. Original Medicare covers most or some parts of coverage for health services and supplies. Medicare supplement coverages may pay for some of the remaining health expenses such as. Some Medicare insurance policies also cover services not included on the Original Medicare program, such as travel insurance.

Medicare covers most healthcare expenses for people 65 or over. The money will also cover medical treatment for people under 65 with disabilities. You can purchase Supplement Insurance to cover the cost of medical expenses, Medicare does not reimburse you. Because it covers some Medicare coverage gaps, it's sometimes referred to as Medigap insurance.

Medicare Supplement plans are available for people whose Medicare Part D is not yet fully implemented. Your open enrollment period begins the day you turn 65. During the current Medicare Supplement Open enrollment period, there is no policy denied unless there are current health issues. Not all state insurance plans are allowed and many states offer plans or services for older adults eligible to receive Medicare. Medicare Supplement insurance allows you to visit any health care provider accepting Medicare patients. Anthrax offers Medicare Supplements plans that cover the entirety of Part C coinsurance.

F Plans provide for deductible and co-pay insurance. Plan F is only valid for those whose eligibility was first approved in February 2020. Various states also offer selections and innovations.

Plan G covers costs not covered by Original Medicare unless Medicare reimburses for a deductible in Part B or a deductible. Select and Innovative can also be ordered from various states.

Part B is billed for a portion of the cost of Part B insurance. You are also responsible in the event of deductibles. Select N and Innovative N are available for a few countries.

Medicare has one part. Part A covers health care and Part B covers other medical costs. You can take meds and wards that accept Medicare. Supplements are available only for Medicare Originals. Medicare Part A hospitals cover medical care. Medicare Part B hospitals cover medical care. Part D (prescription medication coverage) covers generic and brand-name prescription drugs. You may qualify for drug coverage through your own drug plan or by signing up for Medicare Advantage Plans if your prescriptions are not covered. Usually your insurance plan covers a prescription for prescription medications.

It could make sense for you to sign up for a health-care plan called Medicare Part B. You need to have Medicare Part A and Part B and live in the area of a health care plan. Medicare Advantage will be offered by the government to Medicare beneficiaries in some parts of the country. Medicare pays members a fee each month for Part B services through Medicare. These are the premiums that Medicare pays for Part B and Medicare Advantage. Co-pay must also be paid if there are any deducted or deductible costs for an insurance policy. If your Medicare benefits are not covered, your notice of benefits will not appear.

Assignments are agreements between physicians and other health care providers and Medicare. Doctors accepted assignments pay only the amount Medicare pays. All deductible charges will be paid by you. Doctors that refuse assignments will likely incur fees over Medicare's prescribed limits. Your responsibility is in your own hands. In other circumstances, your doctor may ask for your entire insurance cost and then you can wait until your insurance is credited. Use your Medicare summary notification to review charges. Quarterly Medicare summary notification is sent by the Medicare department.

Unlike traditional Medicare plans, where policies differ by provider, they have standardized the benefit packages for each individual letter. It means the United Healthcare Supplement Plan G will cover the same benefits as Plan G offered by Aetna. Generally rates are different from business to business as a provider has a different pricing model. It is crucial that this should include the financial strength of the company as well as any past rates that may have increased. Some companies may offer lower rates, but increase your rates faster after age.

Plan G and Plan F are the simplest Medigap options. Plans A and B are only available to Medicare eligible individuals before 2020. The plan's benefits are broad and about 46% of Medicare supplement users use it. Plans have a 27% market share making them the preferred option for newly eligible Medicare recipients.

Most people prefer Medigap Plan G of UnitedHealth Care AARP. It offers medical coverage from a good quality business. However, all supplements have the common benefits and are able to cover the cost of medical bills as with original Medicare Part A.

The best insurance supplement is a program where the cost is balanced. Policies which offer a greater coverage for the health services usually require higher monthly premiums. More plan b plan c plan e plan f k plan d plank plan d plan e f. The rate can be determined depending on the place in the country, gender and other characteristics. Plan G will benefit people with very little medical bills who will pay about $145 monthly. Having a calm mind is a good way to avoid unexpected medical expenses.

