Medicare Originals have the right to enroll for Medicare Supplement Insurance, called MedSupp, to "fill gaps" in the original Medicare coverage. However, Medicare Advantage recipients are not allowed to apply for Medicare Advantage. Medicare Supplement plans help pay for some Medicare-approved costs like the purchase of prescription drugs for certain purposes. There will be no coverage for dental expenses that are excluded from the Original Medicare plan. A Medigap policy that is no longer sold is no longer available until July 2010.

Medicare Supplement Plans J is among many Medigap plans. Options. Medigap plan covers deductibles and co-payments for services not covered by original Medicare, i.e. medical costs. Medicare's Supplement plan J (formerly called Medicare Supplement plan J), was discontinued on the 1 January 2010 enrollment deadline. All people with a plan may retain it and still get benefits. Continue reading for more information on Medigap plan coverage.

Supplemental plans are designed to cover certain medical expenses that Original Medicare does not cover. This plan fills your gap and includes premiums and coinsurance. In other words, Medicare Supplement plans can provide little or nothing in the form of out-of-pocket cost of health care products or equipment if the plan provides it. Let me guide you to the best Medicare Plan.

Medicare supplement plans are among the many possible Medicare supplement plans available. As part of Medicare's 2003 prescription drug overhaul Act, the program has been suspended from all new members. However, people who had been enrolled in Medicare after June 2010 and already enrolled in Plan J may still retain insurance, as long as their insurance provider continues to provide such protection. Plan J provides the highest available coverage for an individual. Benefit under plan J is Part AA Coinsurance and hospitalization 365 days after Medicare Benefit is withdrawn. Part A and Part B Deductibles.

Medicare Supplement prices may vary according to ZIP code and carrier. In some instances a Medicare Supplement may be more expensive within a ZIP code than in another ZIP code or between carriers. The annual average premium for Medicare Supplement is around $40 to $300. The premiums on your Medicare Supplements are affected by a number of factors. In some cases, Medicare Supplement plans may save you from expensive medical bills. Although premium prices are crucial when selecting a Medigap plan, they are no longer all factors. Ensure you understand insurance policies and other deductible expenses. Medicare does not cover Life Alert services. However, some Medicare Advantage plans may offer coverage for Life Alert services as part of their supplemental benefits.

Upon Medicare enrollment, the patient can receive Medicare Supplement benefits. In a Medicare Original Plan, there will never be a full reimbursement for Medicare coverage. It also leaves beneficiaries with incurred expenses that can rapidly grow. To cover the costs, Medicare Supplements are offered. Once Medicare pays part, your Medicare Supplement plan pays another part. In most cases, your premium is paid for by paying deductibles. After factoring in the monthly premium, Medicare Supplement plans start saving you money right before your initial appointment with a medical professional.

