The Medicare program provides Medicare to seniors who pay for the services. It is packed with various alphabetic sections whose different benefits can be found in various categories. Medicare is facing some problems—including gaps that are completely unfilled and are not even covered. To secure this gap consider joining Medicare Advantage and Medicare Supplement plans. We have collected the best information and research on coverage, prices, conveniences and choices.

After you choose Part B of Medicare Part B or Part A you must decide the best way to fill the hole in the original plan. Important: This discussion is not intended to cover retirees who have been in the military or the private sectors. Unless a person wants retire benefits he should take the private market. The following is an overview of the product types, Medigap Vs the Medicare Advantage. You can purchase more insurance through Medicare by enrollees.

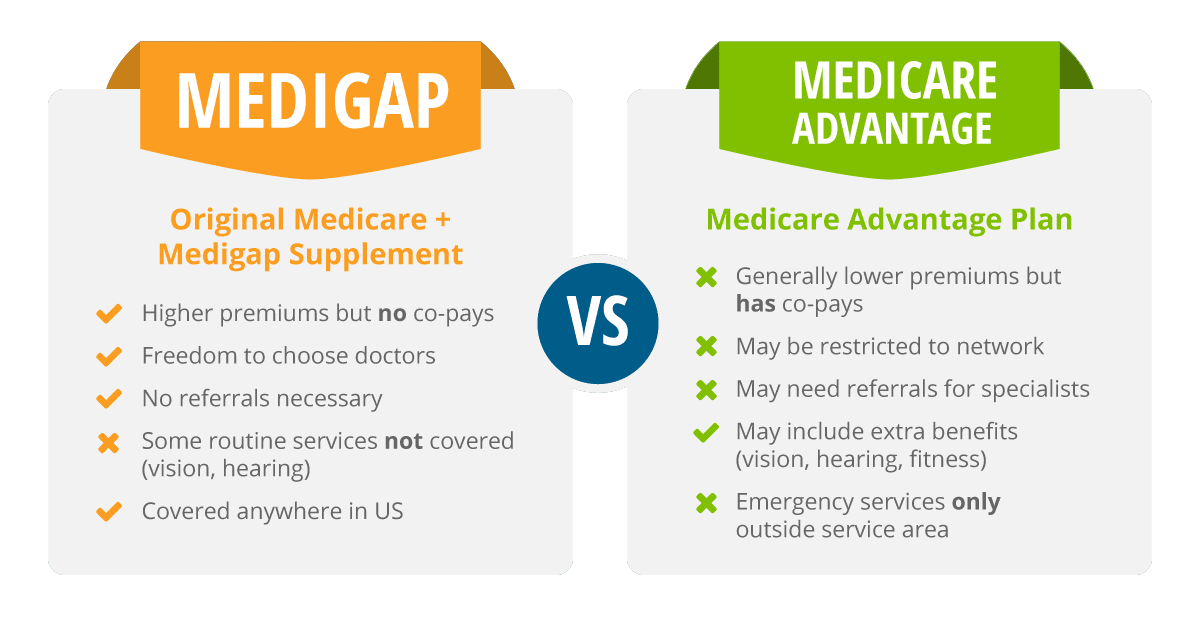

Medigap & Medicare Advantage provide different types of healthcare coverage. The best option is determined by individual requirements. Medigap offers supplemental coverage to individuals enrolled in original Medicare. Medicare Advantage, also called Part C, provides a replacement for this plan. Among some important considerations when choosing an insurance company are:

Our reviews are independent and advertisers do not influence our choice. It is possible for us to earn compensation when you see partner recommendations. More information about advertising disclosures is available here. All individuals looking to enroll in Medicare must decide. But what are Medicare alternatives?

Medicare - A health insurance plan is the same as private insurance. Most services, including offices and labs, surgery and other services, are covered by a small co-payment. Plans offer HMOs or PPOs and most plans have an annual maximum amount of deductible expenses. Almost every plan offers a unique advantage and there are no minimum requirements. Most prescription drugs are covered.

Several people require a consultation with a medical expert and many don't. Some will pay for medical care outside the network, while others will cover only medical services in the HMO or PPO networks. There are a variety of different Medicare Advantage plan options available. It may be important to secure plans that don't have annual premiums or low monthly premiums.

Medicare Advantage policies are offered by government-regulated insurance providers under the name of Aetna Humana or Medicare Foundation. They may be without premium or less than the premium for Medigap or prescription drugs policies. Medicare benefits cover hospitals, doctors and many prescriptions for services which are not covered by Medicare. In 2020 42% of the population will choose this plan. Most Medicare plans are operated through a Health Care Maintenance Organization (HAO) or preferential providers organization (PPO).

