Medicare Supplements - Medicare Advantage Plans. Often called Medicare supplement plans, Medicare Supplements is a Medicare Supplement insurance program. Medicare Advantage recipients can participate in Medicare's Medigap program.

Medigap provides coverage for Medicare-approved costs. This plan doesn't include dental services that aren't covered by original Medicare plans. Plan J were Medigap policies but are not now available until June 2010. Those enrolling into Medigap's plan prior to this time can maintain their plan J insurance if their employer offers their Medigap policy.

Medicare Supplement Program J is an alternative to other Medigap plans. Medicare Part A and B are not available to Medicare beneficiaries. Medicare Supplement Plans J or Medicare Supplement Plans J have now been discontinued from enrolling patients after July 1, 2010. Any person who has had a previous plan will have the benefit of this program as long as they are enrolled. Continue reading to find out more about Medigap plans and the steps that should be taken when registering.

The Medigap Plan J is no longer available for enrolled patients. Medigap's F plan was discontinued on January 1, 2020. Those already registered to one of the programs could continue to use them. Medicare supplement schemes, called Medigap, provide assistance for Medicare-related expenses. Private insurers offer MediGap plans that can fill any Medicare coverage. Some of these terms can be useful in determining what is best insurance:

Medicare Supplementary Insurance (or Medigap) plans were discontinued in 2010. Those enrolled in the plan before this date can only utilize their current benefit. Medgap Plans J provide many important benefits.

Medicare plans J are among the most popular Medicare supplemental plans that could be selected. The program was discontinued in July 2010 because the Affordable Care Act changed its prescription medication provisions. However those who were enrolled in Medicare after June 2010 were permitted to retain insurance if the plan remained offered.

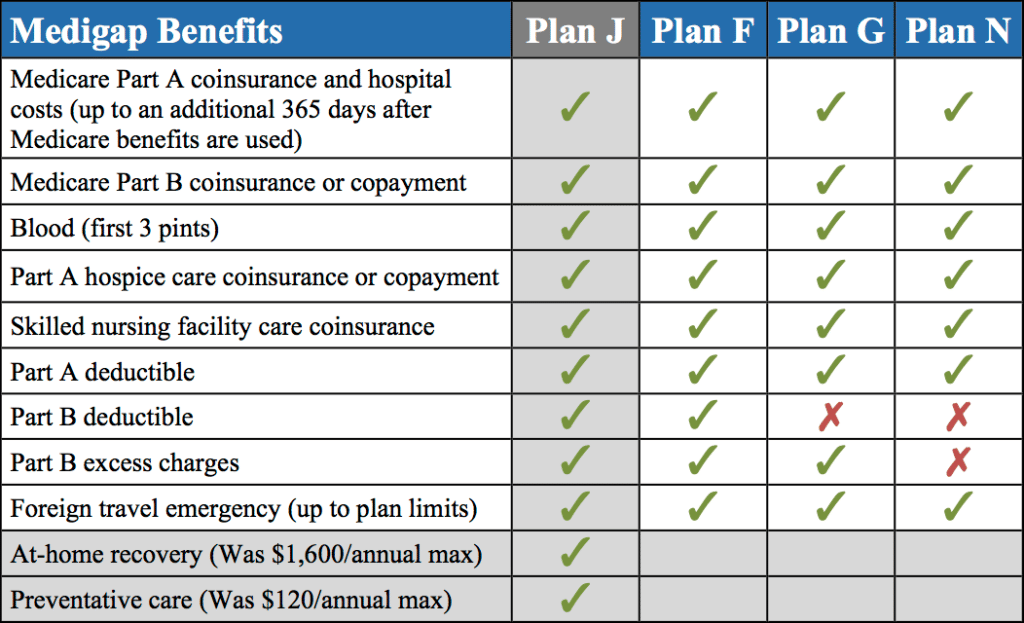

As far as coverage goes Plan J has been considered the most comprehensive plan a person can purchase. The benefit from Plan J varies by plan type and includes: Medicare Part-A deductibles and hospitalizations for a maximum of 365 days following Medicare remission, Medicare Part A and Part-B deductibles.

Medicare Supplement Insurance Programs J aren't available for new subscribers until 2010. Find details for these plans and compare them with existing Medigap plans. Medicare Supplemental ad hoc insurance or Medicap is a type of private insurance used in conjunction with your original Medicare (Part A/Part B) plan to pay deductible and copayment for medical costs in the United States. In 2010, Medigap's plan was not extended to all enrolling persons. All those who were registered for Supplementary Insurance Plan J before 2010 were able to retain this program. There are 10 Medigap plan options available today for all states.

