Medicare provides federal health coverage in varying forms. The Medicare program does not cover everything, including medical expenses. Medigap is a supplementary insurance policy whose benefits are not covered by Medicare. One in three True Sources are also enrolled in Medicare Part B as part of MediGap policies. Medgap offers 10 different coverage plans with different coverage options for different people. One of these plans is Plan G. Many individuals chose Medigap Plan G as being one of only the Medigap plans covering Part B excess charges.

Medigap Plan G prices may be very varied depending on several variables, such as your geographical location. How much plan G costs will depend on the place of residence, the age of the person, and the gender of the person”. Plan G costs range in most areas of the United States between $91-110 monthly. There is also another state which is less and another that has a much higher rate. This is one example of current (October 2021) Plan G pricing in various parts of the country. Important: This rate is for examples only.

Medicare Supplement Program G offers the broadest available Medicare supplement (Medicaid) for new seniors. These coverage have increased in popularity recently. Find Medicare plans online or offline. Medigap plan G satisfies a gap in the amount Medicare pays to you as compared to the expenses. These plans can be used by a variety of Medicare users throughout the USA if required.

Medicap Plan G is a standard Medicare insurance plan in most states. Massachusetts and Wisconsin have several possible choices. Medicare Supplement Plan GP has the fastest expanding Medicare plan. Read on to find out what Medicare Advantage plans are a great Medigap plan for you.

If you're interested in enrolling in the Medigap G plan, you will be covered by Medicare Part A and Part B. Pre-existing conditions can affect your enrollment in Medicare Supplement Plan G. Conditions can no longer influence your enrollment when applying for Medigap Plan G during your Medicare Supplement Opening Enrollment Period. During such periods an insurer can refuse to cover your claim. Upon re-enrolling, you will face health risks underwriting. However certain state rules may allow your application to enroll without answering this question, which will be vital to understanding your state's permission.

Like other Medicare Supplement Plans, Medicare Supplement G provides supplementary coverage as opposed to Original Medicare. Original Medicare provides no complete coverage for medical care. Medicare Supplements can cover your outright costs. Ten standard Medicare Supplement plans are in operation across the nation. Medicare Supplement Plans are indicated with letters A to N. Every Medicare Supplement Plan is a separate coverage plan with separate monthly premiums to cover the medical care needs or meet budgets. Medicare Supplement Plan G is a senior option in 10 categories.

The Medicare Supplement Act does not mandate Medicare Supplement plans be offered in some states. In some states, the insurance company offering Medigap plans should offer an alternative plan for people under 65 years of age. In some cases, these providers offer Medicare supplement plans. The most commonly available plan for people below 60 is Medicare Supplement Plan A. Medigap A provides the most essential advantages. Some carriers are aware of the importance of broad plan availability, which will allow people with disabilities into Medicare Supplement Plan G.

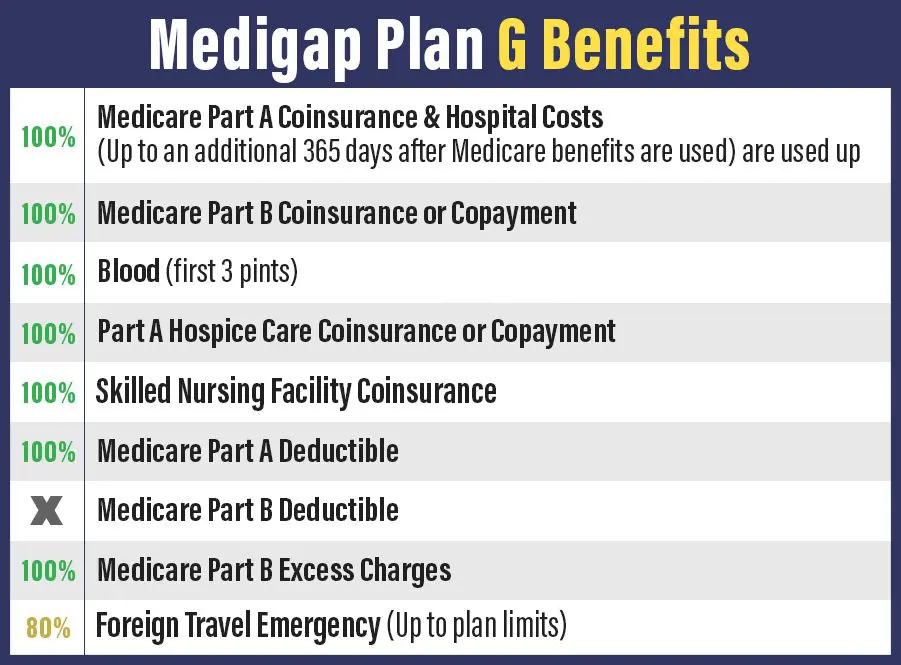

Medigap Plan G helps minimize expenses. Benefits of Medicare supplement plan G include: The only costs of Medicare supplement plan G are deductibles and deductible payments. When you meet your Medicare Part B deductible, you can avoid additional copayment charges and medical costs. In addition, the Medicare Supplement program provides the same benefits regardless of the company's coverage. However, the monthly premium rates vary from state to carrier. How do you compare health insurance options and choose a plan with the best rates and benefits available?

