Medicare supplement is Medicare insurance designed for people with unforeseen problems and sold by the private sector. The Medicare plan reimburses most or all of the cost related to covered healthcare.

A Medicare Supplement insurance plan will help cover some of the remaining healthcare costs. Some Medigap policies also cover services which Original Medicare does not cover, such as medical services if you travel outside the U. S.

Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

Medicare Supplements are enrolled in Medicare if you are enrolled in Part A or Part B. Your opening enrollment is for 6 months beginning with the day your 65-year-old turns 62. For Medicare Supplement enrollment periods there are no restrictions on coverage for a patient with an existing or previous medical condition.

Not all countries have insurance coverage for health care coverage or certain states offer plans that are not suitable for a 65-year-old. Medicare Supplement insurance allows you to consult any physician accepting Medicare patients. Anthem offers Medicare Supplement plans covering 100% co-insurance.

Medicare Supplement plans do not offer prescription drug coverage, although there may be supplemental benefits to buying Part D plans. The Medicare supplemental plans also do not provide dental and vision services, so you can buy a dental and vision insurance plan from Anthem for a premium of 3% a year. The United States has many innovative Medicare Supplement programs that include vision and hearing support.

Medicare Supplement or Medicare Advantage plans may be available but not all. Tell us the difference in your choice? Medicare Part B Coinsurance or Copayment Includes coverage for doctor's services and supplies. A copayment is the amount you pay for each medical service. For example, a Physician's Visit.

Part A hospice/respite care coinsurance or copayment. See how Medicare costs may work with these Medicare coverage examples Applying for a Medicare Supplement insurance plan The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you're both age 65 or older and enrolled in Medicare Part B.

All policies offer the same basic benefits The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs. out of pocket costs.

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Coverage may be limited to Medicare-eligible expenses. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected. Depending on the insurance plan chosen, you may be responsible for deductibles and coinsurance before benefits are payable.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

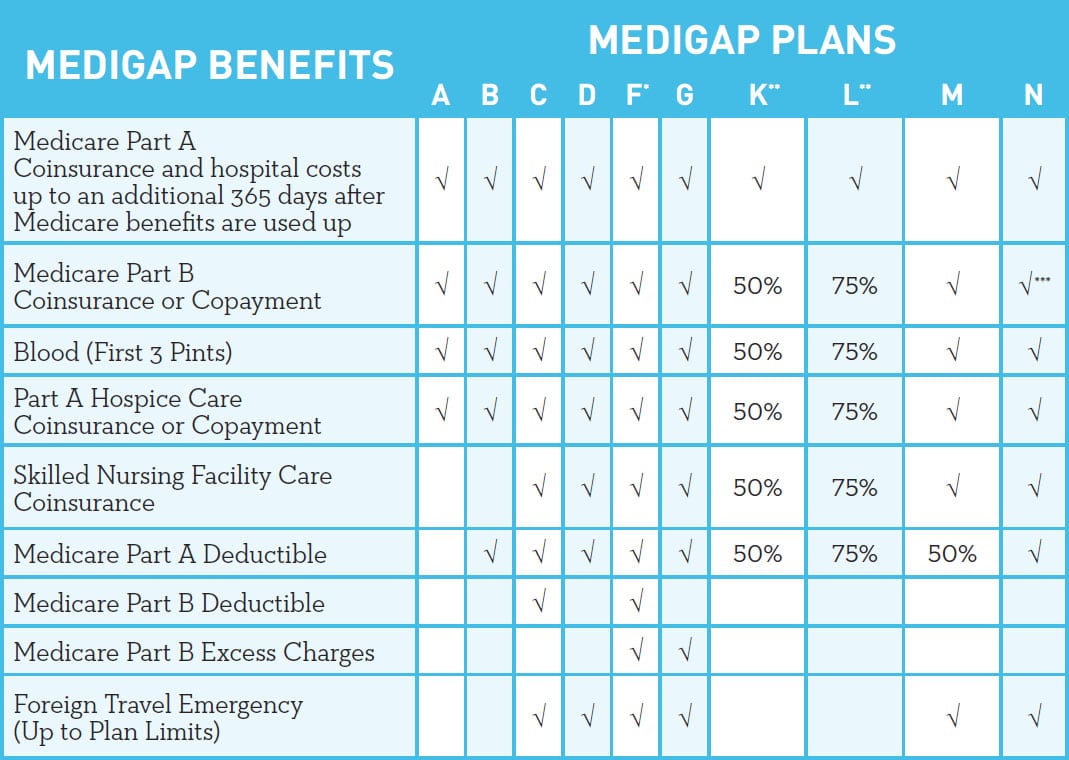

Compare Medigap Plans Medigap Benefits Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up Part B coinsurance or copayment 50% 75% *** Blood (first 3 pints) 50% 75% Part A hospice care coinsurance or copayment 50% 75% Skilled nursing facility care.

Anthem Blue Cross Life and Health Insurance Company (Anthem) has contracted with the Centers for Medicare & Medicaid Services (CMS) to offer the Medicare Prescription Drug Plans (PDPs) noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans.

Want to choose your doctor? You can see any doctor who accepts Medicare patients. There are no network restrictions. A variety of plans to choose There are many different Medicare Supplement Insurance plans, so it's important to understand what each plan covers and how federal law affects your eligibility.

Hospice Care Coinsurance or Copayment Medicare pays all but very limited copayment/coinsurance for outpatient drugs and inpatient respite care. A copayment is the amount you pay for each medical service.

Plans are not available in some states and regions. Check your state's Medicare Supplement Outline of Coverage for exact plan offerings. See an outline of coverage Select your state to view a PDF summary of Medicare Supplement coverage. Error or missing data.

A copayment is the amount you pay for each medical service. For example, a Physician's Visit. Coinsurance is the percent of the Medicare approved amount that you have to pay after you pay the deductible for Part A and/or Part B. Medicare Part B Excess Charges A doctor may charge an amount for services that exceeds what Medicare covers. The charged amount that exceeds Medicare coverage is called an excess charge.

Wisconsin is a non-standardized state and we offer the Basic Plan and optional riders. ** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for ER visits that doesn't result in an inpatient admission.

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

Our company and agents are not connected with or endorsed by the U.S. Government or the federal Medicare program. This is a solicitation for insurance. An insurance agent may contact you. Premium and benefits vary by plan selected. Plan availability varies by state.

You can attend a virtual Medicare webinar. Or, if you prefer, come to a live Medigap seminar in your area where a Medicare licensed agent will be present to answer your questions. Find An Event ‡ Original Medicare: Part A (Hospital Insurance) and Part B (Medical Insurance).