If you recently joined Medicare you might know about Medigap. You're probably curious to find out what it is and how to apply. Medigap policies cover most expenses related to the Medicare program. There are a variety of medical insurance options available so do your research and find the best one. Tell me about the process to enroll in Medigap, how you will get paid for various programs. Medigap insurance provides supplemental coverage for original Medicare expenditures and covers copayments, coinsurance and deductibles.

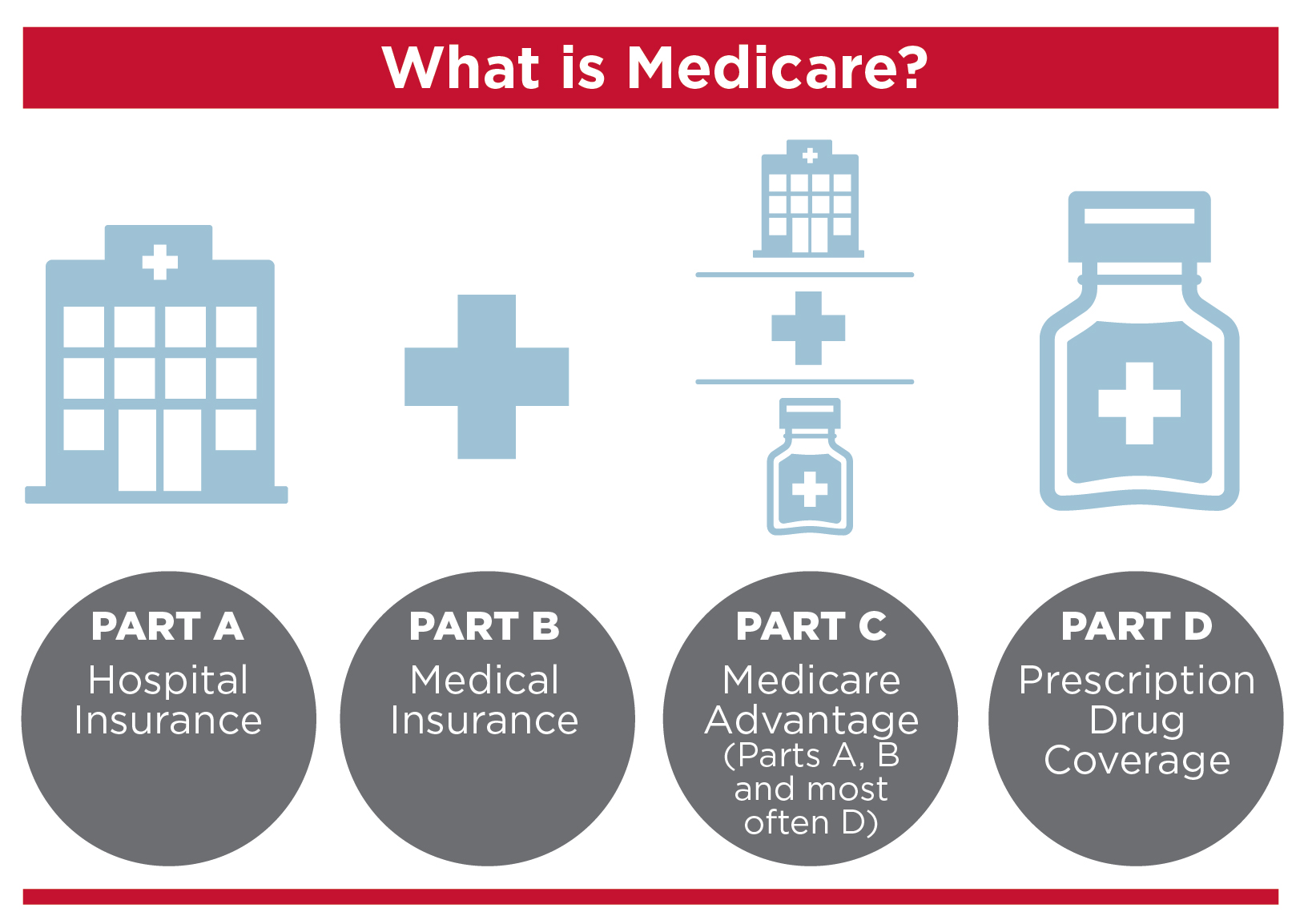

When you reach age 60, understanding Medicare may seem scary but it's much easier. Original Medicare has a single Part A and Part B. Part A of Medicare covers hospitals and nursing home costs and is generally premium-based. Medicare Part B covers healthcare and medical equipment, and also includes some medical equipment that requires monthly premiums from your Social Security payments.

Medigap a Medicare Supplement is a Medicare Supplement insurance product that focuses on filling gaps, and is marketed privately. Original Medicare covers the majority of covered medical care expenses, but not everything. Medicare Supplement Insurance (Medigap) policies will pay for a few of the other medical costs including:

Medicare Supplement or Medigap plans may be offered by private companies for help in paying for some medical costs that original Medicare does not provide such as copayments, insurance or deductibles. Other Medicare plans may offer coverage for services that Medicare does not pay. The insurance company will pay for it.

Medicare supplement cost varies based on state insurance companies. Costs depend mostly on location and age. Keep in mind that insurance companies have to determine how much the premium rates are for policyholders who are older than 75 to get lowered. The price of a policy can vary depending on the company. The cost can vary depending on the company and certain plans have higher deductibility options. Are Medicare Supplement insurance plans right for you? Find professional, licensed agents that understand the requirements of your coverage and help find the right Medicare option for your situation.

Medicare supplement plans are sometimes called MedigaP plans because they help cover coverage deficiencies in Medicare Part A and Part B. You will also need the Medicare supplement insurance to get Medicare supplement insurance. Most Medicare plans include the 20% of this which is not covered under Part B. Private insurers offer Medicare Supplements. Each plan must provide national benefits, the same, but premium rates will vary between providers.

Generally speaking, you should apply for Medicare Supplement plans within your 6-month enrollment window. Open enrollment begins the first months you're 66 and are enrolled in Medicare Part B. Until then, you can no longer buy Medigap plans or pay more. You may apply for Part B without penalty during a Special Enrollment Period when your First Enrollment Period ends. Contact the CMSM to see if there are eligibility requirements.

Medicare Advantage is an insurance form providing supplementary health coverage as part of Medicare Part A. Part B includes eye, hearing, and dental coverage. Many Medicare Advantage plans provide supplemental insurance coverage for drugs. Medicare Supplement plans are sometimes called Medigap plans for filling specialized gaps in original Medicare coverage. These plans typically do not pay for eye care or other services. These products are purchased by insurance companies and are regulated to provide a consistent benefit across providers.

Medicare supplement enrollment begins within one month when you qualify under Medicare Part B or older. Some people can qualify as being older for disability insurance based on their disability status. This open enrollment period runs six months and allows you to purchase Medicare Supplement plans from any state. When the initial Medicare Supplement open enrollment period ends you can not purchase a Medicare Supplement plan.

Medigap Costs You'll pay a private insurance company a monthly premium for your Medigap coverage. This premium is in addition to the monthly premium that you'll continue paying for Original Medicare Parts A and B. Costs vary based on coverage as well as location.

A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap plan from any insurance company that's licensed in your state to sell one.

If you need drug coverage, you may want to enroll in Medicare Part D (prescription drug plan). Part D is offered by some private insurance companies and may require separate payments. How And When to Apply for a Medicare Supplement Plan The best time to apply for a Medicare Supplement plan is during your six-month open enrollment period.

Medicare Supplements (Medicaid) plan holders age 60 or older can get a discount for Medicare Part B. Generally a Medigap program can be offered to people younger than 65 who are diagnosed with a disability.

