The price of Medigap will vary considerably between cheapest available prices and high. Medigap is reporting premium rates for the plans in the 50 states (female, 65 years old). How can a health care insurer offer a free quote to their customers for health care? The insurance provider is responsible for determining what coverage is needed under Medicare. One plan G is basically the same as the other plan G. Nevertheless, insurance companies have different pricing. They also increase the rate I'll bet. I believe in being good shoppers. Comparing different plans will help you choose the most affordable coverage available. It may save money in large quantities.

Medicare Supplement (Medgap) plans have different costs in different states. Although Medicare benefits are universally available, Medicare costs vary widely between states. How do you find a Medicare plan? Rules about price policy vary by state and costs of living may also influence price differences. Below, we listed some of the most expensive states to purchase Medigap insurance in.

Learn how much Medicare Part B and Medicare supplemental health benefits cost. Original Medicare Parts A and B have standardized costs for all states. In some cases however, a premium for Medicare supplementary insurance plans may vary depending on the location of the patient's house. The following table summarizes the average Medicare benefit costs for each state.

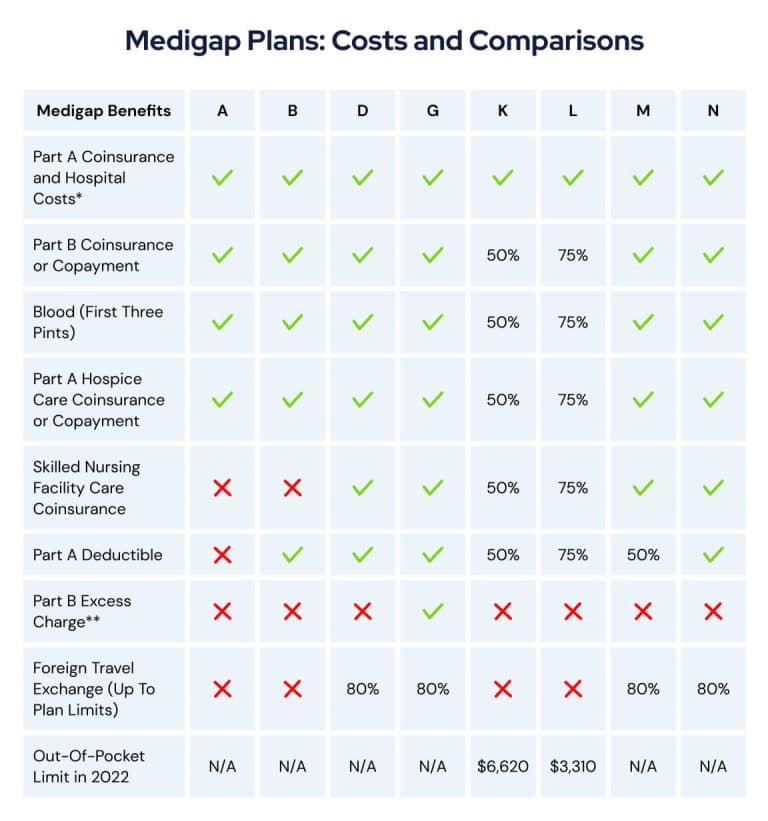

Typical premiums for Medicare Supplement insurance plans are around $150 a month, industry sources say. These insurance programs are intended to fill the gaps between Original Medicare Part B insurance and Medicare Advantage Part D. Medigap helps offset any deductible costs you might be incurred, including coinsurance. Medigap Supplements provides coverage for: The Medigap plan is managed through an individual insurance company that Medicare reimburses. These variables result in a large fluctuation in policy. Two insurers will likely charge very different fees to the same insurance company. In most situations, the higher the insurance cost.

Medicare costs vary largely according to states. The state listed uses community ratings to calculate plans prices. It does not mean that there are differences of premium cost between male and female enrollees. All people of different years pay the same coverage rates as the plan. Medigap premiums are typically much higher throughout the country using community rating technique. In addition, the states listed are often very expensive to live in. The state of New Jersey, Rhode Island, Rhode Island, and Maine are among the most expensive to live in.

For 2023 Medicare supplemental insurance premiums were approximately $1500 a month or $1000 an year. Many things impact Cost of Medigap, including age and location. Rachel Christian is the author and research assistant for RetireGuide. She focuses on the topic of retirement insurance and retirement income. Rachel is a member of the Financial Counseling & Planning Educational Society. See other posts by Matt Mauney. Matt Maunny - Financial - Editor.

There are currently 10 Medicare Supplemental Plan options available across the United States. Plan G can be purchased in all states and is an extremely well-known Medicare plan in the United States. Medigap plans G are the second largest in the industry. 22 per cent of the Medigap beneficiary population is registered under Plan G. This table outlines the average monthly premiums for Medicare Supplemental Plan G in each of 2018.

