Medicare Supplements Plan F, G or N can assist in filling Medicare coverage gaps. We are here to help guide you to Medicare and other Medicare benefits when you reach the age of 69. How do I find my way in Planning? The plan has another benefit than Plan G. Plan G usually includes a lower premium than Plan N, since it includes additional coverage. You'll save more if Plan N has more coverage because the cost will exceed the cost of the premiums on Plan G. Medicare Supplement Plans F and N help address Medicare gaps if necessary.

Many plans offer Medicare Supplements. Find out how many people choose them and how to do them. Marketwatch highlighted these products in order to help readers feel they're helpful. We'll share more information. We may be compensated for products bought through this link from MarketWatch. Having Medicare Supplement plans for seniors can be a difficult decision. This article focuses on three different Medicare Supplement plans and gives an extensive breakdown of them. Important information. If you are considering changing your Medicare plan, there are several steps you should take to make sure that you make the best decision for your needs.

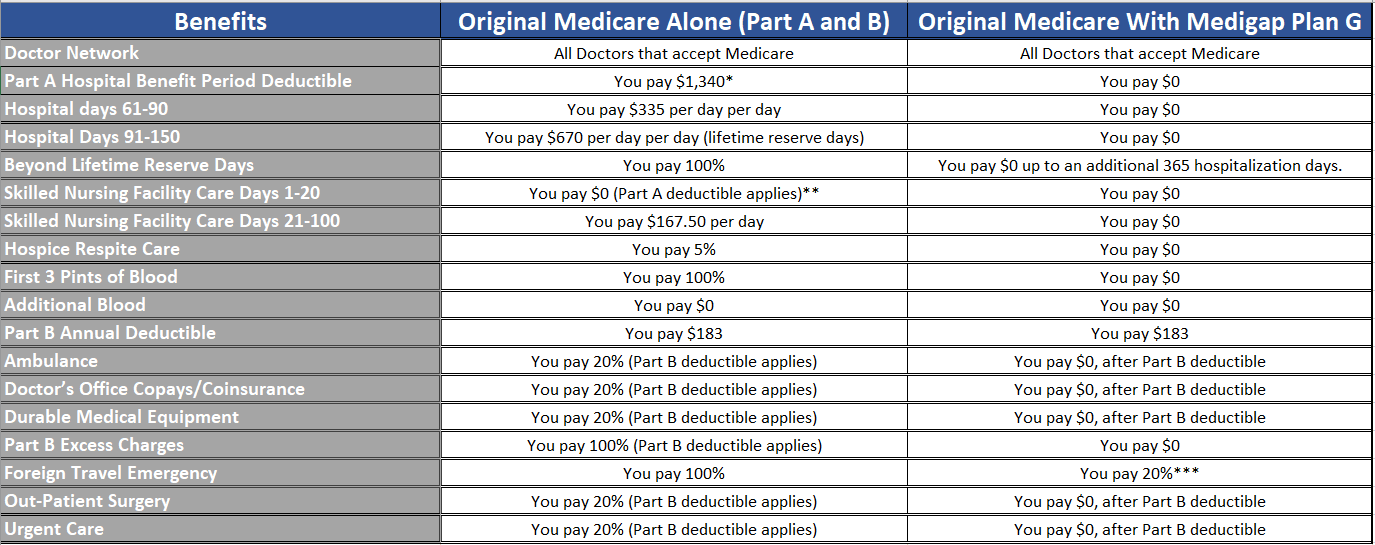

Medicare supplement plans allow you only to cover Part B deductible and Medicare deductible. Then the Medicare plan gives you 100% of your Medicare-required health care costs. Medicare Part B Deducts will be $226 by 2023. Therefore, outside of your monthly premium, your annual health care costs are $226 per person. Because of its low cost, Medigap plan G will be among the most effective supplementary plans by 2023. Because the enrollment restrictions for Medicare Supplement plan F have become more common in the United States, Plan G is now the preferred Medicare supplement plan. Medicare Supplement Plan G are good options for those people:

Medigapping plans are easy to enroll in. “Medical supplement purchases are usually made by agents or directly by the carrier,” says Corujo. Because there are no open enrollment periods per year you can apply anytime. To buy Medicare / Medicaid policies you can enroll in a 6-month open enrollment period. The Medicare Part A payment period starts at the beginning of each Medicare Part A payment period unless you are 65 or over. You can buy all Medigap policies in your state during these times if you have serious medical issues. How do I buy Medigap Plans?

