Original Medicare recipients are eligible for Medigap or MedSupp supplement programs to “fill the gaps” in their original Medicare coverage. Medicare Advantage patients aren't eligible for Medigap. Medicaid supplement plans can provide Medicare-approved services that include prescription drug costs or health-related costs. This does not cover dental fees which do not appear to be covered by Medicare. Plans J and B were Medigap policies but were updated in June 2010.

On the other hand, Carolyn needs to enroll in a plan that offers more comprehensive coverage, as she goes to the doctor at least once a month. How Do Medicare Supplement Plans Work? Medicare Supplement plans achieve one goal: lowering out-of-pocket costs for Medicare beneficiaries.

Medigap plans J are currently unavailable to new enrollees. On February 30, 2020 Medigap F was discontinued from enrollee accounts. People in both plans can retain them. Medicare Supplement Plans or Medigap are designed to cover Medicare outright costs for Medicare. Private insurers provide Medicare-approved Medigap policies to fill gaps from initial Medicare. The following terms can help with the selection of the best health plan:

Medicare Supplements provide coverage for some medical expenses that Original Medicare has lost. This plan fills in gaps in your coverage, like copayments, deductibles and coinsurances. If your Medicare Supplement plan is eligible, you can avoid outright expenses for services and equipment that Medicare covers. Find your ideal Medicare plan today!

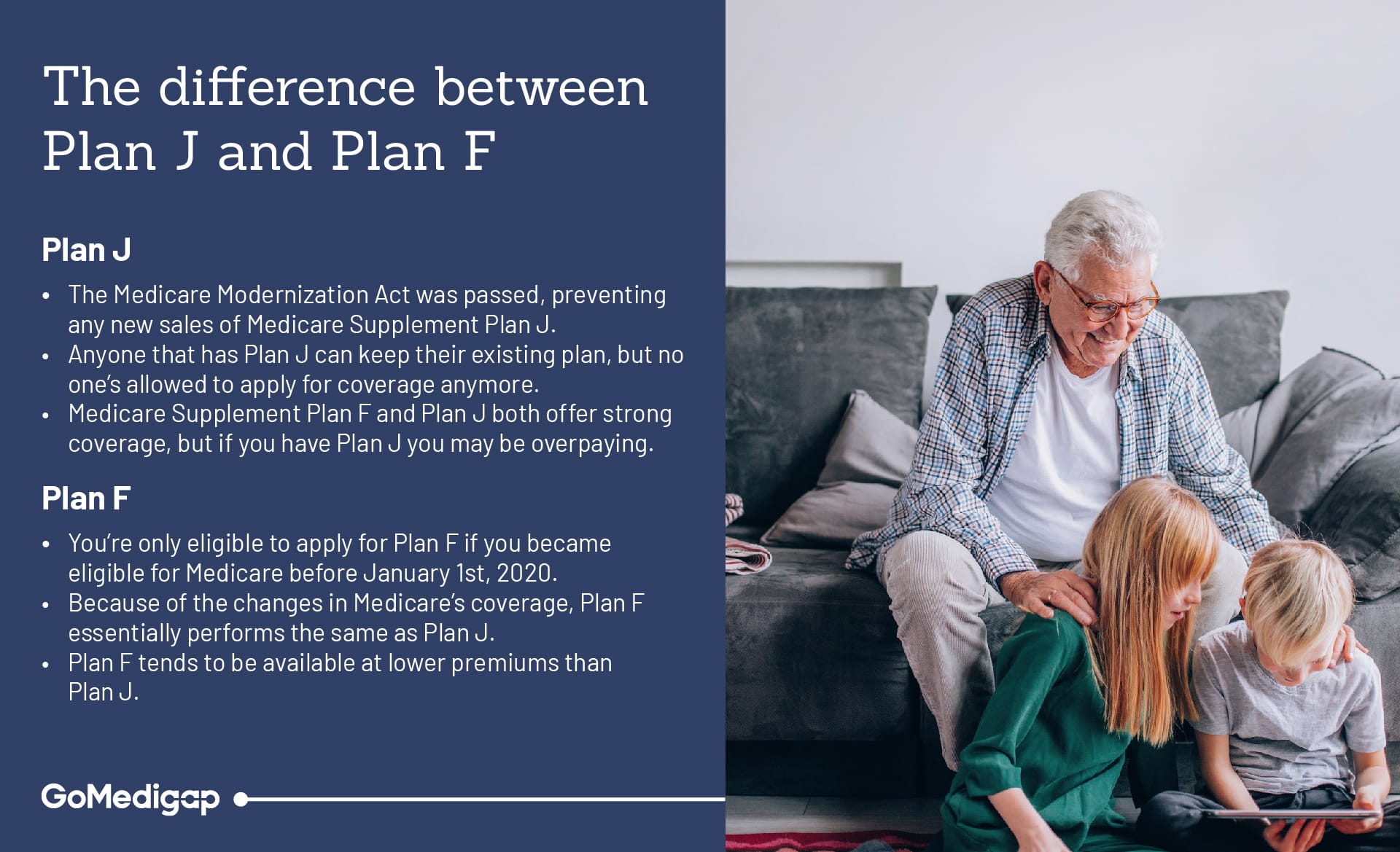

Plan J is no longer available to new participants under Medigap. All beneficiaries with previous participation can use the plans now. Medigap Plans J provides basic benefit packages in multiple ways.

