Medicare Supplement or Medigap differ from each other as the same health insurance plan - both have their own names. Medicare Supplement and Medigap are different names of the same type of insurance. The term Medigap is a health insurance policy designed to address some “gaps” of health coverage which Original Medicare does not cover. The “Medicare Supplements” are an alternative to traditional Medicare that covers the cost of a portion of your out-of-pocket medical expenses.

Medigap plans (also referred to as Medicare Supplements) are available in private markets that help pay for some health care services Original Medicare does not include. Many Medigap Plans also provide coverage for services that Medicare does not include such as medical care if you're traveling overseas from your home. Medicare pays the Medicare Part A premium on unused medical insurance for covered services. You can pay Medigap if you pay it back.

Medigap Medicare Supplement Insurance provides assistance in filling gaps in the Original Medicare program, which is offered by private organizations. Medicare pays a large portion, though it may not cover all covered healthcare. Generally speaking, Medicare Supplement Insurance covers certain costs, such as medical bills. If you have original Medicare and you buy Medicare Supplement insurance, it will cover certain health benefits.

Medicare offers health coverage for elderly individuals. Besides, there are various types of coverage and benefits. Medicare is also subject to problems, with many gaps completely hidden. You can apply for supplemental Medicare and/or Medicare Advantage plans to meet these needs. We have gathered the best information available for evaluating each of your options.

Our reviews are unbiased and advertising does not influence our picks for this list. You may be compensated for the visit with the partner you suggest. Please see the advertisement disclosure page. Any person interested in joining Medicare will need to make many decisions. Which is the most important choice for a new Medicare plan?

Medicare - Medicare Advantage health plans have similarities with private medical insurance. Some services are covered with just an additional charge. Plans provide HMO networks as well as PPO networks and all plans set annual minimum costs. All plans are regulated by various benefits. Some have prescription drugs. Certain patients need a referral for seeing a health professional, but other people don't. Some may provide outside medical care and some may cover physicians and hospitals who belong to an HMO or PPO network. In addition, other kinds of Medicare Advantage plans exist. Selecting an affordable plan can be crucial.

Medicare Advantage plans offer the same benefits provided as Original Medicare with additional coverage for services that are not covered under Original Medicare. Some plans provide a ride to doctors' appointments or adult day-care services,” said Amanda Baethke, president of Aeroflow Hospital of Raleigh. Plans may customize their plans to give benefits to those with chronic illnesses. Cigna recently introduced the COVID-19 vaccine transportation service to Medicare Advantage users.

Medicare Advantage plans are sold through private, Medicare-approved insurance providers. It can also be a little more expensive than most prescription drugs. Medicare Advantage plans provide hospitals or doctors with coverage of prescriptions and services not included with Medicare. In 2022, 47% of Medicare beneficiaries chose a particular plan. 5. Most Medicare Advantage plans are operated by health maintenance organizations (HMOs) or preferred provider organizations.

Medicare supplement help you reduce your costs for your life by making it much more cost efficient for the family. “From a cost sharing perspective many customers like this because the doctor can pay for what they have every day when they go to hospital,” added Jacobson. Almost every doctor in America is available. For instance, a resident in Phoenix might fly to Minnesota for May Clinic. Jacobson said having these benefits is more important for people who get sicker.

The Common Wealth Fund has published an article comparing Medigap programs offering nontraditional benefits like eye health and speech care that aren't included with the ACA. We found very little of the plans that offered this benefit just 77%, Jacobson said. “. Many people are unaware that they have plans that provide similar benefits to Medicare Advantage. On the federal level, it is difficult to determine whether the policy encourages or inhibits this benefit.

The monthly average premium for the Medicare supplement is usually between $150-200, depending on where you live as well as your insurer. Similar to Medicare Advantage plan, the 65-year-old will save $841 a year in the Plan G or $648 a year in the Plan N if they enroll in a less expensive option available within the area. Jacobson emphasised that he is pursuing the option of private insurance plans as a method to improve efficiency for the individual population.

Medigap Advantage offers different benefits depending upon your particular health needs. Medicare Medigap provides more health insurance for individuals who have Original Medicare. However, prescription drugs cannot be covered by this program. The Medicare Advantage plan also offers a similar coverage level to Original Medicare with additional services like vision, oral, hearing and other health care services.

5. 55 percent of Medicare-related older adults who qualify for Medicare Part A and B choose Medicare Part A and B, and it covers hospital, physician and other health care services. Approximately 76% of the Medicare Supplement Insurance beneficiaries also pay for Medicare Part D coverage. 6. Medicare Supplemental, aka Medigap plans do not have any relationship to or support Medicare programs. Although it's the most expensive option, its benefits have many.

When shopping, make sure to not believe the Medigap plan is cheaper than Medicare Supplement plans or that the Medigap Plan provides much greater coverage. They've got similar plans. The companies who sell health insurance plans for Medicare must comply with all federal and state regulations aimed at protecting your privacy and must clearly label their plans. Generally speaking it could also refer to the Medagap because of their shorter meanings.

