Medicare provides cornhole distance Medicare-qualified insurance to older adults for the cost of medical expenses and for retirement. It is an alphabetically diversified system with various components offering different types of protection and advantages. Medicare does Jazz Weekly face some issues. To cover this gap, you may consider taking advantage of Medicare Supplements or Medicare Advantage. Our research and analysis has helped you choose the most efficient and cost effective plan for your business.

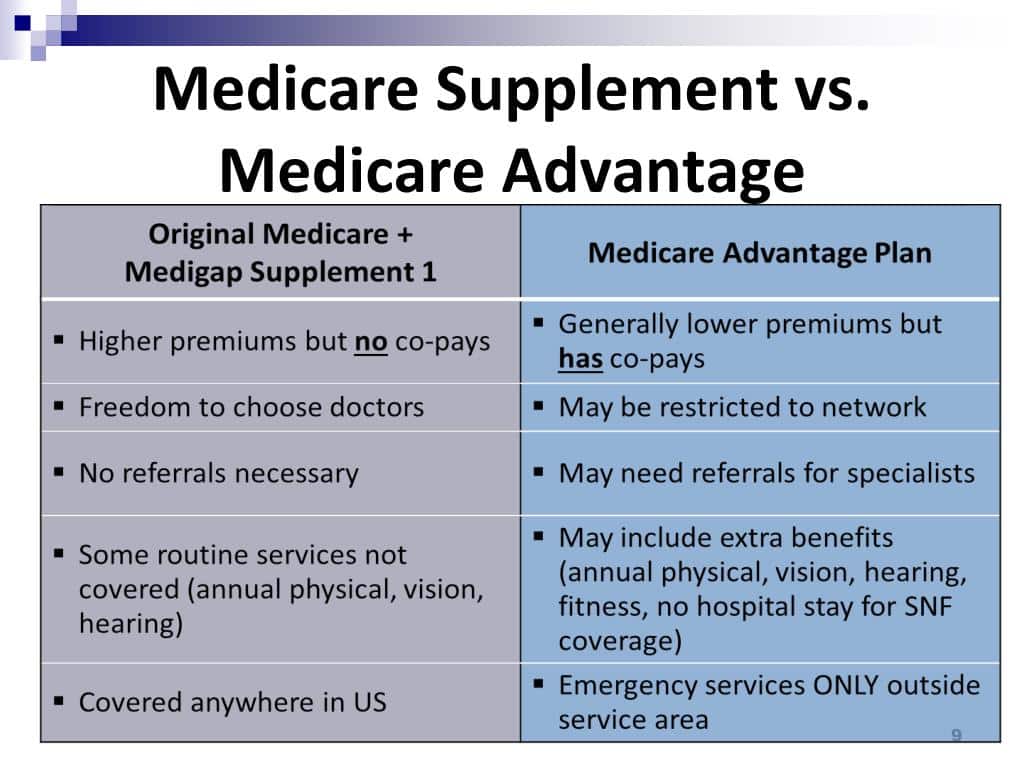

Medicare Part A or Part B — the Original Medicare plan has coverage gaps. This includes services or goods not included under Original Medicare along with costs for services that require out-of-pocket costs. Medicare Advantage and Medigap plans are aimed at filling gaps. Example of What isn't covered in Medigap? Work differently to address these gaps. You cannot use Medicare Advantage and Medigap plans simultaneously. So you have to consider how each will be able to suit your specific requirements and budget.

However, they provide 2 different types of coverage, and you can't have both at the same time. Let's compare both types of Medicare plans to see which 1 may best fit your needs. What's the difference between a Medicare Advantage and a Medicare Supplement plan? Medicare Advantage bundles Original Medicare Parts A and B into one plan and usually includes Medicare Part D prescription drug coverage.

Medicare allows private insurance providers to take your risk and administer you'll receive health coverage if you join the Medicare Advantage plans. These programs provide Medicare beneficiaries with a coverage option in primary coverage and may also provide benefits other than typical healthcare. Let the show be listened to today. They can also be offered through a regional network that includes doctors. Additionally, your medical professional may refuse coverage for any health coverage unless they are not covered.

The Medicare Supplement plan covers the costs of health care and the prescriptions for certain drugs, as well as prescription drugs for the treatment of certain illnesses and injuries. This plan is sometimes called Medigap which complements your existing health plans. In some cases, your insurance will cover out-of-pocket costs not covered by Part A.

The purpose of this site is the solicitation of insurance. Contact may be made by an insurance agent/producer or insurance company. eHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. We offer plans from a number of insurance companies.

Having an insurance policy that covers health needs may be difficult. Please consider these factors when considering the benefits of comparing them.

Unlike original Medicare and Medigap, which cover all doctors and other providers who accept Medicare, most Medicare Advantage plans have a provider network and may charge more or may not cover doctors or facilities outside of a plan's network.

This page lists a list of things a person can compare between Medicare Advantage and Medigap plans. Some will require you to consult a medical or hospital within their plans network. You have to find the doctor who accepts the patients in Medicare.

Some plans require referrals and may require network specialists. Doctors are available without referral. Non-accidents may vary depending upon the services available through the plan. Emergency treatment generally includes travel within the USA and occasionally internationally.

The Medigap plan offers additional coverage on original Medicare, but it doesn't cover drugs. In addition, the Medicare Advantage plan provides a similar coverage as Original Medicare with additional benefits like prescription drugs, vision, dental, hearing and other health-care services.

AHIP estimates Medicare Advantage plan premiums are around $18 monthly. Average is however very different from place to place. The average of individual states in the United States ranges from $ 0 per month in Alaska to $ 77.77 in the United States. Premium varies based upon plan availability, coverage and other factors. Premium fees shouldn't be a big factor when evaluating your Medicare benefit program.

If you want to cancel your Medigap policy, contact your insurance company. If you drop the Medigap policy, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a " trial right. " If you have a Medicare Advantage Plan.

Almost everything on the Medicare Advantage program is capped at $ 0. The plan's premium is $165 for a month. Medicare Part B coinsurance and the deductible is $226, according to Medicare.gov. When those conditions have been met, the co-pay in Medicare Advantage is typically 10% from the Medicare-approved amount for many services and products, such as long term medical equipment like medications.

To be eligible for a Medigap plan, you have to be 65 years or older and be enrolled in both Medicare Part A hospital insurance and Medicare Part B medical insurance. You are not guaranteed that your application for a Medigap policy will be accepted if you don't purchase a plan when you are first eligible for Medicare.

The most common type of Medicare Advantage plans is Medicare Advantage. Part A is a Medicare Part B health and medical coverage that covers patients. Enrollment takes place for a limited duration but there is no possibility that your insurance will cover a pre-existing condition. Currently the Medicare Advantage plans include prescription drug coverage as well as non prescription drug coverage in three windowes.

Medicare must approve all private insurance companies that offer Medicare Advantage plans. These plans bundle Part A hospital coverage, Part B doctor and outpatient services, and often Part D prescription drug coverage into one package.

Medigap policies differ from Medicare Advantage plans. These plans provide a means of getting Medicare while a Medigap plan may supplement your original Medicare benefits. The monthly payments to insurance companies and Medicare for coverage.

Comparing Medicare Advantage plans vs. Medicare Supplement Insurance plans Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans both offer coverage for out-of-pocket medical expenses. You cannot have both a Medicare Advantage and Medicare Supplement plan.

Medigap plans are available for those with original Medicare, but they do not cover prescription drug prescriptions. Unlike Medicare Advantage plans, Medicare Advantage offers the same benefits as Medicare Original plus additional medical care services.

Recent Blogs :