Home / FAQs / Medicare Advantage and Medicaid Supplement Plans / If you want more information about Medicare Supplement and Medicaid plan options please click here. The first thing you need to do before you decide on the best Medicare Advantage plan for you is to determine if Medicare Supplements or Medicare Part D is right for you. The right plan can be a very helpful step in enrolling into coverage. Find Medicaid Plans online today Using this tool you will find the best Medicaid coverage that fits your lifestyle.

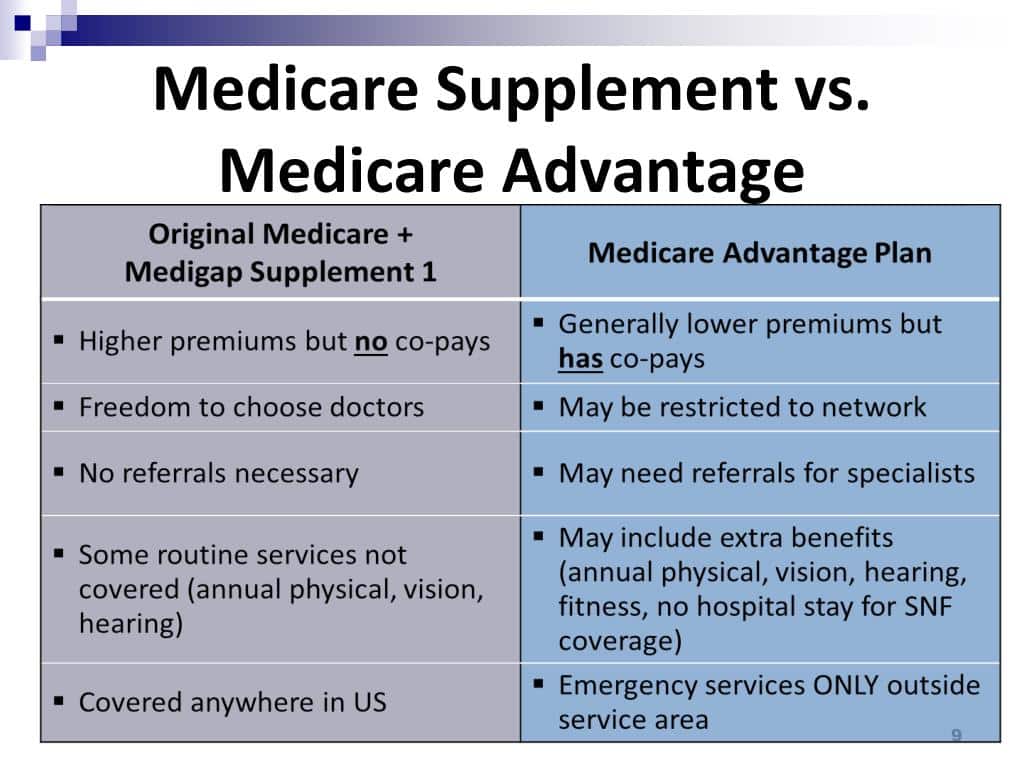

Medicare is designed to cover seniors ages. This is an alphabet-based collection of components that offer diverse types of coverage. Medicare also has some difficulties—including some holes which are just not covered altogether. For this reason, consider obtaining insurance through a Medicare Advantage or Medicare Supplemental plan. For a thorough comparison of pros and cons, we collected expert information about coverage, costs, conveniences and options available to our customers.

Summary: Medicaid Supplements and Medigap are distinct names for a similar health plan. Medicare Supplement and Medigap are separate names for similar health insurance programs. To explain this terminology, you can imagine Medigap as a program which fills a gap in benefits that Original Medicare does not provide. You can consider Medicare Supplements as a package which supplements or increases Original Medicare coverage by paying a portion of Medicare's yearly cost.

Medicare / Medicaid is an option for Medicare patients with additional benefits. Obviously, both kinds of planning work differently, and they are different. Medicare supplemental insurance is available only to individuals who have taken part in Medicare Part A hospitalizations and Part B doctors. This is not the official government-run program but private insurance for Medicare. Medigap plans pay 20 percent of coinsurance that would normally cover medical care.

Medigapro is Medicare Supplement insurance which assists in the gaps and sells through private companies. Original Medicare covers most, if not all, costs of coverage services and supplies. Medicare Supplemental Insurance (Medigap) can help pay re-payments of health care costs, including health care costs.

Medigap plan F, a more expensive plan, pays for Part B deductibles while covering the 20% cost of services Medicare doesn't pay. Medigap plans do not provide prescription drug coverage, and Medigap cannot be combined with Medicare Advantage. But Medigap plans are a way to tweak your Medicare to your specific situation while covering larger expenses.

Private insurance companies offer Medicare benefits to patients. This plan serves as essential insurance for Medicare-acquired individuals. Medicare reimburses the private company's risk. Please watch our Podcast now! These plans have also been able to have regional networks of physicians and hospitals, which means the coverage of the program won't be carried by you when travelling. In fact, your doctor might no longer consider this plan a health insurance plan. The Medicare Advantage plan provides you with the same coverage as original Medicare. There are also options to add other advantages. Despite their differences, this additional benefit varies between different plans.