How insurers set their rates can affect the cost of Medigap coverage. For some employers, age is not a factor. Another insurance company might increase your policy prices each month or lock in a rate according to the age of your policy purchase. Bob Glaze an insurance professional explains how age can influence cost in Medigap.

It is based upon your current age when you start acquiring the plan. Compared to other years the premium is lower. It's possible that age can influence your price. Amy bought a policy that covers age 65 and pays $12 a month. His policy is effective from age 72. It costs about $170 monthly for this same policy. The premium on Amy's car will continue to decline with age. Prices are more or less fixed at the period at which the product has been issued and the costs of such policies will gradually be increased by inflation.

The cost of the course depends on your age. Your premium increases with age. Attained or older insurance is your best choice, if you are enrolled into the first Medicare program. However, the price will gradually increase with time. Premiums may also rise as inflation increases. Don't let it be a gamble — you work hard and think ahead all the time. Do this now to maintain your wellness. Get Medicare assistance to save money and save time.

Age is no problem for Medigap policies. Your annual premium may fluctuate in inflation, but the age doesn't determine what amount you are paying. The average premium on these types of insurance policies is the same, no matter how old the customer.

Part A and Part B in Medicare are grouped by cost, which are similar in each state. Tell me the cost of the insurance if Medicare will require it for 2022? Read additional health insurance guidebooks and information for a comprehensive overview of your Medicare expenses if needed.

The table below lists the average monthly payments for the Medicare Part D plan. You also have the option to compare Part D plans offered wherever in the country or enroll for Medicare prescription drugs on myrxplan.com.

Medicare Supplement Insurance Carriers Pre-Check (Months) Benefit Plans Available Aetna Life Insurance Company (Independent) Bankers Coneco Life Insurance Company(Independent) EmpireHealth Choice Assurance (d/b/a) & Co. Aetna Medicare Advantage is a health insurance plan offered by Aetna that provides coverage for Medicare-eligible individuals.

A certified agent can assist in finding Medicare benefits plans that match your needs. Read on to see what is available to you and find the right insurance policy for the right budget.

The Medicare Advantage plan is managed through CMS. If you have a specific query about Medicare plan benefits, contact the Medicare website directly.

It's free and no obligation! Find the Most Affordable Medicare Plans in your Area Related Posts Updated on October 6, 2022 Average Cost of Medicare Supplement Plans If you are shopping around for Medicare Supplement coverage, one of your biggest questions may be: what is the average... Updated on February 1, 2022 9 Factors That Impact Your Medicare Supplement Rates Many factors can impact your Medicare Supplement rates.

Click on the links below to see Medicare Supplement insurance companies and their upcoming monthly prices. DFS Portals.

Read more 2023 Best States for Medicare | Medicare Advantage Prescription Drug Plans by State This report details where Medicare beneficiaries have access to the widest range of quality 2023 Medicare Advantage Prescription Drug plans at the most affordable prices. Read more Medicare Disenrollment: A Part-by-Part Guide to Dropping Coverage Are you looking to change your Medicare coverage?

In the 2022 period, the Medigap premiums averaged $128 per month. Several types of Medicare plans have significantly less enrollees than others. These differences affect average monthly payments paid by Medigap beneficiaries.

They are no longer available to people who become eligible for Medicare after Jan. 1, 2020. Some plans charge higher premiums than others. Plans with higher premiums generally provide more comprehensive coverage. Insurance Company Some insurers may offer special discounts to married couples or nonsmokers.

Find your Medicare Advantage plans today, at no additional cost. Maine, South Carolina, New Mexico and Idaho have the lowest annual health insurance benefit premiums for 2022 with each state requiring an average annual premium of $42 and under per month.

Insurance Travel Tours With Other Agents Discounted CE – WebCE 10% Conference medicare insurance conference Request a Quote Medigap Premiums for All States - Lowest and Highest Medicare Supplement Premiums Medigap Premiums by State for 2022 show a significant difference between the lowest available cost and the highest.

The average monthly premium for the Medigap program is $1800 per annum. There is largely a factor that affects cost at Medigap, including age and location.

Discounts Receive updates about Medicare Interactive and special discounts for MI Pro courses, webinars, and more. Register When you are choosing a Medigap policy, it is best to look at policies from a range of insurance companies, especially if you've already decided on a particular standardized policy. Policies with the same letter name offer the same benefits, but premiums can vary from company to company.

Do Medigram plans cost a lot? Medigap Plans G have an annual cost of 146.44 dollars for older adults over age 65. Only benefit that is not covered by the plan — the annual Medicare Part B deductibility — cost just $333 annually for 2022.