Medicare Supplement Plan E was the former Medicare Supplement Insurance (Medicap) plan and was not offered in 2010 to the new enrollee. However, those who have plans E can still keep them. Medicare provides most, but not all, of the health care expenses.

Medigram plans cover some remaining expenses if the client is currently in a financial crisis. In 2010, Medicare patients cannot enroll under Plan E. A person who is already enrolled under the Plan E policy can retain the Plan E policy. Those who want to switch plans may however prefer a more economical alternative.

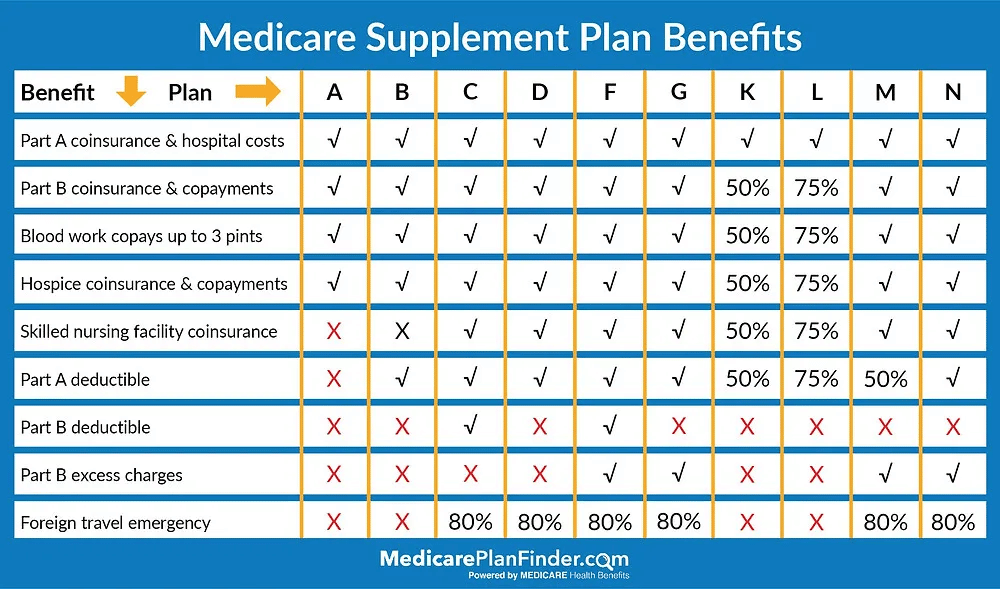

Every Medicare Supplement coverage must be covered under state and federal law that protects your health and must clearly identify as Medicare Supplement Insurance. The insurance company will only sell you standardized policies labeled with letters.

Each policy varies from basic policies, but some of them also include other benefits that you may need for your needs. In Massachusetts, Minnesota, and Wisconsin Medigap policies differ from one another. All companies determine the type of Medigap policy that they want to sell, but different states have different policies on them. Insurers offering Medigap insurance:

Those covered by Medicare Part A or Medicare B (original health insurance) may benefit from Medigap coverage to address a gap. Medigap is a private policy that offers assistance and helps pay for the costs of your coverage. Medigap plans are standard, but some standard plan plans are not available for you.

Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs (e.g., deductibles, copays and coinsurance) not covered by Parts A and B. These plans are available in all 50 states and can vary in premiums and enrollment eligibility.

Typically this first enrollment period will allow your first eligible patient a limited period to join Original Medicare (Part B or A) after a successful qualifying application. Once you've enrolled in Medicare Part B, you're offered a number of other coverage options.

The most suitable time to acquire Medigap policies is six months, which begin the day you turn 65 or younger and enroll in Part B. After that time, the possibility for purchasing Medigap coverage may be limited and it may be denied. Different States handle different situations, but some have longer opening enrollment periods for certain students.

Medigap coverage generally does not have network restrictions and can be obtained anywhere Medicare accepts the plan. Durable medical equipment (DME) is any medical equipment used to serve a medical purpose that can withstand repeated use.

The Medicare enrollment periods are as follows: Initial Enrollment Period (IEP) This is the period when you first become eligible for Medicare. It typically begins three months before your 65th birthday and ends three months after your 65th birthday.

Legal Disclosure Not connected with or endorsed by the U.S. Government or the federal Medicare program. The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent or insurance company. This policy has exclusions, limitations, and terms under which the policy may be continued in force or discontinued. Medicare coverage for nursing home care depends on the type of care being provided. Medicare Part A covers up to 100 days of skilled nursing facility (SNF) care after a three-day hospital stay.

The Centers for Medicare and Medicaid Services (CMS) constantly monitors Medicare Supplement Plans, current economic situations, and maintains the needs of senior citizens.

MedicareSupplementSolutions.com is not affiliated with or endorsed by the United States government or the federal Medicare program. By using this website, I confirm that I understand and agree to the applicable Privacy Policy & Terms of Use.