While Medicare is a federal government scheme, states have the option of applying various Medicare rules to comply with basic Medicare rules. Some states are making regulations that enable seniors who need to change their Medigram Plan changes. This article highlights some of the different Medicare rules in the United States. How can a Medicare Advantage plan help a Medicare Advantage member get a plan that meets his needs?

Medicare is an American federal program which covers over 64 million senior and disabled Americans across the nation. Approximately four in 10 Medicare beneficiaries are eligible for Medicare Advantage coverage. All the rest are covered by Medicare Original but many are covered by employer-sponsored programs such as Medicaid.

In 2015, one in four Medicare recipients had private insurance — also called Medigap — to provide coverage to cover deductibles or costs. This article provides a comprehensive overview of Medigap enrollments and explores consumer safety under federal laws and state regulations.

Medigap plan coverage is universal throughout all of Canada. Three different states have different Medigap schemes. This includes Wisconsin, Massachusetts, and Minnesota. Instead of traditional mail plans, this state offers diversified coverage. Milwaukee offers four customizable Medigap Plans. The three Wisconsin plans are: The state provides riders which give policyholders additional coverage and the high deductible F program. Find a Medicare plan in three simple steps Massachusetts has three Medicare plans. This is:

Depending upon your Medigp insurance, some plans may contain additional charges. For many individuals these factors may be crucial in the decision about enrolling in the policy. Under the following States the policyholder will have no problem dealing with a charge that's too high.

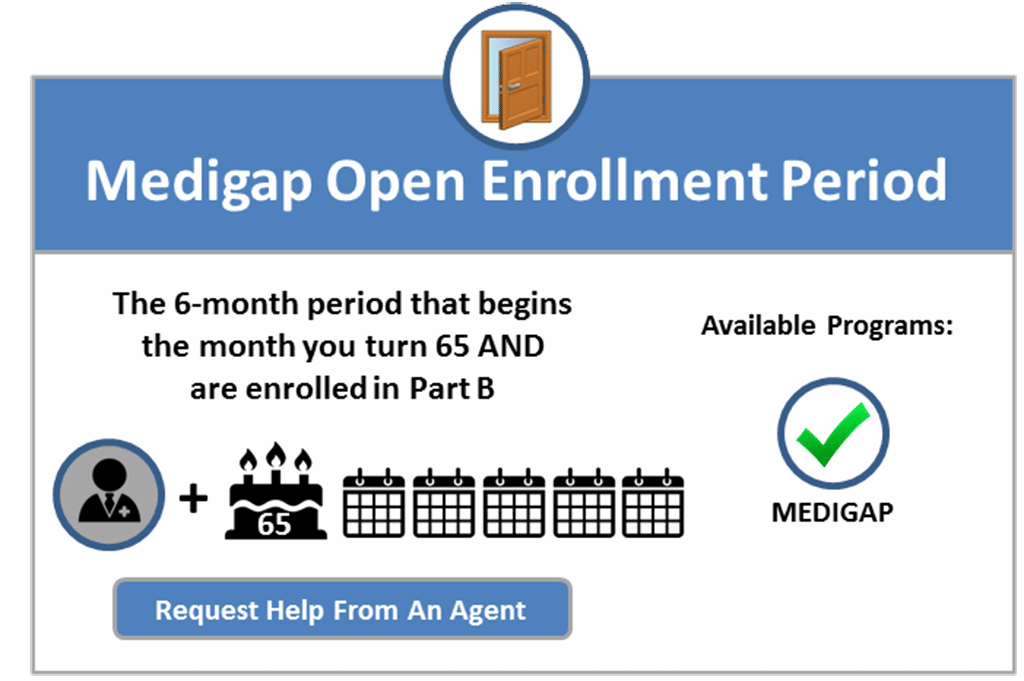

When should I take advantage of Medigap? In many cases, there will be higher rates and greater choice in policy types and services. During that time you can purchase any Medicare coverage available to you in a state. This is a period automatically started when you are 65. There'll never be a change. After completing the enrollment process, it is possible you cannot obtain health insurance with Medigap. When purchasing an expensive item the cost may increase as a result of health problems.

If you have had at least 6 months of continuous prior creditable coverage, the Medigap insurance company can't make you wait before it covers your pre-existing condition. Many types of health care coverage can count as creditable coverage for Medigap policies, but they'll only count if your break in coverage was no more than 63 days. I have other insurance.