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments Coinsurance Deductibles Note Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible.

Anyone concerned about Medicare supplemental premiums should consider purchasing a Medicare supplement plan. Among other costs, the Medicare - Medicaid program includes the coinsurance for deductibles. Consider these things while purchasing a Medicare supplement.

These plans are available for people enrolled in Medicare parts A and B, not for those who elect a Medicare Advantage plan. Medigap plans pay for costs such as deductibles and copays and other charges that Medicare doesn't cover. In 2010 the federal government standardized the types of Medigap plans, creating 10 options designated by A, B, C, D, F, G, K, L, M and N.

The Medigap plan covers most or all of the costs listed below except for a number of exceptions. Visit insurance companies websites for reviews about Medigap Plans.

If you have questions or comments on this service, please contact us . Related Articles: Do Medicare supplement plans include prescription drug coverage? What in-home care will Medicare cover? To what extent will Medicare cover long-term care? Dental coverage: What to expect from Medicare How does Medicare cover vision services and treatment? How to choose between Medicare Advantage, Medigap and Part D.

Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

In addition to being a liability to Medicare and Medicaid, Medigap insurance providers are not permitted to offer insurance to patients if they are not covered for their previous medical conditions. An existing condition is a condition or disease which has not yet been discovered before the introduction of insurance.

One quarter of Medicare patients had private insurance a year ago known as Medicare Advantage. The program provides for deductible coverage and cost share protection. This article gives a summary of Medigap enrollment and analyzes federal law and state regulations that may have a positive impact on beneficiaries accessing Medigap.

Riaz Ali CEO, Saeidan. RAIZA ALI CEO, Saeidan A few Medigap plans provide non traditional benefits like vision, dental, and hearing care. As enrollment for Medicare increases, policymakers must weigh the benefits and disadvantages.

Medigap's policy is subject to federal and state regulations aimed at protecting you and must be clearly identified as "Medicare Supplement insurance." Insurance companies can provide you with only the standard policies that can easily be found on the letterhead. Each insurance plan is similar in terms of basic, but some offer additional benefits, so you'll be sure to decide if that policy is the correct choice. Medigap policy is the standard in Wisconsin, Minnesota and New Hampshire. All the insurance companies choose which Medigap plans they sell, although certain state regulations affect which ones they are offered. Companies selling Medigam policy:

The exclusive cost is $6620 for 2022. $3310 for 2022 * Plans F & G have high-deductible plans in some states as well. If you want a plan that covers your own Medicare-covered costs, you must pay it in full by 2022. Plan F is not available to individuals who are currently receiving Medicare on or after January 1, 2020. ** If you meet both the annual out-of-pocket and part B deductibles, the Medicare benefits will be paid.

The table below lists a list of the benefits that medspa covers. the plan covers 100% of this benefit. the policy doesn't cover that benefit 0%. the plan covers those percentages if the person has a disability.

The choice to enroll in Medicare Advantage is difficult. This report highlights the additional ways Medicare and Medicaid differ from the MA, as the access to additional medical services in MA has grown. Beneficiaries will have to decide on costs and access based on incomplete and inaccurate medical information. The decision about the use of Medicare Advantage and Medigap plans is complicated by how they were designed and funded.

Medicare Supplement Insurance, also known as “Medigap” insurance, provides supplemental health insurance coverage for Medicare beneficiaries. Individuals in traditional Medicare may want to obtain Medicare Supplement (“Medigap”) insurance because Medicare often covers less than the total cost of the beneficiary's health care.

Medigap (Medicare Supplement) If you are enrolled in Medicare Part A and B (Original Medicare), Medigap plans can help fill the coverage gaps in Medicare Part A and Part B. Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs (e.g., deductibles, copays and coinsurance) not covered by Parts A and B. These plans are available in all 50 states and can vary in premiums and enrollment eligibility.

These data include the number of policyholders as of December 31, 2016 for each state, insurance company, and type of plan sold. The number of covered lives represent a snapshot of enrollment at that time, rather than average enrollment over the course of the year.

Guaranteed issue means that an insurance company is required to sell a policy and may not force an individual to prove “insurability” by making the person pass an insurance physical examination.

Impact on Beneficiary Decision-Making Choosing whether to enroll in traditional Medicare, with or without a Medigap plan, or to enroll in a Medicare Advantage (MA) plan is complicated. This analysis highlights another way that traditional Medicare with Medigap diverges from MA, as access to additional benefits such as dental, vision, and hearing in MA is growing.

The Medicare program that Americans know and cherish has been allowed to wither. Traditional Medicare, preferred by most beneficiaries, has not been improved in years, yet private Medicare Advantage plans have been repeatedly bolstered. It's time to build a better Medicare for all those who rely on it now, and will in the future.

Medigap policies are standardized; Medigap policies comply with federal laws designed to protect people. In some instances insurance companies will offer a standardized policy that has recognizable letters in many states.

Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefits: Hospital coinsurance coverage 365 additional days of full hospital coverage Full or partial coverage for the 20% coinsurance for provider charges and other Part B services.

In 1990, Omnibus Budget Reconciliation (OBA) was held. Generally, the bill requires the sale of new Medicare coverage under a new plan that is branded Plan A through J.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care. Policies B through L vary considerably.

Medigap plans have been classified by CMS as being available to a total of ten private companies. Each Medigap program has its own unique benefits. The coverage offered will roughly match the premiums.

Coinsurance The percentage of coinsurance varies depending on plan. Limits and Considerations Limits Most of the time, Medigap coverage has no network limitations and is available anywhere that Medicare is accepted.

The advantages to Medigap are: Higher monthly payment rates. It's difficult to navigate various types of plans. Unlike most insurance plans, you don't have prescription insurance.

Know More: Dentists That Accept Medicare

In 2015, a third (26 percent) of people who benefited from conventional Medicare supplemental health insurance had Medicare deductible and supplemental cost-sharing insurance to cover costs and to prevent catastrophic medical bills and other medical bills. The report offers an analysis of Medicare enrollment procedures for Medigap enrollee services and provides a comprehensive overview.

As Medicare enrollment increases, policymakers need to assess the potential advantages and disadvantages of these plans.

Choosing between traditional and supplemental Medicare is tricky. This analysis demonstrates a different way Medicare and Medicaid have different approaches as the access to dental, visual otometry and hearing services has increased across Massachusetts. In order for beneficiaries the choice of a cost/access plan must be taken in a fair manner with incomplete details regarding their healthcare needs. A broader problem is that Medicare's plan structure is dependent in part upon how the government administers its programs, the former is varied by county and the latter is generally uniform.

All medical policies must follow federal or state laws intended for your safety a clear definition is deemed "Medicare Supplements Insurance". Insurance companies sell your policies by letter only. All plans offer a similar basic benefit, however certain have additional features. The policies on Medigap differ from those of other states such as Wisconsin, Minnesota or Connecticut. Each insurance agency decides the types of Medigap policies it sells. However, the laws of a certain state can influence their policies. Companies offering Medi-gap coverage:

Extra charges. $6620 in 2022. $1310 in 2024. * Plans F and G also offer a high-deductible plan in certain states. In 2022 your premium is $24,490 for supplemental insurance coverage and $2,390 if your premium is less. Plan F and C cannot be purchased if you were newly eligible under plan k and l / c / e.

A detailed list of health insurance policies can be found on this page. The Medigap policy covers only after you pay the premium (unless the Medigap insurance also pays the premium for the benefit).

Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicare's benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending. Medicare requires a Part A deductible for hospitalizations ($1,340 in 2018), a separate deductible for most Part B services ($183), 20 percent coinsurance for many Part B.

