There are a number of Medicare Supplement insurance programs that consumers have found to be a little confusing. But everybody's interpretation of the plan varies from person to person. What are your benefits? Costs. Is this another thing? How does one compare different insurance plans in different areas of America? With a free internet comparison of plans, it will be easy and affordable for you to understand what each plan covers.

Each Medicare Supplement Insurance policy must be governed by federal laws and must be clearly marked by Medicare Supplement Insurance. Insurance brokers may sell you standardized policies identified by letters. All policies are similar in basic terms but others offer additional benefits to make it easy to pick a policy to meet your specific needs.

Medigap policies in Minnesota are standardized in other states. Each insurer chooses which Medigap policy to market, though the law may affect which ones. The insurance company who sells Medigap insurance policies.

In the absence of an employer-sponsored Medicare Part B (Original Medicare) plan, Medigap may be necessary in some circumstances.The Medigap plan has been sold to private insurers that offer assistance in paying your premiums. Medigap is standardized, but some plans are not yet available.

The initial enrollment period is a short period during which you can enroll in Medicare Part A if you are already enrolled. Once you have joined Part B or Medicare you have the option to select another coverage option from approved private insurance companies.

When buying a Medigap policy, the best times of the year are the 6-month period beginning the first day of the month in which you turn 65 or older and enroll. After the period the ability to buy the Medigap policy is limited. Depending on how you treat the situation, each state has its own open enrollment period.

Medicare Supplement Plan F offers the most comprehensive Medigap plan and thus is the ideal Medicare Supplement plan. All insurance options are guaranteed until Medicare has paid a percentage. Medigap Plan F provides coverage for Part B deductibles and other premiums.

Medicare Supplement Insurance (Medigap) plans, including what they cover, how much Read Article Find Aetna Medicare Supplement Plans in Texas Aetna offers Medicare Supplement plans in Texas, including popular Plans F, G and N. Learn about Aetna Read Article Health Insurance Medicare Enrollment Guide Medicare Overview Medicaid Prescription Drug Coverage VA Benefits and Resources Retirement Retirement Social Security Taxes and Financial Abuse.

This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they don't. Visit centurymedicare.com Plan N: Best Medicare Supplement Plan for Cost Cost is always important when shopping for health insurance, and some consumers will even place it as their top priority. High-deductible Plan G and high-deductible Plan F are typically the two lowest-cost Medigap plans available.

Plans are insured and offered through separate Blue Cross and Blue Shield companies. Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract.

Find Cheap Medicare Plans in Your Area Currently insured? Find Plans Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive.

This plan covers the same benefits as the standard Medicare Supplement Plan G but offers a lower monthly premium due to its higher deductible. Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Remember that Medicare Supplement High Deductible Plan G comes with the same higher deductible as High Deductible Medicare Supplement Plan F, which is $2,490 in 2022.

FAQs Is Medicare Supplement Plan F the best Medicare Supplement plan? Medigap Plan F is considered one of the best Medicare Supplement plans because it provides the most comprehensive coverage. With Supplement plans, the best choice for one individual may not be the best plan for another person.

n general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums. View more Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Medicare Part A coinsurance Medicare Part B coinsurance 50% 75% Blood (3 pints) 50% 75% Part A hospice care coinsurance 50% 75% Skilled nursing facility.

It is no secret that the Supplement plans come with the most affordable monthly premiums. Depending on your state, high-deductible Medicare Supplement Plan F or Plan G will cost anywhere from $40-$80 each month. However, when you look at overall spending with the high-deductible Medicare Supplement plans.

Full Coverage Car Insurance Liability-Only Car Insurance Free Car Insurance Quotes Best Car Insurance Companies Cheapest Car Insurance Health Insurance Quotes Travel Credit Cards Medicare Find Plans 4 Best Medicare Supplement Plans for 2022 4 Best Medicare Supplement Plans for 2022 by Stephanie Guinan Reviewed by licensed agent Brandy Law updated Aug 30, 2022 Plan G is the most comprehensive Medigap policy in 2022, but it's also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Medigap enrollment is available year-round for Medicare beneficiaries. The only stipulation for admission to a policy is the need to answer underwriting health questions in most states. Medigap Plan Comparison in Massachusetts, Minnesota.

Supplement (Medigap) plans available to most Medicare beneficiaries in 2022. Our easy-to-read Medigap plan comparison chart makes reviewing these plans easier than ever.

High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020. Effective January 1, 2023, the annual deductible amount for these three plans is $2,700.

Compare Plans Select which Medicare plans you would like to compare in your area. Get Quote Compare rates side by side with plans & carriers available in your area. Sources: Medicare FAQ is dedicated to providing you with authentic and trustworthy Medicare information.

Medigap Plans Medigap Plan F Medigap Plan G Medigap Plan N High Deductible Plan F High Deductible Plan G Medigap Plan A Medigap Plan B Medigap Plan C Medigap Plan D Medigap Plan K Medigap Plan L Medigap Eligibility Choosing Medigap Policy Medigap FAQs It's free and no obligation!

These increases in the limits are based on estimates of the United States Per Capita Costs (USPCC) of the Medicare program developed by the Centers for Medicare & Medicaid Services (CMS). Calculation of the OOP Annual Limits: The annual OOP limits are determined in accordance with section 1882(w)(2) of the Social Security Act.

Your best Medicare Supplement plan should match your cost and coverage. The most comprehensive insurance plans with deductibles have higher monthly premiums. See more Plan B. Plan C. Plan D. Plan E. Plan K. Plan L. Plan M. N. Price quotes for policies are from a sample of quotes from women in the age group of 65 and over. Depending on location and gender rates may be different. Plan G can be beneficial to people who want to have a low health bill that'll be around $990 per month. You'll get a little comfort knowing there's no medical emergency.

