In one look, Original Medicare customers could enroll in the Medicare Supplemental Plan, called MedSupp, for “filling in the gaps” in the coverage under their original Medicare plan. Medicare Advantage customers may be denied coverage by Medigap.

The Medicare Supplement Plans help pay for certain expenses, like prescription medication costs. There will be no dental or other expenses which can't be covered by an Original Medicare plan. Plan J was Medigap's Policy that has not been released since June 2010.

Medicare Supplement Plan J provides subsidized coverage to cover the cost of living. The Medicare program was stopped by the company to enroll new customers. Medicare supplement plans or MEDICAP cover the costs of those who are enrolled in Medicare, like coinsurance and deductibles. In addition, private insurers administer Medicare coverage that is covered through a Medicare-approved plan. The Medigap policy may not be applicable if Medicare benefits are changed.

Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and copayments. If you want to get Medicare prescription drug coverage, you have two options: You can enroll in a Medicare Advantage Prescription Drug plan (MAPD). These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs.

In the past the Medicare Supplement Programs have been used in several ways. Medicgap plans help cover things Medicare doesn't cover (including the medical bills and copayments). Medicare Supplement Plan J is no longer available to Medicare-accountees after January 1, 2010. Anyone with the plan can continue to receive their benefits. Read more for a complete overview of Medigap's J plan coverage.

Medicare Supplement insurance plans were not renewed until 2010 for new enrollment. Only beneficiaries with prior enrolled accounts can use this service. Medigap plan provides many basic benefits to its clients.

According to previous reports, a person may remain on a Medigap plan J for at least two years. Only 3 percent of Medicap recipients participate under Medicare Supplemental Insurance Plans. 22%. What are your plans to retaining Plan J? The next consideration will be determining the price of a plan.

A new membership will no longer be allowed to join Plan J, thereby increasing overall plan risks by a significant proportion. Age and frequency of claims. Plan J premium may increase more rapidly compared with other Medigap Plans premiums. Among other factors there must also be the benefit. Although no Medigap plans can be identical to plans J, dozens come close in quality.

Medicare plans J are widely available to patients because they are backed by comprehensive coverage of Medicare' s deductible. The option for a variety of healthcare coverage costs remains present in Medigap Place F.

The Plan F plan cannot be used for beneficiaries who are eligible for Medicare prior to January 1, 2020. In cases when your plans don't include a plan for F, it may be worth looking into MediGap plan G. Both Medicare Supplement Insurance Plan J and Plan F provide the following coverage: Plan J and Plan F provide the insurance for international travel emergencies. Although plan F provides 80% coverage, plan J provides 100%.

You can learn more by reading Does Medicare Cover Home Care. Because Medicare doesn't cover personal care, or Long Term Care, neither does Plan J Medigap Plan J Is Now Obsolete Going back to what we discussed earlier, Medicare Part D covers prescription drugs, making the drug coverage inside Plan J obsolete.

Prescription drug plans (PDPs) are health insurance plans that help cover the cost of prescription medications. PDPs are a type of Medicare Part D plan, which is a program that provides prescription drug coverage for people with Medicare.

Medicap plan J is regarded among several Medicare Supplements available. As a result of the Affordable Care Act 2003, the plan was discontinued by the new enrollees. But people who have enrolled in Medicare after April 2010 or have already enrolled in Plan J can retain their insurance if it continues to be offered to customers. Plan J was designed to give people maximum protection for their medical needs in determining their future health. The benefits from Plan J are: Part A coinsurance and hospital stay for 365 days after Medicare Benefits have been exhausted.

Medicare saw a major transformation in 2003 when its prescription medications reform legislation became law. This benefit change adds prescription drug protections to the Medicare Part D program – a program previously only available through Medigap Plans. In June 2010 plans were retired due to the fact that Medigap plans did not offer prescription drug coverage. It also amended the original Medicare program to add coverage for health benefits previously not offered under the Medicare plan J such as home rehabilitation services.

Medicare Supplement Insurance Plan J no longer provides coverage for new enrollments. Learn the benefits of J that differ from existing Medigap Plans. Medigap is private type insurance, which is used with Medicare Part a and Part b for certain Medicare deductibles and copayments. Medigamp Plan J has been discontinued for new enrolled customers since 2010. All patients enrolled in Medicare Supplement Insurance plans J or later may continue to qualify. Medigap is currently offered in the majority of US countries however.

While Plan J cannot be accessed by new Medicare beneficiaries, there are certain Medicare patients who enrolled on such Medigap policy types. While Plans J covers some coverage quite comprehensively, Medicare is evolving over the last 10 years and many plans have additional benefits within its Federal Medicare plan. The change could have led plan J users to be confused about how to update the Medigap program. There's a number of reasons to drop Plan J and switch to a cheaper Medigap program.

Because Medigap is available for many different types of customers there is understandable confusion. Below are some best methods of finding the best medical coverage available for a patient. SHIP can help with selecting policies. Please note that not everyone participates in SHIP. Find out how to use it here. Research online: See the Centers for Medicare and Medicaid Services website for detailed information regarding Medicare coverage.

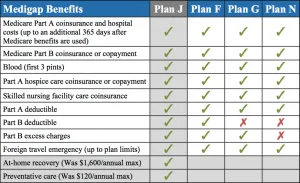

This Medicare Comparison Chart compares the benefits of every type of Medicare Supplement Insurance plan available to new enrolls in 2022. Please scroll to the right to view the chart to view the expanded graph. If you are already in a Medicare Plan C, you can enroll as soon as the plan is available at your location. Plans E, D & E have high-deductible plans that each have a maximum annual deductible of $2490.20 by 2022.

The annual Medicare Supplement insurance premiums were $60.07 per month. The costs of MediGap are usually determined by factors including age and gender health care and the amount the plan costs. This average price list also covers options in Medigap Plan J that are less expensive than those listed, as well as some plans that carry comparatively high premium costs. It will not be sold in any new enrollment year.

Medicare's policy serves as the extra protection when the policy is purchased. Medigap reimburses Medicare patients with the remainder of their costs including deductibles and copayment costs. Medigap may also offer medical assistance that Medicare does not offer. There currently are 10 different Medigap Plans: C, D, A, B, and C. Some plan options are not currently available for people new to Medicare.

Medicare Supplement Plan F provides a standardized benefit over other current Medicare Supplement plans. Due to federal law, Medicare plans are not able to offer coverage in the first year of their existence. You should have planned on keeping your C plan until 2022 or Plan F. If your Medicare eligibility was not met by 2020 you could still get a plan F or plan C if both of these plans are available.

Plan J was never a viable choice for the people who didn't have Medicare before 2010. Several plans still exist offering similar services to Plan J. The closest compatible option was Plan A before, but the new plan is not available in January 2020 for Medicare enrollees. The most current comparable options are Plan G and Plan N.

Medigap Plans have been withdrawn. Unlike Medicare, Medigap does not pay the full Medicare cost for medical care. You can take advantage of Medicare prescription drug protection by using one of the following options. You cannot use both Medicare Supplements and Medicare Advantages for the same period of time.

Get us your free Medicare guide and latest Medicare information in your email. Please click here to register! By registering with MedicareAdvantage, he or she agrees with MedicareAdvantage and Medicare.gov. Massachusetts, Wisconsin and Minnesota offer varying plans.

Although you don't have plan J unless you are currently enrolled, there are a variety of Medicare Advantage plans which offer similar services. An insured agent can assist you with finding out the plan's coverage and what it costs.

Medigap Supplemental Insurance provides supplemental insurance for health expenses the original Medicare does not provide coverage for. Unlike Medicare, Medigap offers private medical insurance companies.