There is often a misconception about who is responsible for medical expenses. Many consumers are confused when they feel that Medicare or supplemental coverage for extended care is needed. Unfortunately, it doesn't work. In addition Medicare may cover up to 200 days of skilled nursing in long-term care. After 90 days of coverage, the insurer will not provide any additional benefit to either of them.

Medigap is an insurance program geared at filling gaps between Original Medicare and private insurers. Medicare covers most or most of its costs for coverage of health care and other products if needed. Some health insurance products can help you cover the rest of your health care expenses such as.

The coverage that is available focuses on any qualifying medical services received as part of long-term care services. Temporary stays in skilled nursing facilities, which are often also long-term care nursing homes, can be covered by both Original Medicare and Medigap supplemental insurance. Patients who have had surgeries that require longer rehabilitation periods often use skilled nursing facilities to aid in their recovery.

Medicare Supplemental Plan Benefits: Extension of Medicare benefits. Each plan varies in benefits. Unlike traditional retirement plans, a senior does not receive rembursements from the health care system despite making a lower payment. Benefits are dependent upon what insurance plan an individual purchases from a particular insurance provider. Medicare will pay for skilled nurses 100% for ten days or about 90% for 80 days. Almost all Medicare Supplements policies (Medigaps) cover 80%. Senior citizens also can receive at least 100 days of residential health care at no outright cost.

Even the best-in-class Medigap Plan does nothing to address the elderly. Medigap plans are an attempt to fill a gap in Medicare insurance. But a Medigap plan doesn't cover aging needs. This policy does not cover assisted living, Alzheimers care, custodial care (personal care), or adult day care services. In best cases, they provide care to nursing home residents temporarily or support their hospice care. Medicare provides limited help to seniors recovering from injuries in a medical procedure. They are just temporary.

Private supplement Medicare insurance aims primarily at addressing unforeseen gaps in Medicare. Moreover they provide specialised services to the patient's needs. Supplemental coverage does not cover custody or interim care. Medicare Supplement Plan A – N has 10 modernization options. The six plans that cover the coinsurance for skilled nurses not covered by Medicare are labeled C, E, F, M and N. Plans K and L cover 50% and 75% each. Coinsurance is a premium due during a medical visit to the nursing home.

The biggest gap they fail to bridge is for custodial care in a nursing facility or for skilled care in a nursing home beyond the first 100 days. For coverage of this type of care, you must either purchase long-term care insurance or qualify for Medicaid coverage. Medigap also does not cover vision care, eyeglasses, hearing aids or dental care unless such treatment or equipment is needed as the result of an injury.

These areas of coverage include the coinsurance for days 21 to 100 in a skilled nursing facility, the Part A and Part B deductibles, foreign travel emergencies, and prescription drug coverage. States may authorize the sale by insurance companies of the basic plan package and any number of the other nine approved combinations of benefits, so there may be fewer than 10 options to choose from in your state.

Medicare Supplementary insurance is often called Medigap. Medigap is a supplement to the original Part B - Part B Medicare plan sold by the private sector. To be clear, a Medigap policy isn't useful when a user has Medicare Part C coverage. Also, the Medicap policy does not cover Medicare Advantage users. Among the 10 standardized Medicap plans available under Federal law are the plans A B C D F G, C, M and N. None of these plans are offered across the nation and no insurer has chosen to offer all plans.

Medicare Part B covers medically necessary ambulance services to the nearest appropriate medical facility that can give you the care you need.

Medicare does not offer long term care services at the cost of the individual. Part A - B provides full coverage for skilled care after a 20-day accident or illness. After 20-day treatment, Medicare can cover roughly 80 percent of the cost. After 100 days of care there will not be another reward. The truth remains that Medicare only offers benefits to patients undergoing long stays in hospitalizations. The medical services provided are managed by a doctor. Medicare doesn't cover supervised care.

They can, however, help cover costs like coinsurance and deductibles for post-acute care. Do Medicare Advantage Plans Cover Long-Term Care? As of 2019, Medicare Advantage plans can offer benefits for some long-term care services. These benefits include transportation to doctor appointments and frozen meal delivery. If you have an Advantage plan, you should review your policy for details.

Yes, so long as you save nearly all your assets and share the rest with someone. Medicaid may also affect spouses share of property after their death. Medicaid Spenddown and recapture is an arduous process that is financially and emotionally difficult for spouses and family alike. In some state Medicaid facilities, care received may not meet family expectations. Medicaid is generally only available after estate expenditures.

When a senior is in recovery mode following an accident or procedure, Medicare plans will help in a limited capacity with skilled nursing care. But this is short-term only. Medicare pays for 100% of skilled nursing care for the first 20 days, and then a coinsurance applies for the following 80 days. But with most Medigap plans, 50-100% of the remaining cost is covered, depending on your specific plan.

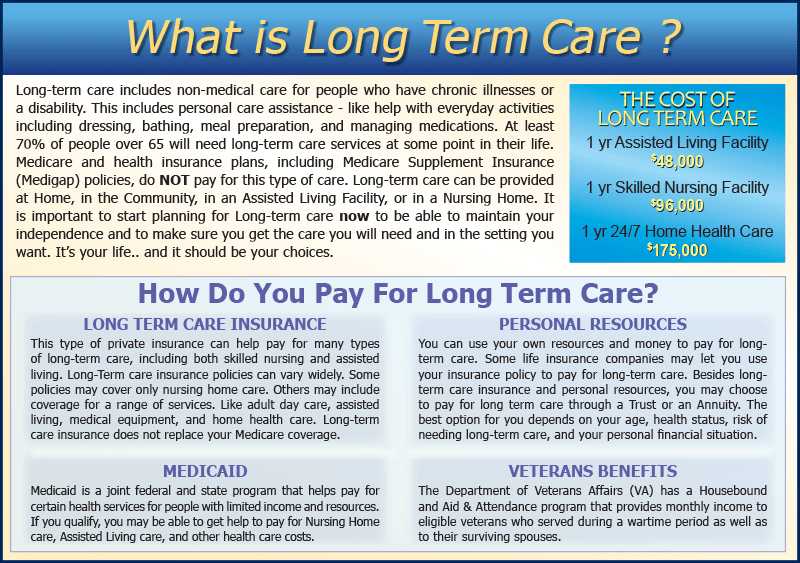

Long-term care is a range of services and support for your personal-care needs. Most long-term care isn't medical care, but rather help with basic personal tasks of everyday life (also called "activities of daily living"), such as dressing and bathing. Medicare (including Medigap plans) doesn't cover long-term care or nursing home care, because both are considered custodial care.

Seniors can therefore receive up to 100 days of nursing home care with little out-of-pocket cost. No Medicare Supplement Insurance / Medigap policies pay for assisted living, memory care, or other forms of non-medical personal care. Medical care is covered for people who reside in assisted living, but not room and board or personal care received in those residences. The Medicare Flex Card is a prepaid debit card that can be used to pay for healthcare expenses.

A medical alert system is a device that is designed to provide an individual with medical assistance in the event of an emergency. It typically consists of a base unit and one or more wearable devices, such as a wristband or pendant.

You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

There are ten modernized Medicare supplements to choose from – Plans A-N. The six plans that fully cover skilled nursing care coinsurance not covered by Medicare are labeled C, D, F, G, M and N. Plans K and L cover 50% and 75% of the bill respectively. Skilled nursing facility coinsurance is the amount due in days 21-100 of a hospital or facility stay. In 2014, the coinsurance amount due per day is $152.00 after day twenty. Each year, Medicare usually increases the skilled care coinsurance amount by a small amount.