Our selections of top products are reviewed through an independent review process, with no advertisements influencing our selection. We might be compensated for the visit of the partner that we recommend. Please see the advertising disclosure. Medigap Plans are private insurance programs that sell private policies separate from Medicare. Medicare Supplement plans cover costs of coverage that aren’t reimbursed under Original Medicare. These may involve prescription visits, eye and dental treatment and other procedures. The best Medicare supplements providers are available at a competitive rate and have streamlined websites and intuitive interfaces.

Medicare is sold to private insurers but Medicare coverage is administered through the government. In other words, Medigap plan G provides the same Medicare benefits no matter who the insurer is. Most states have a set of 10 standard Medigap Plans. The insurer has the responsibility for the plan type, the cost and if there are a number of other benefits and also provides customers with support services. Each business possesses a unique strength and a unique weakness.

The Medicare Supplement plan is a primary insurance plan after Medicare pays a part of the amount for a period. The Medigap program is indicated in varying letters A through N. Medicare Supplements offers a range of health plans and a number of high deductible health insurance plans for the enrollment in Medicare. In each carrier, the benefits of the letter program are essentially the same. In fact, these three most popular Medicare supplement programs have high benefits. These plans are popular because the coverage, affordable costs and availability are factors that helps customers achieve overall satisfaction. This section will show how Medicare Supplement benefits can help you get your coverage.

Medicare Supplement Plans N are the best affordable options in our list of best Medicare Supplement plans. But that will also bring additional incurred expenses for you personally. Medicare Supplement N consists of Part A deductible and Part B 20 % coinsurance. Medicare plan N requires you to pay a small copay when you visit a hospital or a physician. In addition, you may incur excess charges on these plans for any state in which you receive treatment. This charge can be quite uncommon even in states that permit it. Medigap Plan N requires $20 in coinsurance for doctors & $50 in emergency visits.

Medicare Supplement Plan G allows you to manage your medical expenses without requiring a deductible. You will then receive full Medicare medical reimbursement. Currently Medicare Part B deductible is $2,500 or more. Your only medical expenses will cover all your costs outside your monthly premium. Because of the relatively low outlay, Medicare Supplement plans G are the best Medicare Supplement plans available until 2020. As a result of Medicare Supplement Plan F enrollment regulations, Plan G has quickly become the most used Medigram option. Medicare Supplement Plan G is a good option when:

Original Medicare only covers about 80 percent of your healthcare expenses. Medigap plan helps you control your expenses. Senior people may consider Medigap plans to the following extent.

Whenever you are considering Medigap, it is important to ask what providers' policies are. Insurance companies have age limits in a number of jurisdictions and the older the better the pay. Nonetheless, some insurers like UnitedHealth's AARP employ community-driven approach. Depending upon age, the premiums may be identical. Remember even community subsidies can still go up from their annual level, depending primarily upon the inflation factor. Insurance firms are regulated to use community ratings on insurance companies for assessing their customers' insurance coverage.

Please watch your calendar when you are approaching your Medicare eligibility period. Your open enrollment for Medicare starts on the day of your 66th birthday. If a user decides to enroll in Medigap during a free enrollment period, you may incur an unforeseen late fee. There are a few exceptions, of course, which will be described more fully later.

Plan F is the most used Medigas program. Plans are available for Medicare only if eligible before 2020 and due to comprehensive benefits, around 49% of all Medicare Supplement enrollers are using them.

Medicare Supplement Plan F is a comprehensive Medigap plan and is considered to be a good Medicare Supplement policy. All of the benefits will be covered by your original Medicare plan unless you pay your part. Medicare Part C coinsurance is included.

So, for example, Medigap Plan G has the same Medicare benefits regardless of which insurance company you choose. In most states, there are 10 standardized Medigap plan types. The insurance companies are responsible for which plan types they sell, what they charge and whether to include extra perks, as well as providing customer service.

Our licensed insurance agents are interested in pairing you with the best coverage for your needs rather than prioritizing a particular insurance company. What is the next best Medicare Supplement plan after Medigap Plan F is discontinued? For those newly Medicare-eligible, the next most comprehensive Medicare Supplement plan is Medigap Plan G.

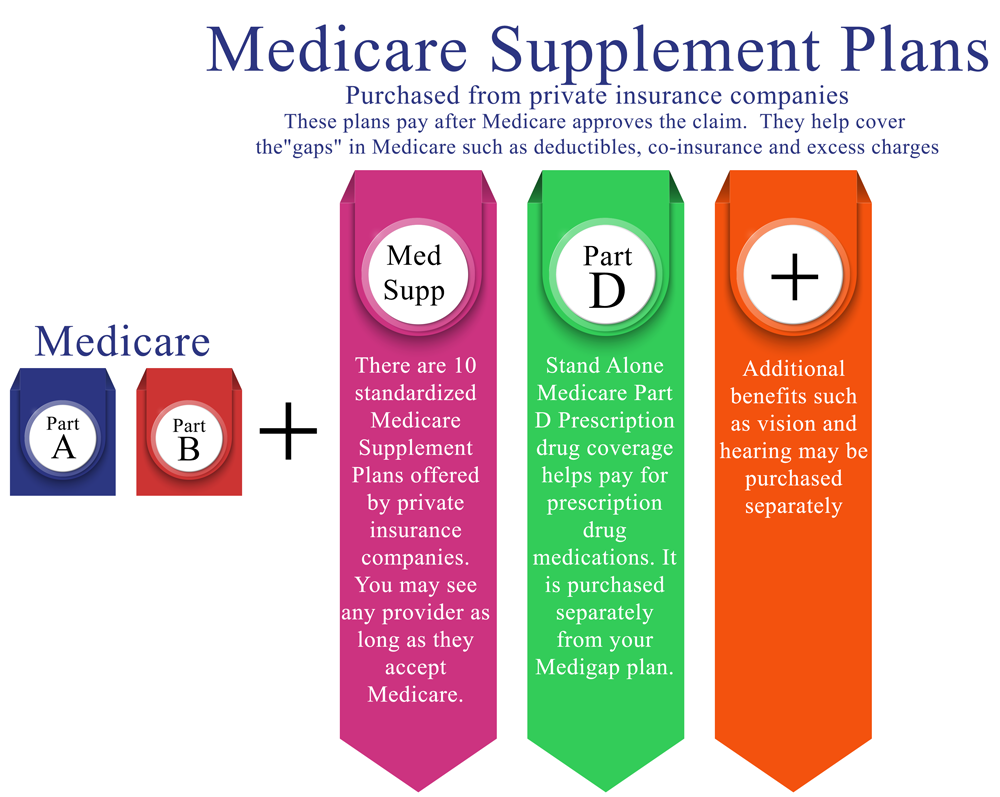

Medicare Advantage plans serve as a substitute for Original Medicare, providing the same coverage plus additional benefits like prescription drugs coverage (Part D). Meanwhile, Medigap plans are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that coverage. Medigap plans provide standardized coverage and help pay for things like deductibles, coinsurance and copays.

only after you've paid the deductible The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible). Compare Medigap Plans Medigap Benefits Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Part A coinsurance and hospital costs up to an additional.

If you're unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance. When Can I Buy a Medicare Supplement Plan? When it comes to Medicare eligibility , you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65.

Anthem's optional dental and vision coverage add-ons are rare among competitors. It offers only a few Medigap plan types, though, and serves relatively few states. Pros Anthem offers several tiers of dental and vision coverage to mix and match with Medigap plans.

ure you receive the most complete coverage possible. What Are the Top Medicare Supplement Plans? Medicare Supplement (Medigap) plans pay secondary, meaning after Original Medicare pays its portion. Each Medigap plan is identified by a different letter, A through N.

This option supplies you with 100% coverage after Original Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductibles and coinsurance. While on Medicare Supplement Plan F, you will never spend a dime on any Medicare-covered medical services outside your monthly premium.

Best cheap Medicare Supplement plan: Plan K If you are interested in the cheapest Medigap policy that still provides some coverage on top of Original Medicare, you may want to look into Plan K. Plan K is significantly different from many other Medigap policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible.

A person enrolled in Original Medicare who wants prescription drug coverage must purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan. What is the most popular Medicare Supplement plan? Plan F, Plan G and Plan N are the most popular types of Medicare Supplement plans.

Due to these enrollment restrictions, Plan G is becoming the most popular Medicare Supplement plan type for new Medicare enrollees, as it covers the most Medicare costs of any Medigap plan type that's available to all beneficiaries.

Medicare Supplement Plan G's premium Are looking for catastrophic coverage If you enrolled in Original Medicare before 2020, you are only eligible for Medigap High Deductible Plan F. Those who sign up for Original Medicare in 2020 or later are only eligible for High Deductible Plan G.

A person enrolled in Original Medicare who wants prescription drug coverage needs to purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan. Meanwhile, Medicare Advantage policies are only standardized in that they must provide the same benefits of Original Medicare, as the plans serve as a direct substitute.

Services: 15 States. Medigap offers: A, F, G, and N. Plan availability differs based on location. In some locations Anthem provides additional coverage at cost sharing for services not provided in standard Medigap plans. Anthem extras packages include the expense of tooth cleaning, dental treatments and eye examinations. Anthem is the 2nd biggest health insurer in America. Medicare Supplement Insurance is offered through the Blue Cross Blue Shield Collective as well as individually. In comparison, Anthem provides additional dental and vision coverage as a free option.

One in four Medicare patients in 2014 had private supplemental insurance known as Medigap to pay for deductible payments or other costs. It offers a comprehensive overview of Medigap enrollment, and analyses consumer rights under federal law or state regulations affecting the beneficiaries' access to Medigap.

In 2024, most Medicare beneficiaries can choose from a variety of Medicare Supplement plan options. Medigap plans comparison chart is incredibly simple. How do I find an effective Medicare plan?

Medigap can be rolled out anytime during the year. The most suitable period for obtaining Medicare supplement insurance is the first year of enrollment. If the carrier is refusing you insurance in this situation, the application process will continue. You are eligible for all Medigap Plans. You may miss the enrollment period for an initial Medicare Supplement plan later on in life. Medigap enrollees can enroll in Medicare all year round. There is only eligibility if an applicant can provide information to underwriters about health issues.

All Medigap plans must comply with federal or statutory laws designed to protect you. Insurance companies can only sell standard policies whose name is often attributed to a letter. Each policy has a basic feature, although others offer more features, so that it will fit your specific requirements better. In Massachusetts, Minnesota, and Wisconsin, Medigap policy is uniform in different ways. Depending on state and federal laws, the insurer can decide what type of coverage he/she wants. Insurance company that sells insurance for Medigap.

When you compare all 12 Medigap Plan options you'll find that every plan includes different monthly costs and varying costs. Cost for Medigap Plans varies from one plan to another depending on your choice. Often plans will include copays and deductibles, while many require a deductible for coverage before 100% coverage is effective unless a policy is purchased. Understanding your own costs and responsibilities in any one plan is crucial when evaluating the plan you want.

Medicare Part B is the primary Medicare program that helps you fill gaps in Medicare Part A. Medigap is offered by private insurance companies that helps you pay a premium. Medigap plan is standard. However, a majority of standard plan options aren't available within your local area.

