Medigap plans are incredibly affordable compared to all other supplemental insurance programs that can help reduce the total cost for a patient. However, people who have become eligible for Medicare since December 31, 2018, may no longer buy plans. The plan F is intended to address many of the insurance gaps covered in Part C. You can get the Medicare plan directly through your insurance carrier during the Medicare open enrollment period. As with many health coverage plans deductible insurance premium rates will not be imposed upon a taxpayer.

The Medicare Supplemental F program is available to all individuals with Medicare who are already enrolled in Medicare. Plan F provides a complete Medicare plan that can meet a wide range of health needs. Find Medicare Plans in Three Easy Steps Specifically, this plan provides 100% Medicare cost sharing and will not affect the costs you incur for medical insurance. Below you will find out how Medigap Plan F fits you and whether you are a qualified beneficiary.

The Medicare Supplement plan F for eligible people has expired. If you currently participate in Plan F, you can continue with your plan or change your option or change plan. Medicare Supplement plans F and B were created to cover deductible expenses which were excluded under Medicare Part A and B. Generally referred to means that all plans are designed to offer a uniform benefit no matter where one is buying. However, exceptions may apply.

Medicare can be complicated. Many of the people who have heard ‘Part A' or 'Part B' or 'plan F' get really confused. Medicare provides the federal health coverage to older Americans available from 65 to 65. There is a two-tier plan: Part A covers hospital visits with no monthly fee, and Part B covers doctors and outpatients with a weekly cost. Medicare Plans F also serve to provide Medicare Supplemental Insurance.

Plan F was developed to solve certain problems. Notably, Plan F is a more comprehensive plan. If most people just want the maximum protection possible, Plan F can be a simple and affordable choice. Knowing that you have the maximum coverage available gives you the peace that you won't be wasting money on anything else besides the coverage that you currently have. Plan F is highly popular and reduces the costs. The more insurance providers provide Plan F, the lower their costs due to competition. Although Plan F is generally the more costly plan given coverage, the proportion of coverage and cost tends to work well since the product is offered by several insurance firms, compared with other options.

It is worth explaining the difference between Supplement Plan plans. The Medicare Supplement Plan or MediGap is a group of Medicare plans that offer private health care services. This program provides a free healthcare plan without the need of paying medical fees. It also pays out the out-of-pocket cost of original Medicare coverage. Unlike most insurance plans, which cover the actual medical care provided to you, Medicare Supplement plans include things such as deductibles and premiums for Medicare Part B. Medigap covers several fee categories with several available plans.

We believe Plan A will be a more popular one soon. This program provides exactly that same coverage, but plan N offers different payment arrangements from the other plan. The plans have copayments which are paid when you come in to the doctor, so your premium will be cheaper. This policy covers all the Plan F coverage, with the exception of Part A deductibles. An excess fee is the fee you pay for a medical appointment when a provider does not accept Medicare assignments. In these cases, you may have to choose an excess cost that is not included in any Medicare payment plan.

All plans have premium rates that increase annually. This applies particularly to Medicare supplement plan F because of the phasing in. As less people enroll annually, the cost increases for the insurance company, which means insurance rates are increasing in comparison with others. It can be beneficial to research the rate growth history when selecting a plan. Medicare supplement plan F rates increased by about 5% over the past five years. This figure however continues to rise. Find out how many Medicare companies increase their rates when you consider enrolling.

s the National Association of Insurance Commissioners explains, the changes to Medicare Supplement Plan F result from the Medicare Access and CHIP Reauthorization Act (MACRA), which was made law in 2015. Although the law didn't directly change Plan F, it did prohibit the sale of any Medigap policies that covered Part B deductibles for newly eligible individuals after January 1, 2020.

Medicare Supplement plans may be cheaper. However this scheme offers the maximum advantages for enrollees. The average monthly cost of these programs is approximately $ 270. Many variables affect premiums. Medigap plans are typically priced between $150-400 annually or above. Factors that affect your costs may include your ZIP codes, gender, age, smoking history, etc. Remember that your monthly insurance premium for Medicare is the sole cost you will pay to receive your Medicare coverage. There are no deductibles or copayment fees for service provided.