The MCBS is a nationally representative longitudinal survey of Medicare beneficiaries, which provides information on beneficiary characteristics, coverage, service utilization, and spending. We used data from the National Association of Insurance Commissioners (NAIC) Medicare Supplement Insurance files for our analysis of Medigap enrollment by plan type and by state.

Plan type designation “P” identified policies issued prior to the effective date of this state's revisions to its Medicare supplement regulatory program pursuant to the Omnibus Budget Reconciliation Act (OBRA) of 1990, and which are no longer offered in a state. Policies not meeting either of these definitions should be designated with “O.”

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies

All Medigap policies have been defined in accordance with federal and state laws that protect you. They should be branded as "Medicaid Supplement Insurance" and if applicable. Almost all insurance policies in the U.S. are written in the US.

The insurance company must continue to renew the discontinued Medigap policy each year you wish to keep it. See the Medigap Plan Benefits Chart for plans purchased between July 31, 1992, and May 31, 2010 for more information on your Medigap policy's coverage. Related Courses Level 2: Medicare Coverage Rules.

Medigap's market dramatically changed after OBRA in 1990 passed. This legislation requires that all new insurance plans sold on Medigap comply with the one or more different unified benefit packages, labeled plans A through J.

Medicap is a federal program marketed to individuals and businesses with a broad spectrum of coverage ranging from A to N. Various Medigap plans offer varying benefits. The coverage offered is generally proportional to the cost to purchase.

A Medicare beneficiary who dropped a Medigap policy upon enrolling for the first time in a Medicare managed care plan but who subsequently disenrolled from the managed care plan within 12 months is guaranteed issuance of the same Medigap policy from the same insurance company if that policy is still being offered for sale.

In 20 states, at least one-quarter of all Medicare beneficiaries have a Medigap policy. States with higher Medigap enrollment tend to be in the Midwest and plains states, where relatively fewer beneficiaries are enrolled in Medicare Advantage plans. 4 Figure 3: In 20 states, at least 25 percent of Medicare beneficiaries have Medigap—often highest in Midwest and plains states, 2016 Medigap coverage is substantially more common for Medicare beneficiaries ages 65 and older than it is for younger Medicare beneficiaries.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care. Policies B through L vary considerably.

The low enrollment in Medigap by beneficiaries under age 65 is likely due to the absence of federal guarantee issue requirements for younger Medicare beneficiaries with disabilities (discussed later in this brief) and higher rates of Medicaid coverage for people on Medicare with disabilities who tend to have relatively low incomes.

information on purchasing a Medigap policy. Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefits: Hospital coinsurance coverage 365 additional days of full hospital coverage Full or partial coverage for the 20% coinsurance for provider charges and other Part B services Full or partial coverage.

Medicare in Spain pays a portion of the medical care costs of 65 and older citizens. Besides providing health insurance for disabled people under 60, the new bill covers certain services. Medicare supplements may cover you for a few extra costs you can't cover under Medicare. As a way of avoiding “gap” in Medicare coverage, Medicare supplement coverage is also sometimes referred to as Medicare Supplement Insurance.

Medicare supplemented insurance that fills gaps in the system. Original Medicare covers some or all of the coverage for healthcare and supplies. Some Medicare Supplement Insurance (Medicaid) policies also cover medical costs not covered by Original Medicare.

When it comes time to move to a new country make sure it stays in effect. In some circumstances, assuming you're claiming Medicare supplement coverage, you can continue the coverage based upon your Medicare supplement plan.

There are also some exceptions if you have a Medicare Select plan or if you use an additional plan which includes extra benefits, including vision coverage, if you purchased a new one. If you have Medicare Advantage plans, contact them to see how much you can find for a new ZIP code. When a plan doesn't work, it must be changed. You may switch your current Medicare Advantage plan to a different Medicare Advantage plan for your new area.

Medigap supplements Medicare coverage. Typically, the Medigap plan is designed to offer a more complete coverage of services that Medicare does cover but, at times some of those expenses cannot be reimbursed by Medicare, such as vision or dental coverage.1. Medigap plans are intended for reimbursement of costs incurred directly from your own pocket. The plans are provided by private insurance firms so you need to compare your options and find a plan that matches your requirements and your finances. Letter-based plans of each company share the same advantages as those specified by gov. 1.

Original Medicare contains a number of components. Part a focuses on medical expenses, while section b focuses on other medical expenses. The doctors can take care of you. Medicare supplements are available only through original Medicare. Medicare Part A provides for medical care — Medicare Part B covers medical services; Medicare Part D provides for generic drug insurance. You can obtain prescription drug coverage by enrolling in one of the Medicare Advantage plans that include prescription drug coverage for you. Your health plans may already cover prescription drugs.

It entails a collaboration between doctors, other medical professionals, and Medicare. The doctor accepting assignments is charged what Medicare pays to provide such a service to Medicare. All payments you receive must include deductible, coinsurance or other payment for your services. Doctors who refuse to accept an assignment are liable if they are charged an extra fee. This will be your responsibility to charge a higher rate. Depending on what the provider does the cost will be billed by Medicare. You may need a Medicare summary notice to check charges. The government sends you quarterly health summary information.

You have a chance to register for Medicare Part B and Medicare Advantage plans, you need both Part B and live within a state which is covered by Medicare Part C. In some areas, Medicare Advantage is offered in some states. Medicare pays a specific fee each month for the service to the plan. You pay your Medicare Part B monthly premiums. Co-payment, deductible and coverage is required under this policy. If you have Medicare-related plans, your Medicare Summary Notification will not be issued to you.

You may be well aware that Medicare Parts A and B cover the basics and Part D provides an optional prescription drug plan that can be purchased by private providers with Medicare and an insurance. Medicare Advantage Part C replaces all basic federal coverage with private plans. But if you go for Medicare Original Plus Part C—and have the desire for Medigap plans—the letter is more complicated, and it's not just for "plans." All letters represent standards of coverage. Most Medigam plans use F and G options as their main choices.

If you enroll in Medicare Part B, your Medigap plan should be eligible to enroll within the first 2 weeks of the payment period if you have a medical condition. When your enrollment period has not begun for six months, your insurance company will usually require medical underwriting and you can have your medical insurance denied. As time goes by you can switch the plan depending upon its cost or different cover levels. Please do not quit paying premium on an upcoming plan.

In re-insurance for medical expenses, Medicare does not provide coverage for medical expenses incurred by Medicare. Unlike Medicare Advantage plans, private health insurance companies can also provide private coverage. Typically these plans are created as Health Management Organizations (HMOs) that replace every service provided under original Medicare. Medigap may provide more flexibility than Medicare Advantage, as long as your physician or facility accepts Medicare.

There are ten Medicare supplementation options. Generally every plan has an alphabetic letter with different benefit combinations. Plan F typically offers higher deductibles than the other plans. Plans N, K, and L have separate cost-sharing elements. All businesses offer Plan A. Those who offer other plans should be given Plan B or Plan F in order to qualify.

atment or long-term hospitalization. Many private insurance companies offer Medigap policies, so be sure to shop around. 1:59 Watch Now: Medigap vs. Medicare Advantage What Is Medigap? Medigap is a supplement to Medicare coverage.

These plans are offered by private insurance companies, so you'll have to do some comparison shopping to get the one that fits your needs and financial situation. Keep in mind that lettered plans from each company have the same benefits, according to government mandate.

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

Higher costs or outright denial may be the outcome. How much Medigap coverage? When deciding how much gap coverage you'll need, it's important to think about your health situation at age 65 and how healthy you might be at 75, 85, and 95.

Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

Medigap plans (known as Medicare Supplements) are private companies and can provide some of the health care expenses original Medicare does not cover including copayments, coinsurance or deductibles.

