Connect to care is a website service for managing healthcare. WebMD receives fees for providing this service when you order the product. WebMD does not endorse anything on this site except for referring products, services. How do Medicare Advantage and Medicare Medigap work? Depending on the health care provider, Medicare Advantage or Medigap can help with the cost of the insurance plan. Medicare Advantage and Medigap add original Medicare coverage and have significant differences from one another. Find your perfect Medicare plan: Find more than 200 insurance plans available.

The Medigap program is Medicare supplemental insurance designed for addressing gaps and sold through private firms. Original Medicare covers the costs of covered healthcare services and supplies. Often Medicare Supplement Insurance (Medicigap) policies cover medical expenses other than medical bills. Some Medigap policies include services not included by original Medicare. Those who buy Medicare and use it for a business trip outside the United States.

Summary: Medicare and Medicaid benefits are two different coverages. But they cannot all have the same benefits. Let’s see if a particular plan meets the requirements. Find your nearest plan right here! When you turn age 70, you should have access to original Medicare coverage for a lifetime if your insurance was not available. Part A (hospital insurance) and Part B (medical insurance) cover many medical expenses and do not cover all.

We recommend unbiased reviews of products that are not sponsored by advertisers. We can get compensated for visiting partners we recommend. Please consult the advertising information on the company page if there's a conflict. Anyone interested in enrolling in Medicare should make some important decisions. Which one is most crucial for Medicare Advantage?

Medicare Advantage is the same as private insurance policies. Almost all services, including office visits, laboratory visits, surgeries and much more, can be covered by a small co-payment. The plans may have HMOs and PPOs, but the plan limits are set for each annual total of incurred expenses.

All plans have specific benefits. Most insurance policies cover drugs. Some patients are referred directly from their doctor. Certain providers pay some out-of-network costs, whereas other providers will cover doctors and medical providers who belong to HMOs. Other Medicare-based benefits also exist. It can be difficult to select an affordable plan without any premium.

Medicare Advantage policies (Part C) are offered through private health insurance companies under such a name as aetna, humana or Kaiser foundations. They might have zero premiums or lower rates than the high premiums on Medigap and prescription drug coverages. The Medicare Advantage Plan covers doctors and hospitals and includes a large number of prescription drug coverages, including some services that aren't covered by Medicare. 42% of Medicare patients in 2021 choose a plan of this nature. Medicare Advantage is primarily an HMO and preferred supplier organization plan that operates on a bundled basis.

Medigap or Medicare Supplement Insurance is a Medicare-like supplement which provides coverage where there is no cover. The Medigap plan typically covers vision, long-term care, or home care. But these policies are useful for a variety of coverage such as medical care when travelling and frequent medical emergencies. For example, in the Medigap plan N emergency and hospital visits can be incurred while urgent care costs $50. Medicare does not pay Part B co-payments but does pay a 20% service premium. Medigap plans provide no medical coverage or can't combine Medicaid with the Medicare Advantage plan.

About 58% of Medicare beneficiaries choose Original Medicare Part A or Part B. Part C covers healthcare, doctors, medical care and other services and costs. Some 81% of those individuals provide coverage under the Medicare Part B prescription drug program.6. A total of 81.2% pay for Medicare Part D. Medicare Supplement Insurance plans or Medigap programs are not affiliated with Medicare programs. Although it is more expensive, there are advantages.

Original Medicare covers Part A (hospital insurance) or Part B (medical insurance). You may combine this plan with a Medigap supplemental plan. Despite being covered by Medicare Part 1B, you need to buy supplemental insurance for yourself.

Find out about a plan available within your zipcode. Once a user is created in Medicare.com, the name of a drug can be entered into the system.It is easy to compare the cost of your coverage, deductibles, or star.13 If you don't have any prescription medications, you need help if they're not All Medicare-related plans should still cover the majority of drug usage. Besides high costs, you may want to consider a coverage gap period that kicks in when you spend $4430 on covered medications in the Donut hole.