This initial enrollment period provides you with only a short period to apply for Medicare when you first get eligibility for Part A and Part B. Once you enroll in Part A or Part B, you have the option to select other plans such as Medicare Supplements. The most convenient way for a customer to purchase a Medigap policy is during the six-month period that starts with a birthday on the first day of the month — you are 65 or younger. You can then purchase the Medigap plan at any time. The states have different rules and regulations, but sometimes there may be additional enrollment periods.

Each different type of Medigap plan has different benefits based on different characteristics and different responsibilities. Most cover all parts deductible.

Insurance firms can offer up to 10 types of Medigap policies in A, B, C, E, D, F. Every letter of policy is standardized. This means all policy labels are identical regardless of whether the insurer has the same price.

These plans are available for people enrolled in Medicare parts A and B, not for those who elect a Medicare Advantage plan. Medigap plans pay for costs such as deductibles and copays and other charges that Medicare doesn't cover. In 2010 the federal government standardized the types of Medigap plans, creating 10 options designated by A, B, C, D, F, G, K, L, M and N.

They are sold by private insurance companies. If you have a Medigap , it pays part or all of certain remaining costs after Original Medicare pays first. Medigaps may cover outstanding deductibles, coinsurance , and copayments. Medigaps may also cover health care costs that Medicare does not cover at all, like care received when travelling abroad.

Medicare beneficiaries also purchase Medigap policies to make health care costs more predictable by spreading costs over the course of the year through monthly premium payments, and to reduce the paperwork burden associated with medical bills.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Medigap plans are standardized; however, all of the standardized plans may not be available in your area. Costs Premium All Medigap plans require that you continue to pay your Part B premium and a separate premium for Medigap coverage. Deductible Some plans have deductibles. Copays A copayment may apply to specific services.

On the other hand, broader guaranteed issue policies could result in some beneficiaries waiting until they have a serious health problem before purchasing Medigap coverage, which would likely increase premiums for all Medigap policyholders. A different approach altogether would be to minimize the need for supplemental coverage in Medicare by adding an out-of-pocket limit to traditional Medicare.

DFS Portal Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS). For information about what plans are available, plan benefits and premium rates, contact CMS directly or visit CMS Medicare website.

DFS Portal Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS).

Once you've paid that amount, they take care of 100 percent of covered services for the rest of the year. In 2022, the limit for Plan K is $6,620, and the limit for Plan L is $3,310. These limits increase each year, based on inflation. Remember, Medigap does not cover prescription drugs or dental, vision or most other needs that original Medicare doesn't cover.

Medigap is a key source of supplemental coverage for people in traditional Medicare Medicare beneficiaries can choose to get their Medicare benefits (Parts A and B) through the traditional Medicare program or a Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage. because Medicare's benefit drug plan, or your other insurance begins to pay.

Several Medicare supplement plans can be arranged for patients. The benefits vary by plan type. Plan F offers high-deductible options. Plans N, K, L and M share a cost.

Store your doctor & Rx drug info in one, secure location. Experience a faster application process. Learn how to get the most out of your plan benefits. Favorites Find Medicare Plans Find Medicare Advantage Plans Find Medicare Supplement Plans Find Medicare Part D Plans Learn About Medicare New To Medicare Enrollment Open Enrollment.

Some factors impact your health insurance premium. Because this is the case, all Medicare beneficiaries are individually charged the same premium. When you want to get Medicare Premiums quotes, you should start by searching online.

Please complete the online form to get quotations. You will also need to contact us before you see anything other than this. A sales representative will contact you shortly with your rates, if required. How do we choose a Medicare Supplement plan? Below, we'll explain how factors affect the premiums.

Even if the neighbor is the same Medigap letter carrier as you, their rates won't match. This may be the result of several factors that affect Medigap premiums. It must be noted that the plan is uniformized in the government.

This implies that all letter programs have benefits that remain the same whatever carrier they are used for. It is identical for Medicare Supplement Plans G through Aetna if you choose Cigna; the only difference is your premiums.

If you have more income If you earn more, you can pay more premium fees for Medicare Part B prescriptions. It is known as income-related monthly adjustments. This is how it works: Part B covers your medical services or out-patient treatment.

By paying your coverage your insurance premium is automatically withdrawn from Social Security. The Medicare premium is then remitted directly to the private insurer that provided the plan.

For 2022 Medicare Supplement plans (sometimes referred to as Medigaps) will cost around $163 monthly. The costs will be dependent on the policy choice as well the pricing structure within a particular country.

Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

For example: Policy A bought from company 1 has the same benefits as Policy A bought from company 2, but company 1 and company 2 can charge different rates. When choosing a Medigap, ask what factors the Medigap insurance company uses to set your premium . The following factors may affect the cost of your Medigap.

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.

Discounts Receive updates about Medicare Interactive and special discounts for MI Pro courses, webinars, and more. Register When you are choosing a Medigap policy, it is best to look at policies from a range of insurance companies, especially if you've already decided on a particular standardized policy. Policies with the same letter name offer the same benefits, but premiums can vary from company to company.

This premium is initially based on your current age but can rise as you get older. Community rated . The same monthly premium is charged to everyone who has this policy, regardless of age. Issue-age rated. This premium is based on your age when you first buy the policy. The younger you are, the lower the initial premium.

Some common groups offered discounts on Medicare Supplement plan premiums are nonsmokers, women, married people, those who pay premiums in a lump sum annual payment, or those who set up automatic bank drafts for paying monthly premiums. Source: Getty Medical Underwriting: There are some instances when the Medicare guaranteed issue does not apply to Medicare Supplement plans, such as if you are outside the Medigap open enrollment period.