Many Medicaid Advantage programs offer a zero-priced plan. Baethke explained the issue in terms of the fact that Medicare Part B has about 65% premiums per year and that the premiums are about $165. Medicare Part B coinsurance and the deductible is $226. If you meet this requirement, your copay under Medicare Advantage will usually exceed 20% of the Medicare-approved value. For many services / items such as durable medical equipment and glucose.

Medicare Advantage is generally available to: You must be registered as a member of Medicare Part A or Part B (hospital insurance) and live within Medicare coverage areas. Enrolment occurs only during some periods and no claim will be denied unless there is some pre-determined medical condition. In this context, you are able to enroll in Medicare Advantage plans in three windows.

Original Medicare includes Medicare Part C (hospital and dental insurance). You can supplement these insurance plans by purchasing one or more Medicare Part D supplemental health insurance products. If a patient has joined Medicare for Part A or Part B then they must purchase these supplemental coverages themselves.

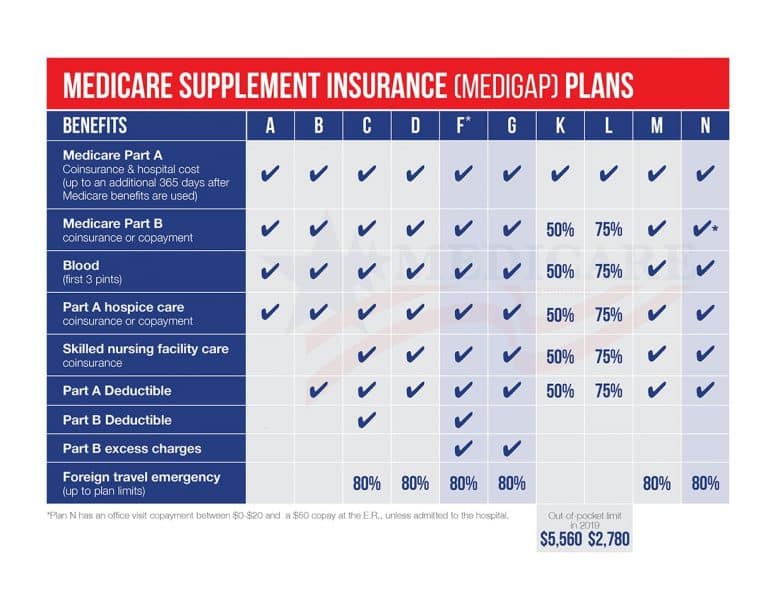

Private insurance companies offer Medicare Supplement plans or Medicare Advantage plans. 34% of people who are enrolled in Medicare were covered by the Medicare Supplement program in 2018, the Kaiser Family Foundation said. The Medigap plan provides standard insurance with deductibles, coinsurance and copayments.

If it isn't available, you can buy another Medigap policy. The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D) . If you joined a Medicare Advantage Plan when you were first eligible for Medicare, you can choose from any Medigap policy. Some states provide additional special rights to buy a Medigap policy.

Getting health insurance in retirement can be challenging since you never know when it will cost you much more than your income yearly will. While traditional Medicare Part A or Part B offers good coverage, it covers just about 85% of hospital fees approved to reimburse physicians. Approximately 20 percent is for individual responsibility, but the statutory limits do not apply to coverage under the ACA. Tell us about the reason for heart bypass surgery.

Original Medicare pays for much, if not all, of the costs associated with obtaining medical insurance coverage. The Medicare supplement insurance (medigap) plan may help pay recurrent medical costs, including copays or.

A Medicare Advantage plan can help you avoid large financial losses. Medicare, plus the Medicare Medigap coverage typically gives you more freedom in how you receive treatment.

If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap plan pays its share. What are the differences between Medigap and Medicare Advantage plans? A Medigap plan is different from a Medicare Advantage (MA) plan (PDF, 107KB) . MA plans are a way to get Medicare benefits, while a Medigap only supplements your Original Medicare benefits.

Some disadvantages of Medigap plan include: Higher monthly premium. It is necessary that you understand different types of plans. The insurance does not cover prescriptions (which can be purchased under plan D and E).

As you shop for a policy , be sure you're comparing the same policy. For example, compare Plan A from one company with Plan A from another company. In some states, you may be able to buy another type of Medigap policy called Medicare Select . If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

Medigap is an insurance program that is sold privately to pay the cost that Original Medicare does not cover such as premiums, coinsurance and deductibles. Other Medigap policies cover certain advantages Original Medicare cannot provide.

Medigap helps pay your Part B bills In most Medigap policies, the Medigap insurance company will get your Part B claim information directly from Medicare. Then, they pay the doctor directly. Some Medigap insurance companies also provide this service for Part A claims. If your Medigap insurance company doesn't provide this service, ask your doctors if they "participate" in Medicare. This means that they "accept assignment " for all Medicare patients.

Know More:

Medicare When Moving to Another State | Medicare Coverage of Ambulance Services

Is Silver Sneakers Covered By Medicare | Medicare Supplement vs Medicare Advantage Pros and Cons