Medigap offers several disadvantages: high monthly premium rates and lower monthly fees. The difficulty of finding the most effective plans. Neither is pharmacologic coverage that is purchased in Plan D.

This area includes the coinsurance for days 210 and 106 at skilled nursing facilities, the Part A or Part B deductible, travel emergencies and prescription drug coverage.

Pre-Existing Conditions A pre-existing condition exclusion means that health insurance may not cover the costs incurred as a result of a medical condition a person had prior to obtaining the health insurance coverage. The ability of insurance companies to impose pre-existing condition exclusions has been severely constricted since the enactment of a federal law called “HIPAA.”

I will turn 64 soon enough. The best time to buy a Medigap policy is a 6-month period that starts the first day of your age on the month you are 63 and are enrolled in Part B. In other words if you are turning 66 and are enrolled in Part B in June you are.

like copayments, coinsurance and deductibles. Some Medigap plans also offer coverage for services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs.

Medicare Supplements - Medicare Advantage Plans. Often called Medicare supplement plans, Medicare Supplements is a Medicare Supplement insurance program. Medicare Advantage recipients can participate in Medicare's Medigap program.

Medigap provides coverage for Medicare-approved costs. This plan doesn't include dental services that aren't covered by original Medicare plans. Plan J were Medigap policies but are not now available until June 2010. Those enrolling into Medigap's plan prior to this time can maintain their plan J insurance if their employer offers their Medigap policy.

Medicare Supplement Program J is an alternative to other Medigap plans. Medicare Part A and B are not available to Medicare beneficiaries. Medicare Supplement Plans J or Medicare Supplement Plans J have now been discontinued from enrolling patients after July 1, 2010. Any person who has had a previous plan will have the benefit of this program as long as they are enrolled. Continue reading to find out more about Medigap plans and the steps that should be taken when registering.

The Medigap Plan J is no longer available for enrolled patients. Medigap's F plan was discontinued on January 1, 2020. Those already registered to one of the programs could continue to use them. Medicare supplement schemes, called Medigap, provide assistance for Medicare-related expenses. Private insurers offer MediGap plans that can fill any Medicare coverage. Some of these terms can be useful in determining what is best insurance:

Medicare Supplementary Insurance (or Medigap) plans were discontinued in 2010. Those enrolled in the plan before this date can only utilize their current benefit. Medgap Plans J provide many important benefits.

Medicare plans J are among the most popular Medicare supplemental plans that could be selected. The program was discontinued in July 2010 because the Affordable Care Act changed its prescription medication provisions. However those who were enrolled in Medicare after June 2010 were permitted to retain insurance if the plan remained offered.

As far as coverage goes Plan J has been considered the most comprehensive plan a person can purchase. The benefit from Plan J varies by plan type and includes: Medicare Part-A deductibles and hospitalizations for a maximum of 365 days following Medicare remission, Medicare Part A and Part-B deductibles.

Medicare Supplement Insurance Programs J aren't available for new subscribers until 2010. Find details for these plans and compare them with existing Medigap plans. Medicare Supplemental ad hoc insurance or Medicap is a type of private insurance used in conjunction with your original Medicare (Part A/Part B) plan to pay deductible and copayment for medical costs in the United States. In 2010, Medigap's plan was not extended to all enrolling persons. All those who were registered for Supplementary Insurance Plan J before 2010 were able to retain this program. There are 10 Medigap plan options available today for all states.

Beneficiaries currently on the plan may continue on the Medigap plan. Only 3 percent of Americans enrolled in Medicare Supplemental Insurance Plans are from the United States and qualify for Medicaid and Medicare Supplements. Should I continue my plan? Initially there is the costs involved.

A plan that accepts no members is deemed risky because age and frequency are increasing. The plans will increase their premiums more quickly as they are higher than the other Medigap plans' rates. Another factor to take into consideration is benefit. While no Medigap Plan matches plan J coverage, some are quite close.

The main distinction between plans J and F is the degree of coverage available for foreign emergency services. Plan J pays a full 100 percent premium for medical assistance on a trip abroad. Plans F covered 80 % of the cost for emergency travel to other locations around the world. If you travel frequently abroad you may wish that your Plan J is maintained because there are more benefits. However, when it comes to traveling outside the United States, this additional insurance might no longer be a good idea to you. Plan FS is the best Medigap plan currently available.

A similar Medigap policy with Plan J has also been named plan C. Like Plan F and Plan G, Medigap Plan C provides 80 percent of foreign emergency expenses. Plan C is also applicable for Medicare Part A excess fees. Medicare Plan F provides a partial reimbursement of the expenses. Medicare excess fees represent a charge you could have a health care provider that doesn't accept Medicare Assignments. The service providers are not refunded by Medicare. The provider may charge you 15 per cent extra for Medicare approval.

Medigap plan J benefits have been popular with Medicare recipients since it provides comprehensive reimbursement for Medicare costs. Under Plan F, there are still health insurance options to cover all of their costs. Plan F is not available to those eligible to enroll on Medicare from January 1, 2020. If you have no plans available, you may consider taking a Medigap plan. Both Medicare Supplement insurance Plans J and F are covered. Both Plan J and Plan F also cover travel and emergency medical care. Although Plan F covers 80% of the cost, Plan J provides 100% coverage.

When Medicare is reimbursed by its agreed cost, Medigap plans offer additional coverage. Medigap covers leftover costs based on the approved Medicare amount. In fact, Medigap provides medical services that Original Medicare does not. Currently, there are a total 10 specialized health insurance plans available in California. Those who have enrolled in Medicare are not eligible to use the plan except under plan J.

Since there's so many options available to MedigaP users there may be some people who feel overwhelmed with options. Here's a list of best practices for choosing the best insurance program for you. SHIP can help you with the selection of policies. Not every state has participated in the SHIPS program. Explore this site. Search the internet for details about Medicare.

Medicare Supplement Plan J Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have been used.

Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and copayments. If you want to get Medicare prescription drug coverage, you have two options: You can enroll in a Medicare Advantage Prescription Drug plan (MAPD). These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs.

Medigap Plans F and G are the most popular Medicare Supplement plans in 2019. Learn more and compare your Medigap plan options. Read more Medicare Supplement Insurance Plan D Learn about Medicare Supplement (Medigap) Plan D coverage, costs and benefits. Compare Medigap Plan D options available where you live. Read more Medigap Plan F Benefits.

This law introduced Medicare Part D plans, which are standalone Medicare prescription drug plans (PDP) sold by private insurance companies. Due to this law, Medicare Advantage plans (Medicare Part C) can also offer prescription drug coverage . The 2003 legislation also expanded certain Original Medicare benefits.

Both Medicare Part D and Medicare Advantage plans are offered by Medicare-approved private insurance companies. Review your options before making a decision on Medicare prescription coverage.

Medigap programs provide for things Medicare does not cover, such as copays on doctor appointments. Medicare Supplement Plans J and Medigap Plans J were discontinued in 2010. Any person enrolled in a plan may continue the plan.

Plans G and J offer similar benefits as Plan J except that unlike Plans F and D, they only cover 80 percent of foreign travel emergencies. Plan G covers a total cost of $600 for an entire year of health insurance. Medigap plans are covered by the deductible. Medicare Part B deductibles will be $333 a year for 2022.

The Medicare Supplement Plans are policies to help pay for out-patient expenses. Medicare will discontinue this program in favor of newly enrolled customers. Medicare Supplemental Insurance Plan — sometimes dubbed Medigap — helps pay some of the premiums that Medicare users have incurred including coinsurance, deductibles or copayments.

