Since 2012, the federal government has reclassified Medicare benefits as income tax for the self-employment. Almost 64 million Americans have access to Medicare. While the bulk of the cost is funded from payroll taxes and other sources, enrollees cover about a quarter of the cost of Medicare with their insurance premiums paid monthly. These premiums will definitely be a big deal in the coming years. In contrast to employer-backed health coverage many people have throughout their career, Medicare isn 't typically covered using pretax funds.

The Internal Revenue Service, a government agency specialized in tax deductions. However, the Code does specify what deductions are able. However, not all expenses that occur frequently may qualify. How can I choose the best Medicare Plans? Federal deductions can lower the amount for which a federal employee is subject to taxes and lower their burden during tax season. Hence, most Americans seek tax credits every year to help cover expenses.

What is going on? Deaths Tax. Now it is Tax Day. Is this the only tax return you'll get today? The study revealed the number of extension requests by 12 million taxpayers every year. Is Medigap's premium tax-deductible in any form? In simplest terms, it is true that Medigapa's premium is tax-deductible, but it is not deductible. Medigap Premiums are treated as normal medical costs and they are treated as standard expenses.

The Medicare premium is tax free and you will also receive additional Medicare expenses if you add a deduction to your income tax return. Your unpaid medical and dental expenses are eligible for tax relief in any case. If your adjusted gross income exceeds $35,000, your medical expenses may exceed $2,000.

Medicare recipients are often billed if there are unforeseen medical expenses they did not have covered, such as long-term care and accommodation when traveling for medical purposes. Certain expenses can be deducted taxably within a certain period. Tax-deductible medical expenses are categorized as Artificial Teeth. Bandage. This generally includes the costs for the installation of ramps in a home or extending the doorway in the house. Examine eyeglasses. How much does a guide dog cost? Audience assistance. Long term care premium rates. Nursing homes can be costly if your primary use is medical care. Psychopathology Treatment. Wheelchairs. Wig, when doctors give it advice.

Not a single Medicare cost can be deducted. The Medicare premium is tax-deferential for the IRS because it views these as medical expenses if the government follows the guidelines for calculating this amount. The cost of medical treatment is deductible for individuals whose taxes have been itemized. Similarly, costs related to treatment can be excluded. It covers the cost of preventative services and medical equipment. The IRS lists deductible medical expenses. If your taxes are not properly assessed, we recommend checking out the following lists.

You might be thinking that your Medicare premium is tax-deductible. So it's simple. Medicare premium payments may be tax-deductible if they exceed certain limits. Medicare users are eligible for deductions if their medical and dental deductibles exceed 75% of their adjusted gross income. Upon successful application, it is recommended that you sign the Schedule a 1040 form. Your deductions will be added to the total of your gross earnings. Your total tax liability determines your total amount owed on your property.

If you go by car, you can deduct a flat 16-cents-per-mile rate for 2021 (down from 17 cents for 2020), or you can keep track of your actual out-of-pocket expenses for gas, oil and repairs. Claim all eligible deductions Contact us if you have additional questions about claiming medical expense deductions on your tax return. © 2021 Share This Post Previous All Next Want To Learn More? Connect with one of our experts today.

This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your AGI, you qualify for the deduction. If Medicare members itemize deductions on their income taxes, Medicare costs, such as premiums and copayments, may be deductible. Unreimbursed medical and dental expenses, including premiums, deductibles, copayments, and other Medicare costs, may be deductible to the degree that they surpass 7.5% of the adjusted gross income.

There are several components that establish whether a Medicare beneficiary is allowed to include their Medicare Advantage premiums as a tax deduction when filing their taxes. Seniors aren't automatically eligible to do so. It's very important to consult with a tax professional prior to filing each year. When can you deduct Medicare premiums? If you're self-employed, you may be eligible to deduct all of your Medicare Advantage Insurance premiums.

