Part B excess charges can increase the price by as little as 10 per cent. Physicians who are unable to pay Medicare for this extra expense are required to pay for it. In a recent survey, a third of Medicare customers said they had not paid any excess. Medigap insurance protects people from such risks. Rachel Christian Financial Writing Professional. Rachel Christian is the author/author of RetireGuide. During his career he covered insurance coverage and other important retirement topics. She has served on the Board of Directors in Financial Advice & Planned Parenthood. Continue Reading Lee Williams Senior Financial Editor.

What are the cost to pay your deductible? I've asked hundreds of Medicare customers to understand Medicare and their benefits throughout my career. Most people answered “yes” and half said they don't need more. And a third replied, “yes I think that's possible”. Sometimes even husband and wife differ greatly from each other in this crucial but potentially costly question. But none have had a specific, precise response yet. Generally the costs of undergoing an invasive procedure are more than 85% higher in some states. Medicare.

Medicare Part B excess costs are rare. Occasionally beneficiaries are entitled to medical bills for an additional charge. Physicians who are unable to accept Medicare for their healthcare services may charge up to 15% extra for this service than Medicare's approval rate is. This article shows the process behind excessive fees and ways to avoid them.

Medicare excess charges with the exception of ambulance services and medical equipment. Ohio: State law prohibits health care providers from balance billing, which means excess charges aren't legal in Ohio. To find out if your location limits or prohibits Part B excess charges, reach out to your state's department of aging.

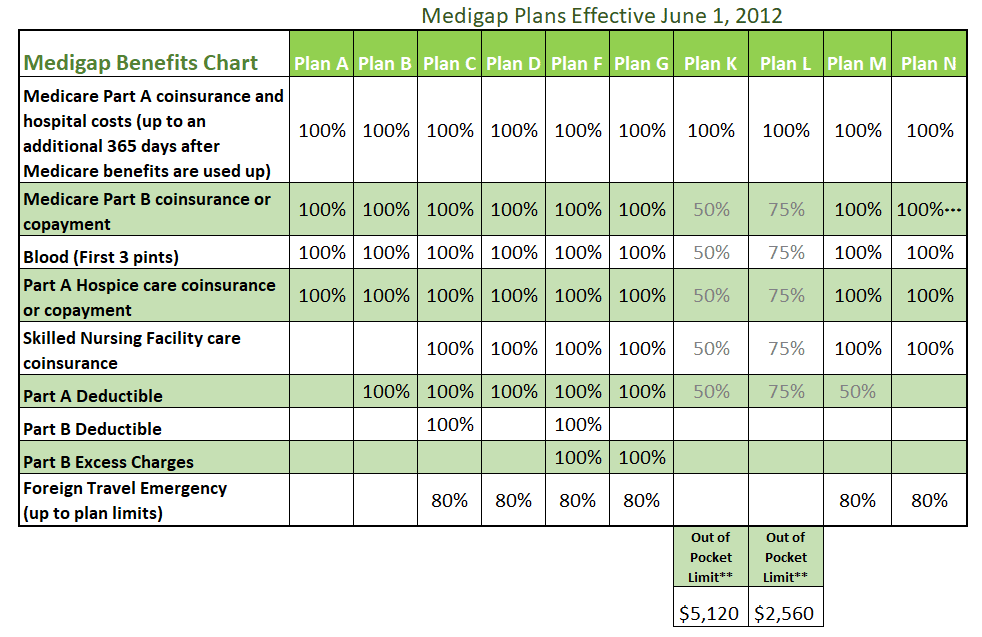

Many doctors are willing to take assignments but always check the assignments carefully. You can find an Medicare physician by using the Medicare Physician Finder tool. There are no Medicare Advantage plans that offer coverage for overpayments. Two kinds of supplements are still covered by our Medigap supplement policy. Medigap plans that include excess fees The Medigap program offers several different types. Each has a written designation that must comply with federal and state regulations aimed for protection. All types of plans offer basic benefits irrespective of where they were purchased.

There's a limit called the limiting charge that limits how much Medicare-covered care a non-participant can pay if a patient has not been treated. A nonparticipating provider who is accepted in Medicare may charge up to 15 % more than Medicare charges for a specific service in the case. If you use non-participating providers, you can expect an upfront payment of all fees and waiting until your provider receives your reimbursement from Medicare. Your provider must file a Medicare reimbursement claim without being required to pay.