MIPPA has released new, standardised plans for the period ending June 1, 2011. In response to MIPPA's recent reorganisation, Medigap policy changes are being made for sale from July 1, 2010. MIPAA enacts a reduction in standard plans that are currently 14 to 1. Plan X and Y were withdrawn.

In addition Medicare Supplement (Medicap) premium varies between states. Although benefits can be standardized, Medicare is varying in cost in states. Find Medicare plans in 3 Simple Steps. We can help with the right health care plans today. The costs of obtaining Medicare coverage may vary depending on the country's situation or its coverage type. Prices policies differ by region, and the cost of living also affects prices. Here is a list of the ten highest cost states for Medigap plans nationwide.

What are Medicare Supplement insurance plans? Find your local plan immediately! If you have already signed up or have already qualified under Medicare, you may consider purchasing Medicare Supplement insurance. Medicare Supplements (also called Medigaps) are a private insurance company that helps with the out-of-pocket expenses of Medicare Part A or Part B, like deductibles, copays and coverage.

This list the different Medigap plan types available to 63 year-old non-smokers in North Carolina. Medigap plan types Monthly Premium Price Range. Medigap plan A – the main advantages offered under the Medigap plan without additional costs. $75 - $116. Medigap plans B provide basic health care plus coverage for the deductible. 1313. $ 307.

Medigap plans are low priced and cover the majority of Medigap benefits. $10-6340$. Medigap Plans G offer maximum coverage for newly enrolled Medicare. Available in some locations with standard plans and high deductible plans. 95 – 33. High-deductible medical insurance plans: $30-69.75.

Some Medicare Supplement insurance plans offer community-based coverage. There's no age limit in premium payments for each individual member. Pricing is sometimes called no age rating or age-based. Aged e-newsletters. Prime prices depend upon the age of the purchase. The younger population typically pays a higher premium than the older population.

Pricing is also known as entry-age ratings. Age-advanced. Premium rates are determined according to age and cost will rise with age. Some states require specific prices for Medicare supplement coverage, therefore not all have the corresponding pricing options.

Medicap is billed by Medicare as being about $200 per month, industry experts say. The new plans help address gaps in original Medicare coverage. Medigp can assist you in the payment of all deductible and coinsurance costs that arise. Medigap Supplemental coverage may cover: Medigap plans are governed by private insurance providers which Medicare reimburses.

This results in incredibly large price variation in the insurance market. Two insurance companies can charge very different premiums for identical coverage. The greater coverage a health insurer offers, the greater the premium will increase.

There are many different factors which influence the cost of Medicare. Some states are using community rating methods for pricing their plans. It does not affect the premium cost of enrollment for female or male enrollees. All people under 65 receive the same amount of protection under this plan. Medigap premiums tend to be high throughout the board within states with community ratings. In addition many states listed are very expensive for living. California, New Jersey and Rhode Island are all among the most expensive states to live with.

In 2022 supplemental insurance premiums were approximately $150 a year or $1800 annually. Several factors can affect the Medigap cost, such as the age or place of residence. Rachel Christian: Rachel Christian is author and researcher for the RetirementGuide website. She is devoted to life insurance and retirement topics. Rachel is an Associate Member in Financial Planning Education.

Medicaid helps many low-income people on Medicare with their Medicare premiums and cost-sharing requirements, and may also cover some benefits that are not covered by Medicare, such as dental services and long-term services and supports.

How an insurer rates its policies can directly influence how much it costs. In some insurance companies, age does not affect premium rates. Some companies may increase your insurance rates each year. Bob Glaze, a registered insurance expert, describes how aging affects Medigap cost.

Depending on how older you are in the past the cost is dependent upon the policy. The monthly premiums increase with age. Depending on age you can find a more affordable policy if you are eligible to receive Medicare. But with time, this option can get you a lot more cost-effective option. Inflation or other factors can cause premium increases. Keep it at the risk that it will never happen to you. It takes time to think about things that you haven't thought of before. Make it ok. Get Medicare advice the best way for you.

It varies by how old you have been during your initial purchasing period. Premium rates are low in the youth group. But the prices are likely to remain stable with age. For instance Amy purchased an age-rated policy in her 60s and paid $12 per month. Bob begins coverage at 73 and pays $170 a month on similar policies. Amy will not receive more premiums when her age reaches a certain limit. It is almost guaranteed from your date of issue but cost can gradually increase with inflation.

Medigap Plan Costs in California It should be no surprise to see California Medigap plans on this list. Medicare beneficiaries enrolling in a Medicare Supplement plan can expect to spend close to $163 each month for a Medigap plan. In California, the biggest Medigap perk is the birthday rule. California's Medicare Supplement birthday rule allows beneficiaries to change Medigap policies during.

If you do not qualify for Medicaid and you want to stay in traditional Medicare, you could try to switch to a less expensive Medigap policy. Your options will vary based on your state, however, so it can be helpful to work with an agent you trust. 4. Another option could be to enroll in a Medicare Advantage plan.

With Plan L, you pay 25%. High-deductible plans require you to meet a deductible of $2,490 in 2022 before the Medigap policy pays for anything. » MORE: Compare Medicare Supplement Insurance plans Medigap cost comparison chart Here are the price ranges for each Medigap plan type available.

Your options will vary based on your state, however, so it can be helpful to work with an agent you trust. 4. Another option could be to enroll in a Medicare Advantage plan. Medicare Advantage plans provide all benefits covered under Medicare Part A and Part B. A few details: - Medicare Advantage plans.

Medicare Advantage plans provide all benefits covered under Medicare Part A and Part B, but often have lower cost-sharing requirements than traditional Medicare.

Medicare Supplement Medigap Plans Medigap Plan F Medigap Plan G Medigap Plan N High Deductible Plan F High Deductible Plan G Medigap Plan A Medigap Plan B Medigap Plan C Medigap Plan D Medigap Plan K Medigap Plan L Medigap Plan M Medigap Eligibility Medigap Coverage Medigap Enrollment Periods Medicare Supplement Videos Medigap by Carrier Medicare Part C Medicare.

Medigas'disadvantages include high monthly premium fees. The difficulty in navigating various plans. There is no prescription drug insurance for the patient.

Are there any medical advice available? Medigap policies supplement original Medicare coverage and cover additional cost of care. Medigap gives you more flexibility and offers a wider network of providers that are comparable to others. Having travel coverage that Original Medicare cannot provide is the most important option.

Pay a bit more to cover medical expenses, so people who need more medical services will make bigger payments. Medigap plans can be more costly than Medicare Advantage, however, it can help you cover your medical expenses better.

Deductible, copayment, coinsurance etc... Medicare Supplement plan G costs a 65-year-old $13.46 a month while Medicare Plan F costs $89.95 - $188.93 monthly. It's free to check Medicare Supplemental Price online.

Medigap policies can be priced or "rated" in 3 ways: Community-rated (also called “no age-rated”) How it's priced Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. What this pricing may mean for you Your premium isn't based on your age.

The Medicare program provides Medicare to seniors who pay for the services. It is packed with various alphabetic sections whose different benefits can be found in various categories. Medicare is facing some problems—including gaps that are completely unfilled and are not even covered. To secure this gap consider joining Medicare Advantage and Medicare Supplement plans. We have collected the best information and research on coverage, prices, conveniences and choices.

After you choose Part B of Medicare Part B or Part A you must decide the best way to fill the hole in the original plan. Important: This discussion is not intended to cover retirees who have been in the military or the private sectors. Unless a person wants retire benefits he should take the private market. The following is an overview of the product types, Medigap Vs the Medicare Advantage. You can purchase more insurance through Medicare by enrollees.