Medicare supplement coverage helps cover gaps in deductible payments, coinsurance, and copays. Medicare supplement coverage covers services Medicare says are medically necessary. Payment for these services is generally governed by Medicare's approval. Some insurance programs provide benefits Medicare does not provide such like emergency care outside the country. Medicare supplements are provided by private insurers licensed by TDI. The Medicare Supplements Benefit is regulated by the government.

If you have an opening enrollment period, you should get Medicare Supplement insurance. You begin open enrollment in Medicare Part B if you're over 65. These days the companies no longer offer insurance for people with health problems. If you wait for the open enrollment period, you can't purchase insurance if you don't already have an existing health condition. Your Medicare Supplement policy will renew annually for a continuous policy of coverage based on your needs. If you have stopped using your Medicare Supplements policy, then you will probably lose it or have to purchase a new policy.

Medicare Supplement programs don't offer prescription drug cover but offer Part D plans with additional premiums. Medicare Supplement plans also lack dental or vision protection, but it's possible to acquire Anthem vision protection for an additional premium for residents from Texas or Arizona. The state offers a variety of innovative Medicare supplementary plans that offer hearing and vision support.

Before purchasing a health insurance plan, find out how to pay the Medicare premiums without any additional costs. This list of options will help you with paying your costs.

The Medicaid Medicare Savings Program provides for insurance coverage for those eligible for Medicare payments and reinsurance. This type of program allows people to save money for expenses and buy coverage. Medicare savings: Federal Medicare Part B insurance plans pay Medicare Part B premiums and cover deductibles and copayments. It does not require a health supplement insurance plan for QMB members. The remainder of this program covers Medicare Part A or Part B premiums. You may have to purchase Medicare supplements in order to get some extra money back from other expenses.

The open enrollment period for the Medicare supplement plan is six months of your Medicare supplement plan. During these periods, the insurance providers will offer you coverage even in a medical crisis. This open registration period begins when you enroll in the Medicare Part B. You need to purchase both part C and part B to qualify for Medicare Supplements. You may use the open enrollment option multiple times during the 6-month period. You might decide to change a policy, buy a new policy, or buy a different Medicare supplement policy. Medicare Part C, also known as Medicare Advantage, is a type of health insurance plan offered by private health insurance companies that contracts with Medicare to provide Medicare Part A and Part B benefits.

Medicare supplemental plan G and F offer high-deductible options. In addition, the Medigap plans J can be purchased without a deductible. It is available to all individuals who haven't started a Medicare program before 11/2 2020.

Overviews. Medicare Supplement Plan F provides the largest Medicare supplement coverage. It covers both Medicare deductibles, Copays and Coinsurance, leaving no extra money for you to spend. It was updated to 2022.

Medicare Part D (prescription drug coverage) pays for generic and brand-name prescription drugs. You can get prescription drug coverage by joining a stand-alone prescription drug plan or by buying a Medicare Advantage plan that includes drug coverage. If you have group health insurance, your health plan might already cover prescriptions. Prescription Drugs, Dental, And Vision Coverage Medicare Supplement plans do not include prescription drug coverage, but you can purchase a Part D plan for an additional premium to help cover medication costs.

Prescription drug plans are health insurance plans that cover the cost of prescription drugs. These plans typically provide coverage for both generic and brand-name medications, as well as over-the-counter drugs.

Medigap's advantages are as follows: Added premiums on monthly. Have difficulty finding the various plan types? This plan does not offer prescription coverage.

One such change you may recommend to your clients is moving from traditional Medigap Plan F (Medigap F) to a high-deductible Plan F (Medigap High-F). Medigap F provides the most comprehensive coverage of the current Medigap plans offered. With Medigap F there are no annual deductibles and no out-of-pocket costs for procedures covered by Medicare.

Plans A, H I, and J have not been updated, and are able to be retained in most cases, however a plan can still exist. Medicare customers cannot claim part B of a Medicare premium deductible.

Acting as a representative of Medicare or a government agency. Selling you a Medicare supplement policy that duplicates Medicare benefits or health insurance coverage you already have. An agent is required to review and compare your other health coverages. Suggesting that you falsify an answer on an application. If you believe that an agent or company has engaged in unfair and illegal practices, file a complaint with TDI.