Contrary to popular opinion Medicare Advantage is a very separate type of coverage and you cannot get either. Let's see what policies you can use. Get a map of your location right away! You may be relieved by knowing that after age 65, you'll have coverage through original Medicare throughout your entire life. Although Part A (hospital insurance) or Part B (medical insurance) provide some health care costs, they do not provide for all the costs.

Medicare offers Medicare-related coverage to older individuals. It includes alphabetically arranged components offering various types of coverage and benefits. But Medicare does face challenges, some gaps are just not addressed. If you want this opportunity, consider taking part in a Medicare Advantage plan. We gather unbiased experts opinions about insurance and other factors to help you make the right decisions.

Our selection is evaluated by independent reviews and advertisers are not influencing our selection. You will also be compensated for visiting a partner we have referred. Please consult our advertising disclosures for additional details. Any patient preparing for Medicare will make many choices. How should I choose Medicare vs. Medicaid as an alternative option?

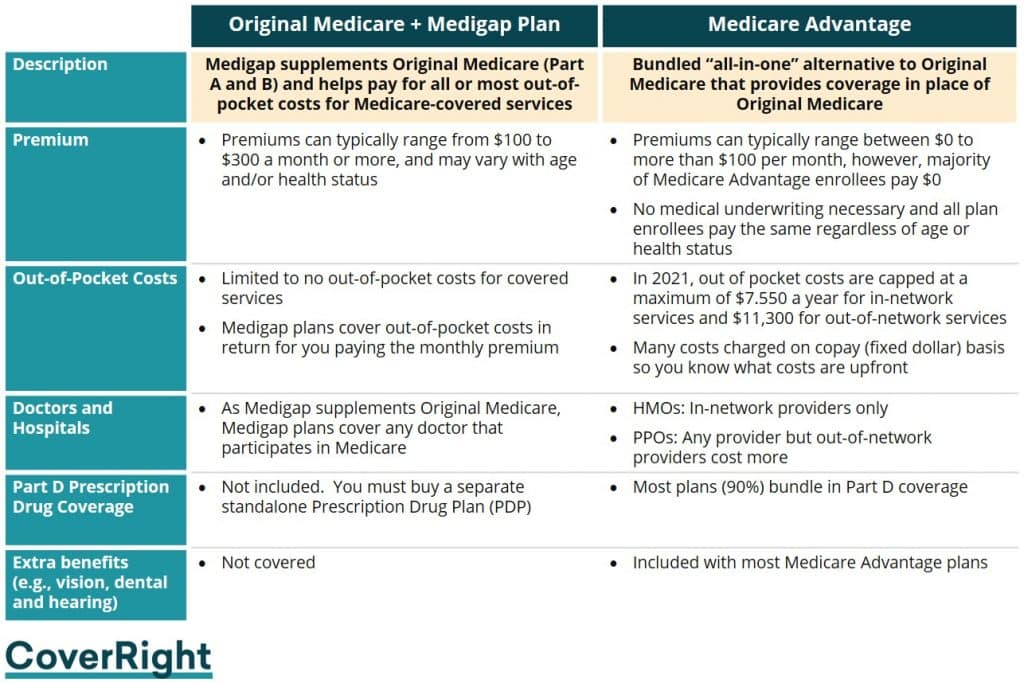

Medigap is Medicare Supplement Insurance which fills gaps and sells privately. Original Medicare pays most if not all costs for the coverage for the service. A Medicare Supplemental Insurance policy can help pay for the rest of the health care expenses.

If you enroll in Medicare Advantage, your benefits will be administered through that private plan, which will replace your Original Medicare coverage. You also won't be allowed to enroll in a Medicare Supplement plan or a stand-alone Part D plan. Many Medicare Advantage plans don't charge an additional premium above the usual Part B premium. You still may have a deductible, copays, and coinsurance, but MA plans generally put a limit on how much you have to spend each year (the out-of-pocket maximum). Medicare Part B covers medically necessary ambulance services to the closest appropriate medical facility that can provide the needed care.

Medicare Advantage Health Plan is the same as private medical coverage. Most services like medical care, laboratory and surgical care are included with a modest fee for an additional fee. Plans can offer a network with a health care insurance plan or a prepaid health plan, and all plans have a maximum annual cost per person. Different plans have different advantages. The majority provide medical insurance on prescriptions. Several require an appointment with an expert, while others don't. Some patients can pay for some out-of-network care while others cover medical facilities within the network of the HIMO and PPO. Some other Medicare Advantage plans also exist. Selecting plans with low annual premiums may be helpful.

The Medicare Advantage (MA) plan offers a better option than the Original Medicare. This service is supplied through private insurers in Canada. Generally you will get Part A and Part B, but you will also be given Part D and other benefits, as well as routine dental and vision care, all under the same policy. In addition, Medicare Advantage plans cover health care services like doctor visits, laboratory tests or hospitalizations. You can still use network connections or get referrals before your payment plan pays out. Donovan. You can see the doctors in your area who have accepted the plan.

More than 57 per cent of seniors and disabled people receiving Medicare benefits choose Original Medicare, Part A or Part B. These Medicare Parts cover health care providers, doctors, and surgeries. Approximately 81% of those people supplement their coverage through Medicare supplement insurance, Medicaid or employer-sponsored insurance. Additionally, 46 million also fund Medicare part D insurance. Medicare Supplement insurance or Medigap plans have no affiliation or support from the federal government or the Medicare program. Although it can be cheaper, it has many benefits.

The Medicare Advantage plan is a substitute for Medicare Original. Sold via the Private Insurers, they cover all the covered items under Original Medicare but can offer additional benefits if Medicare does not. In some cases, prescriptions are also available for hearing, dental and vision services as well as vision care. You may purchase Medicare Advantage plans after signing up for Medicare Part B hospital health insurance. Upon enrollment, your Medicare Advantage plan is replaced by Medicare Part A or Part B insurance.

Medicare Advantage plans offer all the same benefits as the Original Medicare plan and also coverage for services and goods not included with Original Medicare. Some plans also offer transportation for doctor visits or adult daycare,” says Amanda Baethke, president of Aeroflow Hospital North Carolina, in reference to the expanded supplement benefits. Plans can even customize their benefits package for patients with chronic illnesses. In addition, Cigna offers free vaccinations to patients with Medicare Advantage plans.

Medicare Supplemental Insurance, or MEDGAp, works in conjunction with your Original Medicare. The program provides subsidized travel to certain destinations that Part A and Part B are unable to afford things such as travel abroad or excessive costs. The insurance can help you to cover part-b coverage - including part-distribution - costs. Given this cost, the Patient Advocacy Foundation is asking people to sign a Medigap agreement to cover certain copayments.

The cost of healthcare in retirement can be difficult to budget due to recurring medical bills that can be extremely high or low. While traditional Medicare (Parts C and B) provide good coverage, it covers less than 80% of the costs it accepts for hospitals, doctors and medical procedures. 20 % are individual's responsibility and unlike coverage under the Affordable Care Act, the amount paid is not limitable. Tell me about your heart bypass surgery.

Having fewer hospital expenses makes Medicare Advantage a good and affordable option. In the case of serious medical conditions and a lot of expensive treatments, it would be better to use Medigap. Talk to an insurance specialist about your specific situation will help you choose the most appropriate plan. Since you aren't able to take Medicare Advantage and Medigap together, you need to choose carefully to ensure the best coverage possible.

Medicare Supplements provide more flexibility to your monthly expenses and make budgeting more efficient. According to Jacobson, cost-sharing helps people reduce stress when they go to the doctor or are hospitalised. You can see virtually all doctors you need. Suppose we live in Arizona, you could travel to Minnesota and go see a doctor in Mayo. Jacobson believes that the health benefits tend to be even more important in sicker individuals.

The study examined the benefits available under Medigap plans that offer nontraditional services including vision, dental and hearing that can not be covered under Original Medicare. Our study shows fewer plans—only 7%— offer such benefits. Most people do not know that these plans offer the same benefits as Medicare. The policies and discouragements offered in federal programs are weighed against each other.

Medicare Supplement plans (sometimes called Medigap plans) are provided by private insurance firms to assist in providing coverage to Medicare beneficiaries. In 2018 34% of those enrolled in Original Medicare have Medicare Supplement plans covering the cost of the approved services that would be about 11.25 million. Medigap plans offer standard cover for things such as deductibles, coinsurance and co-payments based on letter names A to N.

Medigap is meant to fill gaps Medicare hasn't covered: copayments, deductibles, and coinsurance. Currently, Medicare only covers 85% of the cost of medical care for patients under Medicare. Typically a Medigap program covers 20 per cent of your expenses. Medigap doesn't cover everything Medicare Part B covers. This means you can't claim Medicare for prescription drugs.

Medicare Supplement Insurance ( Medigap ) is extra insurance you can buy from a private company that helps pay your share of costs. Enter your ZIP code Start How to buy a Medigap policy Step 1 Decide which plan you want Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need.

Some Medicare Advantage plans provide no premiums, so be sure to look into these plans. Baethke explains that a plan that pays premiums requires a fee every month as an added expense. Medicare Part B deductibles and coinsurance are $226 according to Medicare.gov. Once these are met your Medicare benefit will be 20% of the Medicare-approved price.

The average monthly premiums of any supplementary plan in most countries can vary by the state you live in and the insurers. It's also good to shop around if the average 65 years of age is eligible for Medicare Advantage Plans. Our goal is to find more equitable and efficient private health care systems," he said.

Medigap Advantage offers many advantages depending on your particular health needs. Medicare Medigap offers additional coverage to Medicare beneficiaries, although the plans do not cover prescription medicines. Medicare Advantage offers identical coverage to Medicare Original with additional services including vision, dental and hearing services.

Medigap and Medicare Advantage programs have different advantages and disadvantages. Depending on your individual situation you will have to consider a variety of health factors and finances. Before you buy a Medi-Grad Medicare or Medicaid Advantage plan you should compare the different benefits. Expanded.

Medicap has the biggest negative impact on the budget. Medicare Advantage plans generally pay more monthly than Medicare Advantage plans. Medicare Part B premiums are paid every month. Medigap cannot pay deductibles for Medicare Part B unless your health insurance plan changes. In the case of Medigap coverage, a patient must be over 60 or older and be enrolled in Medicare Part B hospital coverage as well as Medicare Part B health coverage. If your Medicare plan is purchased before you qualify, you will not receive a guaranteed acceptance of your Medicare plan application.

Medigap covers your expenses in exchange for your original Medicare plan. It is possible that Medigap will make you choose a doctor you like. You have a choice between several medical centers that accept Medicare. If your physician is not enrolled under Medicare Advantage, you should consider Medigap. This gives you access to all the physicians who accept Medicare. Although Medigap's premiums are generally higher than Medicare, Medigap may charge lower costs.

Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services, and usually Part D prescription drug coverage into one package. If you decide to get coverage through a Medicare Advantage plan, you'll still have to enroll in Medicare Parts A and B, including paying the premiums for Part A, if you don't qualify for it free, and Part B.

Yeah. You could switch from Medigap to Medicare Benefits (MA). This is also a wise move for Medicare beneficiaries depending on their situation.

Medicare Advantage Plans provide more protection for borrowers who can pay for the entire cost in a way that is affordable to you. Regular Medicare and Medicaid coverage gives you a broader choice in the places you get medical care.

The biggest disadvantage of Medicare Advantage plans is their network of providers that limit the choice of doctors and hospitals that are available. Medicare Advantage costs are also very largely determined based on the amount of medical care needed.

Summary Medicare Advantage is based on the same principles that Medigap provides. Let me tell you the policy that suits your requirements. Find the plans for a particular area right now!