As you shop for a Medigap policy , be sure to compare the same type of Medigap policy, and consider the type of pricing used. For example, compare a Medigap Plan G from one insurance company with a Medigap Plan G from another insurance company.

However, according to Vice President of Senior Market Sales Brian Hickey, picking the right Medigap plan isn't all about price. “There are other factors that should be considered, including rate increase history, financial stability, customer service experiences and claims history,” Hickey told RetireGuide.

This method does not use age as a factor in determining premium costs. Instead, one calculation is applied to everyone the company sells a plan. The price calculation often includes things like total benefits paid in previous years, expected increases in health care costs, and inflation but does not include factors related to an individual policyholder.

Our plans do not cover the entire geographic area. Our services are limited to the programs we offer to you. Please call (847)577-8574 or for information. Medicare plan premiums are determined through a government system. Medigap / Medicare Supplement - plans however have differing rates because it is available from authorized private insurers and has different coverage available.

The downsides include high monthly fees. There are several options for a specific project. No prescription insurance?

The plans are designated by letters of the alphabet, A through N, but companies do not have to issue all plans. How are Medicare Supplement Plan Premiums Set? Source: Getty There are three main methods that Medicare supplement plan companies use to set their rates. These are community-rated (no age-rated), issue-age-rated (initial age-rated), and attained-age-rated.

It is possible you change or convert to the Medicap plan anytime. If you want more money and want to save time, we recommend changing your Medigap plan to one that provides enrollment assurances known as Guarantees. Those factors can help to keep costs low if the doctor has a medical history. Medigap enrollment protection protects your enrollment if you move or lose insurance. Medigap is offered in a number of locations. Currently, California allows for annual changes to Medigap Plans owing to expanded regulations, although others can' t provide as much flexibility.

Find out how to change Medicare supplemental plans. Medicare Part D and the Medicare Advantage plan offer annual Open Enrollments for Medicare recipients between November 15 and December 7, which allows seamless switching from one plan to another. In contrast, Medicare Supplement (Medigap) plans have a no-transfer cycle. It's easy for Medigap to switch providers. However, this is true, here is a complete information guide to switching plans for seniors over 65 who are not currently on Medigap.com.

Before deciding to switch to Medigap plan, there are several important things to learn. How do Medicare plans work together? First, changing Medicare insurance policies is difficult when there are no insurance agents on your side. Agents can help guide you on this journey; they are a valuable resource to any beneficiary. Interested in switching insurance? Call an insurance specialist for more information. You have the option to change your plans. No recipient stays on the program.

Medicare can prove a bit confusing. Many problems are difficult to understand for Medicare. What is causing confusion is whether you can change your Medicare Supplement plan or enroll in Medigap. It's distinctly different from Medicare's rules on the enrollment and change in Medicare Supplements. Tell me a little more about these different things.

In determining Medicare Advantage or Medigap, it is usually important to consider access to a medical provider and the types of costs incurred. The Medigap plan is typically more expensive, but will also cover a greater percentage of your medical bills and is also a decent option for people who want comprehensive medical attention in the long run. Medigap plan offers more options for doctors as you may be going into any doctor accepting the Medicare program. So it's the perfect choice when traveling frequently or if you own a second home. The Medicare Advantage plan provides affordable monthly payments and offers benefits for people with dental and other health care needs.

Medicare is an integrated Medicare plan that covers the majority but not all of your medical services. Those that are not covered include Medicare deductibility, co-pay, co-insurance, and other charges. These Medicare Supplement Plans provide a way to cover the cost associated with the Medicare Supplement. Some Medicare Supplement plans reimburse coinsurance for Medicare Part A and Part B. Many medical insurance companies also provide for Part B and Part A deductibles. This chart shows the Medicare out-of-pocket costs for a different type of insurance plan compared. Medicare has been provided to the public.

Those looking to get Medicare Advantage can change their Medigap plans at any time through contacting their health insurance provider and making a payment. In many countries, you have to answer medical questions and it is possible that you are denied treatment by the doctor because you have preexisting conditions. Although some insurers may require a little medical assistance to get their policy approved, some require fewer. If you are not covered by a guaranteed switching period, call the 800-930-7956 number to find an effective option that best suits your situation.

This period begins the month after a beneficiary turns 65 and signed up for Part B. During this time, you can enroll in any one of the 10 standardized plans without going through medical underwriting. This means an insurance company can't turn you down or charge you more if you have a pre-existing health condition. As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period.

The list above shows just a few of these situations. For more information, see this publication from the Centers for Medicare & Medicaid Services. You have an older Medigap policy that's no longer sold You may wish to reconsider switching plans if this is your sole reason for changing plans. You don't have to change plans just because the one you have is no longer offered.

You should be able to keep them once you relocate to Florida but check with your insurance provider first as Massachusetts has some unique rules regarding Medicare Supplemental insurance. If you were not able to keep them for whatever reason, then that would trigger a special enrollment where you could sign up for a plan in Florida without Medical underwriting.

But if you do change it, you could face some restrictions that didn't apply when you originally signed up. Can I Change Medicare Supplement Plans? Policies have a six-month Medigap Open Enrollment Period . This period begins the month after a beneficiary turns 65 and signed up for Part B. During this time, you can enroll in any one of the 10 standardized plans without going through medical underwriting.

What Are Guaranteed-Issue Rights? The main way to avoid medical underwriting is if you have a Medicare Supplement insurance guaranteed-issue right . Some guaranteed-issue rights occur when: Your Medigap insurance company went bankrupt or ended your policy through no fault of your own. Your Medigap insurance company committed fraud and you are canceling your policy.