Medicare Supplement programs help reduce the cost of healthcare non-covered by Original Medicare, including co-pays, co-insurance deductibles and other benefits. Anyone whose health care plan may be costly for their beneficiaries should think about a Medigap plan, which may cover these expenses in determining the cost. Several Medicare Supplements offer coverage for services not covered by the Medicare original, like medical care necessary during travel abroad. Medicare patients who frequently travel often get a layer of extra protection. Silver Sneakers is a fitness program that is offered to some Medicare Advantage and Medicare Supplement insurance plan members. The program provides access to health clubs, exercise classes, and other wellness activities at no cost or a reduced cost.

Medicare Advantage is an alternative to Original Medicare and provides the same coverage as prescription drug coverage. Medicare supplement plans — known as Medigap plans — are offered by private insurers for individuals with a basic Medicare plan. Among the 10 types of Medigap policies there are many different types of coverage to help with costs such as coinsurance or deductible fees. Because plans are standard, the monthly premiums vary between providers. The Medigap insurance policies do not include prescription drugs.

Medicare Supplements are private policies purchased for the purposes of supplying funds for Medicare's coverage which isn't covered by Original Medicare. This secondary coverage plan covers Original Medicare only. Medicare part D covers prescription medications but may include coverage under an Advantage program. Medigap Plans differ from the Medicare Part A or Medicare Advantage plan.

Policies C and F have more comprehensive outlines, however it typically requires much less money for the same. Consult the Benefits Chart for details about the different policies available through Medspa.

Medicare Supplement Plan E is the most popular Medicare Supplement Plan for 2020. Learn how others are used and compare Medigap plans.

Providers & Services Providers & Services Caret Icon Chat Log in Home Supplements & other insurance How to compare Medigap policies Search Search Print this page. Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap in Massachusetts Medigap in Minnesota Medigap in Wisconsin Medigap & travel How to compare Medigap policies.

Not affiliated with or endorsed by any government agency. Callers to QWIS will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls to QWIS will be routed to a licensed agent who can provide you with further information about the insurance plans offered by one or more third-party partners of QWIS.

Keep in mind you will pay a monthly premium for your Medicare Supplement plan. You must pay these monthly premiums whether you use the covered services or not. This is why it's crucial for retired seniors on a limited income to weigh the pros and cons of each Medigap plan. RELATED: Speak with a licensed Medicare insurance agent by calling: (847)577-8574. Medicare Supplement Plans Must Adhere to State and Federal Laws Every Medicare Supplement plan must follow strict federal and state laws.

The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

These are also known as Medigap plans . A Medicare Supplement plan is additional insurance you can purchase to reduce the out-of-pocket health care costs Medicare alone doesn't cover. You should always compare Medicare Supplement plans to choose the one that works best for you . You should also do this each year, as some of the benefits and Medicare regulations may change.

Be aware that different insurers may charge different amounts for the exact same Medigap policy. Not all insurers offer all the available Medigap policies. Compare costs apples to apples, such as a Medicare Supplement Plan G with a Medicare Supplement Plan G at different insurance carriers. Choose carefully because you may not be able to switch Medigap policies later.

In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer.

What Is a Medicare Supplement Plan? To help cover your out-of-pocket expenses after using Original Medicare (such as your 20% coinsurance), you can purchase a Medicare Supplement plan from an insurance company.

The Medigap plan names are along the top, and on the left are the coverage categories. How to choose the best Medicare Supplement plan The average cost of a Medicare Supplement plan is $163 per month in 2022. However, rates can vary widely from $50 to more than $400 per month.

Finally, Medicare Supplement Plan N is considered a pay-as-you-go type of plan that tends to be the most affordable for beneficiaries who don't require medical care regularly but are interested in emergency coverage. Is Plan F the best Medicare Supplement plan? Medicare Supplement Plan F is considered one of the best Medigap plan types due to its comprehensive nature.

What is the most popular Medicare Supplement plan? Plan F, Plan G and Plan N are the most popular types of Medicare Supplement plans. Medicare Supplement Plan F is the most comprehensive Medigap option available, providing beneficiaries with 100% coverage of Medicare-covered medical expenses after Original Medicare pays its portion. Medicare Supplement Plan G leaves beneficiaries responsible only for their annual Medicare Part B deductible.

Medigap Plan N has a higher copayment for some medical visits than Plan G which does no copayment. Medigap Plan N is cheaper to buy and has lower costs.

Although these plans are similar in some ways, the main difference is the plan with the largest coverage in the country. Plans F also covers Medicare Part B deductibles. Plan G doesn't.