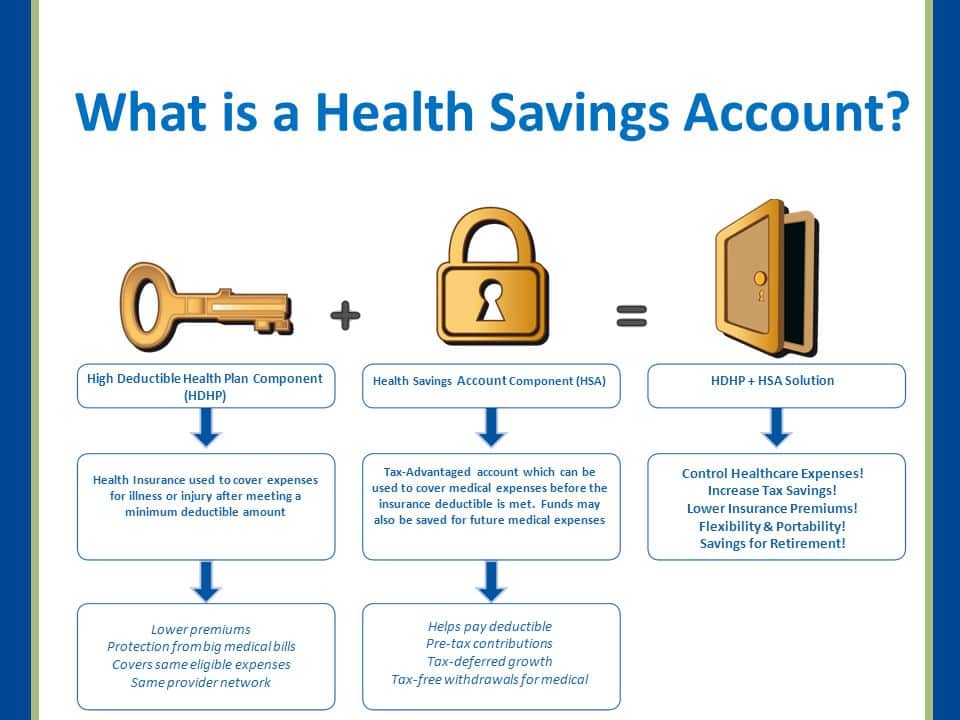

Health Saving Accounts (HSA) are funds you can use to pay for health expenses using pre-tax funds. Generally speaking, HSAs have monetary limits that must be met for some people. Your medical insurance coverage is mandatory, unless you have a high-deductible health plan. Because the HSA's Medicare coverage is deemed an alternative health plan, your HSA can no longer receive your HSA payments after enrolling. That's not saying the HSA cannot be used alongside Medicare. If you do have an HSA you may also use your funds for expenses such as Medicare premiums, co-payments or deductibles.

Thank you for retiring soon! If you envision the free time you get in your commute or workday coffee then it is probably time to think about how you will pay your retirement expenses. In retirement come some crucial decisions. One of the decisions about enrolling in Medicare is the choice of how to use your HSA. Firstly, a simple HSA overview: If you have a high-deductible medical plan, you are eligible for an HSA opening.

There is a set of regulations and policies that must be followed for a health savings account. A health savings account is a savings account where the funds are put into medical expenses. As you approach retirement time, it is important that you understand the relationship between your health savings account and the Medicare program. Find Medicare Plans in 3 Simple Steps. Find Medicare Plans in one Easy Step Today.

If a person has Medicare you can use the HSA as part of their Medicare plan. The age of the applicant is 62 or over. Optum Financial, a leading provider of HSAs in U.S. markets, has explained that the age to contribute to spouses' Medicare benefits is 65. If you are over 55 and you are an HSA holder you may be able to pay a Medicare premium to an older heir who will be able to pay it tax-free. When you and your partner are on an HSA, the idea is that the funds from an HSA should be reduced so they are free of administrative and maintenance charges. The HSA may pay for your Medicare or your wife's premium if necessary.

