Most seniors will have 12 different Medicare Supplement (Medicaid) Plans in 2024. When comparing a MediGap plan, we offer an easy downloadable chart. Get a Medicare Advantage plan with this simple guide to find the most efficient and affordable plan.

All policies offer the same basic benefits The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way.

It is sometimes hard when you are trying to understand Medigap max out-of-pocket (MOOP). Keeping in mind is that all Medigap Plans K & L have costs shared. It means your plan covers all the benefits you receive with a maximum limit to keep seniors from paying over a limit: The Centers of Medicare & Medicaid Services (CMS) have compiled the United States Per Capita Costs estimates (USPCC) to determine these increases. Medigap plan K and L are subject to maximum out-of-pocket expenses (MOOPs) of 6940 and $3470 for 2023. Estimations of 2020 OOP limits are based upon CMS's estimate of Medicare's USPSC program in the US.

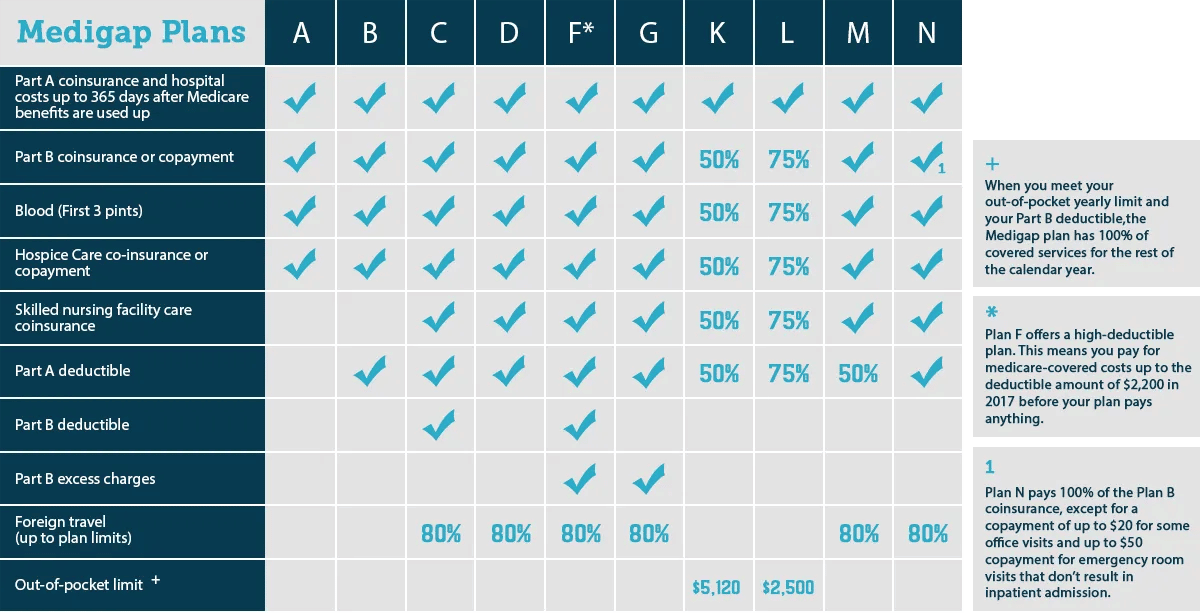

The following chart shows the coverage of the twelve Medigap programs after Original Medicare pays its portion. Make no mistake about Medicare Part A or Plan B. The original Medicare program also contains Medicare Part A in the hospital and Medicare Part B in outpatient doctor visits.

Medigap plans B and A offer insurance for a variety of health care conditions. If you have opted for the Medigap program, you can use that coverage for all doctors who accept Original Medicare across the country. The Medicare provider will not take you away unless you have chosen the Medicare carrier.

Those are the typical pros and cons of Medicare Advantage. Medigap – Medicare Supplement Pros and Cons: What about the other type of plan, Medicare Supplement insurance, which is also known as Medigap? Let's take a look at that so we can understand the differences between Medicare Advantage vs Medigap Let's first talk about the pros of Medigap plans.

