Hundreds of Medicare Supplement Plans exist. Find out why you need them and what's their most common use. MarketWatch highlighted these product offerings as we believe readers are finding them useful. It is independent of MarketWatch Newsroom and we might be rewarded with commissions for purchasing goods through links to our articles. For some people, it is tough to select a Medicare Supplement plan for their particular health care requirements. It offers an overview of the three most popular Medicare Supplements as well as an overview for each of them.

Medicare supplements are very widespread in most states. Nearly two out of five individuals on Medicare have a Medicare Supplemental Insurance Plan or “Medicap.” Can you list some best Medicare Supplement Plans that can be purchased? According to the latest data from the United States Health Insurance Plan (AHIP), the largest Medicare supplement is the Medicare Supplement Plan F. Because recent laws affect Medigap Plan G, Plan G is becoming a popular new Medicare Supplement plan.

Medicare Advantage plans act in place to supplement the original Medicare coverage and provide the coverage as well as additional coverage like prescription drug coverage (Part D). Meanwhile a group Medicare Supplement Plan (Medicap Plan) is offered to people who are enrolled in Original Medicare as a way of filling gaps. The 10 different types of Medigap plans provide universal coverage to beneficiaries across the country, as well as helping to cover things including the deductible, co-insurance or copayment. As all plans are standardized, annual premium prices vary between providers. The policies of Medigap do NOT provide prescription drug protection.

It's simple to register with Medigap. Supplements are available at a pharmacy and are either purchased from a physician or directly from a company’s supplier. The program is not open every year, and you can apply anytime to be part of it. In order to purchase Medigap insurance you must enroll in the open enrollment period that lasts a minimum of six months for Medigap. The months begin on July 1, when you have Medicare Part B and you are turning 65 or over. In the meantime you could get Medigap insurance if you are having health problems. Please follow this guide when purchasing a Medigap plan.

Medicare Supplement or Medigap is an insurance policy that is purchased to provide a way to cover things that are not included in the Original Medicare program. They apply only for Original Medicare — and no other public policy. Medicare Part D is for prescription drugs and can be combined with an insurance benefit that offers drug protection and coverage for the elderly. Medicare Part C or Medigap plan differ from Medicare Advantage.

The consumer is often more receptive to some Medigap plans compared to others. The reason that Plan F was popular is likely that it covered the most out-of-pocket Medicare costs than many similar standardized Medicare plans. Plans F provides beneficiaries with low deductibles and low copays. Plans F and C are called Medigap plans as they cover all the Medicare benefits and coinsurance.

Despite Plan F being the most popular plan, Medigram Plan C, Plan G and Plan N are among the most popular Medicare Supplements plans. List the popular Medigap plan choices including: They are uniform everywhere except Minnesota, Massachusetts and Wisconsin with several alternative routes. Medigapans least popular are Cost-Selling Plans : Plan K and Plan L, plus a more recent Plan M.