Medicare Part A and Part B are the only Medicare Medicare plans that provide coverage for Medicare Part B. The Medicare Medigap Plans are offered by private insurance carriers and have a streamlined payment process that will save you the cost. Medigap plans are standardized but all of these standard plans may be unavailable to you locally.

The Initial Enrollment Period is an initial window of time when your eligibility to enroll into Medicare is reduced from 1 to 1. Once you have completed your enrollment with Medicare Part A and B, you can choose other insurance products. The best period to obtain med-gap policies is the period of 6-months which starts on the first day of the month of your 65th year and is enrolled in Part B. After these terms the ability to purchase med-gap policies is not available. Different states have varying policies on this subject, but some states offer an extra open enrollment. There are several different enrollment periods for Medicare, depending on the specific type of coverage you are enrolling in.

A state-based policy on Medicare can vary by state. Among these rules are annual birthday rules and other requirements. This regulation was created by states to offer seniors a variety of benefits when completing Medicaid and Social Security benefits.

Guaranteed issue rights provide protection for Medicare enrollees. This protection does not allow insurance firms to reject a policy if a beneficiary meets certain eligibility criteria. To be eligible to receive guaranteed issue rights, beneficiaries should follow MACRA during the selection of the plan.

The current Medicare Supplement Plans will be available exclusively on the Medicare Supplement Plans F or C of the CMHP. Open enrollment period guaranteed issue rights allow a user to join the Medicare Supplement plan without underwriting any questions about his/her health. Medicare recipients after January 1, 2020 are expected to comply with MACRA when in open enrollment.

In the following states, the insurance provider has a policy that enables a new Medigap plan without any underwriting questions. Birthday Rules. All state-wide birthday laws vary in varying ways. Currently, in California, you can switch to any service provider no matter what carrier your plan uses.

Louisiana requires that you remain on the same carrier. Find a Medicare Plan in 3 simple steps Let's start with finding your ideal Medicare Plan today. Therefore you can't face denial from policies because of preexisting conditions. Year-long guarantees issued.

These rules include annual birthday rules, guaranteed issue rights, disability plan requirements, excess charges, and more. Established by state governments, these regulations give seniors more options when it comes to Medicare Supplement policies outside of initial enrollment. Guaranteed Issue Rights and Open Enrollment Periods Guaranteed issue rights are protections for Medicare enrollees in certain situations.

And more than 23 million Medicare beneficiaries also purchase stand-alone Medicare Part D Prescription drug coverage , since Original Medicare does not cover outpatient drug costs (most Medicare Advantage plans have integrated Part D prescription coverage; nearly 27 million Medicare beneficiaries have Part D coverage as part of an Advantage plan).

Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicare's benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending.

If you mix employer protection with Medicare, the different states have their own rules about who gets first paid as well as what benefits you are eligible for.

Voluntary group termination implies that your insurance provider has stopped providing your service. Sometimes the insurance is cheaper to purchase compared to Medicare. If it's what you're doing now, it's probably good for you.. How can I locate the most affordable Medicare plans in 3 simple steps? However, a place can be considered an exception to the rules above. In this case, you can use a protected issues right to convert from employee insurance to Medigap.

Medigap plans have been uniformly adopted throughout the country. Currently, three state-specific Medigap programs exist. This state includes Wisconsin, Massachusetts and Minnesota. Instead of traditional letters, these states give greater coverage.

Until 2022 only two states allowed MedigaP beneficiaries to have birthdays. Oregon was first. The federal government has adopted new regulations regarding birthdays for Medicare Supplement plans. These states are Idaho, Illinois, Louisiana, or Nevada.

Unless you bought a Medigap policy before you needed it, you'd miss your open enrollment period entirely. Outside open enrollment If you apply for Medigap coverage after your open enrollment period, there's no guarantee that an insurance company will sell you a Medigap policy if you don't meet the medical underwriting requirements, unless you're eligible due to one of the situations below.

Parts A and B together can be called Original Medicare. Original Medicare provides standardized prices across the country. You are covered regardless of where you reside, and you may apply for coverage anywhere you travel from there.

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

If a Medigap policy cannot cover a specific health issue, then a company may refuse to cover the claim if it's not covered by the plan. My condition has existed. These preexisting health issues may be treated at any time for a maximum of 6 months.

I have a pre-existing condition. The insurance company can't make you wait for your coverage to start, but it may be able to make you wait for coverage if you have a pre-existing condition A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your out-of-pocket costs Out-of-pocket costs Health or prescription drug costs that you must pay on your own because they aren't covered by Medicare or other insurance.