Our recommendations are based on independent reviews and advertisements have no effect on our recommendations. We may receive compensation for visiting partners recommended to us. See Advertiser disclosures below. A Medicare Supplemental Plan (also referred to in Medicare terms as a Medigapan plan) is a private-sector plan, independent of the Medicare program.

These Medicare Supplements usually cover supplemental health insurance costs that weren't covered by Original Medicare. They could also involve reassurance from doctors and dentists as well as vision treatment. The most reliable Medicare supplement insurers offer competitive rates and simple website interface.

Medigap plans sell through private providers, while Medicare covers it. This regulation applies to all plans. In fact, Medigap plans G are similar to Medicare no matter which insurance you choose. Most states have ten standard Medigap plans. The insurance firms have control over the plans sold by the insurance companies and their prices for the plans. The companies have varying strengths and weaknesses.

Medicare provides excellent retirement savings opportunities. Those 62 and over who qualify for Medicare also consider it to be the best healthcare plan. Nevertheless, the system is not able to deal with any problem. In fact, some people need insurance called Medicaid supplemental health insurance - aka Medicaid - for a full range of health concerns.

It's easy to enroll with Medigap. The medication supplements could either be purchased direct with an agent, Corujo adds. Since the enrollment is not available every year you can sign up for free. In order to buy a Medigap policy you should sign up at the open enrollment time for Medigap, a term of six months.

Those days start in the first week after you are 65. In these times, it is possible to purchase the Medigap policy in any State even though it is not available. Use the instructions below to purchase Medigap Plans.

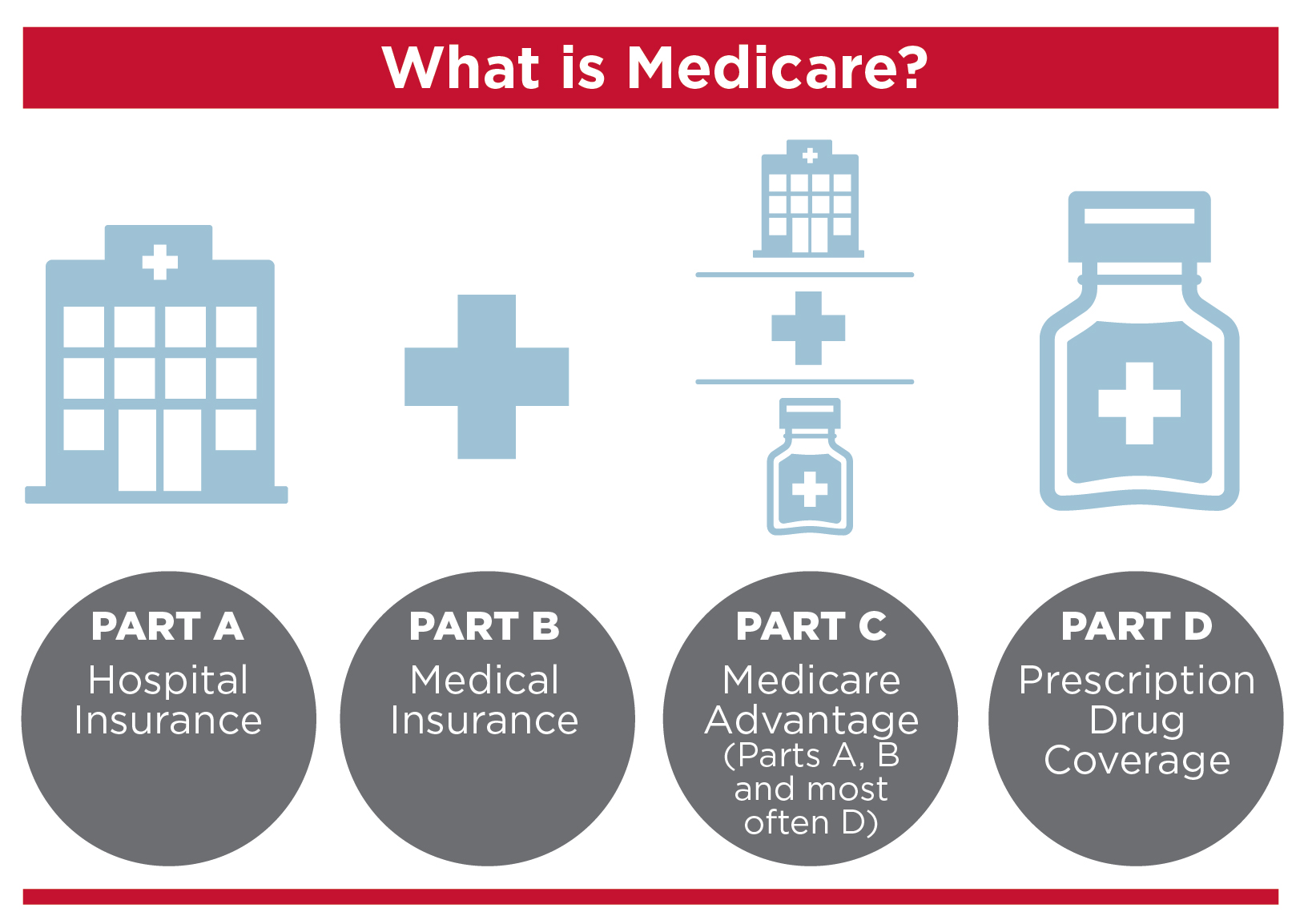

How many Americans are eligible to receive Medicare benefits depends on specific health-related issues. Medicare Advantage is an alternative to Original Medicare that includes the same coverage with some extra benefits, including drug protections (Part D). Similarly, Medicare is offered to Medicare recipients by private insurers to assist in filling gaps in the coverage. Medigap provides universal coverage for things such as the deductible copayment or copay. Medigap's policy however does not cover prescription drugs.