Related Articles Changing Medicare Supplement Insurance Plans When Can I Cancel My Medicare Supplement Insurance Plan? Medicare Supplement Insurance Enrollment Find Plans in your area instantly! ZIP Code Your ZIP Code allows us to filter for Medicare plans in your area. County See Plans Related Articles Changing Medicare Supplement Insurance Plans When Can I Cancel My Medicare Supplement Insurance Plan.

If you want a new MediGap plan you have the right to have it if it's a new one you need it for. Learn how to switch Medigap plans using an insurance professional's guidance.

If you bought your policy before 1992, your policy: Might not be a guaranteed renewable policy An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable. May have a bigger premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Some of the advantages of Medigp are: Added monthly costs. The difficulty of finding the different type of the plan. Medications are not covered under Plan D.

Connecting with your physician is an online service that can help with your care. When utilizing this service, WebMD might receive an additional fee. WebMD is not a provider of the products or services described in the website. Learn how you can find the best Medicare benefits and Medicare Medigap plan that suits you. When Medicare is inaccessible for most of your healthcare needs, it may be helpful to have Medicare Advantage or Medigap. Medicare Advantage supplement Medicare to give more insurance, but the two differ in certain aspects. Get matched Medicare Plans Search More Than 200 Medicare Plans for You!

We recommend a selection of the best items from a reputable evaluation process. Advertisement hardly influences our picks. In addition to our fees, we may have to pay for visits to partners we recommend. Read our Advertising Information Disclosure Statement. Anybody enrolled in Medicare should make several big decisions about it. What is the difference between using Medicare Advantage and Medicare Advantage?

What is the difference between the Medicare Supplement and Medigap name? Both are names. Medigap is another name for a health plan you can use. To explain this concept, you could consider “Medigap” as a program that fills in some “gaps” that Original Medicare does not cover. It’s possible to view a “Medicare supplemental plan” as an option to expand or supplement your existing Medicare coverage.

Medigap - Medicare Supplement Insurance helps cover gaps and sells through private firms. Medicare pays some or all of the cost of the covered medical service or supply. Medicap is a Medicare Supplement & Supplemental insurance program that helps cover some of your healthcare costs.

Medicare's health insurance plan is a type of private health insurance in many ways. Many of these services are provided with a small co-payment. Plan may also include HMO and PPO networks, and all plan sets a yearly limit to the total costs. Various plans have various advantages and requirements for their beneficiaries. Many do have insurance for prescription drugs. Some patients require an appointment while others don't. Some providers provide outside care while others may cover all physicians and facilities within HMO or PPO networks. In addition, there is another type of Medicare plan available.

The choice to choose the most affordable plan at low cost is a good decision to take. Medicare does not cover the cost of stair lifts. However, some private insurance companies may offer coverage for stair lifts as part of their long-term care insurance policies.

Medigap also called Medicare supplemental coverage provides coverage for gaps you are not covered under. Typically Medigap plans do not include vision, hearing, long-term care and in-home support. But the policies are useful for certain forms of coverage such as travel health insurance or medical assistance in emergencies. Under Medigap plan N, foreign emergency and medical care services may be included. Medicare is unable to cover 20% of the cost of Medicare services. Medigap plans do not offer prescription drug coverage, and Medigap is not integrated into Medicare Advantage.

Because Medicare Supplement insurance plans differ, you might want to determine which benefits you want and which plan you want before you enroll. Types of insurance that are not Medicare Supplement insurance include Medicare Advantage plans , Medicare Prescription Drug Plans, Medicaid, and veterans' benefits. Medicare information is everywhere. What is hard is knowing which information to trust.

You can think of “Medicare Supplement” as a plan that adds to or supplements Original Medicare coverage by paying for some of Medicare's out-of-pocket costs. You may find both terms used by the Centers for Medicare & Medicaid Services (CMS), the government entity that administers Medicare. See plans in your area instantly! ZIP Code Your ZIP Code allows us to filter for Medicare plans in your area. County See Plans Medicare Supplement insurance plans and Medigap plans.

A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one. It's important to compare Medigap policies since the costs can vary between plans offered by different companies for exactly the same coverage, and may go up as you get older.

When shopping don't be confused about the benefits a Medigap Plan has over a Medicap Plan. It is a similar plan. The insurance companies selling Medicare Supplement plans are required to comply with federal laws to safeguard your rights and must also declare them as Medicaid insurance. The term “Maigap” is often a more colloquial name since it is short.

The original Medicare program covers Medicare Part B and Part A hospitals insurance. The plan may also include supplemental health coverage from Medicare Part A. While a person's Medicare membership can put you into Part A and B, they must purchase the policy themselves.

It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D) Part D adds prescription drug coverage to: Original Medicare Some Medicare Cost Plans Some Medicare Private-Fee-for-Service Plans Medicare Medical Savings Account Plans These plans are offered by insurance companies and other private companies approved by Medicare. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans.

Unlike Medicare Advantage Medicare policies, they do not have the same benefits. Some plans offer Medicare benefit, but Medigap only provides additional coverage for Medicare. Payments for periodic amounts by a health insurance carrier or health insurance plan for health coverage.

Medigap has several disadvantages including heftier monthly premiums. Have a hard time navigating different plans. No medical insurance (adopted through Plan D).

What is the coverage of the Medicare Supplemental Program? Part A of Medicare is not the same as Part B. Medigap Plans B help cover gaps uncovered by Medicare Part A, Part B.

Medigap plan F offers the most advantages of any supplemental health coverage available. Plan F addresses most of the insurance gaps in the Part A/B Medicare program. You can buy it directly through your insurer during the Medigap enrollment period. In comparison to other health insurance plans, the cost is deducted by taxation as a result of the premiums. Those who became eligible to apply for Medicare after Jan 2022 will have no option of purchasing plan F. Here at Century Medicare, we want to get you the best for your plan.