Medicare premiums are based on postal codes and carriers. Medicare supplement plans may be more expensive for different ZIP codes as well as carriers in different areas of America. According to your type of Medicare Supplement Plan, a monthly premium could reach up to $300.

The amount you pay for the Medicare supplement varies. In some cases, utilizing Medicare supplemental insurance can help reduce high unexpected medical expenses. Although premium prices are important factors in choosing the Medigap program, they should not be considered as the main consideration. Ensure you know about coverage costs.

Currently Plan J is restricted to Medicare enrollees, but some Medicare beneficiaries have already joined Medigap.gov. Although Plan J's coverage is fairly comprehensive, the Medicare system evolved over the past 10 years. Some benefits of Plan J are also available through other means through the government Medicare programs. Affected plans may be asking why they should change Medigap policies. Before you drop Plan J, you should consider some things - costs. The yearly taxable benefit for Plan J is $2370 as of 2021 - much larger than the average medical coverage deductible.

In the last couple of months, Medicare Plan J has been widely used due to its comprehensive protection of Medicares outright costs. Medigap plan F offers an extensive array of health care coverage; Plan F is no longer available for Medicare recipients after January 1, 2020. If you aren't eligible for Plan FS, you can try Medigap Plan G. The Medicare Supplemental Insurance plans J and F provide coverage for: The plans J and plan F provide additional coverage for medical emergencies abroad. Although the Plan F offers 100% of all expenses coverage, Plan J has 100% coverage.

Once you start receiving Medicare, you are entitled to Medicare Supplements. If you are on Original Medicare, you don't have full Medicare coverage. So beneficiaries will have to spend money that will quickly increase. The cost can be offset by enrolling in Medicare Supplementary Schemes.

When Original Medicare pays part of it, Medicare Supplement will pay second. In some plans it is possible that the payment cannot exceed the deductible for your plan. Once you factor in a monthly premium the Medicare Supplement plan starts saving you money at your first doctor visit. An annual deductible is the amount of money you have to pay out-of-pocket for covered healthcare expenses before your insurance coverage begins to pay for those expenses.

Medigap policies are a coverage option that provides additional coverage to beneficiaries who already pay Medicare for services. Medigap pays back the remaining Medicare reimbursements based largely on the copayments, coinsurances. Medigap is also available to offer medical assistance when traveling abroad to a country other than the US. In addition to maternity insurance, Medicap provides services like maternity care to people whose incomes exceed $100,000 or less. Some of these plans can no longer be found for those who were recently enrolled in Medicare.

Currently eligible beneficiaries can stay in Medigap plans J as stated above. Only 3 percentage points are enrolled with Medicare supplement plans. Why do I need Plan J? Then you should consider the plan's costs.

Because no new membership has been approved for the plan, the total Plan Risk pool will increase with age and claims frequency. Depending on the plan plan, premiums can increase quicker than others on Medigas. Second, there are benefits. Despite not being identical to Plans J, many other health insurance plans have similar coverage to Plans J.

Medicare underwent some changes after the passage of the Medicare Prescription Drug Improvement Amendments. This benefits update adds prescription drug coverage to Medicare (Medicare Part D), which is now only accessible through Medigap plans in place. Since the Medigap plan doesn't provide coverage for prescription drugs, Plan J was removed in May 2010. The legislation also included new changes in Medicare and a new plan that provides for additional services previously not available through Medicare Plan J like home recovery or preventative care.

AARP Medicare Supplement Plan J is a type of Medigap plan offered by UnitedHealthcare Insurance Company, in partnership with AARP. However, it's important to note that Plan J is no longer available to new enrollees who became eligible for Medicare after June 1, 2010.

Currently Medicare Supplement plans don't offer supplemental insurance coverage for things Medicare doesn't cover. Medicare Supplement Plans are the correct secondary coverage for Medicare Originals.

The plan also pays after the original Medicare pays the remainder of the payment. Medicare Supplements cover varying amounts of expenses. These costs are displayed on the comparison chart below. Some of the benefits a Medicare supplement does not cover include vision, dental, and prescription drugs. But you don't have much luck with Medicare Supplements.