Medicare Advantage offers all the same coverage offered by Original Medicare with deductible coverage for things and services that aren't covered under Original Medicare. Often plans will even offer transportation to the doctor’s office or adult daytime services. Several plans are also offering more supplemental benefits based on new expansion. Moreover, a plan may tailor its benefits packages to provide benefits to people with chronic illnesses. In addition, Cigna offers free vaccination transport to Medicare beneficiaries.

Medicare Supplement plans can be used by a person to make their costs less expensive. From a cost share perspective, many people like that because they don't worry what they have to pay at each hospital visit, Jacobson said. Almost anyone can be seen anywhere. You can travel to Minnesota and visit the Mayo Clinic to see the doctors. Unfortunately, Jacobson explains the benefit is usually more important in cases of illness.

A recent study by Associated Public Health Insurance Companies focuses on Medigap plans offering nontraditional services, including hearing services, dental care, and vision care. The results showed that only 7% of plans offer these benefits. I think many people aren't even aware of this kind of plan. In federal politics, there have been varying levels of policy incentives and disabling policies.

The cost of Medicare Supplement coverage can range from $150 to $200 depending on the states of residence and insurers' plans. It's worth shopping around as Medicare Advantage plans can cost up to $840 per year. Jacobson continues to study the ways private plans and Medicare can provide better services for individuals, he explains.

The health benefits offered by Medicare Advantage are varied. Which one can best meet your needs? The Medigap plan provides extra coverage for individuals who qualify for original Medicare except for prescription medication. In addition Medicare Advantage offers the same benefits as a Medicare supplement with supplementary benefits like prescriptions, vision, dental, hearing and other health services.

Medigap is a private insurance option that is designed to work well with Medicare (Part A and Part B) plans. How do I choose between Medicare Advantage and Medigap? Consider your priorities, like budget, choice, travel, and health conditions. While Medicare Advantage can be more affordable for people with long term health issues, Medigap gives you flexibility and choice by expanding your network.

Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services, and usually Part D prescription drug coverage into one package. If you decide to get coverage through a Medicare Advantage plan, you'll still have to enroll in Medicare Parts A and B, including paying the premiums for Part A, if you don't qualify for it free, and Part B.

Medigap plans offer additional coverage to Medicare patients, though the program does not cover prescription medications. The Advantage plan also has the same coverage as original Medicare but includes extra benefits including prescription drug coverage, vision, dentistry, hearing and other health services.

Medicare Advantage can help reduce health care costs. For serious medical conditions that require costly treatment or care, Medigap usually provides the best treatment.

59% of Medicare beneficiaries (65 and older) and people with disabilities are using Original Medicare, Part A and Part B. These covers hospitals, medical professionals and procedures. 5. Almost 91% pay for Medicare Part D prescription drugs and 46% pay for the Medicare Part D prescription drugs. Medicare Supplement Insurance: A Medicare Supplement Plan is not sponsored by the United States government. Despite being the most costly option, it also offers many benefits.

After your Open Enrollment Period, if you want to change Medigap coverage, you will have to answer health questions (go through underwriting) to qualify for the Medigap plan. If you do not answer “no” to all the health questions there is a very good chance you will be DENIED from getting new Medigap coverage.

If you have Original Medicare and a Medigap policy, you may also benefit from a Medicare Part D prescription drug plan to help cover prescription drug costs. How Are Medicare Advantage and Medigap Different? With a Medigap plan, you have access to any doctor or provider who accepts Medicare.

Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®). Edited By Savannah Hanson Financial Editor View Bio 7 Cited Research Articles View Sources U.S. Centers for Medicare & Medicaid Services. (2022, September 27). 2023 Medicare Parts A & B Premiums and Deductibles 2023 Medicare Part D Income-Related Monthly Adjustment Amounts.

To be eligible for a Medigap plan, you have to be 65 years or older and be enrolled in both Medicare Part A hospital insurance and Medicare Part B medical insurance. You are not guaranteed that your application for a Medigap policy will be accepted if you don't purchase a plan when you are first eligible for Medicare .

Various disadvantages of the Medigap plan are: High monthly premiums. There are many options available to you. It's not prescription coverage.

In Medigap you are eligible for Medicare coverage from any physician. In the case of Medicare Advantage, however, the choice of doctor is less clear. In practice, Medigp is not available through Medicare Advantage. However, you can change your plan at any stage.

Medigap plans offer a number of different options for a specific situation. You must compare Medicare plan details closely to ensure that your coverage will suit you. Compare Medicare benefits and Medigap plans. You can also take this to your health. Get Medicare Assistance To Prepare for Life!