Various variables influence these figures. Plan F premiums depend heavily upon where you reside, but the underlying factors of sex age and smoking use are also considered. Sometimes a discount is given for smokers, spouses or husbands whose policies cover many people. However companies that underwrite medical insurance may charge higher premiums depending on your health condition. Plan F enrollees will pay the minimum of $200 per month, and the average is $220. This figure can vary greatly depending upon which provider you choose.

The premium for each plan differs significantly by the amount of coverage and premiums you get. Medicare plan F has slightly lower median rates in comparison to Plan G compared to Plan B compared with $119. The higher premium will come as you gain broader coverage under the F Plan program. Below is the comparison between two Medicare plans: Benefit Plans, F Plans G, and Medigap Plans G will not include the Medicare Part A deductible in the plan. The Plan G plan also includes the Part B deductible, which costs $226 for 2023.

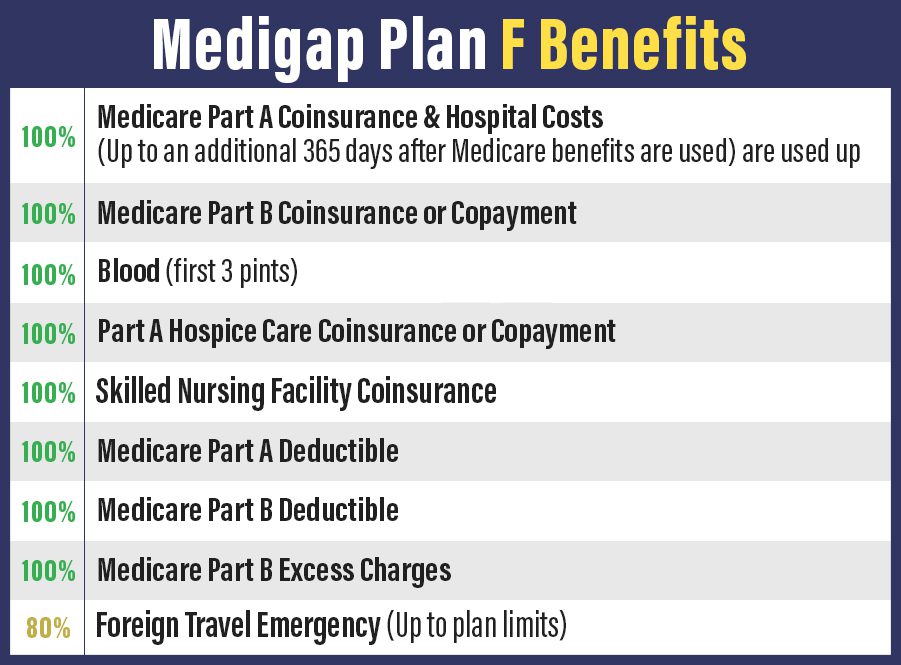

Yes, Medicare plans F are available to those claiming benefits before 2020. Plan F covers the following: Part A coinsurance Part B coinsurance or copayment Blood (first 3 pints) Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance Part A deductible Part B deductible Part B excess charges 80% of Foreign Travel Expenses Plan F is also offered in a high-deductible version.

As the new Medicare plan has been restricted to just a few subsets, people with new insurance may have a hard time selecting coverage options. Is Medigap Supplement plans needed? Are there any alternatives? Price recommends conducting a thorough online search and talking to a professional insurance agent for guidance. Medicare.gov has an information tool to assist users in comparing dietary supplement plans. Save the most for you and get the most protection possible.

Medicare supplemental insurance program plans containing Medicare Part B's annual deductible have been discontinued. By removing this program Medicare beneficiaries should not have to pay out-of-pocket costs to receive healthcare.

Plan G offers almost identical benefits as Plan X. It doesn't pay for Part B deductibles.