Unlike Medicare Supplement plans, the Medicare Advantage plan pays secondary to the original Medicare Advantage plan which becomes your main insurance source when you enroll. Medicare pays an amount to whichever carrier the plan enrolls in for your annual insurance needs. Some new Medicare beneficiaries may see considerable Medicare Advantage plan advertising and very little promotion on Medicare Supplement programs. It is because carriers have a different profit margin between Medicare Advantage or Medicare Supplement plans. A plan that can fit your lifestyle, budget and health insurance needs.

The Medicare supplement is different than a health plan that offers supplemental benefits. Medicare Part C plans are structured to provide a comprehensive solution offering low premium payments. Medicare Supplements are available for patients at a lower cost. Below are a few comparisons of Medicare Supplemental Advantage Plans. When discussing Medicare Supplement vs. Medicare Advantage we often hear clients complain they don't have enough money available for the costs that can occur when enrolled with Medicare Advantage programs. How do I search for the most comprehensive Medicare coverage?

Medicare Supplement plan offers are also available from private insurers. However, it must be provided in every case, regardless of the carriers. Medicare Supplements cover all costs associated with Medicare for which the original Medicare plan covers you only. Medicare supplementation gives us an option for determining cost. Because each plan has a set benefits, you will know all your expenses. The Medicare supplementary plan doesn't require any medical network. The coverage is available at most medical offices and hospitals who accept original Medicare.

Many Medicare benefits include a 0 percent premium. Baethke states that in an insurance policy that charges a premium the premium is paid every month along with an additional premium of $165 [as per income]. Medicare Part B's coinsurance and the deductible are $226 according to a recent Medicare.gov report and once these are met, your copayment for Medicare Advantage can typically be around 20% of the Medicare approved amount for most products such as specialized medical devices like medications and deductible prescription drugs.

Medicare Advantage plans provide all of the same benefits provided by Original Medicare and provide coverage for services which are not included in Original Medicare. Some programs provide transportation to doctor visits or day-care services for adults. Besides extending coverage, a plan may also offer benefits for patients with chronic health conditions, the report said. For Medicare Advantage patients, in addition to Cigna, free vaccinations are available.

Medicare Supplement plans, also referred to as Medigapping Plans, can be purchased from private companies to help fill gaps in Medicare coverage. The Kaiser Family Foundation reports on a recent study comparing the health benefits of Medicare for individuals with their health insurance. There are 10 Medigap plan types available that offer universal coverage as well as helping pay for things such as deductibles, coinsurance and copay.

Additionally, it helps save money by reducing your monthly expenses. Jacobson said many people prefer it because they do not have to worry about what they have to pay each visit and hospital visit. You can see almost all of our medical professionals. In Arizona, you could take flight to Minnesota and visit the Mayo Clinic. Jacobson has found that obtaining such benefits is arguably important for people who are sick.

In the new report, CommonWealthFonds examined Medigap plans offering nontraditional benefits, including eye care, dental and hearing treatment, that are not included with Original Medicare. Jacobson added that there were very few companies who offer these benefits despite their own claims and also pointed out that. Most people probably have not realised they could use a program with similar benefits to Medicare Advantage”. On the federal level, policy encourages a certain level or deterred this benefit.

In general, Medicare Advantage is provided for: In Medicare Advantage plans, there are additional requirements. Enrollments can only occur during a specified period of time and you will not receive a refund if there are any preexisting medical conditions. In particular, you have the option of joining a Medicare Advantage plan with or without drugs coverage during the following time frames:

Do not believe you can receive an improved price on Medicare Supplement plans or Medigap plans versus Medicare Supplement plans. They are similar kinds of plans. Insurance companies offering Medicaid and Medicare Supplement insurance policies have to conform to federal regulations and must identify themselves by name. The word Medigas is often shortened by being more colloquial.

In most cases, an insurance company' s average annual premium can be around $200. Similar to the Medicare Advantage plans, it can save 62 percent or more per year for older adults a month with the lowest-cost Medicare Supplement. Jacobson says we’re examining whether private insurance is efficient and affordable.

Medigap and Medicare Advantage plans offer various advantages depending upon individual health requirements. Medigap plans provide coverage for people in Medicare except for the prescription drug plan. Medicare's Advantage program currently provides similar coverage as Medicare Originals, but also provides more benefits including prescription medications, vision care, dentist, hearing, and other wellness benefits.

Medicare policies differ in some ways from Medicare. These plans provide Medicare coverage and MedigaP policies only supplement the Original Medicare coverage. Payment for health insurance coverage by Medicare / insurance companies.

Medigap is a private insurance supplement marketed in private markets that covers a portion of the costs Medicare has not covered such as copayments, insurance, and deductibles.

Medigap is secondary due to the remainder cost. If the services you have received are not included in Original Medicare then you may not receive additional insurance coverage. Medicare Advantage Plans cover services provided by Medicare Original. Medicare Advantage Plans cover. However, Medigap isn't the only insurance option available as an alternative to Medicare.

Medigap offers several disadvantage based plans such as: Increase in monthly premiums. Have to find a good balance between different types. Prescription drugs are not included in Plan D.