How do Medicare AARP Benefits and Benefit Plans work? People who have a keen interest in this policy may find it interesting to learn a bit about the organizations behind them. AARP is a nonprofit advocacy group founded by Ethel Percy Andrus in 1958 under the leadership of JoAnn Jenkins. More than 38 million seniors are members of AARP, which enjoy the educational resources and benefits offered through its program.

United Healthcare was created from 1975 to 1975 in Minnetonka, Minnesota. It is now one of the largest health insurers.

If you have UnitedHealth Care Medicare Supplement Insurance, you get the same policy. AARP supports and promotes certain UnitedHealth Care plans through this business agreement. In turn, they receive the expected 4.95% fees per plan purchased.

The Medigap policy also includes additional benefits compared with Medicare Part B. An additional plan will cover your medical bills by providing coverage for deductibles and other costs. Depending on what plan you choose, coverage may be available. Medicare Part B can pay $100 of the cost.

A variable plans structure may make comparing costs difficult because of the most accurate comparison of quotes from different insurers, depending upon location and circumstance. The various formulae for prices that increase as you age affect your overall life-time cost.

A woman 65 could pay higher rates for a Medicare supplement if she opted for another plan by Humana or BlueCross BlueShield. However, a AARP plan has a slower price rise. By age 85 Medigap has an average cost of 62 percent.

Plan G usually has higher premium costs, as plan n offers broader coverage. The plan's premiums can be higher than plan G if the health needs differ. In some instances Medigap's costs may be influenced by states or carriers.

Medicare Supplement Insurance (as well as Medigap) is a common choice among most Americans. This rating does not compare with others. AARP's endorsement of your plan will provide you with peace of mind.

These Medicare Supplements are among the best available and most widely used programs with 31% of Medicare Supplement users using AARP/United Healthcare. In order to be eligible for insurance coverage, the insured has the right to be registered in an AARP account.

These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographical availability and may be discontinued at any time. None of these services should be used for emergency or urgent care needs.

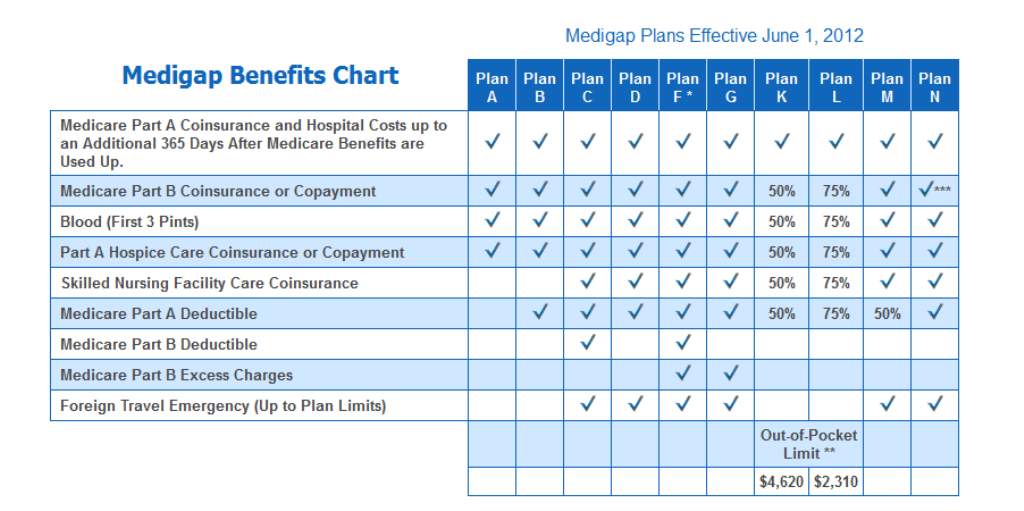

Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, co-payments and deductibles. AARP Medicare Supplement Plan Comparison View PDF 10 Things to Know About Medicare Supplement View PDF What is Medicare Supplement Insurance?

Providers & Benefits Medicare Cost Basics Introduction to Medicare Back Learn About Medicare Introduction to Medicare Introduction Eligibility Coverage Options Prescriptions, Providers & Benefits Medicare Cost Basics Types of Plans Overview of Plans Medicare Advantage Plans Medicare Supplement Insurance Medicare Prescription Drug Plans.

To understand how aging will affect your costs, you can request multiple price quotes to discover the best deal now and for decades to come. How do AARP Medicare Supplement plans work? When you buy an AARP Medicare Supplement Insurance plan, you're actually getting a policy from UnitedHealthcare .

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Not all plans are available in all locations. View Important Disclosures Below UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers.

What it covers : All Medigap plans cover some portion of out-of-pocket costs (deductibles and coinsurance) for Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). What it doesn't cover : A supplemental plan will not cover prescription drugs.

Available discounts can vary according to factors such as your location, household status and how you apply for a policy. Back to top UnitedHealthcare's spending on care 71.7% for member benefits Medicare Supplement Insurance providers are required to report data on the premiums they collect and how much they spend to provide benefits for members.

Enrollment in these plans depends on the plan's contract renewal with Medicare. You do not need to be an AARP member to enroll in a Medicare Advantage plan or Medicare Prescription Drug plan. This information is not a complete description of benefits.

Plan B On average, AARP/UnitedHealthcare's quoted prices for Medigap Plan B were about 16% higher than the least-expensive Plan B policy in the area. Get details on AARP/UHC's rates for Medigap Plan B In each of the locations used for this review, AARP/UnitedHealthcare only offered Plan B with wellness extras included.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP Medicare Supplement Insurance Plans AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

AARP Medicare Plans from UnitedHealthcare United Healthcare UnitedHealthcare Insurance Company or an affiliate or an affiliate AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company, or UnitedHealthcare Insurance Company of America, or United Healthcare Insurance Company of New York.

Medicare Advantage plans and Medicare Prescription Drug plans Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor.

Know More : Medicare Supplement vs Medicare Advantage Pros and Cons