Medigap & Medicare Advantage provide different types of healthcare coverage. The best option is determined by individual requirements. Medigap offers supplemental coverage to individuals enrolled in original Medicare. Medicare Advantage, also called Part C, provides a replacement for this plan. Among some important considerations when choosing an insurance company are:

Our reviews are independent and advertisers do not influence our choice. It is possible for us to earn compensation when you see partner recommendations. More information about advertising disclosures is available here. All individuals looking to enroll in Medicare must decide. But what are Medicare alternatives?

Medicare - A health insurance plan is the same as private insurance. Most services, including offices and labs, surgery and other services, are covered by a small co-payment. Plans offer HMOs or PPOs and most plans have an annual maximum amount of deductible expenses. Almost every plan offers a unique advantage and there are no minimum requirements. Most prescription drugs are covered.

Several people require a consultation with a medical expert and many don't. Some will pay for medical care outside the network, while others will cover only medical services in the HMO or PPO networks. There are a variety of different Medicare Advantage plan options available. It may be important to secure plans that don't have annual premiums or low monthly premiums.

Medicare Advantage policies are offered by government-regulated insurance providers under the name of Aetna Humana or Medicare Foundation. They may be without premium or less than the premium for Medigap or prescription drugs policies. Medicare benefits cover hospitals, doctors and many prescriptions for services which are not covered by Medicare. In 2020 42% of the population will choose this plan. Most Medicare plans are operated through a Health Care Maintenance Organization (HAO) or preferential providers organization (PPO).

Medicare Advantage offers all the same coverage offered by Original Medicare with deductible coverage for things and services that aren't covered under Original Medicare. Often plans will even offer transportation to the doctor’s office or adult daytime services. Several plans are also offering more supplemental benefits based on new expansion. Moreover, a plan may tailor its benefits packages to provide benefits to people with chronic illnesses. In addition, Cigna offers free vaccination transport to Medicare beneficiaries.

Medicare Supplement plans can be used by a person to make their costs less expensive. From a cost share perspective, many people like that because they don't worry what they have to pay at each hospital visit, Jacobson said. Almost anyone can be seen anywhere. You can travel to Minnesota and visit the Mayo Clinic to see the doctors. Unfortunately, Jacobson explains the benefit is usually more important in cases of illness.

A recent study by Associated Public Health Insurance Companies focuses on Medigap plans offering nontraditional services, including hearing services, dental care, and vision care. The results showed that only 7% of plans offer these benefits. I think many people aren't even aware of this kind of plan. In federal politics, there have been varying levels of policy incentives and disabling policies.

The cost of Medicare Supplement coverage can range from $150 to $200 depending on the states of residence and insurers' plans. It's worth shopping around as Medicare Advantage plans can cost up to $840 per year. Jacobson continues to study the ways private plans and Medicare can provide better services for individuals, he explains.

The health benefits offered by Medicare Advantage are varied. Which one can best meet your needs? The Medigap plan provides extra coverage for individuals who qualify for original Medicare except for prescription medication. In addition Medicare Advantage offers the same benefits as a Medicare supplement with supplementary benefits like prescriptions, vision, dental, hearing and other health services.

Medigap is a private insurance option that is designed to work well with Medicare (Part A and Part B) plans. How do I choose between Medicare Advantage and Medigap? Consider your priorities, like budget, choice, travel, and health conditions. While Medicare Advantage can be more affordable for people with long term health issues, Medigap gives you flexibility and choice by expanding your network.

Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services, and usually Part D prescription drug coverage into one package. If you decide to get coverage through a Medicare Advantage plan, you'll still have to enroll in Medicare Parts A and B, including paying the premiums for Part A, if you don't qualify for it free, and Part B.

Medigap plans offer additional coverage to Medicare patients, though the program does not cover prescription medications. The Advantage plan also has the same coverage as original Medicare but includes extra benefits including prescription drug coverage, vision, dentistry, hearing and other health services.

Medicare Advantage can help reduce health care costs. For serious medical conditions that require costly treatment or care, Medigap usually provides the best treatment.

59% of Medicare beneficiaries (65 and older) and people with disabilities are using Original Medicare, Part A and Part B. These covers hospitals, medical professionals and procedures. 5. Almost 91% pay for Medicare Part D prescription drugs and 46% pay for the Medicare Part D prescription drugs. Medicare Supplement Insurance: A Medicare Supplement Plan is not sponsored by the United States government. Despite being the most costly option, it also offers many benefits.

After your Open Enrollment Period, if you want to change Medigap coverage, you will have to answer health questions (go through underwriting) to qualify for the Medigap plan. If you do not answer “no” to all the health questions there is a very good chance you will be DENIED from getting new Medigap coverage.

If you have Original Medicare and a Medigap policy, you may also benefit from a Medicare Part D prescription drug plan to help cover prescription drug costs. How Are Medicare Advantage and Medigap Different? With a Medigap plan, you have access to any doctor or provider who accepts Medicare.

Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®). Edited By Savannah Hanson Financial Editor View Bio 7 Cited Research Articles View Sources U.S. Centers for Medicare & Medicaid Services. (2022, September 27). 2023 Medicare Parts A & B Premiums and Deductibles 2023 Medicare Part D Income-Related Monthly Adjustment Amounts.

To be eligible for a Medigap plan, you have to be 65 years or older and be enrolled in both Medicare Part A hospital insurance and Medicare Part B medical insurance. You are not guaranteed that your application for a Medigap policy will be accepted if you don't purchase a plan when you are first eligible for Medicare .

Various disadvantages of the Medigap plan are: High monthly premiums. There are many options available to you. It's not prescription coverage.

In Medigap you are eligible for Medicare coverage from any physician. In the case of Medicare Advantage, however, the choice of doctor is less clear. In practice, Medigp is not available through Medicare Advantage. However, you can change your plan at any stage.

Medigap plans offer a number of different options for a specific situation. You must compare Medicare plan details closely to ensure that your coverage will suit you. Compare Medicare benefits and Medigap plans. You can also take this to your health. Get Medicare Assistance To Prepare for Life!

In 2015, 1.4 million people were covered under the Medicare Supplemental Insurance Plan, which includes supplemental health insurance that can cover their deductible. The brief provides information about the benefits of Medigap enrollments and analyzes consumer protections in federal laws and federal regulations that affect beneficiaries' participation in Medigap.

Each Medigap policy should adhere to federal law and state regulations aimed at ensuring your protection if you are enrolled in Medicaid or Medicare. The insurers have only to offer standard policies identified by letters in many states. Each policy offers the same fundamental features, but some have additional benefits that allow you to choose which one suits you best.

In Massachusetts, Minnesota & Wisconsin Medigap policies are standardized in different ways. All insurers determine the type of coverage they wish to sell and states may also have their policies regulated by law. Insurance providers selling medap insurance:

The extra charge is $6620 and $3310 for 2022. The F and E plans also include high deductibles in ten states. The policy will cover Medicare-covered expenses (coinsurance, copays and deductibles) until 2021 and the policy pays nothing until 2024. Plans C and F are not available to people whose Medicare benefits lapsed after Jan 1. 2020. ** For plans K and L, after you exceed your deductibles and your annual Part B deductible, the Medicare benefit increases.

A detailed breakdown of the benefits covered by Medicare can be seen here. The Medigap policy covers only after you have paid the premium, except Medigap policies also pay the benefits for.

In addition to paying the Part B deductible, new Medicare customers will not have the option to purchase a Medicare plan. This means plan F and B have been discontinued for all new Medicare users beginning January 1. If your insurance is not available in January 2020, your coverage may be withdrawn. In some cases, a patient who is not currently enrolled can apply and get subsidized through Medicare.