Because of standardization, each Plan F policy has the exact same advantages regardless of which insurance plan you choose. The carriers cannot modify the protections that come with the plan. You may also qualify for benefits if you join certain carriers including gym membership or stipends on glasses or hearing aids. These additional benefits should not be offered by carriers unless the individual subscribes to the same plan.

What is Medicare Supplement Insurance? If you're new to supplement plans, then some additional explanation is in order. Medicare Supplement Plans, also known as Medigap plans, are insurance plans offered by private health insurance companies. These plans don't directly pay for medical care. Rather, they pay for out-of-pocket costs associated with Original Medicare insurance.

This means that whereas most health insurance plans cover actual medical services. People who already had or were covered by Medicare Plan F before January 1, 2020 are also able to keep their plan. Eligible people can purchase Medicare Plan F from private health insurance companies, such as Aetna , UnitedHealthcare and Kaiser Permanente, says Price.

Medicare supplemental plan F covers only the cost of prescription medications administered in hospitals which are normally covered by Medicare Part A. However, Medicare's plan F won't cover prescription medications you take from your home. You should sign up with Medicare Part D for medical care. Medicare Part D - Medications - are used as part of the original Medicare program with or without Medicare Supplements.

Benefits not covered by Medigap Plan F include: Dental coverage Vision coverage Hearing coverage Cosmetic surgery Prescription drug coverage If you enroll in Medicare Supplement Plan F, these benefits are not unobtainable. However, you will also need to purchase a separate policy to receive additional coverage. It is not uncommon for Medicare Supplement policyholders to have stand-alone plans for other desired benefits.

Tell me the cost of a Medicare Supplement plan and do you have your premium rates too low? Depending on the situation, High Deductibility Plans F can be an alternative for evaluating your options. If you can reach a higher deductible and have full coverage with these plans, it might be worthwhile. How do I search for Medicare plans? When a client meets the deductible, the coverage of the premium is 100%.

Not all Medicare beneficiaries are eligible for supplemental Medicare plans because the program has been discontinued for some. How do I find a Medicare plan in three steps? These changes were caused by Medicare's MACRA reforms. MACRA was originally incorporated by Medicare as the Medicare – Access and CHip Act. The changes were made in a bid to reduce Medicare costs for the benefit of Medicare.

You can continue your Medicare Supplement if the plan changes. Then just contact your carrier to get your new address free. The Medicare Supplement plans are uniform and the benefits won’t change. The premium will vary depending on the ZIP code that you choose.

In case you missed it, Medicare Supplement Plan F will be discontinued in 2019. Do not be worried if you have plans in place. You can continue to plan for any length of time you wish. However, unless your Medicare benefits have expired by January 1, 2019, you are no longer eligible.

Are there any new Medicare Supplement insurance plans for 2019? Unfortunately, Plan F has not been extended to Medicare patients since January 2020. It will also apply to Medicare Supplements plans that cover Medicare Part B annual deductibles.

Is There an Alternative to Medicare Supplement Plan F? Suppose you are interested in enrolling in Medicare Supplement Plan F but find that the premium rates are more than you want to spend. In that case, High Deductible Plan F is a potential alternative for you to consider. If you are comfortable reaching the higher deductible before receiving full coverage for this plan, the lower premium could be worth it.

(Plans C and F cannot be applied if a person was recently eligible for Medicare in January 2020. ) The Medicare Advantage Plan K & L is applicable if the plan's maximum annual deductible is less than 10%.

How should we change the plan? There is not a comprehensive Medicare replacement in place of Part F. But the best plan is the Medicare Supplement Plan G. Like the plan F, Plan A is fully covered by the Benefit Plan G including Part B co-insurance.

Is There an Alternative to Medicare Supplement Plan F? Suppose you are interested in enrolling in Medicare Supplement Plan F but find that the premium rates are more than you want to spend. In that case, High Deductible Plan F is a potential alternative for you to consider. If you are comfortable reaching the higher deductible before receiving full coverage for this plan, the lower premium could be worth it.