Whether you opt for Medicare Supplemental Health Insurance, you should purchase a Medigap policy. Private insurance companies have Medigap coverage, but the government has strict regulations about it. This policy is available to those with Medicare Part B, but not those with Medicare Advantage plans. Medigap insurance pays for expenses such as coinsurance and copay.

There will be 12 health insurance options available to seniors in 2023. Our quick chart helps review Medigap plans faster as compared to other plans. Find the best Medicare Plans in three steps.

Once you've paid that amount, they take care of 100 percent of covered services for the rest of the year. In 2022, the limit for Plan K is $6,620, and the limit for Plan L is $3,310. These limits increase each year, based on inflation. Remember, Medigap does not cover prescription drugs or dental, vision or most other needs that original Medicare doesn't cover.

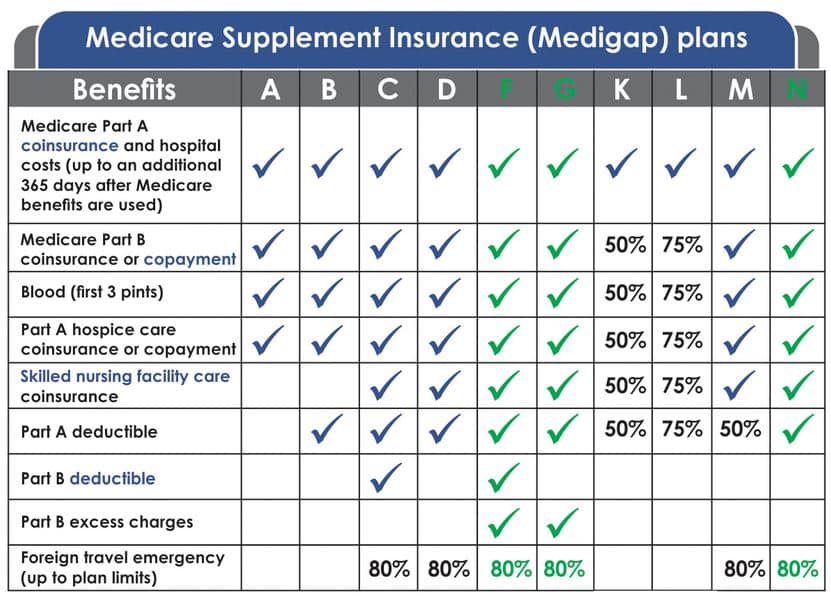

Medsupp Table Plans available to all applicants Medicare first eligible before 2020 only Medicare first eligible before 2020 only Benefits Plan A Plan B Plan G Plan K Plan L Plan N Plan C Plan F Part A Coinsurance and hospital coverage (up to an additional 365 days after Medicare benefits are used) Part B coinsurance or copayment 50% 75% 1 Blood (first 3 pints, per year) 50% 75% Part A Hospice coinsurance or copayment 50% 75% Skilled nursing facility care coinsurance 50% 75% Part A deductible 50% 75% Part B annual deductible Part B excess charges Foreign Travel Emergency Care 2.

The chart below shows the 12 Medigap plans covered by Original Medicare as part of this coverage. Do not confuse Medicare Part A and Part B plans. In addition, Medicare has Medicare Part B for hospitalized patients as well as Medicare Part B for outpatient medical visits. Medigap plan A or plan B provides supplementary coverage that covers the cost of original medical insurance. Whatever plan you choose, you'll receive the benefits at a doctor's clinic that offers Original Medical Assistance to Medicare. Medicare-approved medical professionals may refuse your application to a medical plan that you have chosen.

You can sign up for Medigap anytime throughout your life cycle. However, the Medicare Supplement Open Enrollments Window may be the best time to enroll in MEDGAP programs. When the applicant submits the claim during the claim period, the carrier can refuse the coverage. All Medigap programs can be purchased. You may opt out of a Medigap open enrollment period later in your life, but still need it. However, you have the option of answering health questions in most states. Therefore, it is possible that you could be denied premiums for the following conditions.

File a Commendation or Complaint Professional Standards Unit Civilian Commendation/Complaint Forms Report Fraud Link to CDI's two suspected insurance fraud reporting systems – 1) Insurance Company Suspected Fraud Reporting Portal and, 2) Consumer Suspected Fraud Reporting Portal. News Press Releases Official announcements, news releases.