We used data from the National Association of Insurance Commissioners (NAIC) Medicare Supplement Insurance files for our analysis of Medigap enrollment by plan type and by state. These data include the number of policyholders as of December 31, 2016 for each state, insurance company, and type of plan sold.

Medigap policies are standardized Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance." Insurance companies can sell you only a standardized policy identified in most states by letters. All policies offer the same basic benefits The health care items or services covered under a health insurance plan.

Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicare's benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending. Medicare requires a Part A deductible for hospitalizations ($1,340 in 2018).

Register Medigaps are health insurance policies that offer standardized benefits to work with Original Medicare (not with Medicare Advantage ). They are sold by private insurance companies. If you have a Medigap , it pays part or all of certain remaining costs after Original Medicare pays first. Medigaps may cover outstanding deductibles, coinsurance , and copayments.

Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefits: Hospital coinsurance coverage 365 additional days of full hospital coverage Full or partial coverage for the 20% coinsurance for provider charges.

QMB program benefits include: Payment of Medicare premiums. Payment of Medicare annual deductibles. Payment of Medicare coinsurance amounts. Thus individuals who qualify for the QMB program generally also do not need.

Part B coinsurance or copayment 50% 75% *** Blood (first 3 pints) 50% 75% Part A hospice care coinsurance or copayment 50% 75% Skilled nursing facility care coinsurance 50% 75% Part A deductible 50% 75% 50% Part B deductible Part B excess charge If you have Original Medicare, and the amount a doctor or other health care provider.

However, there is a basic benefit package, known as the “core benefit” plan, which must be allowed in all states and which must be offered by any company which sells Medigap insurance. Although individual Medigap policies have been standardized since 1992, some seniors are still covered by previously issued non-standardized plans.

The Medigama markets changed significantly with OBRA 1990. This legislation requires all new Medigap products to meet one of the following criteria:

Medigap policy is standardized All Medigap policies have corresponding Federal law and must have a clear label "Medicaid Supplement Insurance." The insurance company will sell you one standard insurance policy identified by the letter.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care. Policies B through L vary considerably.

Medigap plans are grouped under ten separate categories by the CMS. Medigap plans have various benefits. The amount covered will roughly correspond to the premiums paid.

The insurance company must continue to renew the discontinued Medigap policy each year you wish to keep it. See the Medigap Plan Benefits Chart for plans purchased between July 31, 1992, and May 31, 2010 for more information on your Medigap policy's coverage.

A person buying an updated standard policy will have just one Medigap Policy. This policy will be removed from the standard plan. This protects customers from costly duplicate insurance policies. The 12 standardized benefits plans labeled A to L.

Medicap plans or other Medicap supplement plans sold through private firms can provide some health-care costs that Original Medicare can't afford, such as copayments, coinsurance and deductibles. Some Medicare plans also cover services that Original Medicare does not cover. So your Medigap plan gets paid.

Medicap is a Medicare Supplemental Insurance plan that fills gaps and is offered by private corporations. Medicare covers most of a portion of the cost of covered care. Medicaid Supplement Insurance (Medicigape) policies may help pay if there are unforeseen health care needs for a client.

You may join your Medicare Supplement Plan unless you have Original Medicare Part a and Part B. Your open enrollment period lasts six months from your 65th birthday. During this Medicare Supplement open enrollment period there is no possibility of re-entrying a program if your current condition is present.

Not all countries provide underwriting for healthcare plans. Some states provide plans for people under 65 who may not qualify for Medicare for a medical reason other than a disability. Medicare Supplement insurance gives you access to all medical facilities that accept Medicare patients. Anthem offers supplemental insurance policies covering 100% of Part A and Part B coinsurance.

Medicare Advantage Plans provide an alternative to traditional Medicare with similar health coverage but with additional benefits including prescription drug coverage. Meanwhile, private insurers provide Medicare Supplement plans to individuals who enroll in original Medicare to cover the gaps that exist in the coverage.

Medigap provides nationwide standardized coverage for a large number of people who are unable or unwilling to take maternity insurance. Since coverage is standard the monthly premium rates vary from provider to provider. The MediGap policy does not cover prescription drugs.

The enrollment procedure is simple in Medigap plans. Those prescription drugs are usually purchased through an agent and are delivered direct from a carrier,” he said. The open enrollment period is not annually and you may apply at anytime. The Medigap plan can be ordered during an extended open enrollment period of six months for an average of six months. The period begins the day after you start having Medicare Part B for age 55 and above. Medigap insurance is offered for all states and residents during the current time. Follow these steps to purchase Medigap plans:

It will vary depending on how many people are enrolled in Medicare and Medicaid Advantage plans. Medicare Advantage is an alternative to Original Medicare and provides the same coverage but additional benefits, including prescription medication protection (Part D). In addition, Medigap insurance is sold to people enrolled in Original Medicare to fill in gaps. Medigap provides standard coverage and helps pay deductibles, insurance, and premiums. Unlike most drug plans, Medigap covers no prescription medications.

The most commonly used Medicare Supplement Plan is Plan N. Medicare Supplement plan F provides beneficiaries full coverage for Medicare-covered medical costs once original Medicare reimburses a percentage. Medicare Supplemental Plan G only covers Medicare Part C yearly deductibles after the plan is able to cover 99% of Medicare coverage. Finally, Medicare Supplement plan N is an arranged plan that is more economical to administer as a payment option.

Generally speaking, Medicare is a government-sponsored insurance plan designed to provide reassurance that Medicare doesn't cover the full cost of the health care. The secondary insurance policy is available only with the Original Medicare program. Medicare Part D does not generally provide prescription coverage, and you may want to enroll in one of these Medicare Advantage plans. Unlike Medicare Advantage Part C Medicare Medicap has no similar benefits to Part B.

If the Medicare Advantage plan is approved, it will not cover Medicare Advantage plans. The insurer can delay a claim for six months if there is no coverage for your condition. If you re-enroll for Medicare Part B coverage before 62, you should enroll as soon as your Medicare Part C enrollment begins. Medigap policy is invalid unless your status and your medical coverage changes.

Medicare plans don't provide prescription drugs coverage, though you can purchase part-D insurance plans to help cover medication expenses. Unlike Medicare Supplement plans, Anthem provides you with additional dental care and vision coverage within the United States. In addition, California, Kentucky and Nevada offer innovative Medicare Supplements that include eye and hearing support.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. , and you may pay more if you join a drug plan later. If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments.

The cost of medical supplements is dependent on the company and plan chosen and a few carriers do not all offer their plans. Medigap policies have been determined from individual insurers that sell them. Companies determine pricing on premiums in three ways. Medigap insurance is bought through a private insurance company that pays the company monthly premiums directly.

Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

The Medicare Supplement program helps to reduce health care costs that cannot be paid by original Medicare. All patients in Medicare should be aware that their health insurance coverage is likely to be very high. Some Medicare Supplement plans provide insurance to certain services that the original Medicare does not cover.

A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap plan from any insurance company that's licensed in your state to sell one. Any standardized Medigap plan is guaranteed renewable even if you have health problems.

The plans and what they cover are standardized by the federal government. General features of Medicare Supplement insurance plans Medicare Supplement insurance plans work with Original Medicare (Parts A & B) to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans: Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

Medigap Some types of insurance aren't Medigap plans, they include: Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan) Medicare Prescription Drug Plans Medicaid A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

Medigap is the Medicare Supplement insurance program helping fill gap gaps, which is distributed by private businesses. Original Medicare provides coverage for a large amount of coverage for healthcare. Medicare's Supplemental Insurance (Medicaid) provides for some of the remaining medical costs.

Currently the Medicare program is primarily funded through the government and is used to pay healthcare costs to seniors. Moreover, there'll also be health insurance available at an affordable rate for those who have had a handicap in the last decade or so. You may purchase Medicare Supplement insurance for the expenses Medicare wont help cover for you. It can help cover a few gaps in Medicare coverage, which are often called Medigap insurance.

One in four patients with traditional Medicare (26 percent) had Medicare-approved supplemental insurance to cover the deductible for Medicare and costs of Medicare. In 2014, fewer than half had Medicare-related medical insurance. This brief provides a brief summary of Medigap enrollment and analyses federal regulations that affect beneficiaries' use of Medigap.

Medicare Supplement Insurance helps fill gaps in coinsurance and deductible payments. Medicare's supplement plan only covers the services Medicare considers medically necessary and payment is usually determined by the Medicare payment schedule. Among these plans are emergency care services that Medicare does not offer. Medicare supplement plans are offered by private insurers licensed with TDI. Medicare Supplements are provided under federal government rules and conditions if necessary.

Regardless of where you relocate, you need your health insurance plan. In some cases, a Medicare Supplement policy remains in effect. It will be possible for people with Medicare to opt out of certain Medicare-specific plan plans. If you have Medicare Advantage plans, ask if they're available in your new ZIP code. If there are no plans available then you will need another plan. This can be done by switching to a different Medicare Advantage plan or the original Medicare.

The government has 10 Medicare supplement insurance schemes. Several plans have different advantages. Plans F offer high deductibility. Plans K, L M and N contain an alternative costsharing feature. All companies must have a plan A available. Unless they offer an additional plan they must offer the plan C.

Medigap's name is derived from the notion that it exists to cover the difference or "gap" between the expenses reimbursed to providers by Medicare Parts A and B for services and the total amount allowed to be charged for those services by the United States Centers for Medicare and Medicaid Services (CMS) . Over 14 million Americans had Medicare Supplement insurance in 2018 according to a report by the American Association for Medicare Supplement Insurance. Medicare Part C, also known as Medicare Advantage, is a type of health insurance plan offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits to eligible individuals.

If it is conceivable that the company will falter, that his costs will rise, or that coverage will diminish, the individual may wish to purchase an independent policy. Remember, however, that if a new policy is purchased the old policy must be dropped. Most Medicare beneficiaries are not eligible for Medicaid or QMB, however, and may want to obtain Medigap insurance.

Acting as a representative of Medicare or a government agency. Selling you a Medicare supplement policy that duplicates Medicare benefits or health insurance coverage you already have. An agent is required to review and compare your other health coverages. Suggesting that you falsify an answer on an application.

Under HIPAA, if an individual had health insurance coverage for a period of at least 6 months prior to their initial open enrollment period for Medicare, no pre-existing condition exclusion may be imposed.

You can get prescription drug coverage by joining a stand-alone prescription drug plan or by buying a Medicare Advantage plan that includes drug coverage. If you have group health insurance, your health plan might already cover prescriptions. Ask your plan's sponsor whether the plan has prescription drug coverage that is comparable to Medicare Part D. Insurance companies approved by Medicare offer Part D coverage.

Prescription drug plans (PDPs) are health insurance plans that help cover the cost of prescription medications. PDPs are a type of Medicare Part D plan, which is a program that provides prescription drug coverage for people with Medicare.

Some of these rights are an expansion of federal law. Regulating Medigaps In California, Medigaps are regulated by two state agencies. The California Department of Insurance (CDI) regulates most Medigap policies, and the Department of Managed Health Care (DMC) regulates Medigap plans sold under the trademark of Blue Cross or Blue Shield.

You and your spouse must buy separate Medigap policies. Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

On the other hand, broader guaranteed issue policies could result in some beneficiaries waiting until they have a serious health problem before purchasing Medigap coverage, which would likely increase premiums for all Medigap policyholders. A different approach altogether would be to minimize the need for supplemental coverage in Medicare by adding an out-of-pocket limit to traditional Medicare.

Medicare Supplement plans can help you offset your healthcare expenses. California's Department of Insurance regulates Medicare Supplement policies issued through authorized insurance companies.

Medigap policy must conform to federal and state regulations. They protect your rights. Those policies must clearly state Medicare Supplement Insurance. There is a need for a comparison of the various policy options in Medigap as the costs vary.

Medicare (Part B and Part B) is a federal program meaning that coverage will remain the same. You will receive the same coverage. Medicare - Part D - Part G - Medicare - Part A - Medicare - Part D - Part D - Medicare - Part D All optional Medicare coverage is regulated in different states and can vary a lot.

Our selections are based on independent evaluations of products and advertising does not affect them. It is possible that our partner will be compensated for visits. Read our advertising disclosures.

Medicare-Supplies Plans, also referred to by some names as Medigaps or Medicare Supplement Plans, are privately sold insurance plans that do not compete with Medicare. Generally, the Medicare Supplement plan covers the cost and gaps that are a result of a non-payment by the original Medicare. It could include prescriptions, medical visits and dental services. Most of the leading health insurance companies offering supplements offer competitive pricing and a simple, user-friendly interface.

Medicare is the perfect choice for seniors. Medicare has been cited as a good health policy for people 65 years or over. This does not cover all. You may need Medicare supplemental insurance for health problems as you mature.

It's simple to sign up with Medigap plans. The supplements are either available through the agent of the insurance provider or by the insurance carrier in a direct transaction. Since there is no open enrollment cycle per year, your membership is free of charge. The best option is to buy Medigap policies when you are currently in the Medigap Open Registration period of 6 months. The period starts in your first month of Medicare Part B. The MedigaP policy is available to consumers throughout that period, even if there's no health problem there. How do I get a Medigap plan online?

Plan A, Plan B and plan C provide the most common Medicare Supplements plan options. This program provides a 100% coverage option for Medicare-covered medical bills once a Medicare beneficiary pays the portion of the Medicare payments. Medicare Supplement Plan G provides a limited amount of coverage for all medical costs.After that it provides 100% coverage to Medicare patients. The Medicare Supplement plans are typically paid-up and tend to be aimed more at beneficiaries who don't require regular medical care but are interested in emergency coverage.

The best period for Medicare supplemental coverage is during your initial Medicare Open enrollment period - the six-month period which begins on the 1st of the month unless you are older than 65. This period of enrollment is open to all Medicare beneficiaries unless you have a medical degree. If an individual is trying to get enrolled in a Supplemental Insurance Plan during the enrollment period then they may receive an additional payment or denied coverage. Do people have any questions on Medicare Supplements?

Whether a person buys Medicare Advantage or Medigap plans reflects his specific needs. Medicare Advantage Plans are an alternative plan to Medicare Original. They have the same coverage as other benefits. Medigap is currently offered by private insurers to people who are eligible for Medicare Original Medicare. MediGap provides standard coverage that covers everything from deductibles to coinsurance and copays. However, the Medigram policies do not provide prescription drug coverage.

Serving 16 states. Medigap Plans available: AB, FG - N.. Exceptional features: Anthem can provide additional cover in certain locations for services not available under standard Medigap plan types. Anthem Extras offers a number of options to pay if an appointment is necessary. Anthem is the United States' second most valuable insurer. The company is a provider of Medicare Supplement Insurance under the Blue Cross Blue Shield group. Anthem provides an additional dental and vision protection option that is very limited in competition.

Medicare Supplement, also called Medigap (Medicare Supplements - Part A - Part C). This secondary insurance program is exclusive to original Medicare, not any other private insurance plan, standalone Medicare plan, or Medicare Advantage plan. Medicare Advantage plans typically do not provide for the prescription of medicines. You can also enroll in Part D Medicare Advantage plans that provide drug coverage. Medigap Plans differ from Medicare Part C or Medicare Advantage Plans.