Medigap is Medicare supplementary coverage which fills in gaps in Medicare that is sold by private corporations. In the first instance, Medicare covers the majority of the costs for medical care and equipment. Some Medicare Supplement Insurance (Medicap) policies may help cover the remaining healthcare costs.

If you are in Medicare Part A or Part B Original Medicare, Medigap Plans can help fill the gap for Part A and Part B coverage. The Medigap plan is backed by private insurance providers that offer supplemental financial support for medical bills. Medigap plans are standard. However, some plan types will vary depending on your area.

The Initial Enrollment period has a limited time during which individuals will qualify under Original Medicare. After your enrollment for Medicare Part A and Part B, your insurer will provide additional coverage options. The most effective time to purchase Medigap coverage is the six-month period that begins on the day that you turn 65 or older and enroll in Part B. You will have to pay an extra amount to buy the Medigap policy. In some states, enrollment periods can be extended.

Medicare coverage does not restrict network coverage in any location that Medicare accepts.

You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium.

Medigap 4 steps to buy a Medigap policy Guaranteed issue rights How to compare Medigap policies Medigap & travel When can I buy Medigap? Buy a policy when you're first eligible The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have Medicare Part B (Medical Insurance) Part B covers certain doctors.

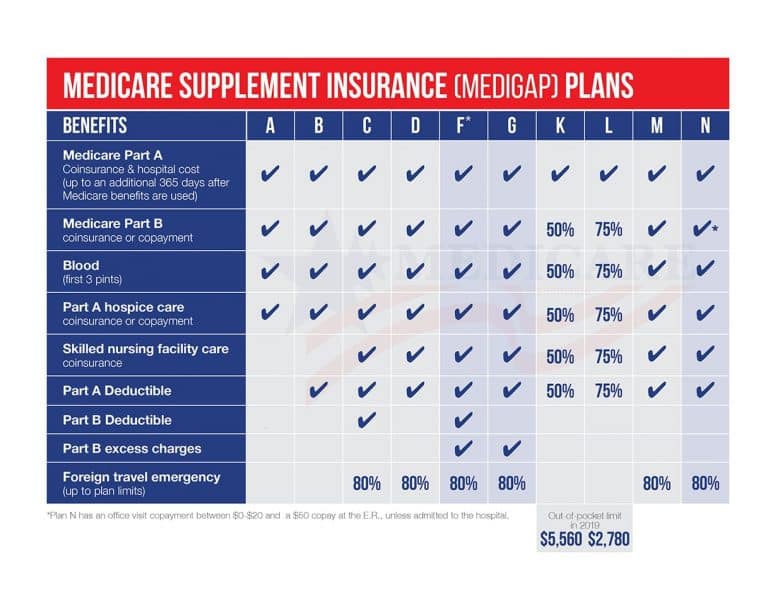

Medigap plans (sometimes called Medicare Supplements) are offered by private insurers that may help with health insurance expenses that Original Medicare does not cover, including copayments, insurance and deductibles.

As you shop for a policy , be sure you're comparing the same policy. For example, compare Plan A from one company with Plan A from another company. In some states, you may be able to buy another type of Medigap policy called Medicare Select A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits.

Medigap plans offer several disadvantages. Have a difficult time finding a suitable plan. No prescription protection for the plan.

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

If you're healthy and have very little health expenses Medicare is the best and moneysaving alternative. However, if you suffer from serious medical issues that require costly treatments, Medigap is generally better.

Medicare Supplement Insurance ( Medigap ) is extra insurance you can buy from a private company that helps pay your share of costs. Enter your ZIP code Start How to buy a Medigap policy Step 1 Decide which plan you want Medigap policies are standardized, and in most states are named by letters, Plans A-N.

Is it necessary to take Medigap? Medigap policies supplement Original Medicare coverage by ensuring you cover additional charges. Medgap has a wider network of healthcare providers compared to many others. If your travel insurance is not provided by your current Medicare plan, then Medspap is an ideal solution.

Medicare Supplement Insurance ( Medigap ) is extra insurance you can buy from a private company that helps pay your share of costs. Enter your ZIP code Start How to buy a Medigap policy Step 1 Decide which plan you want Medigap policies are standardized, and in most states are named by letters, Plans A-N.

After this period, your ability to buy a Medigap policy may be limited and it may be more costly. Each state handles things differently, but there are additional open enrollment periods in some cases. Title When to Enroll Description When you are first eligible, your Initial Enrollment Period for Medicare Part A and Part B lasts seven months and starts when you qualify for Medicare, either based on your age or an eligible disability.