Summary: A deductible maximum may protect against costly hospital bills. All Medicare Advantage Plans have one this is a government regulation. Medicaid's annual maximum annual out-of-pocket limits have been set for Medicare Advantage Plans. They may set arbitrary limits, but these limits cannot surpass the CMS maximum. The maximum CMS amounts vary year by year. When looking at the Medicare options, you might consider your out-of-pocket expenses.

Plus, optional benefits can protect a beneficiary from other costs, such as the hospital deductible and skilled nursing facility copayment for days 21-100. For example, those who have Plan G are responsible for just the Part B deductible ($233) when they use providers who see Medicare patients.

In 2022, 69 percent (78%) of beneficiaries in the program have zero-cost individual health care plan (MHCP). They have no additional premiums, except for the Medicare Part B (180.50 for 20202). MA-PD coverage covers Part a and Part b insurance and Part e prescription drug coverage. By 2022, 87% of Medicare Advantage beneficiaries in a general enrollment scheme will be covered by prescription drugs.

If your plan covers the service, it'll usually pay most of the costs and charge you a copayment or coinsurance amount. A yearly deductible may apply. You might not be charged at all for some preventive services. Costs vary among plans. How can I manage my medical costs? A Medicare Supplement insurance plan can help cover your Original Medicare out-of-pocket costs.

The majority paid Medicare taxes at the same time. You don't have a Parts A deductible unless you are 65 or older. Some people call them "premium-free parts." You can purchase this if you are not eligible for a premium-free Part A. Part a payments will be $278 or $506 per month. Depends on the period of employment or paid taxes. Remember: $1600 for each hospitalization benefit. Medicare has no limit. The maximum number of benefit periods are granted per year. So the deductible can be paid multiple times per year. All-time reserves.

Most Medicare Advantage plans have cost sharing as well. Typically, this is in the form of a fixed co-payment for doctor's visits (rather than the 20% coinsurance you pay with Part B). Medicare Part D (Prescription Drug Coverage): Annual premiums vary across Part D plans, estimated to average around $31.50 per month in 2023 for standard coverage

In 2023, the average enrollment-based premium for PDs is $12 per month. Average MA and PD premiums vary according to Plan Type and range between $15 and $20 a month for HMOs and $30 a month for PPO locals and $49. Nearly 79% of Medicare beneficiaries will join the health care program in 2022 compared to 72% who joined local PPOs. Regional PPO programs were created to allow rural patients more affordable health care benefits from Medicare. In 2022, MA-PD premiums will fall from $36 monthly to $8 yearly for 2018.

Maximum out-of-pocket: the most money you'll pay for covered health care in a calendar year, aside from any monthly premium. After reaching your MOOP, your insurance company pays for 100% of covered services. The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit.

Most Medicare plans include an additional deductible of up to 85% in addition to the copay of the deductible. You may not be eligible for the premium on Part B plans unless you are paying the full amount.

Now that you've got a better idea of how a MOOP works and why it's important, take note of the maximum out-of-pocket limit listed for the Medicare Advantage plans you're considering. Want to learn more about Medicare? Oscar's goal is to help you save time and money. Click here to learn more about Medicare Advantage and get an opportunity to speak with a licensed broker.

When your age is less than 65 years old and you have not received Social Security payments in the last three months, you must apply for Medicare Part B. This happens automatically. In the event you already receive Social Security benefits, you are automatically eligible for Medicare Part A or Part B. Medicare is offered in the following three major categories:

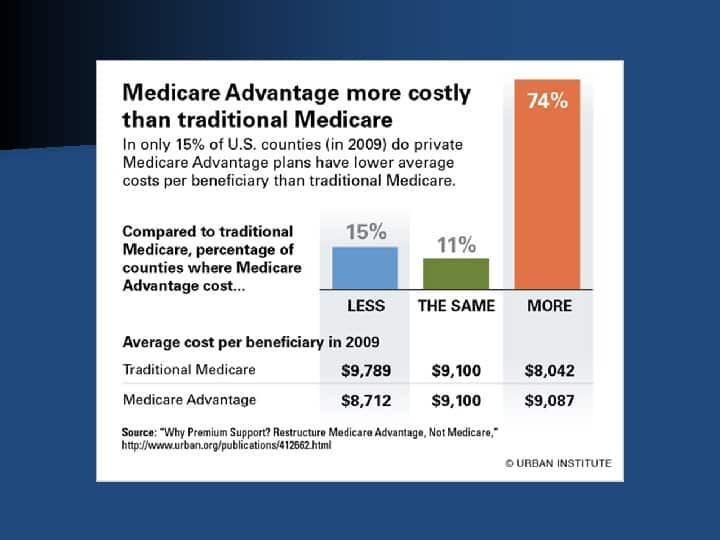

Medicare Advantage Plans are an alternative option in the Medicare program. This type of coverage is available in the United States through private insurers which contract with Medicare for Part A / Part B benefits and sometimes Part D (prescription) benefits.

Some plans provide services that Original Medicare has not offered like hearing and dental. The Medicare Part C & A program requires that you enroll in the Medicare Advantage program. Medicare Advantage insurance companies pay fixed monthly premiums on their own policies to provide coverage for their patients.

Medicare deductible is the total amount billed for health care service before Medicare begins paying. When your tax deductible reaches a limit, your copayments or coinsurance are reduced by your Medicare plan. Currently a Medicare plan provides for $1600 for hospital visits to Medicare Part A in the United States. Most Medicare Advantage plans don't require any fees, but they may require you to pay fewer monthly costs.

Is there a Medicare out-of-pocket maximum limit for Medicare Advantage Plans? Medicare Advantage plans are offered by private insurance companies that contract with Medicare, and after they meet the Medicare minimum requirements for coverage, these companies have some flexibility in setting their premiums, benefits, and cost-sharing structures.

Variables depending on plans. These sums vary annually. If you have Part B you need to pay your Part B premiums to stay with the plan. Compare health plan costs by plan. See how to enroll in an insurance program with Medicare.

Help with the drug costs: If your income is low then you might be able to pay your premium on a drug or other plan premium. In case of eligibility you will never have to pay a Late Registration penalty. Find out how you could help. Get in touch for information regarding Part D.

Original Medicare includes Part B and Part B. 3. Health insurance is provided. For items which are not covered by Medicare, you can get Medicare Supplement Insurance called Medicare Medigap. This policy can be bought by private insurers and covers things Medicare cannot cover including prepaid insurance, a medical insurance plan and copayments. Medigap plans vary and the cheapest is offered through Plan F covering copayment and deductibles. The two plans covering deductibles are no longer available to Medicare beneficiaries.

The Centers for Medicare and Medicaid Services (CMS) now considers those costs when calculating the limits . Here are some facts to know. This limit excludes monthly premiums and prescription medications. Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans have a limit on in-network care of $7,750.

Medicare Part B (Health Insurance Part C) Premium: $0 for most people; otherwise $277 or $56 per month. Inpatient hospital Benefit: $1600. Co-assurance: Variable based on location and duration of the stay. *This is known to Medicare as 'life time' because Medicare pays for the extra hours once during your lifetime only. Part X Health Insurance (Health Insurance): $63.80/m. The deductible may increase or decrease depending on income. Deductible is $226 yearly.

The out-of-pocket maximum for plans that allow you to see out of network providers may be higher. If your Medicare Advantage plan includes prescription drug coverage you will have a separate out-of-pocket maximum for prescription drug costs.

Recent Blogs: