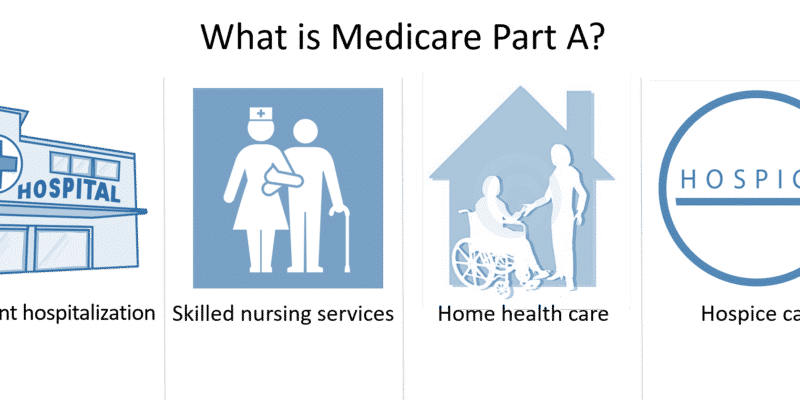

Medicare Part A and Part B are separate Medicare Parts. Medicare Part A insurance covers hospital inpatient care, skilled nursing, hospice, and home health services. Find Medicare plans in 3 easy steps. Let us find you the best Medicare plan today for your needs. There are also certain prerequisites. If so then the premium is payable monthly. Here are some basic information on Medicare Part A eligibility, coverage enrollment, and other details.

Generally, Medicare does not pay for all of your services and you can also assume a large amount of the costs of a deductible. Most Americans do not receive a monthly Part A payment because they have a quarter of their job coverage with Medicare. In 2020 Part A premiums for those under 30-month health insurance can increase by $506 a month unless they exceed 50 percent. Those who have 30-40 quarters of Medicare employment will pay $278 in premiums monthly.

If you want coverage for prescription drugs, you must sign up as soon as you're eligible, unless you have what's called “creditable” prescription drug coverage elsewhere. For example, if you're still working and covered by your employer or your spouse's employer sponsored health coverage, you may be able to wait.

Medicare is an independent insurance policy that provides coverage for individuals. It includes Medicare Part A and Medicare Part B for health coverage. Helps pay for hospital stays and outpatient treatment. Helps pay for doctors visits and outpatient treatment.

You do not have to pay a premium for Part A if you or your spouse worked and paid Medicare taxes for at least 10 years. Part A does charge a deductible and copays. Part A deductibles are charged per benefit period, A benefit period begins the day you are admitted to the hospital and ends when you've been out of the hospital 60 days in a row.

Part C Medicare plans cover Part B and Part A, and some even provide prescription drugs and benefits not available under Original Medicare. Consequently, nearly 22 million Americans are choosing Medicare's Advantage plan for Medicare. Medicare Medicare coverage is part A and part B. Part A covers hospital care, home care and other hospital services. Part B covers outpatient care including medical consultations and screenings as well as preventative care. There may be more coverage required for medical care. In other words, Original Medicare does not cover prescription drugs.

The list below provides a summary of Part B-covered services and coverage rules: Provider services: Medically necessary services you receive from a licensed health professional. Durable medical equipment (DME): This is equipment that serves a medical purpose, is able to withstand repeated use, and is appropriate for use in the home.

Medicare Part-B covers medical care outpatient. The table below shows the coverages for Part B-covered services. This list contains commonly covered services and items, but is not exhaustive. You may be responsible for part or all of the coinsurance for the Medicare coverage. The 2023 Part-B premium costs $16.80 a month. (The rates are for those with yearly incomes over $97,000 as well as married couples whose annual income has risen from $974,000 to 976,000.)

ent the Part A premium is $506 per month. If a person has 30 to 39 quarters of Medicare-covered employment, the Part A premium is $278 per month. What is Medicare Part B? Medical Insurance. Medicare Part B provides outpatient/medical coverage.

You could choose to purchase Medicare benefits through the Medicare Advantage Plan (Part C). Medicare Advantage Plans have the most basic benefits of Original Medicare. Part D can be obtained through Medicare Advantage. There are numerous types of medical insurance programs available. The coverage may be purchased at the cost of Part B Premiums.

To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services. Home health care : Medicare covers services in your home if you are homebound and need skilled care . You are covered for up to 100 days of daily care or an unlimited amount of intermittent care.

After you meet the deductible, Medicare will pay you in full the first 60 days. On days 61-90, the cost is $400 / day for hospital coinsurance. Medicare will provide 60-hour retirement day. How do I locate my Medicare plan in 3 easy steps? When the time for the retirement benefits is over 60 days, you are responsible for all expenses. You have to be at the hospital for more than 30 days before your next benefit date. In addition to beginning an additional benefit period, you must pay Medicare Part A deductibles once more.Should I Enroll In A Medicare Advantage Plan?

Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital . Skilled nursing facility (SNF) care : Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage.

You can select an Advantage plan when you apply for Medicare for the first time at the initial enrollment period. This is a 6-month period that includes: If you were already on Medicare Advantage, you could change your plan at this time. You will also be permitted alterations to your Medicare Advantage plan during the Medicare Benefits open enrollment period January 1st through March 31st.

The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years.

Read More: