Medicare Supplement is the most popular plan available to Medicare users in Manhattan. Some 500 million American people have Medicare-related health coverage plans which pay for health care expenses which Medicare does not fully cover. 1. The following should be helpful to anyone thinking about using Medigap: List out the benefits of your Medicare Supplement plan. The insurance company is not required to offer coverage unless they have a preexisting condition to be eligible. You have the option to enroll in Medigap for any of the following year.

Medicare Plan in New York! Year-Round Open Enrollment for Medigap Plans in New York New York has a year-round Medicare Supplement Enrollment Period for all seniors. So, you can apply for a Medigap plan at any time of the year without needing to answer any health questions. However, Medicare Supplement premiums tend to be higher in New York than in most other states. At any time, New Yorkers can enroll in a Medicare Supplement plan, and insurance companies cannot deny coverage.

Medicare supplementation and Medigap plans in New York are designed for people who have lost a significant amount of coverage from Medicare and Medicaid in the past. The Medigap program in New York is available year-round. For insurance coverage, there are no underwriting medical concerns that must be answered. In most states Medicare has several advantages that are similar. This guide focuses primarily on these benefits. Compare Medicare Plans Find a cheapest Medicare Plan in NYC!

Federal law requires Medigap guaranteed issue protections for people age 65 and older during the first six months of their Medicare Part B enrollment and during a “trial” Medicare Advantage enrollment period. Medicare beneficiaries who miss these windows of opportunity may unwittingly forgo the chance to purchase a Medigap policy later in life if their needs or priorities change.

Two States provide enrolled students with a free year-round program that can be switched from year to year. Currently updated: 27 September 2019 at 9:06 pm. Several countries deal with this. Most of us are eligible to be eligible under Medigap's Guarantee period.

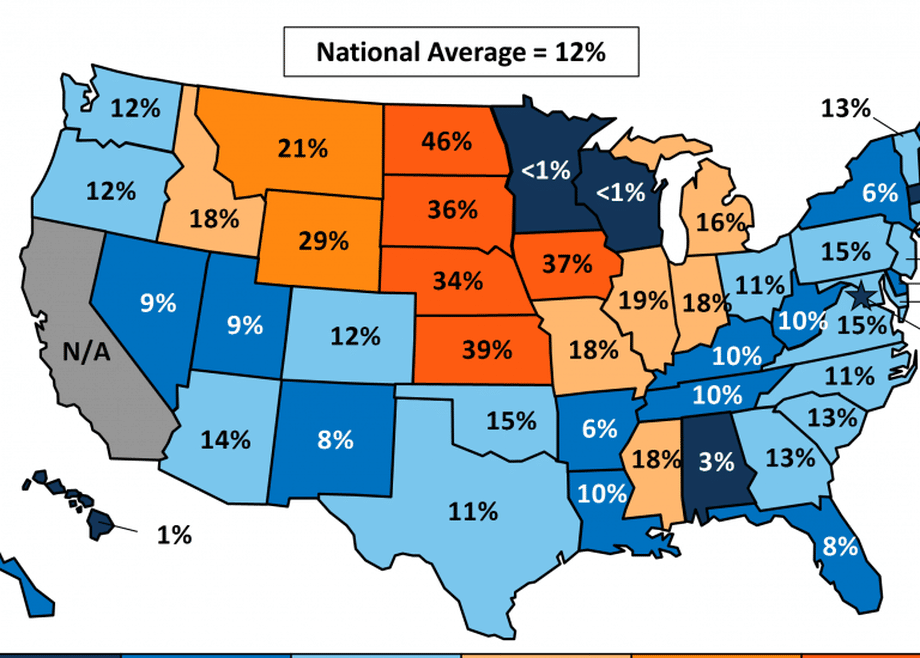

14% of Americans who had regular health insurance had Medigap in 2015. This brief provides information about Medicare's participation in Medigap enrollment in order to assess consumers' rights under federal laws.

Open Enrollment As stated on the State Dept. of Financial Services website , New York State law and regulation require that any insurer writing Medigap insurance must accept a Medicare enrollee's application for coverage at any time throughout the year. Insurers may not deny the applicant a Medigap policy or make any premium rate distinctions because of health status, claims experience.

Many states do not mandate Medicare Supplements for disabled persons. In New York, however, for people who can't get insurance for medical conditions under 65 who qualify under age 65, they can use the Medicare Supplements. You should also remember the high costs that you could have for someone 65 years old. In addition carriers are increasing premiums for people under 65 for their disabilities liabilities. Unfortunately, the benefit levels have largely been standardized but the premiums are not included. As prices increase, most Medicare beneficiaries who are disabled opt for Medicare Advantage until age 60 and may then go on to Medicare for more comprehensive coverage.

All seniors in New York enjoy Medicare supplement enrollment. So you are able to get Medigap plans anytime of the year without any health concerns being raised. Medicare Supplement prices are also generally more costly in the United States. New Yorkers are entitled to receive Medicare Supplements anytime. Insurance carriers cannot refuse coverage. Although many plans include preexisting condition waiting periods, the policy is generally only applied if you have no credit card coverage during the last 63 days. If you are covered by credit-worthy insurance, you might have to wait a little longer.

The Medigap plan in the state of New York follows similar standard plans in almost any state. The plan offers a total of 10 Letter Plan options, as well as two highdeductible plans for the same premium. MediGap plans offer you coverage to pay the cost of Medicare. Consequently, your expenses will probably go down. Some of the more well-known Medicare Supplement plans are Medigap Plan F and Plan N. This program is popular among seniors as it offers lower out-of-pocket costs and optimal coverage. Compare Medicare Plans. Find New York's most economical Medicare Plans!

Medicare beneficiaries pay no fees unless they receive medical advice from their physician. Medicare recipients are not liable for some preventive services and are required to pay a co-insurance fee for a visit for the services. Medicare covers two kinds of examinations one if you were new to Medicare and another every yearly thereafter. Welcome to Medicare. Physical examinations are a yearly review of your health and provide education and counseling on preventing illness.

Medicare Select is a type of insurance program for Medicare which allows insureds to choose specific health services or specific doctors to be eligible. Medicare Select policies have the minimum requirements for Medicare policies and may not include any limitations. Medicare Select policies are subject to fewer premiums. Medicare pays part of the approved charges and the company's insurer has the responsibility of any additional health care benefits under Medicare Select.

During the Open Enrollments period, eligible individuals can view health and prescription drug coverage available for a specific geographic segment and determine the coverage they are looking to get. This will give eligible beneficiaries a new opportunity to join Medicare Advantage and Medicare Part D prescription programs. People with Medicare are able to compare current Medicare Advantage plan options with current Medicare Part D plans. It is possible to find resources for comparison of the plans.

Medicare Advantage plans are regulated in the United States by the Centers on Medicare. The Medicare Advantage Plans can be found here.

Medicap may offer a six-month waiting period before obtaining coverage for an existing medical condition. Generally speaking, the diagnosis or treatment is provided in a patient's name. However, according to the law of New York, the waiting period can be a little or completely reduced. The Medigap insurer is obligated to decrease the waiting time by the number of days you have covered under a credit-worthy coverage if there is a break between 62 and 61 calendar days.

New York Medigap plans were reviewed in partnership with communities. This means the premiums you pay are non-determinable according to age, health or race. The monthly rate of payment depends upon the enrollment in a health insurance supplement plan. The following charts show how the premiums are calculated for Medigap plans in New York. Compare Medicare Plans. Find a Good Medicare Plan for You to Live in NY!

All insurance companies that provide health insurance for the Medicare enrollee must accept this request anytime during the year. Insurance carriers cannot deny or separate the application from Medigap policies for health reasons or claim experiences. Nevertheless, coverage offered in groups is restricted to only the person or groups for which the policy is issued.

Maine lets Medigap members switch plans at any time during the year with the same or lesser benefits. You are also eligible to use any other Medigap plan in case the plan is changed. Whereas you have Plan G, you have the option of changing to any plan except Plan G. Please contact Medigap to find out how they work. Please click here to get the best Medigap quote.

The top Medicare Supplement plans in New York are comparable to the top plans nationwide. All three plans offer excellent benefit at a low price. In addition, as long as people have an active medical plan, they may change their plan. They may be in Medigap. When their health is worse, they need more coverage. The benefits of being enrolled in Medicare are huge.

A medical care program of the Indian Health Service or of a tribal organization; A State health benefits risk pool; Federal Employees Health Benefits Program; A public health plan; A health benefit plan issued under the Peace Corps Act; and Medicare supplement insurance, Medicare select coverage or Medicare Advantage plan (Medicare HMO Plan).

New York is the only state without Medicare Part B excesses. Whatever carrier you opt for, the letters are the same for everyone. New Yorkers shouldn't feel concerned when they get care in their home state unless they have a Medigap plan to pay them off.

Individual plans in New York are guaranteed to provide assistance for older people. Seniors are not allowed to receive medical assistance because of a health condition, claim or other health condition. Typically, the limit will last six months.

Medigap Plans offer seniors individualized benefits at any time. Rates are not varied by age, gender or health status. The coverage may also be applied if substantial gaps of coverage have occurred (this is normally 6 months).

Washington permits the enrollee to switch from any Medigap plan into the most suitable one.

In Connecticut, the Medigap program has guaranteed coverage throughout the year. Massachusetts offers yearly two-month guaranteed delivery on the Medigap program from February through April.

Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care. However, in order to be eligible for Medigap coverage, you must be enrolled in both Part A and Part B of Medicare. As of June 1, 2010, changes to Medigap resulted in modifications to the previously standardized plans offered by insurers.

If you are in a health-insurance plan, you are guaranteed to receive a Medigap policy. You have Medicare benefits and you are leaving Medicare.

Tell me the way you can purchase Medicare Select coverage for 63 calendar days after your Medicare SELECT coverage is over.

Unlike open enrollment, you may choose any Medigap Plan available in your state. During guaranteed enrollment, you can normally choose just Medigap Plans B - C - F - K or L which are available to your residents.