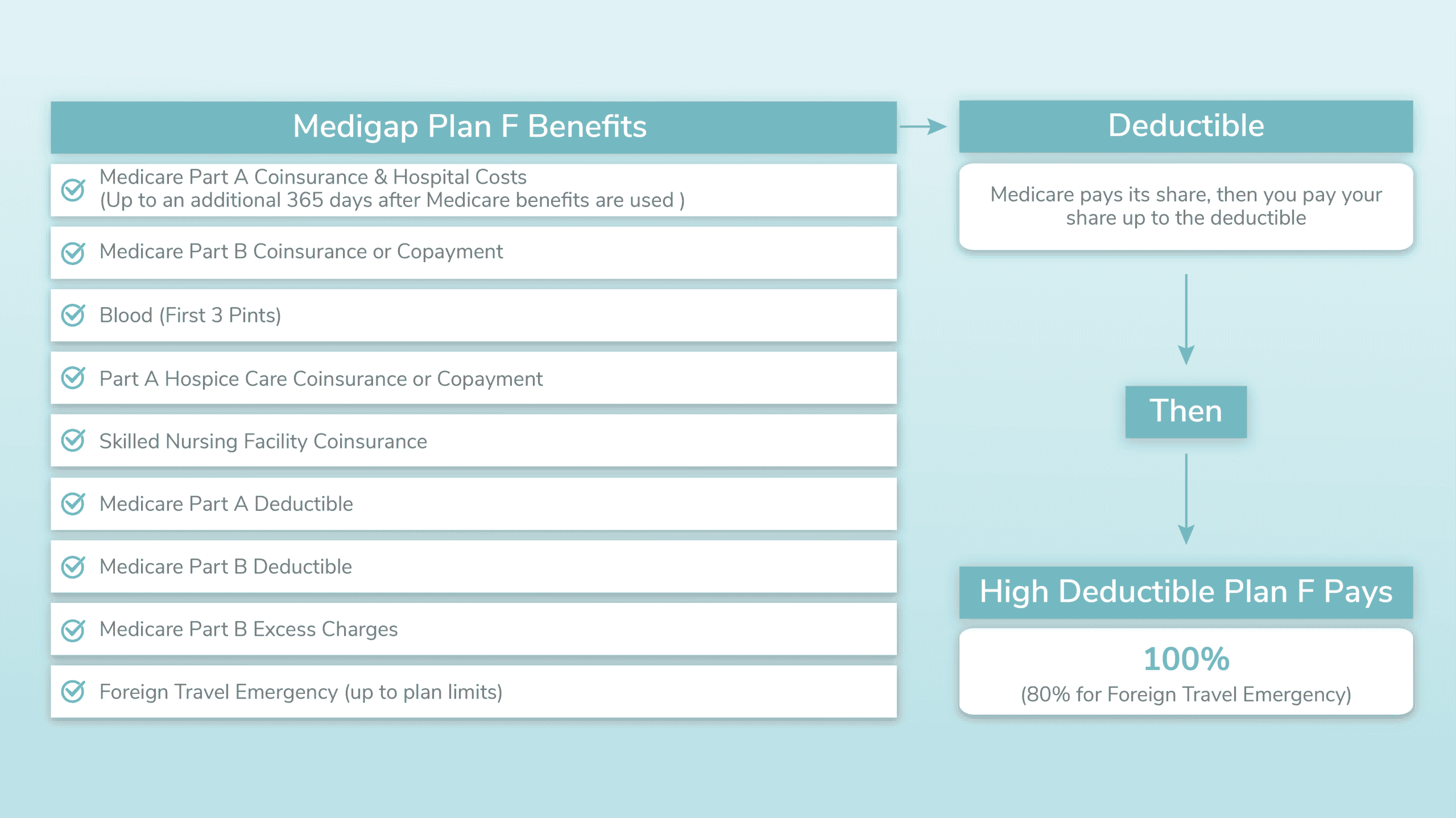

Medigap is private supplemental insurance that's intended to cover some or all gaps. Itemizing versus the standard deduction Qualifying for a medical expense deduction is hard for many people for a couple of reasons. For 2021, you can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of AGI. The Tax Cuts and Jobs Act nearly doubled the standard deduction amounts for 2018 through 2025.

The short answer is yes! Medicare premiums are tax-deductible – but only above a certain threshold. Specifically, Medicare beneficiaries may only deduct Medicare expenses from their taxes if their total deductible medical and dental expenses exceed 7.5% of their adjusted gross income (AGI). If you meet this qualification, you will need to complete Schedule A of Form 1040.

Do you have to show proof of health insurance when filing taxes? While you don't need to send the IRS proof of health care coverage, the IRS still recommends keeping these records. How to Get Help with Your Medicare Costs We hope you now feel better informed about tax deductions for your Medicare costs. Medicare isn't free , so we all want to save money wherever possible. Many beneficiaries want extra coverage but are hesitant to enroll because of the premium price sticker.

These deductions are allowed when the Medicare beneficiary itemizes. As a general rule, premiums for Part B and D are deductible for the most part, although premiums for Part A are only deductible under prohibitory circumstances. What are the limits for deducting Medicare premiums and costs? There is no limit as it relates to traditional Medicare on any out -of-pocket cost.

Is any of this deductible? Does the 7.5 percent of total income threshold apply here? Thank you for your time. — Judy Dear Judy, Yes, your supplemental health insurance is deductible as a medical expense on Schedule A, Itemized Deductions, for Form 1040. You can deduct the amount that exceeds a certain percentage of your adjusted gross income, or AGI, and that depends on your age during the year.

Medicare premiums are medical expenses You can combine premiums for Medicare health insurance with other qualifying medical expenses for purposes of claiming an itemized deduction for medical expenses on your tax return. This includes amounts for “Medigap” insurance and Medicare Advantage plans. Some people buy Medigap policies because Medicare Parts A and B don't cover all their health care expenses.

As much as the IRS supports your dreams of opening that secret recipe barbecue sauce business, you must report a profit from your self-employment in order to be able to deduct your health insurance premiums using the self-employed health insurance deduction on Schedule 1 of your 1040. “You have to have business income,” cautions Steber. “You can only deduct your premiums as much as you earn from your business, so if your business earns no money – you don't get a real benefit.”