A health account helps cover medical costs like medical bills or insurance. The withdrawal of the money will be tax deductible and the money is refundable. Besides earning interest, your balance carries forward every year, which is an investment into the retirement fund. Unfortunately, certain restrictions apply when establishing a health saving account through Medicare. It's only for individuals who are on high-deductible plans. Since Medicaid does not constitute an HDHP enrollment, it does not allow for HSA participation. Once you enroll for Medicare, it is unlawful to keep contributing to a medical saving account.

A: You can also utilize HSAs if you are insured. You can withdraw funds from your HSA anytime - no matter if your contribution is eligible for your HSA. When your age has reached 66, your funds will be available to use. If you want, you might also have to pay Medicare Part B or C premiums and HMO payments, the money will pay for the costs. However, premiums for supplemental Medicare policies like Medigap are deemed nonrefundable. At 65, you can use your money as an eligible non-qualified Medicare supplement without penalties.

After you've reached age 65, the HSA funds will pay for medical costs and deductibles for the Medicare Part B and Part D and Medicare Advantage plans.

Your Health Savings Accounts are used by most government-accredited healthcare institutions for medical expenses including qualifying insurance premiums. The premiums on Medicare coverage and cobra insurance are HSA-eligible. The total HSA health insurance premium is fully tax-free.

Even if you have several years of paid Medicare premiums, you can still reimburse yourself for all of those months! You just need to keep receipts proving that you paid for qualified medical expenses. Those receipts or documents will only be used in the event of an audit. Conclusion Contributing to an HSA in your working years is an excellent way to help plan for healthcare costs in retirement.

Consider your options carefully In summary, once you get Medicare, you're no longer able to keep contributing to your HSA. You are still able to use the HSA funds for qualified medical expenses, including some Medicare costs. Knowing this, it's important to think carefully about your Medicare enrollment decisions once you become eligible.

How it works: After you pay your Medicare Advantage-related plan costs, you can reimburse yourself for them from your HSA. Even though 54% of Medicare Advantage plans have no premium, nearly 1 in 5 enrollees still pay at least $50 per month on Medicare Advantage premiums ( KFF, 2021 ). If you have funds in an HSA account, now is the time to use them to help cover the cost of your Medicare Advantage premium, copays, coinsurance, and deductibles.

I have a client turning 65 in Oct, she says she has a medical savings account, wants to pay premiums from that. With her severe chronic medical issues, she needs a Medigap policy, not a MAPD. She's looking at some very high-cost surgeries in the near future, so Medigap is best for her situation.

Can I use my HSA to pay my Medicare premiums? You can use the funds from your HSA to pay healthcare costs, including your Medicare premiums. Qualified Medical expenses include: Medicare Part B premiums Medicare Part C premiums Medicare Part D premiums deductibles for all parts of Medicare copayments and coinsurance costs for all parts of Medicare dental expenses vision expenses insulin and diabetic supplies over-the-counter medicine Medicare Part B (medical insurance).

You can still use any funds in your HSA to cover expenses like Medicare premiums, copayments, and deductibles. Let's find out more about how HSAs work with Medicare, how you can use HSA funds to pay for Medicare, how to avoid tax penalties, and more. Share on Pinterest How does an HSA work once you enroll in Medicare? To contribute to an HSA, you need to be enrolled in an HSA-qualified health plan with a high deductible.

A health savings account (HSA) is a wonderful tool for covering healthcare costs. The HSA can be rolled out as a pre-tax contribution and used as a qualifying health care expense. Are Medicare benefits worth the cost to the taxpayer? The HSA can be complicated by not having the right coverage for a person who is eligible for Medicare at the age of 65.

If I want to enroll in Medicare Part A, I must have it in place for six weeks. This will prevent you from paying HSA contributions until 6 weeks before enrolled into Medicare. You are allowed to contribute towards your HSA for a period when you have been enrolled in Medicare.

The amount of contribution is based upon the minimum age of the individual. Please refer to the questions above to find out the eligibility criteria.