When you're 67, the health insurance plan is open to you. It's based on federal health insurance that pays out over your working life. Medicare Part A or Part B is an alternative Medicare program that covers all of your healthcare expenses, but it is your responsibility to take care of some of the rest. Under Original Medicare you will pay all costs, including deductible, cotia, copayments and overdraft fees. This cost share is considered your “gap” in the coverages. In the age of retirement we can't wait for unanticipated expenses on our medical bills.

The benefits of the Medigap Plan G are as follows: The high deductible Plan G is available to all individuals who become eligible for Medicare prior January 1, 2020. Generally, though the eligibility period for Medicare has ended January 1, the person can only be considered for the High Deductible Plans. The High Deductible Plan F also includes protection for the Part B deductible. The eligibility age for Medicare is 65, but there are some exceptions and additional criteria.

The most important thing that should be noted is that all the Medigap plans are standard. All policies must also conform to federal or state laws that have been created for your safety. Every plan provides the same benefits at the same levels of coverage, no matter how many insurance carriers. It certainly provides an advantage to customers, as it allows the user free choice in the comparison of the plans apples to apples. If there is any medical option you have it must be examined to ensure that it is suitable for your requirements and budget.

Medicare Supplement Plan G is unable to cover the Part B deductible in any way. Medigap benefits must be met prior to the Medigap benefits start. The supplement plan also provides no coverage for dental, eye, hearing, or prescription medications. Medicare Plans G are not covered by Medicare. This equates only to payment after original Medicare payment. If the Medicare Supplement Plan G does not cover this portion the Medicare Supplement Plan is not covered. Let's imagine you'll have more benefit options.

Depending on the premium you pay for the Medicare Supplement plan, there are several variables that affect your premium. It will depend on the Medicare supplement plan you used at your enrollment. Medicare Supplement Plan G increases are typically between 2% to 6% annually. Remember, the percentage may vary from carrier to carrier. Understanding your carrier's rate increase record is essential. Researching carrier reviews before registering can help to determine the right insurance plan.

A major advantage of Medigap plan G is their low upfront cost. Medigap plans G require you to meet a Medicare Part B annual deductible. This insurance plan does not include additional copayment or deductible fees. Part B s Annual Deductibility costs $233. Once a certain threshold is satisfied this year you will have full coverage for your entire life! You have paid part B annual deductible before Medicare starts paying your supplemental insurance premiums and services.

This is an illustration of how Plan G helps cover the gaps in Medicare coverage. Plan G is generally cheaper than Plan f and is therefore important to compare price with benefits. Keith Armbrecht Medicare on YouTube.

How will Medicare Supplement plans work with your Medicare Supplement plans? If you receive medical insurance for a certain item or service such as skilled nursing care, the same is applicable in the Medicare Supplement Plan G. However if Medicare doesn't cover a service your Medicare Supplement Plan G doesn't cover.In fact, Medicare Supplement Plan G doesn't cover a Fortunately there are independent plans for the services provided.

Despite the low-deductible nature of SSGP, many are unaware. Medicare Supplements Plans G are considered high deductible (GHD). These plans are similar to standard G plans except that they are highly deductible. The 2020 plan's maximum deductibility will be $2492. You will also have your Part B monthly deductible of $233 paid out before Medicare coverage is started. From here, your deductibles are capped at $2,449.

Current plan G covers all standard Medicare Part B deductibles. In 2020, new Medicare-covered health insurance requirements prompted Plan G to offer full coverage options for newly qualified Medicare beneficiaries. Medicare supplement benefits standard plans G. Medicare Part A co-insurance and hospital expenses : Part A co-insurance or co-pays.

Hospice care is medical care for people suffering from terminal health conditions. Medicare offers this service, although copayments must be made. Typically, this copayment includes $5 for each prescribed medication to relieve symptoms as well as 5% from the federally funded reimbursement for inpatient respite care. This cost is fully covered under Plan G.

Medicare Supplement Plan G is one of the largest Medicare Supplement plans available. Medigap Plan will help meet your needs. Medigap plans are available for all patients who are covered by the Medicare Part B deductible. This program can help you save thousands in healthcare expenses each year.

The median Medigap Plan G premiums for aging adults in 2022 were $143.61. In 2022, the most affordable benefit in the plan is just a little more than $19 each month. Beneficiaries who choose between Plan E or Plan G may benefit if Plan E has the same costs.

What does Medicare cost? Medicare plans cost 145 yearly for aging seniors. You can usually see several different pricing rates on insurance coverages because different companies use various pricing techniques to calculate premiums on each plan. 23 October 2022.

Plan G costs start at around $99-110/month in almost every state across North America. There are some states below this level and others much, many higher. Let us list some examples of the current (October 2022) Plan g rates in various areas of the country. 26th of October 2022.

144.36 - What is Mediga plan g? A typical Medigap Plan G premium for older adults in 2022 amounted to $143.64. In 2020, Plan G's deductible is only a benefit that will not be covered in its entirety, and will cost you about $233 an hour. February 3, 2024.