Medicare Supplement insurance plans are marketed through privately owned insurance companies. It's possible the available plan and the premium of the plan can differ. In 2022, the average premium price for Medicare supplemental health plans was $121.61 per month. The cost of every Medigap plan can vary greatly among different plan types. The different types of Medigap plan offer various combination standard benefits, so a plan that has fewer benefits might offer lesser costs. Alteration between two people can influence how much Medigap is costing you.

The Medicare Supplement plans that are available to you depend on the state in which you live. And which Medicare Supplement plan you choose depends on your individual needs. Use the information below to help as you consider which Medicare Supplement plan is best for you. Medicare Supplement (Medigap) plan comparison Only applicants first eligible for Medicare before 2020 may purchase Plans C and F. A checkmark indicates the benefit is paid at 100%.

Medigap plans have different advantages. Medigap plans may help with determining what coverage works best for you and includes premiums which are affordable for you. Medicare Supplement plans are most commonly known as Medicare Supplements. Currently 45 percent of Medigap beneficiaries are in the F2. Plan F covers more standard Medicare expenses than all other Medigap programs. The plan includes all of the standard Medigap benefits. Plan F's average monthly cost is $87.16 per month 20221. Medigap plan G is the second-most widely used medical plan.

Typically the price is the first factor to be considered in deciding on Medigap' s coverage. All Medigap plans are subject to monthly premiums. Your premium will depend on several factors, such as gender or age. The important factor affecting your Medigap premiums is the plan letters you receive. This letter represents your coverage. Medigap plans which offer high protection rates are often much higher priced. Below is a comparison between Medigap Monthly samples of all non-smokers residing at Tampa (3434 ZIP Code).

1 You may only apply for plans C and F if you were first eligible for Medicare before 2020. Plans K and L: Lower Premium, Cost Sharing Plans K and L are cost-sharing plans offering lower monthly premiums. The premiums are typically lower because, for some services, they pay a percentage of the coinsurance instead of the full coinsurance amount.

Supplementary Medicare plans offer Basic Benefits, whereas plan B provides Basic Benefits with Medicare Part D deductibles and other. The Medicare Part A deductible may represent your highest expense for a hospital stay. Plans C and A have generally high upfront expenses, including Skilled Nursing Facility coinsurance and Medicare Part B excess charges. Most comprehensive plans provide you with full reimbursement for all of the costs associated with Medicare services that you receive from your insurer.

Medicgap's policies are backed up by the state law and must clearly define the term Medicare Supplement. Insurance companies may sell mainly standardized policies in most states. All policies have a basic feature but some provide further advantages so you can choose one which suits you best. Medigap policy is standardised in the United States of America and Canada. Depending on what state laws govern the policies the insurance provider will offer you the policy. The insurer selling the Medigap policy:

If you compare all Medigram plans in a single review you'll see that premiums and charges vary. If you have Medicare or Medigap, the following expenses will apply. Medicaid's premiums vary based on plan. Some plan options require copayments or deductibles, whereas other plans require seniors to pay deductibles to get coverage. Examples: Medigap plans F and C. However, a policy with first-dollar coverage that does not require deductibles has not changed.

Only eligible Medicare applicants who have been eligible since 2020 are eligible for plans C and F. Checkmarks indicate the benefit is 100%. Part A Coinsurance and hospital coverage (total for a maximum of 365 days following Medicare eligibility). Coinsurance or copayment. 50% 75% Blood (first three pints / month). 50% 77.5% Part A. Coinsurance or copayment for hospice patients. 50%.

There are 12 Medicaid programs for most states lettered A through N. These two high-deductible options cover the basic policy benefits as well as the different levels of coverage. When comparing health insurance plans, the benefits and cost should be taken seriously. In some letter plan cases, you can pay out medical costs like copays, co-insurance and other expenses.

Remember that you can only have a Medigap if you have Original Medicare. If you are enrolled in a Medicare Advantage Plan, Medigaps cannot be sold to you . There may be other Medigap eligibility requirements that apply to you, depending on the state in which you live. Learn when you have the right to buy a Medigap without restriction

Medicaid plans F and C are no longer offered to individuals who are eligible for Medicare after January 1, 2020. If you have a plan in place before 2020, you still have one. If you become eligible for health benefits by 2020, you can buy Plan C after January 31, 2020, unless you have a different option available at a different location.