Massachusetts, Minnesota, and Wisconsin standardize their Medicare Supplement insurance plans differently from the rest of the country. In all states, insurance companies that sell Medicare Supplement insurance aren't required to offer all plan types. However, any insurance company that sells Medigap insurance is required by law to offer Medigap Plan A.

All Medigap policies must comply with laws and rules designed to protect you. Insurance companies will offer you one standard coverage that is usually indicated by letter. All policies offer a similar basic but some offer more advantages, ensuring that your choice is suitable for your particular requirements. In Massachusetts, Minnesota & Wisconsin, the Medigap policy is standardized differently. Regardless of the policies a policy is sold, state laws can influence how the coverage is offered. Insurers offering Medigap policies.

Medicare Part B coinsurance or copayments. The first three pints of blood. Medicare Part A hospice care coinsurance or copayments. Skilled nursing facility care coinsurance. Medicare Parts A and B deductibles. Part B excess charges.* 80% of foreign travel emergency costs up to plan limits.

When choosing Medigap policies prices will be the most important factor in mind. All Medigap plans require monthly premiums. Depending on your health you will be required to pay an additional fee. The biggest factor to determine your Medigap premiums is the plan letter. These letters reflect the insurance levels you have under your plan. It is no surprise that Medigap plans offer the higher level of coverage at a much higher price than the basic alternatives. Below are sample monthly Medigap premiums for the below demographics.

If a doctor does take Medicare but does not accept Medicare assignment, then that doctor can charge up to 15% more than the approved amount, and you would be responsible for that. This is usually not a problem for a $300 medical bill, but it can be a problem if you have a $300,000 surgery.

The plan includes 12 Medigaps, lettered A through N. These numbers include 2 high-deductible versions, Medigap high deductable plan F and High deductable plan G. Each lettered plan combines policy benefits and different deductible levels. When looking at Medigap plans, you should understand what coverage they offer and how this aligns with their specific health needs. According to letter plans, the insurance coverage includes outpatient medical expenses including copayments, deductibles and supplemental income.

Finally, we will consider Medigap benefits under Medicare Advantage. How do we evaluate a program? It'll cost nothing as long as they've an annual cost. You have an additional drug package for which you have no prescription. This costs additional expenses every month. One more disadvantage is that Medigap plans aren't included with Social Security payments. You need three cards. Crooks can steal your Medicare number from you by giving you a Social Security number until 2020.

How does Medicare Advantage plan compare to Medicaid plan? There's only so little understanding about Medicare and Medicaid in the world that there's classes on it. If a student wants to take free courses, click here to see a video on YouTube called Making Medicare Decisions. It will be very helpful to explain Medicare Advantage and Medi-Gap differences. We need to know how Medicare Advantage and Medigap differ.

Can you list a couple different types of Medicare Supplements insurance plans? Learn more about Medicare Advantage vs. Medicare Medicaid. We will begin with the Pros in comparing Medicare Advantage with MediGap.

Most seniors will have 12 different Medicare Supplement (Medicaid) Plans in 2024. When comparing a MediGap plan, we offer an easy downloadable chart. Get a Medicare Advantage plan with this simple guide to find the most efficient and affordable plan.

It is sometimes hard when you are trying to understand Medigap max out-of-pocket (MOOP). Keeping in mind is that all Medigap Plans K & L have costs shared. It means your plan covers all the benefits you receive with a maximum limit to keep seniors from paying over a limit: The Centers of Medicare & Medicaid Services (CMS) have compiled the United States Per Capita Costs estimates (USPCC) to determine these increases. Medigap plan K and L are subject to maximum out-of-pocket expenses (MOOPs) of 6940 and $3470 for 2023. Estimations of 2020 OOP limits are based upon CMS's estimate of Medicare's USPSC program in the US.