A Medicare excess fee is an additional expense you pay for medical care from a doctor that is not covered by Medicare. Providers with Medicare accept assignment which means they will only charge you an agreed fee. Physicians accepting assignment charge Medicare directly to cover your care. Medicare has 81% of the cost, and it will be paid out for the remainder. Not everyone participates in Medicare or takes employment. Some people don't charge more than Medicare-approved amounts. Medicare also included Medicare excess fees.

If you see a participating provider, that means you owe only your Medicare deductible and coinsurance for covered services, no matter what this provider might charge patients who have other types of health insurance.

If an individual accepts an assignment to Medicare, they must pay Medicare for that amount in full. Medicare-approved amounts represent the sum of money Medicare determines is necessary for reimbursement of a certain service or item. This is less than the actual cost of the treatment. Part B covers outpatient medical appointments and specialized medical devices. Part B excess fees may apply only for patients who visit DME providers who do not accept Medicare payment for their services.

Medigap Plans That Cover Excess Charges Medigap Plan F: Plan F is no longer available to new Medicare beneficiaries. If you enrolled in Medicare prior to January 1, 2020, you can purchase Plan F. If you already have Plan F, you can keep it. Medigap Plan G: Plan G is similar to Plan F, except it doesn't cover the Part B deductible. It does, however, cover Part B excess charges. The Medicare fee schedule is a list of fees that are used to reimburse healthcare providers for services provided to Medicare beneficiaries.

Most state laws do not provide coverage for Part B excess fees. Connecticut: Those who qualify for Medicaid are exempt from charges if their healthcare provider charges a certain amount of money for an individual. All others in Connecticut covered by Medicare Part B may face excess payments. A New York Balance Billing law prohibits the excess charge at a maximum of 10%. Balance billing occurs when patients pay the remaining portion of their insurance to their health insurer.

99% of non-pediatric physicians accept Medicare. 98% of the doctors who accept Medicare are participating providers, thus allowing Medicare-approved medical visits. However, there are a large number of healthcare professionals in the country who do not accept assignments as a burden on patients. It is therefore vital to contact a physician before scheduling an appointment to determine if the doctor will take care of you.

Contact may be made by an insurance agent/producer or insurance company. GoMedigap, eHealth, and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

It shows that Part B's excess charge can be operated. If you did not have any Part B excise costs and you had already met your Part B deductible in the year, the amount would be 60 percent. How Can You Avoid Medicare Part B Excess Costs? Many providers have taken over Medicare. If they accept Medicare assignment, then you should ask for their approval. There's another possible way of minimizing your Medicare excess.

Silver Sneakers is a fitness program that is offered to certain Medicare recipients at no cost. However, Medicare does not directly pay for Silver Sneakers memberships.

A large number of doctors are enrolled in Medicare and accepted assignments. 86% non-pediatric doctors accept new Medicare patients. The study shows that about 1% of nonpediatric medical practitioners have completely resisted Medicare. Tell us the best way to handle excess fees? Suppose Medicare pays $100 to see your doctor, but you'll see someone unable to pay Medicare payments.

The best way to avoid excess charges (if your state permits them) is to make sure your provider or supplier accepts Medicare assignment before scheduling any medical appointments or purchasing medical equipment and supplies.

Almost everyone who is on Medicare accepts Medicare assignments and therefore, if Part B excesses are imposed the cost may not be as common. In 2015, 94 per cent of medical providers accepted Medicare.

A Very Clear Description of Excess Charges Suppose you need an echocardiogram. Also, suppose that Medicare has set the doctor's pay for this procedure at $100. When Medicare sets a doctor's fee like that, it's called the Medicare Approved Amount. It's worth noting that most of the care you receive from doctors is indeed under a schedule of fixed prices that Medicare has set.

A Very Clear Description of Excess Charges Suppose you need an echocardiogram. Also, suppose that Medicare has set the doctor's pay for this procedure at $100. When Medicare sets a doctor's fee like that, it's called the Medicare Approved Amount. It's worth noting that most of the care you receive from doctors is indeed under a schedule of fixed prices that Medicare has set.