How does one get the best Medicare insurance plans? Medicare Supplement Plan F is available in some areas for people who don't qualify for Medicare but are eligible if they don't. Medicare Supplement Plan F is considered the most extensive plan among the 10 policies available through Medicare.

This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. Its comprehensive coverage makes them popular for beneficiaries looking to lower the cost of the insurance, but the premium is also higher. Read more How to Choose Between Medigap and Medicare Advantage Medicare Supplement (Medigap) and Medicare Advantage plans are two very different types of Medicare plans.

Medicare Supplement plan F costs approximately $73,000 per month. Several things influence premium prices. The premium cost for Medigap Plan F ranges from $100.00 to $250.00. Factors that determine your cost include location, gender, age, smoking, etc. The rates are also different according to zip code and other factors. Your Medicare Supplement premiums can be greatly affected by your Medicare Supplement choice. The benefits increase monthly and add premiums. Medicare Supplemental Plans - F is therefore the most costly plan in existence.

Medigap plans do not cost monthly premiums. You may also want to consider the amount your Medicare payment will pay in full. Plan f offers many advantages in terms of covering Medicare-related out-of-pocket expenses. This diagram compares Plan f with some types of Medigap Plan. Plans F and C cannot be accessed by Medicare beneficiaries enrolled after January 1, 2019. Suppose you have enrolled in Medicare prior. Medigap is offered by private insurance companies as an add-on to your original Medicare plan.

Plan F (including the high deductible Plan F) is undergoing gradual elimination. You may even get a Medicare supplement or high deductible plan G. Plan G offers all of the same advantages as plan F, but it doesn’t cover the Medicare Part B Deductible. In the Medicare Advantage plan, there are other Medigap plans that offer lower rates to Medicare beneficiaries. The extensive coverage provided under Plan F usually offers the most help in reducing your Original Medicare costs.

Do Medicare supplement insurer plans go away? It appears Plan F has ended, as does Plan C. The federal government is now unable to provide plan F or C to Medicare beneficiaries enrolled after January 1. If you have a plan in place for 2020 and your plan is not in force, then you can maintain it for another year. If you have been enrolled in Medicare after 2020, you can still qualify for Plan C or Plan F. Learn how health care expenses impact your health.

Medicare Supplement Plans C and F have not changed for older beneficiaries. CMS has stopped all Medicare supplemental coverage plans after passing a new Medicare Act. Medicare's Medigap plans available to people new to Medicare include Medigap plans F, High Deductible Plan F, and Innovative Plan F. Applicants on these plans already or receiving Medicare benefits prior to January 1, 2020, will receive a 0% grandfather-on-roll.

Medicare Plan F consists of supplemental health insurance programs for people with disabilities and ages over 65. The plan is the most comprehensive of the 10 Medigap plans offered in the United States. Plan F is a Supplementary Plan for Original Medicare (Parts B and C) and provides many of the gaps of Original Medicare and provides some additional benefits. There are no health insurance benefits on Plan F.

Medicare Part B is deductible. In addition, policyholders can only use monthly fees of $0 and $170.10 for Part C. Additionally, people can't have to use the money. If you require Medicare Part D, you should take advantage of that option.

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. You would end up paying nothing in medical expenses under this scenario, but you would pay the monthly premium.

Medicare premiums, deductibles, and out-of-pocket costs are determined annually. Because Medicare plan F is the largest Medicare plan, the premiums are costly. It usually costs between $61 and $410 yearly. In some instances, the cost is calculated by location, provider, plan, current medical conditions, if any, age or sex. For this reason, a comparison of Medicare rates for various health plans is important.

Plan F offers higher deductible plans than the standard Plan F because of the annual deductible. Medigap plans are high-deductible, but they are not covered by the standard plan. In 2020 the maximum monthly deductible in the higher-deductible plan was $2,490. You might need a medical exam before a change of plan. A Medicare plan-f policy can help a lot in the case where a doctor thinks that a patient doesn't need medical treatment for a long period.

The Medicare Plan F premium is deductible for federal income taxes. All medical expenses paid from home may be deducted from taxes as an additional payment. If medical expenses were not included in the itemized list the deduction could have added value in the future. During the estimate of expenses, the expense deduction will only exceed 75% of adjusted earnings.

Medicare Supplement (Medigap) Plan F has greater benefits than a typical plan. Learn about Medigap insurance coverage at a low cost compared to other plans. Medicare Supplement insurance plans have a high percentage of eligible beneficiaries under Plan F. What is the cost of a Medicare Supplement Insurance Plan F? In 2018, the premiums for Medicare supplement F were $169 a month.

Medicare Supplement plans may be able to dramatically reduce the cost of your health insurance coverage. Medicare Supplement Plans C covers most of the costs of Medicare you would normally pay for. Some carriers don't offer Plan C and you may no longer qualify. If you did not qualify for Medicare by January 1, 2020, then your application will never go through Medigap plan C. You can check your Medicare start date on your Medicare card. Nevertheless, there are other options if Plan C cannot be obtained. Here at Century Medicare, we want to make sure you get the plan you need.

Find affordable Medicare Supplement Insurance plans. Medicare Supplement insurance plans are the most extensive of ten Standard Medicare insurance plans in most States. Since 2010, only Medigap Plans F offer better protection. Medigap plans cover all Medicare-approved out-of-pocket expenses. In addition to Plan CF and Medicare Supplement Plan D, plans C has been phased out for now. Please be advised you will no longer be eligible to receive the Plan C.

If you already have Plan C, don't worry – you can. During the next five years, you may qualify to get a Medicare plan. Medigap plan C is a popular Medicare supplement that provides coverage for most medical care that cannot be paid under Original Medicare.