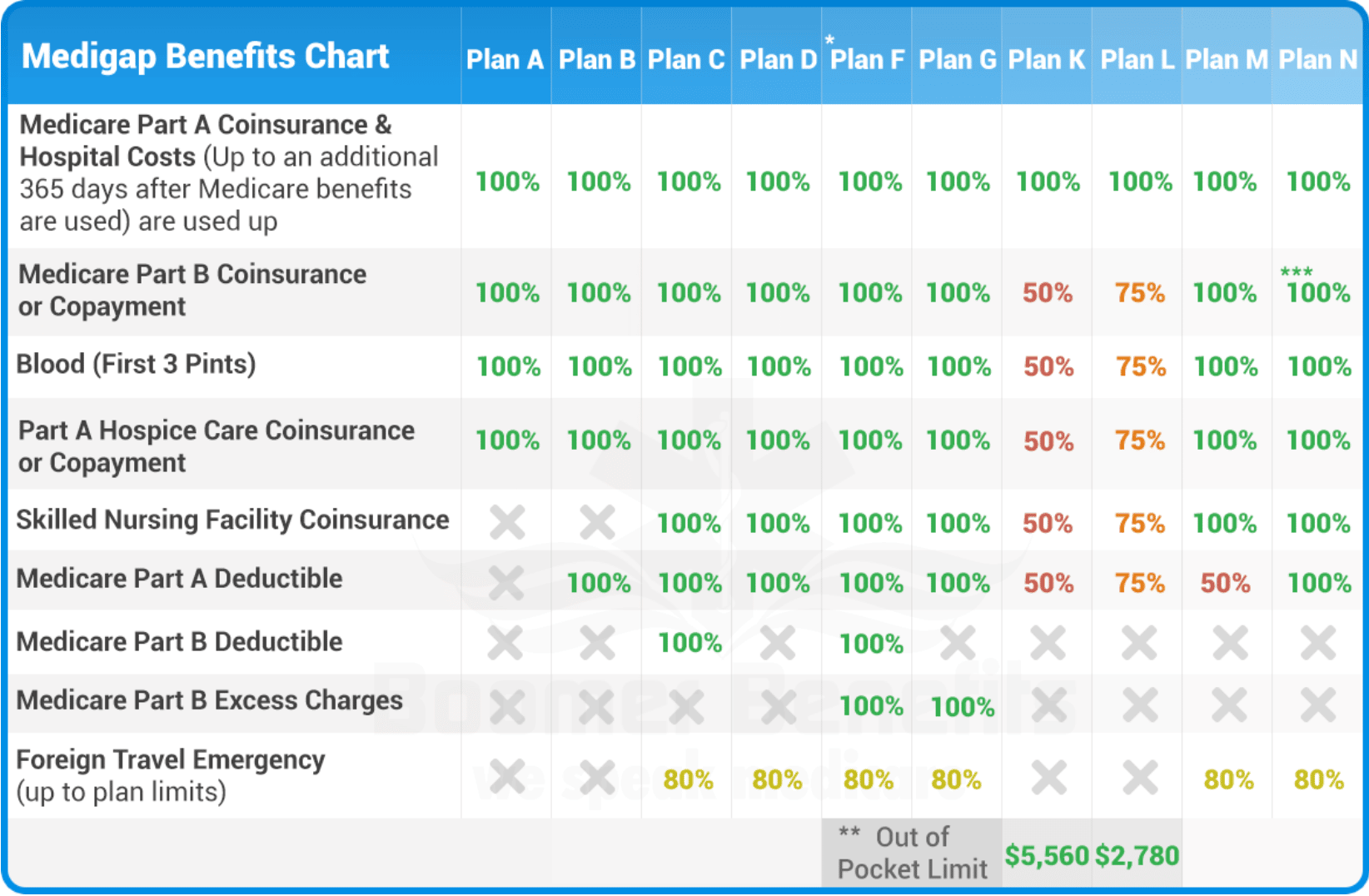

Medicare supplements don't cover everything that original health insurance cannot cover. Medicare Supplements are an excellent secondary coverage for the original Medicare program. Therefore, the plan is only billed once original Medicare has paid its part. All Medicare Supplement Plans cover different percentages of their costs. These costs can be seen on our table of contents. The major benefits of Original Medicare Supplements do not cover dental, vision, hearing prescriptions and vision care. You will also be able to access the Medicare Supplement plan without any difficulty.

Before 2003, Medicare had no prescription drug plan (medicines available from a drugstore). Some Medicare plans included the use of prescribed medications for people who signed up for these plans. Nevertheless, Congress passed Medicare prescription drugs and modernisation legislation. The bill introduced a Medicare Part D plan, which is a standalone prescription drug program that a private company offers. The legislation provides that Medicare Advantage plans may provide prescription drug coverage. The 2003 law also extended the original Medicare benefits.

Although Plan J has been closed to all Medicare users, there are some Medicare patients enrolled in the Medigap program. Although Plan J covers some coverage it is quite comprehensive. Medicare has evolved over the past decade. Some benefits on Plan J can also be accessed from federally funded Medicare through the federal system. Affected plan J recipients can now ask themselves if implementing the Medigap program will be the most cost effective option. Before you ditch Plan J you need several factors to take into account.

As already noted, beneficiaries enrolled in Medigap Plan J may remain on this plan. Only 3 per cent of eligible patients are covered by Medicare. Are people pursuing their plans? What is the first important plan costings? Because Plan J does not allow for new members, overall risk increases with age and claim frequency. It is possible that plan J's premiums will increase faster in the future than other Medigap plans. Secondly there must be a benefit. Several other Medigap plans do match Plan J's coverage, however.

One other Medigap plan similar to Plan J is Plan C. Medigap plan C covers 80 percent of emergency care costs. Plans C does not include Medicare Part B excess expenses. Medigas Plan F includes Part A excise charges. Medicare's excessive charges can be costly if you get medical care from a healthcare provider that refuses Medicare coverage. The provider will no longer accept Medicare reimbursement for the entire amount of services rendered. These providers can charge you a maximum 15 per cent increase to your medical bill.