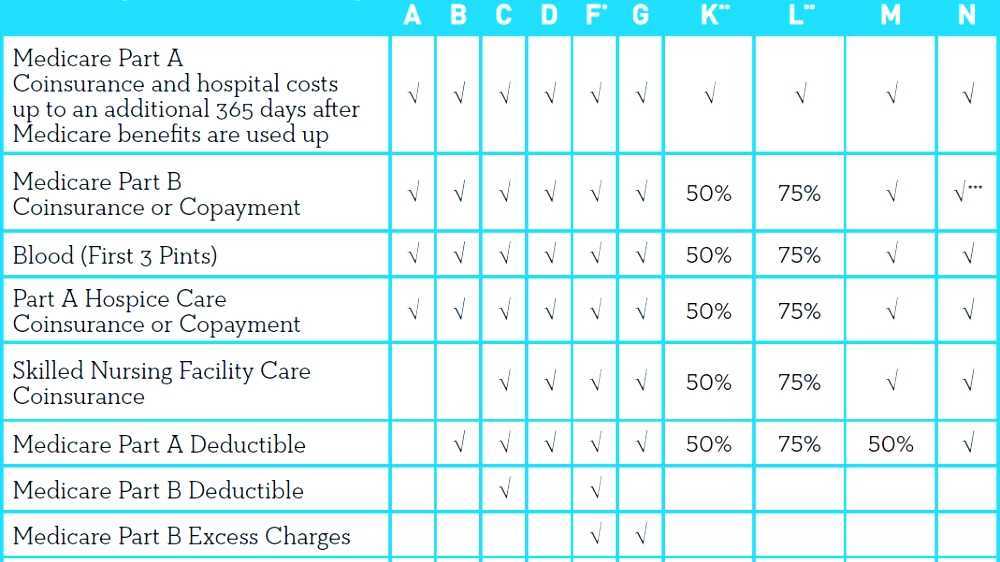

Medigap policy is a private plan which has an insurance broker but not on Medicaid.org or Medicaid.com. They can each have their own standardized coverage set. Plans F and G offer high deductibles for certain states. Occasionally, a plan includes medical care if a foreigner is traveling abroad. Because coverage is standard, Medigap policy is not assessed. Consumers can compare insurer rates for a letter plan with confidence when deciding on a best option. Medigap plans sold by Medicare patients do not cover Part B deductibles.

Medicare will pay its share of the Medicare-approved amount for covered health costs. Then, your Medicare Supplement Insurance plan will pay its share of the costs it covers. There are a wide range of Medicare Supplement plans that differ in coverage and costs, from basic to extensive.

The plans are “standardized” with lettered names, meaning that a Medicare Supplement insurance Plan K sold by one insurance company covers the same benefits as a Medicare Supplement insurance Plan K sold by another company. The price, however, may differ. Most states offer up to 10 Medicare Supplement insurance plans labeled A-N, (E, H, I, J are no longer sold).

Some plans also have deductibles and copays. NEW TO MEDICARE? Learn what you need to know in 15 min or less. What is Medicare Advantage? Medicare Advantage (MA) plans are an alternative to Original Medicare. They're offered by private insurance companies. Under an MA plan, you'll still get Parts A and B, but you'll usually also have Part D, as well as other benefits such as routine hearing, vision, and dental services, all under one policy.

Because Medicare Supplement insurance plans differ, you might want to determine which benefits you want and which plan you want before you enroll. Types of insurance that are not Medicare Supplement insurance include Medicare Advantage plans , Medicare Prescription Drug Plans, Medicaid, and veterans' benefits. Medicare information is everywhere.

A Medigap policy only covers 1 person. If you and your spouse both want Medigap coverage, you must buy separate policies. Medigap policies do not include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). You will pay a monthly premium when you have a Medicare Supplement plan in addition to the Part B premium to Original Medicare.

If you want prescription drug coverage, you may be able to enroll in a stand-alone Medicare Prescription Drug Plan (Part D). Enrolling in Medicare Supplement insurance To enroll in a Medicare Supplement insurance plan, you must have Medicare Part A and Part B and live within the plan's service area.

Medigap is a different name for a different kind of medical insurance - both names will be used. For example, you could consider “Medicigap” a health insurance policy which fills a gap for some benefits that Medicare does not offer. February 26, 2020.

Medigap offers several disadvantages: high monthly payments. Traveled across different plans. Medicare coverage is not available under Plans D.

You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

Medicare is a good option when it provides a maximum out-of-pocket premium to help you avoid big bills. Medicare and Medigap are usually able to provide you with a greater flexibility on what kind of care will go to you.

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits.

Can anyone tell you if my insurance plan is available? A: You will be considered eligible to receive Medicare Supplements (MEDICAp) protections if you have Medicare Part A and Medicare Part B. The open enrollment period is six months from the moment Medicare B becomes effective.