Ron Elledge was an expert Medicare consultant and wrote “Medicaid Made Easy”. His expertise in Medicare helps patients learn about Medicare regulations and strategies. Medicare Supplement Plans (also called Medigas plans) can assist in securing Medicare part A and part B costs including copayment, deductible and coinsurance. If the insurance is available under Medicare Supplement Plans, this can help with medical bills because these policies do not restrict your coverage. The eligibility requirements must remain in Part 1 and part 2, and you must live outside the service area to apply for this coverage.

Only Medicare Part A patients can get Medigap coverage. People who have Part c benefits can not buy the same coverage. Upon turning 65 with Medicare Part B, you will enter Medigap's open enrollment period of 6 months. During this period insurers cannot use medical underwriting to determine if they offer the policy. It can do all of these things due to health issues: The insurance company can refuse to sell you insurance for health reasons or charges for the same.

You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Those who are eligible to receive Medicare coverage have heard of the extra costs Medicare has left. You can learn more about Medigap eligibility and get coverage as soon as possible. How can I locate Medicare coverage in just 3 easy steps? Unless you meet the Medicare annual deductible (if applicable), you'll be liable for co-insurance for medical expenses that you've accrued during this period.

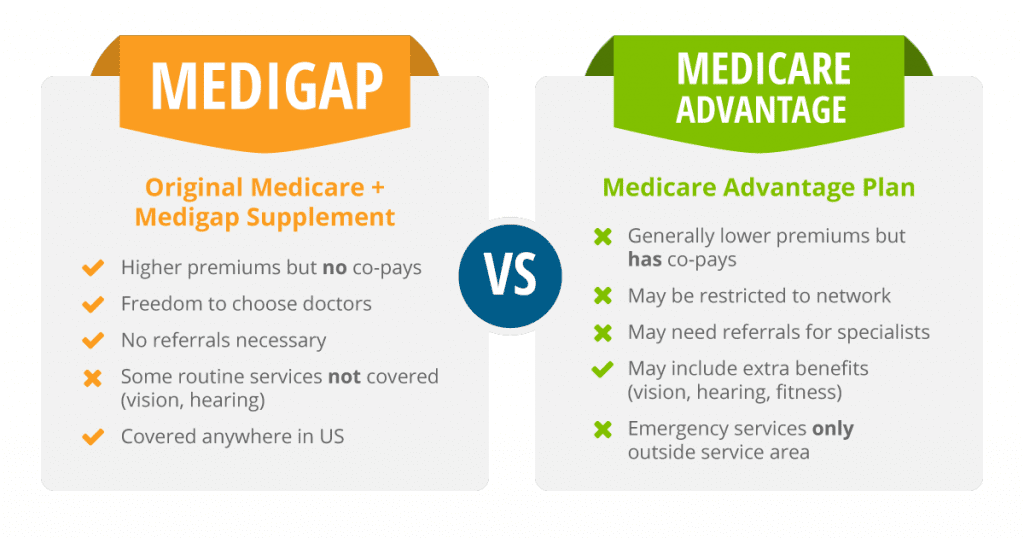

If you want to switch from a Medicare Advantage Plan to a Medicare Supplement policy, you must first disenroll from the Medicare Advantage policy. You can learn more by reviewing the Medicare and You handbook .

One-quarter (25%) of Medicare beneficiaries were covered by Medicare supplemental health coverage. The brief provides an update on enrollment and analyzes consumer protections under federal laws that affect the eligibility to enroll on Medigap.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

When you meet Medicare eligibility criteria, you will no longer be eligible. Depending on your Medicare coverage and coverage, it is also possible for you to apply for Medicare supplements at any time. But this is a good way of admitting it. It is possible to apply for a Medicare Supplement plan without having to undergo a health examination. This period of guarantee can be described in the following words: Some cases allow someone on Medicare to enroll in the Medigap program through a guaranteed issue. The most common scenario occurs when a person loses employment-sponsored coverage as a result of Medicare.

There are some conditions required for Medicare Supplement eligibility. Most seniors are automatically accepted for Medicare Part A as they reach age 65. Some of the participants will be automatically registered under Medicare Part B. After completing Part A and Part B, you have the opportunity to enroll in Medicare's Medicare Supplement Open Enrollment option. If you register for this window, you will never be asked any questions. Hence, any preexisting conditions on your medical record won't affect your entitlement to Medicare.

The most efficient time to purchase Medigap coverage will be the opening enrollment period for Medigap members. A Medigap OEP is the six-month period that starts with the earliest day a person is 65 years old. If you delay Part B insurance, your Medigap OEP will be 6 months starting the first day of the month. In some circumstances however, guaranteed rights may exist.

Once you turn 65 and have Medicare Part B, you enter the Medigap open enrollment period, which lasts 6 months. During this time, the insurance company can't use medical underwriting to determine whether or not it will offer you a policy.

Once you turn 65 and have Medicare Part B, you enter the Medigap open enrollment period, which lasts 6 months. During this time, the insurance company can't use medical underwriting to determine whether or not it will offer you a policy. This means it can't do any of the following things as a result of your health issues

While federal law doesn't require insurance companies to sell Medigap policies to people under age 65, some states require the insurance companies to offer at least one type of Medigap policy to Medicare beneficiaries younger than 65.

Be sure to contact Medigap insurers in your state to learn if they will sell you a Medigap policy outside protected enrollment periods. Cancelling a Medigap policy You have the right to review a new Medigap policy for the first 30 days.