The major advantage of Plan J over Plan F is the coverage available for foreign medical emergencies. Plan J provides 100 percent of your medical care when traveling internationally. Plan F covers 80 percent travel insurance for travel expenses. Those of us traveling frequently can keep their Plan J because it provides greater medical assistance. But in the event you're not traveling outside the U.S., this additional coverage could have little effect on you. Plan F has become a popular Medigap plan.

Plan G has the same advantages as plan J. Except – similar to Plan F. 80% of the cost of emergency medical care abroad is not covered. Plan G covers deductibles and expenses for deductibles. Medigap Plan F covers Part B deductibles. The deductible for Medicare Part B reaches 232 a year by 2020. If you have a plan G option that is cheaper than the plan J, you can make savings in the long-run by implementing g in plan G (provided you have not needed extra health care insurance).

Medicare's policy is a supplement to the health care insurance provided by Medigap. The plan reimburses Medicare-approved unused payments – like copayments, health insurance, and deductibles. Furthermore, Medicare offers additional benefits that Original Medicare does not. It also offers medical assistance to travelers from outside of the United States. There are currently 10 different Medigap plans: B, D, C - A F - G - K - L. Some of those plans are, however, no longer offered for new enrollers on Medicare.

To qualify as part of the Medicare Supplement, the person must be enrolled in Original Medicare. If you have not been enrolled in Original Medicare for ten years or less, you must be eligible: All enrolling periods begin at the beginning of the month the Medicare Part B is in effect. Until you join the Medicare Supplement plan during that period your issue rights are guaranteed. Pre-existing conditions are not considered necessary for acceptance into an ad hoc program.

Medicare Supplement is an insurance plan containing insurance premiums which covers the health care expenses that Original Medicare pays. Providers bill Medicare first, then pay the rest to Medicare Supplement providers. In 47 states, Medicare Supplements have letters N and A in them. Almost all letter plans offer various coverages. Those types of coverage have a Medigram nickname. The resulting federal standardisation is consistent across the insurance industry.

The chart below describes two of the ten highdeductible health plans for Medicare enrolled in Medicare. This coverage is standardized across 47 states and Washington D.C. It means coverage is not different across the nation. Carriers must follow standardized procedures. The three states with Medicare Supplements are Minnesota, Massachusetts and Wisconsin. Each country's Medicaid plan closely follows all the rules in its top standardized Medicare plan.

The median monthly payment for Medicare Supplement Insurance Plan J is 166.07 dollars. The cost of the MedigaP plan may differ depending on the health of a person, the type of coverage the insurance company offers and where your house is located. Below is a list of the average cost for Medigapp plans with lower premiums compared to the lists and plans which have high premium rates. Remember, Plan J has been discontinued for the incoming enrollees.

For people whose Medicare eligibility is not in place as of 2010. There are other plans that are still available offering very similar features to Plan J. Previously, Plan A had a compatible option and as of Jan 2020 the option has not become available in the case of Medicare enrollees. Most comparable plans currently exist are Plan G, and Plan NN.

Plan N combines with the same plans as Plan J, although some exceptions are noted in its name. Unlike Plan J, foreign travel emergencies can only cover 80% of travel costs against 80%. Plan A covers the deductible in a Part B but not in an additional Part A. Doesn t cover the excise costs of Part B. Does not include recovery at home. Note: This resource will give you an overview of plans in comparison to other plans available.

Plan G offers nearly the same benefits as Plan J except for a few notable exceptions. Foreign travel emergencies only cover 80% compared to 100% of plans. Please read about Medigap Plans G and compare it in a different way.

Medigap plans do not include prescription medicines anymore. The Medigram program covers primarily Medicare expenses that do not exceed the deductibles or copayments. You have the choice between Medigap plans or Medicare Advantage plans. It is possible you can't combine Medicare Advantage insurance with Medicare Supplement Insurance.

Hospice care is now covered in Part A (hospital insurance) while preventative care is covered in Part B (medical insurance). The introduction of Medicare prescription drug coverage (Part D) also made the prescription drug benefits aspect redundant.

This Medicare Supplement insurance program referred to as Medigap may help cover insurance expenses the insurance plan does not cover. Contrary to Medicare, Medicare is offered by public health plans.