Beneficiaries currently on the plan may continue on the Medigap plan. Only 3 percent of Americans enrolled in Medicare Supplemental Insurance Plans are from the United States and qualify for Medicaid and Medicare Supplements. Should I continue my plan? Initially there is the costs involved.

A plan that accepts no members is deemed risky because age and frequency are increasing. The plans will increase their premiums more quickly as they are higher than the other Medigap plans' rates. Another factor to take into consideration is benefit. While no Medigap Plan matches plan J coverage, some are quite close.

The main distinction between plans J and F is the degree of coverage available for foreign emergency services. Plan J pays a full 100 percent premium for medical assistance on a trip abroad. Plans F covered 80 % of the cost for emergency travel to other locations around the world. If you travel frequently abroad you may wish that your Plan J is maintained because there are more benefits. However, when it comes to traveling outside the United States, this additional insurance might no longer be a good idea to you. Plan FS is the best Medigap plan currently available.

A similar Medigap policy with Plan J has also been named plan C. Like Plan F and Plan G, Medigap Plan C provides 80 percent of foreign emergency expenses. Plan C is also applicable for Medicare Part A excess fees. Medicare Plan F provides a partial reimbursement of the expenses. Medicare excess fees represent a charge you could have a health care provider that doesn't accept Medicare Assignments. The service providers are not refunded by Medicare. The provider may charge you 15 per cent extra for Medicare approval.

Medigap plan J benefits have been popular with Medicare recipients since it provides comprehensive reimbursement for Medicare costs. Under Plan F, there are still health insurance options to cover all of their costs. Plan F is not available to those eligible to enroll on Medicare from January 1, 2020. If you have no plans available, you may consider taking a Medigap plan. Both Medicare Supplement insurance Plans J and F are covered. Both Plan J and Plan F also cover travel and emergency medical care. Although Plan F covers 80% of the cost, Plan J provides 100% coverage.

When Medicare is reimbursed by its agreed cost, Medigap plans offer additional coverage. Medigap covers leftover costs based on the approved Medicare amount. In fact, Medigap provides medical services that Original Medicare does not. Currently, there are a total 10 specialized health insurance plans available in California. Those who have enrolled in Medicare are not eligible to use the plan except under plan J.

Since there's so many options available to MedigaP users there may be some people who feel overwhelmed with options. Here's a list of best practices for choosing the best insurance program for you. SHIP can help you with the selection of policies. Not every state has participated in the SHIPS program. Explore this site. Search the internet for details about Medicare.

Medicare Supplement Plan J Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have been used.

Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and copayments. If you want to get Medicare prescription drug coverage, you have two options: You can enroll in a Medicare Advantage Prescription Drug plan (MAPD). These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs.

Medigap Plans F and G are the most popular Medicare Supplement plans in 2019. Learn more and compare your Medigap plan options. Read more Medicare Supplement Insurance Plan D Learn about Medicare Supplement (Medigap) Plan D coverage, costs and benefits. Compare Medigap Plan D options available where you live. Read more Medigap Plan F Benefits.

This law introduced Medicare Part D plans, which are standalone Medicare prescription drug plans (PDP) sold by private insurance companies. Due to this law, Medicare Advantage plans (Medicare Part C) can also offer prescription drug coverage . The 2003 legislation also expanded certain Original Medicare benefits.

Both Medicare Part D and Medicare Advantage plans are offered by Medicare-approved private insurance companies. Review your options before making a decision on Medicare prescription coverage.

Medigap programs provide for things Medicare does not cover, such as copays on doctor appointments. Medicare Supplement Plans J and Medigap Plans J were discontinued in 2010. Any person enrolled in a plan may continue the plan.

Plans G and J offer similar benefits as Plan J except that unlike Plans F and D, they only cover 80 percent of foreign travel emergencies. Plan G covers a total cost of $600 for an entire year of health insurance. Medigap plans are covered by the deductible. Medicare Part B deductibles will be $333 a year for 2022.

The Medicare Supplement Plans are policies to help pay for out-patient expenses. Medicare will discontinue this program in favor of newly enrolled customers. Medicare Supplemental Insurance Plan — sometimes dubbed Medigap — helps pay some of the premiums that Medicare users have incurred including coinsurance, deductibles or copayments.

MIPPA has released new, standardised plans for the period ending June 1, 2011. In response to MIPPA's recent reorganisation, Medigap policy changes are being made for sale from July 1, 2010. MIPAA enacts a reduction in standard plans that are currently 14 to 1. Plan X and Y were withdrawn.