Currently both Medicare Advantage or Medicare Medicap programs are supplementation for Original Medicare however these plans differ in terms of cost. Medicare Advantage offers alternative Medicare programs. Medicare benefits usually have a low or no monthly fee and cover most prescription drugs, though doctors and hospitals can restrict the options. It's also impossible for someone to sell you the Medicare Supplement plan unless you've switched to original Medicare if you don't have the Medicare.

A, B - C - F : G - C, X L : There is a Blue Cross and Blue-Shield service in every county so wherever you are there is BCBS Medigap plan for you. Blue Cross Blue Shield represents 34 businesses. The company accounts for 42% of all American health insurers. BCBS provides Medicare Supplements in nearly every state in the US, though since each company operates independently their plans, prices and other aspects vary wildly.

The supplement costs vary depending on carriers and plan options and not every carrier provides the plan for each individual patient,” Brandy Corujo said. The premiums are determined in monetary terms by insurers selling them. The company sets the prices at premium by three methods: Medigap plans can only be bought via private insurance companies and you pay monthly premiums to the insurance company.

A, B C D E F, G K, L & N plans are marketed at Various Locations in the United States. AARP/UnitedHealthcare offers each Medigap plan with one exception Plan M. AARP offers all other Medigap plans. AARP provides all Medicare Supplements in its plans through UnitedHealthcare, a major Medicare Supplement insurer. The Medigap program is less frequent and has fewer complaints than most competitors.

You'll be responsible for deductibles and copayments, but you'll have lower monthly premiums. Select and Innovative N are available in some states. Prescription Drugs, Dental, And Vision Coverage Medicare Supplement plans do not include prescription drug coverage, but you can purchase a Part D plan for an additional premium to help cover medication costs.

Medicare Advantage vs. Medicare Supplement Medicare Advantage plans serve as a substitute for Original Medicare, providing that same coverage plus additional benefits like prescription drugs coverage (Part D). Meanwhile, Medicare Supplement plans, or Medigap plans, are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps.

Medicare Part B (Medical Insurance) does cover emergency room visits. Medicare Part B covers emergency department services provided in a hospital.

“ Health Care Service Corporation COVID-19 Preparedness .” Published March 7, 2020. Healthcare Services Corp. has a strong financial standing, despite providing Medicaid services, which can be less profitable. That's a testament to the company's commitment to quality care.

What Is Our Methodology? We selected the health insurance companies with the highest market share and reviewed them by financial strength, customer satisfaction, and other factors, such as what makes these plans so popular. We also offer information on the companies, including financials, customer satisfaction, complaints, geographic reach, and pricing.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners . Best Medicare Supplement Insurance Companies in 2022 Find the best Medigap insurance company for your needs and your budget. Alex Rosenberg Apr 22, 2022 Share Many or all of the products featured here are from our partners who compensate us.

Anthem Blue Cross Life and Health Insurance Company (Anthem) has contracted with the Centers for Medicare & Medicaid Services (CMS) to offer the Medicare Prescription Drug Plans (PDPs) noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans.

During this Medicare Supplement open enrollment period, you cannot be denied a policy based on past or current health conditions. Not all states allow health underwriting, and some states offer plan(s) to those under age 65 who are eligible for Medicare due to reasons other than age. With Medicare Supplement coverage, you can use any doctor or hospital that accepts Medicare patients.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent or insurance company. Once enrolled into your Medicare Supplement insurance plan, your coverage is guaranteed for the life of the plan with only two exceptions/restrictions: nonpayment of premiums and material misrepresentation.

Medigap's disadvantage: higher monthly premiums. Have to navigate varying plans. Prescriptions are not covered by Plan D.

Unlike Plan A and Plan B, it's a common Medicare supplement that offers a number of benefits. The best known Medicare plan is Medicare Advantage. 47% of all Medicare beneficiaries enroll in the F program.

The best policies can be found online. All plans are different according to your state, your needs and cost. Step 1 - Check whether a person can enroll. In general, it is possible for someone to receive Medicare if he or she turns 65. When Can I Get a Medicare Supplementary Policy? During this time, you are allowed to purchase Medicare Supplement policies from the government of every state you want.

Medicare Supplement plans are not available for meds and can be purchased with Part D program. Medicare Supplements does include dental and glaucoma coverage, but you can purchase dental and glaucoma coverage from Anthem at no extra cost. Several other state-wide Medicare programs include vision and hearing benefits for patients in Nevada, Kentucky and California.

Medicaid Supplement plans can be purchased for any health insurance plan you currently have. Your enrollment period starts in the month of your age. During the Medicare enrollment period, you will not be denied an insurance policy because of your medical condition or past. Not every state allows underwriting and some states provide plans to persons under 65 who qualify for Medicare based on other factors.

Medicare Supplement insurance gives you a choice of medical offices that accept Medicare patients. In addition, Anthem provides Medicare supplement programs covering all part A or portion B coinsurance.

The Plan FD helps pay Medicare deductible payments along with copayments. Currently, the plan F cannot be used for individuals claiming Medicare after Jan 1, 2020. Various states have selections and innovative products available to the general public.

Plans NE help to reduce the costs of Medicare Part A coinsurance. Your premium may be higher, but it's less expensive. Select & innovative Ns are offered in a number of states.