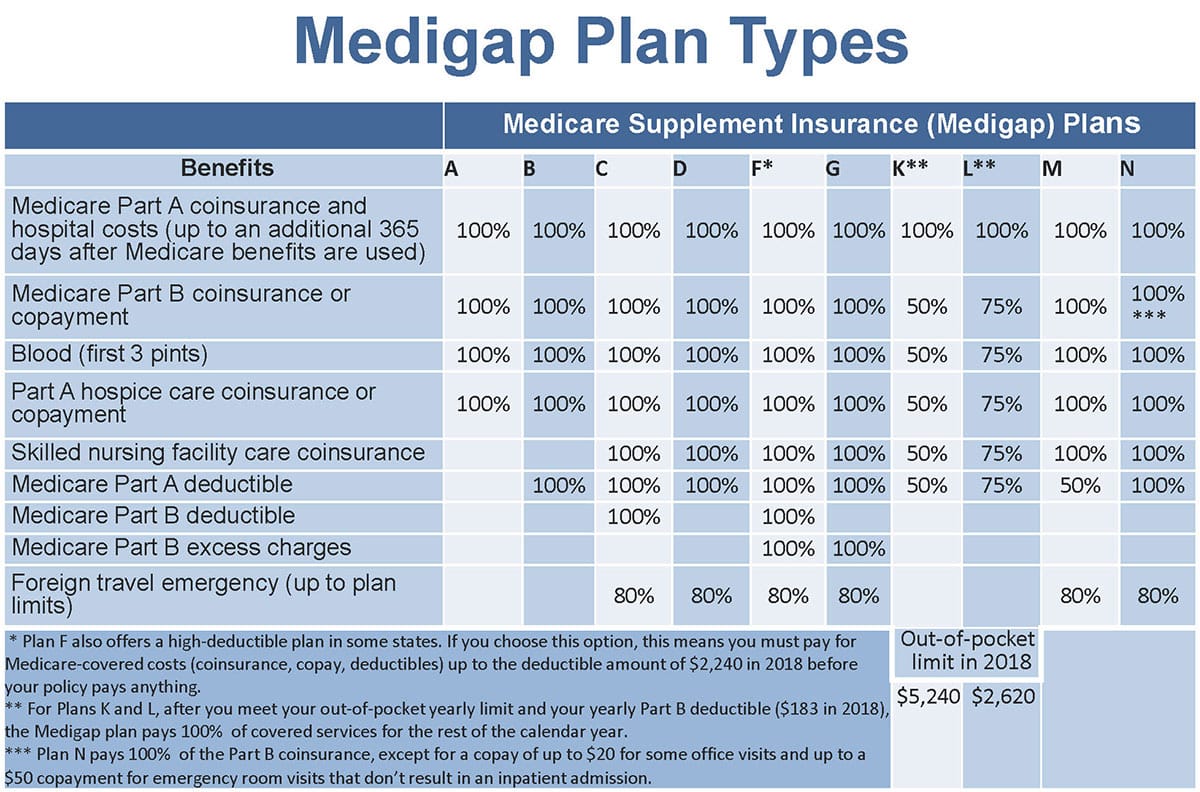

What Do the Most Medicare Supplement Plans Cover? The chart below shows which benefits are covered by each of the 10 standardized Medicare Supplement Insurance plans available in most states. Take note of how Plan F and Plan G coverage compares to other plans, particularly plans like Plan A and Plan B.

Three Popular Medicare Supplement Plans To help you find the best Medicare Supplement plan for you, we've highlighted three of the most popular plans below. 1. Blue Cross Blue Shield According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas.

However, it is important to remember those options may not be the best for your needs; consider the most important aspects of your coverage and go from there. How to Compare the Best Medicare Supplement Plans for 2023 Understanding which of the best Medicare Supplement plans is suitable for you is as easy as picking up the phone. We have a staff of licensed Medicare agents to walk you through finding the best coverage.

This may influence which products we write about, but HelpAdvisor maintains editorial independence, and our opinions and evaluations are our own. Ranking the top 10 Medicare Supplement Insurance companies can be difficult for two reasons. First, Medicare Supplement plans – also called Medigap – offer benefits that are standardized in every state except for Massachusetts, Minnesota and Wisconsin.

These benefits include 100 percent coverage for: Your Part A Medicare coinsurance and hospital costs (up to 365 additional days after Medicare benefits are used up) Your Medicare Part B coinsurance or copayment Part A Hospice Care coinsurance or copayment Skilled nursing facility coinsurance Part A and Part B deductibles Part B excess charges Emergencies for foreign travel (up to $50,000) The first three pints of blood for a blood transfusion Many seniors are now choosing Blue Cross Blue Shield's Medicare Supplement Plan G.

How to Compare the Best Medicare Supplement Plans for 2023 Understanding which of the best Medicare Supplement plans is suitable for you is as easy as picking up the phone. We have a staff of licensed Medicare agents to walk you through finding the best coverage. You can easily compare Medicare Supplement plans and rates for 2023 by filling out our online rate form or calling us.

Monthly premiums can change over time, especially if you purchase a plan that factors your age into its pricing strategy . Ask a licensed insurance agent about how the company determines its rates before you purchase a plan. Medigap policies can be priced in one of three ways: Community-rated Also called no-age-rated, these policies cost the same amount for everybody on that particular type of Medigap plan, regardless of how old you were when you bought it.

Plan K is significantly different from many other Medigap policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible.

In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer.

These companies can include, in no particular order: Central States Indemnity (CSI) GPM Health and Life Insurance Company National General Oxford Life Insurance Company United American Health Insurance Company 12 Choosing a Medicare Supplement Insurance Company Not every insurance company sells Medicare Supplement Insurance in every state. And even each company's plan selection can vary within the states it does serve.

Contrary to traditional medical plans, where policies differ among providers, the Medicare Supplement Plans are standardized so the benefit of the letters are the same. The UnitedHealthcare Medicare supplement plan is identical to plan G offered through the Aetna network. However rates vary from company to business because the different providers have different pricing plans. It should be taken into consideration as well as the company's financial strength and past rate increases. Some companies offer inexpensive rates but raise your prices as you age.

There are differences between Medigap Plan G and Medigap Plans N because Plan N has a copayment for certain hospital or emergency department visits versus Plan G. In the event of not having a copay every single time, it will make a big difference in your life.

Although the plans do differ from Plan A and G, the major difference lies in plan F. Plans F and E cover deductible payments for Medicare Part A deductibles. Plan G doesn't.

AARPs Medicare Supplement plans are exclusively covered by UnitedHealth Care, the largest Medicare Supplement insurer. Medicare Medigap plans have a lower complaints rate than many competitors.

Local plans are available at a reasonable price. United Healthcare Blue Cross Blue Shield earns top rankings amongst the national companies in most states. In total, Aetna Medicare positioned itself in the highest ranking state of all (33) states.