A 2010 Medicare Supplemental Insurance plan has been discontinued. It is not currently offered. Find out what's comparing Plan J with other Medigap programs. In other words, MedigAP is a private insurance program based on your original Medicare plan that helps to pay some out-of-pocket costs like copayments and coinsurance as well. Medigap Plan J is no longer offered to enrolled enrollees. Any Medicare Supplement Insurance Plan J enrolled through 2009 may continue. However, in most states, the plan currently includes 10 Medigap options.

Medicare Supplement Plans are supplemental insurance plans covering medical expenses that Original Medicare leaves behind. Provider billing a Medicare provider first charges the rest to their insurers. Medicare Supplement plan is labelled from A to N in 47 states. Depending on what type of plan you have, the coverage will differ from one to the other. This coverage is sometimes called Medigap. The standard Medicare Supplement Plan means benefits for the letter plan are consistent throughout the nation.

Medigap plans are among the various Medicare supplements available. Since the Medicare prescription drug reform act was implemented in June 2010, the program is discontinued for new participants. In the event that a person is still covered under Medicare or enrolled under Plan J in any way after June 2010, they can still retain that coverage as long as the insurer offers this coverage. Plans J offer the best amount of insurance available. Benefits of the Plan include Medicare Part A deductible.

In the below graph the plan is listed with 10 letters and 2 high deductables which Medicare beneficiaries can access. This policy was adopted in 46 states and Washington D.C. The policy is uniform across all states and all carriers must follow the same rules. The state of Minnesota offers several different Medicare supplement types. Each state provides its own Medicare supplement plan which closely follows all rules from the best Standard Medicare Supplement Plans in the country.

Medicare supplements are designed to reduce Medicare's yearly expenses and reduce costs. When you enroll in Medicare Supplement plans, you are more likely to have medical expenses during this time. Find a Medicare program in 3 easy steps This predictability will help you reduce your unexpected expenses. As with most Medicare Supplement plans, the cost of your premiums are predictable. Depending on the benefits, seeking a Medicare Supplemental plan can be a great solution.

Medicare Supplement Insurance Plans F provides higher standard benefits compared to other current Medicare Supplement Plans. The plan is not available to Medicare beneficiaries who became eligible after January 1, 2020. If your plan is approved for use before 2020, you can continue with the plan. If you were already enrolled in Medicare before 2020, your insurance company may allow you to purchase Plan F if both are offered in your area of residence.

To qualify for Medicare Supplement plans, you will have to join Original Medicare. The best time to apply for Medicare is during the first 6 months of your Medicare Supplement open enrollment period. This enrollment period begins the month your Medicare Part B becomes effective. If you sign-up for an upcoming Medicare supplement, it guarantees you the right to issuance of the policy. Your preferences will not interfere if you are not enrolled.

Not all Medicare Supplement plans offer similar services. Usually these schemes attract many more enrollees. The Medicare Supplements plan N and F are among the best-known Medicare Supplements in North America. Find an effective and affordable Medicare plan with a quick checklist. Based upon the size of your budgets, your care plan may suit the best for you. Nevertheless, Medicare doesn't cover every individual Medicare plan.

The median premium costs for Medicare Supplemental Insurance Plan J in 2018 amounted to $60.07 per month1. The cost of a Medigap program often depends on factors including gender, age, health rate of your insurance provider and your location. The average costs shown above include Medigap Plan J options with lower rates as described, as well as plans with higher premium costs. Plan J can be purchased for new enrollments now.

Due to the many options available with Medigap you may feel overwhelmed with options. Here are some good ways to find a suitable health plan that will suit your circumstances. SHIP offers free help with selecting policies. Not everyone participates in SHIP. Find out the full story here. Research online: Please visit CMS' Official website for detailed details about Medicare benefits.

The Medigap plans aren't covering prescription drugs anymore. Medigap plans cover only some Medicare-related costs, which includes coinsurance. You can take out Medicare and Medigap plans as well; both have distinct benefits. It is illegal in most states for a person to be able to have two different Medicare Supplement plans simultaneously.

Plan J will not be offered in the event of a Medicare withdrawal after 2010. Nevertheless, other plans exist with similar benefits to Plan J. Previously, the nearest compatible option was Plan F, but in January 2020 no longer offers new enrolled Medicare. The best comparable plans currently exist plan G and plan N.

Get enrolled in our email list for Medicare guide and latest Medicare news. Click on the "Submit an Application" button. You acknowledge receiving a Medicare Advantage email. Massachusetts, Minnesota and Wisconsin differ in Medigap standard and option.

Medigap is also a program for a small number of people if you want to save for an unexpected health insurance premium based on your health insurance premium. In contrast to government programs, Medigap is offered by private insurance firms. Private insurance companies are insurance companies that are owned by private individuals, organizations, or corporations, rather than by the government.

If you do not already have an active plan for J, there are several Medigap plans that will offer similar services. Licensed insurance agents are capable of showing how much coverage and the costs for a plan can be.