Medicare in Spain is a federal health insurance program aimed at helping elderly persons pay for health care. This plan provides a range of health benefits for those under 65 who are disabled. It is possible to purchase insurance for supplemental health to pay for the expenses of an employee's medical bills which Medicare cannot cover. Since Medicare provides some benefits that are needed for Medicare supplement insurance the Medigap policy is commonly referred to as the Supplement Coverage.

Medicapac is Medicare Supplements Insurance that is sold by private companies to fill the gap. Medicare is able to take up much of the costs of coverage and provides some services. A medicaid policy may pay some of the remaining costs of the health care, such as medical expenses for traveling overseas and other expenses.

If you have already received Medicare Part A or Part B, you can apply for a Medicare Supplement plan. Open enrollment begins on the date you turn 65. During the open enrollment period of this Medicare Supplement program, you may be required to accept policies without proving your health condition. Some states may provide plans for people under 55 that are not covered under the Affordable Care Act for any other reason. Medicare supplement coverage covers medical treatment for patients in the United States and Canada. Anthem offers Medicare Supplement plans all covered by 100% Part B co-insurance.

F is designed to pay for medical insurance deductibles as well as co-pays or coinsurance. The plan F program was originally approved for people who were eligible to enroll in Medicare after January 1, 2020. Several states offer select and innovative F products.

Plans N cover the co-insurance costs of Medicare Parts A and Part B. Your deductible will be the responsibility of the copayment and your premiums will be reduced by 50% monthly. Select N is available for certain states.

Plans A are the simplest Medigap plans, containing the cheapest premiums. There are many plans that don't pay Part A deductibles on their plans and are a good alternative for many people who have a high income.

Medicare supplement policies provide supplemental coverage for Medicare deductibles, coinsurance, copayments or deductibles that aren’t paid by the original payers. Medicare supplement programs cover services that Medicare claims as medical necessity and payment is generally determined based on Medicare's approval charges. Many plan plans have additional advantages that Medicare cannot provide. Medicare supplement insurance is distributed by private insurers who have been licensed by THI. Medicare Supplements are funded in part through the government.

Medicare has two components: Part B provides coverage for other types of medical expenses. You can visit whichever hospital is accepting Medicare for medical care. Medicare Supplements will not affect Original Medicare. Medicare Part A (hospital coverage) pays for Medicare Part B (medical coverage) pay for Medicare Part D (prescription medication coverage). You may be covered by taking prescription medication through Medicare Advantage if you buy Medicare Advantage coverage. Your insurance may cover prescription medications.

You may have the choice of joining the Medicare Advantage Plan or Part C. The Medicare Part C and B must be enrolled. The government is contracting with insurers for Medicare Advantage in certain areas. Medicare pays the plan an average monthly amount to provide Medicare Part A and B services to a member. You are entitled to Medicare Part B premiums every month as well as Medicare Advantage plan premiums every year. You will need to make any copayment, deductible, or other coinsurance required by that plan. When you enroll in Medicare Advantage plans, you will be denied the Medicare summary notification.

Part A and Part B are paid monthly by Medicare and include deductibles, copays, and coinsurance. In addition, Medicare covers the total costs for medical and dental expenses.

Medicare supplement plans are not available with prescription drug coverage, however you may get part-D plans as part of your plan. Similarly the Medicaid Supplement does not have dental coverage or vision coverage. In addition, you could buy dental and eye insurance from Anthem for the additional premium if you live in California. California and Kentucky have innovative Medicare Supplement plans which provide vision and hearing protection.

If you are considering purchasing Medicare Supplements, make an informed decision. This list may assist you in paying the costs.

Medicare Supplement Plan open enrollment is a six-month period for purchasing any Medicare supplement plan available in Texas. Throughout this time companies must offer your policies even when there is a health issue. The enrollment period is extended by enrolling in Medicare Part B. Medicare Part B and Part C are necessary for purchasing Medicare Supplement plans. You may use open enrollment rights multiple times over a period of up to six months. Alternatively, the policy will be rewritten based on your decision.

Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment. See how Medicare costs may work with these Medicare coverage examples Applying for a Medicare Supplement insurance plan The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed.

We'll provide an outline of coverage to all persons at the time the application is presented. Our company and agents are not connected with or endorsed by the U.S. Government or the federal Medicare program. This is a solicitation for insurance. An insurance agent may contact you. Premium and benefits vary by plan selected. Plan availability varies by state.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. You go 63 days or more in a row before your new Medicare drug coverage begins For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP).

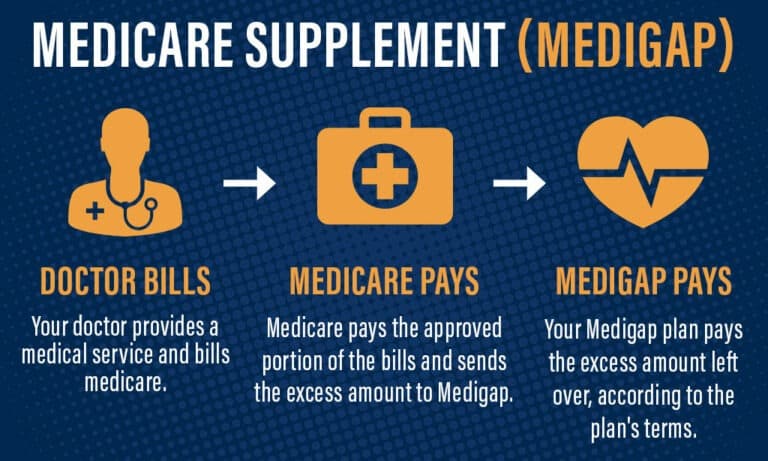

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium.

How does Medicare Supplements Insurance differ from Medicare Supplements Insurance? Espaol | Yeah. Medigap or Medicare Supplemental Insurance are private insurance plans that help pay your share of your medical costs unless you lose. Medigap can only be purchased from a private company.

Medigap is a private health insurance program that provides you with additional insurance that pays for health expenses that cannot be paid by Original Medicare. There are deductibles and copayments if traveling outside the country. Medicare doesn't cover this.

How can you get help with Medigap? Medigap policies complement the original Medicare protection, covering additional costs. Medigap provides more choices and offers greater coverage than any other option. In the event of an unexpected travel or medical need, Medicare may be an ideal plan for you.

Deductible Some plans have deductibles. Copays A copayment may apply to specific services. Coinsurance The percentage of coinsurance varies depending on plan. Limits and Considerations Limits Most of the time, Medigap coverage has no network limitations and is available anywhere that Medicare is accepted. Things to Consider Some Medigap plans cover foreign travel emergency services.

Medigap is optional and assists with addressing gaps based on out-of-pocket costs related to original Medicare. Medicare Advantage Plans replace Original Medicare and usually offer additional coverage.