Medicare Supplement Plan C can still be purchased for Medicare enrolling people until January 1, 2020. The plan was approved for those who were already on Medigap plans C prior to the deadline but are still covered by the plan. Fact Check A licensed insurance professional evaluated the content for the exactness of CMS Medicare Communications and Marketing Guidelines and Medicare Medications.

Retirement Guide. This is retrieved from the website by Mla. Terry Turner. Part A coinsurance and hospital cost up to an additional 365 days after Medicare benefits are used up. Part A deductible. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B deductible. (Since 2020, new Medicare members can't buy any plan that covers the Part B deductible.

Unless you apply through Medigap Plan C within the first 6 months of Medigap Open enrollment, in most cases the insurance firm will not charge your premium if you've been diagnosed with or are in poor health if the policy is not in effect. Your Medigap OEP starts the day after a 65-year-old person is admitted to Medicare.

It is mandatory that you reside in the service area of your plan. When a person applies for Medigap plans outside of his OEP, the insurer may require him to go under medical underwriting without accepting the claim as a participant. You must be enrolled in Medicare Parts A and B to be eligible for a Medicare Supplement plan (it's not available to Medicare Advantage enrollees)

For those purchasing a plan C from Medigap prior to its withdrawal, the policy covers nearly the full cost of Original Medicare. The cost to Medicare. In-person costs for Medicare Supplement Plan C. Medigap plan C covers 80% of the medical expenses incurred in travel abroad — as long as your plan limits. Office visits This plan pays all your coinsurance and copays for office visits. Pharmacy This plan doesn't have Part D prescription drug coverage.

The only additional cost covered under Medigap plans is your excess fee. Normally doctors charge you the most. The current figure is 15 percent above Medicare's recommended service cost. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer.

You're allowed to include dental, vision, or hearing coverage in Medicare supplemental coverage for less than $15 monthly. It’s available to Blue Cross members of its Supplemental Health Insurance Program. The dental hearing package includes the information for the dental ophthalmologist's package. Find out what we have available on this website.

Plan F covers all plan CDs as well as Medicare Part B excess costs. This plan is the most complete Medicare Supplement plan available so they are quite attractive for you to purchase.

Medicare Supplement insurance plan C usually covers: Medicare Part A hospital coinsurance and hospital costs until the original Medicare benefit expires. Medicare Part A hospice coinsurance. Part B - Insurance - Coinsurance.

Medicare Part C, also known as Medicare Advantage, is a type of health insurance plan that is offered by private companies and approved by Medicare. It covers hospital care, doctor visits, preventive care, prescription drugs and more.

Finding affordable Medicare Supplemental plans. Medicare Supplemental Plan N is among 10 standard Medicare Supplemental plans that can be found in most states. This plan helps pay for certain medical expenses not covered by Original Medicare. Here at Century Medicare, we are dedicated to getting you the most for your plan.

This covers medical and dental costs. Plan N offers the same standard benefits and services as many Medigap plan types. You have all the same basic benefits as in Plan N regardless of who you are. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. However, because Medicare Supplement plans are sold by private insurance companies, costs for each plan may differ by location and company (even for identical basic benefits).

Finding plans from Medigam can be hard when shopping alone. What's the best way to know the best solution to meet your needs? Medicare Supplement Plan N provides an ideal solution for those who want comprehensive protection. This section explains what Medicare Supplement Plans N offers. Once you have been billed $233 of Medicare-approved amounts for covered services, your Part B deductible will have been met for the calendar year.

Medicare Supplement Plan N is the standard Medicare Supplement Insurance program available across the United States. In addition, it helps provide reimbursement for certain costs of the remit that otherwise would come from Original Medicare.

With the new Medicare Supplemental Plan N, enrollment has grown every year. Nevertheless, this idea is hardly surprising. Medicare Supplement Plans N offers excellent coverage at affordable monthly rates.

Unlike K/L, the Medicare Supplement plan offers more insurance. It includes all copayments for Part B coinsurance, while L pays 50% and 70%. This applies to the Medicare Part A deductible. A further cost that is not included in monthly premiums is $20 for office visits as well as $50 for trips to the Emergency Room. It helps to compare. Medigap benefit program: B Plan, C Plan, F Plan, D, K Plan, L Plan, N Plan.

Similar to Medicare Supplement Plan GS, Medicare Supplement Plan N aims to give policyholders significant cost-sharing benefits. This benefit includes: Whether you're living in an area that allows excess fees, you might face these costs.

Most doctors take Medicare assignment, therefore, excessive charges are rarely seen. Plan N covers basic Medicare benefits including Hospitalization pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end Medical Expenses: pays Part B coinsurance excluding $20 copay for office visits and $50 copay for ER—generally 20% of Medicare-approved expenses

Like other Medigap plans, you can enroll to Plan N when can you join Medigap Plan N? The most suitable period of enrollment is during the Open Enrollment period for the plan, which takes six months. Insurance companies can not refuse to pay you for any health care expenses because your health is poor.

Only after you've paid the deductible does the amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

During your Medicare Supplement Open Enrollment Period, the enrollment is free. The period can last 6 months after you are 70. Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits run out Part A hospice care copayment or coinsurance Part A deductible Part B coinsurance costs Outside of these time periods, eligibility for Medicare is guaranteed. Underwriting health issues means a carrier cannot deny you insurance claims for a health issue.

Medicare Supplement Plan N includes four main areas of coverage. Plan N pays for it the Medicare Part A deductible of $1,556, coinsurance Parts A and B, three pints of blood and covers up to 80 percent of medical expenses incurred in foreign travel.

Plan N also doesn't cover Medicare Part B excess charges -- which is the amount they can charge in excess of Medicare costs when they are not able to allow Medicare-approved prices. Additionally, there are no out-of-pocket restrictions on Plan N.