The following chart shows the coverage of the twelve Medigap programs after Original Medicare pays its portion. Make no mistake about Medicare Part A or Plan B. The original Medicare program also contains Medicare Part A in the hospital and Medicare Part B in outpatient doctor visits. Medigap plans B and A offer insurance for a variety of health care conditions. If you have opted for the Medigap program, you can use that coverage for all doctors who accept Original Medicare across the country. The Medicare provider will not take you away unless you have chosen the Medicare carrier.

Your first 60 days will be covered by your deductible. This varies from year to year, so you may have to pay Part A deductible more often. For 2020 Medicare Part AA deductibles are $1556. There is no annual deducted tax for these products. This deductible applies to each “benefit year”. The benefits expiration dates expire once the enrolled individual has not received a single hospital stay. Upon entering the hospital after completing an SNF or benefit period, the benefit period can resume. Inpatients pay their medical costs separately during each benefit period.

All Medigap policies must comply with laws and rules designed to protect you. Insurance companies will offer you one standard coverage that is usually indicated by letter. All policies offer a similar basic but some offer more advantages, ensuring that your choice is suitable for your particular requirements. In Massachusetts, Minnesota & Wisconsin, the Medigap policy is standardized differently. Regardless of the policies a policy is sold, state laws can influence how the coverage is offered. Insurers offering Medigap policies.

When choosing Medigap policies prices will be the most important factor in mind. All Medigap plans require monthly premiums. Depending on your health you will be required to pay an additional fee. The biggest factor to determine your Medigap premiums is the plan letter. These letters reflect the insurance levels you have under your plan. It is no surprise that Medigap plans offer the higher level of coverage at a much higher price than the basic alternatives. Below are sample monthly Medigap premiums for the below demographics.

The plan includes 12 Medigaps, lettered A through N. These numbers include 2 high-deductible versions, Medigap high deductable plan F and High deductable plan G. Each lettered plan combines policy benefits and different deductible levels. When looking at Medigap plans, you should understand what coverage they offer and how this aligns with their specific health needs. According to letter plans, the insurance coverage includes outpatient medical expenses including copayments, deductibles and supplemental income.

You may enroll in MediGAP Plans anytime during any season. Your Open Enrollment for MediGap will be an excellent opportunity for you Medicare Supplement to apply for med-gap plans. In such an event, the insurer will not deny your coverage. You may apply in the form of a Medigapp program. The Open Enrollment period for Medigap is shortened by an additional period of enrollment. But in some cases you may also address medical underwriting issues. You could also be denied premiums for any preexisting conditions.

When comparing all Medigap plans, it is found that average monthly premiums and expenses differ. Unless you are covered by a Medicare or Medigap plan, you are still responsible for all these costs. Medigap insurance costs vary according to the plan. Some plans require copayment and depreciation, whereas others like Medicare Supplement Plan X require the elderly to pay annual depreciation. The Medigap program is also available. First Dollar Coverage means no deductible for people on Medicare.

Finally, we will consider Medigap benefits under Medicare Advantage. How do we evaluate a program? It'll cost nothing as long as they've an annual cost. You have an additional drug package for which you have no prescription. This costs additional expenses every month. One more disadvantage is that Medigap plans aren't included with Social Security payments. You need three cards. Crooks can steal your Medicare number from you by giving you a Social Security number until 2020.

How does Medicare Advantage plan compare to Medicaid plan? There's only so little understanding about Medicare and Medicaid in the world that there's classes on it. If a student wants to take free courses, click here to see a video on YouTube called Making Medicare Decisions. It will be very helpful to explain Medicare Advantage and Medi-Gap differences. We need to know how Medicare Advantage and Medigap differ.

Can you list a couple different types of Medicare Supplements insurance plans? Learn more about Medicare Advantage vs. Medicare Medicaid. We will begin with the Pros in comparing Medicare Advantage with MediGap.